XM Review 2025- Words Done

XM Review 2025- Words Done

Overall Rating

Min. Deposit

Spreads From

Max. Leverage

XM Overview

Established in 2009 and headquartered in Cyprus, XM is a well-regulated forex and CFDs broker that meets key safety and compliance standards. Over the years, it has built a reputation for reliability and professional-grade trading support.

XM provides access to over 1,300 tradable instruments, including forex pairs, commodities, indices, and stocks. Traders benefit from its support for MetaTrader 4 and 5, along with complimentary VPS hosting – features that appeal to professionals seeking precision and speed in their trading strategies.

The broker stands out for its comprehensive research offerings and extensive educational resources, which cater to beginners through advanced traders. Its account types and thematic indices further enhance flexibility, allowing clients to tailor their trading experience. Additionally, XM has expanded its platform lineup to include TradingView, appealing to chart-focused traders who value advanced technical analysis tools.

On the downside, XM’s trading fees tend to be higher than average, and it does not provide alternative trading platforms beyond MetaTrader and TradingView. Furthermore, its market coverage and pricing structure may be less competitive compared with other top-tier brokers, which could limit its appeal for cost-sensitive or highly experienced traders.

Overall, XM is a reliable broker for traders seeking robust educational content, solid research, and professional trading tools, though more advanced or budget-conscious traders may find better value elsewhere.

XM Pros and Cons

XM Pros:

- Easy and fast account opening

- Trading Central enhances in-house research

- Full MetaTrader suite supporting copy trading and algorithmic tools

- VPS hosting for professional trading

- Daily videos, podcasts, and multilingual live broadcasts

- Strong educational tools for all experience levels

- Regulated by multiple top-tier authorities

- Extensive instruments: 1,400+ CFDs and 55 forex pairs

- Thematic indices for diversified trading

- Robust educational and research content

XM Cons:

- Limited platform offerings (MetaTrader only)

- No cryptocurrency trading available

- Does not provide a proprietary trading platform

- Above-average trading fees

Beginner – Acceptable Choice

For casual traders, XM offers an extensive range of tradable instruments, comprehensive research, and high-quality educational resources, combined with platforms that are user-friendly and easy to navigate. While these features make XM a solid choice for beginners and part-time traders, its above-average trading fees may be a drawback for cost-conscious users.

News Trading – Acceptable Choice

XM provides a news screener and daily market summaries to help traders track key financial events. While VPS usage can mitigate latency issues, execution speeds above 100 milliseconds make the broker less ideal for reactive news-based trading without the VPS setup.

Scalping – Perfect Match

Scalpers can take advantage of MT5’s 21 different timeframes for precise short-term analysis, combined with one-click trading for fast execution. XM’s VPS hosting ensures execution speeds averaging under 3 milliseconds, providing an efficient environment for high-frequency trading strategies.

Investing – Not Recommended

XM does not provide access to real stocks or instruments suitable for traditional value investing, making it unsuitable for investors seeking long-term equity exposure.

Automated Trading – Perfect Match

VPS hosting at XM supports algorithmic and automated trading strategies. Both MT4 and MT5 platforms include strategy testers, allowing traders to backtest and optimize their trading algorithms for improved performance.

Swing Trading – Acceptable Choice

Swing traders benefit from XM’s 360-degree market research and low-to-average swap charges, making it suitable for holding positions over several days. The broker’s broad analytical content provides traders with a well-rounded view of market trends and opportunities.

Day Trading – Acceptable Choice

With over 1,300 tradable instruments, XM offers day traders ample opportunities across forex, commodities, indices, and stocks. However, similar to casual trading, above-average trading costs may limit profitability for frequent intraday traders.

Social and Copy Trading - Perfect Choice

XM supports copy trading through both MetaTrader 4 and 5, as well as MT4 Multiterminal, enabling experienced traders to manage multiple clients’ accounts simultaneously. These tools make XM a strong platform for social and copy trading enthusiasts seeking efficiency and flexibility.

Who is XM for?

When evaluating XM, it’s clear that the broker offers the features and tools to cater to a wide range of trading strategies. Here’s how it stacks up for different trader styles:

What Sets XM Apart?

XM differentiates itself with a suite of thematic indices, including the Artificial Intelligence Giants US Index, Crypto 10 Index, and Electric Vehicles UST Index. These specialized products give traders the ability to diversify across emerging sectors and capitalize on industry-specific trends.

As a globally regulated broker, XM operates under the oversight of ASIC in Australia, CySEC in Cyprus, and IFSC in Belize, ensuring a secure and compliant trading environment. The broker also offers low stock index CFD fees, quick and simple account setup, and an array of educational resources, including webinars and a demo account, making it accessible for traders at all experience levels.

Whether you’re looking to explore sector-focused investments, access cost-efficient trading, or leverage robust educational tools, XM provides a comprehensive trading experience designed for both casual and professional traders.

XM Main Features

Regulations

IFSC (Belize), DFSA (United Arab Emirates), ASIC (Australia), CySEC (Cyprus)

Languages

Romanian, Turkish, Korean, English, Urdu, Russian, Hindi, French, Indonesian, Portuguese, Thai, Polish, Czech, Arabic, Hungarian, Bulgarian, Italian, Spanish, Bengali, Chinese, Farsi, Japanese, Greek, Bahasa, German, Multi-lingual

Products

Currencies, Stocks, Indices, Commodities

Min Deposit

$5

Max Leverage

1:500 (IFSC), 1:30 (DFSA), 1:30 (ASIC), 1:30 (CySEC)

Trading Desk Type

No dealing desk

Trading Platforms

MT5, MT4

Deposit Options

Webmoney, Western Union, Sofort, Wire Transfer, Moneybookers, Skrill, China UnionPay, Neteller, Credit Card, MoneyGram, iDeal

Withdrawal Options

China UnionPay, Sofort, Wire Transfer, MoneyGram, Neteller, Moneybookers, iDeal, Webmoney, Skrill, Credit Card, Western Union

Demo Account

Yes

Foundation Year

2009

Headquarters

Cyprus

Regulations

IFSC (Belize), DFSA (United Arab Emirates), ASIC (Australia), CySEC (Cyprus)

Languages

Romanian, Turkish, Korean, English, Urdu, Russian, Hindi, French, Indonesian, Portuguese, Thai, Polish, Czech, Arabic, Hungarian, Bulgarian, Italian, Spanish, Bengali, Chinese, Farsi, Japanese, Greek, Bahasa, German.

Products

Currencies, Stocks, Indices, Commodities

Min Deposit

$5

Max Leverage

1:500 (IFSC), 1:30 (DFSA), 1:30 (ASIC), 1:30 (CySEC)

Trading Desk Type

No dealing desk

Trading Platforms

MT5, MT4

Deposit Options

Webmoney, Western Union, Sofort, Wire Transfer, Moneybookers, Skrill, China UnionPay, Neteller, Credit Card, MoneyGram, iDeal

Withdrawal Options

China UnionPay, Sofort, Wire Transfer, MoneyGram, Neteller, Moneybookers, iDeal, Webmoney, Skrill, Credit Card, Western Union

Demo Account

Yes

Foundation Year

2008

Headquarters

Cyprus

Start Trading With XM

| Account Type | Ultra Low Micro Account | Ultra Low Standard Account | XM Zero Accounts |

|---|---|---|---|

| Minimum Deposit Requirement | $5 | $5 | $100 |

| Demo Account | Yes | Yes | Yes |

| Spread From | 0.6 pips | 0.6 pips | 0.0 pips |

| Commission | $0 | $0 | $7 |

| Islamic Account | Yes | Yes | Yes |

| Contract Size | 1 Lot = 1000 units | 1 Lot = 100,000 units | 1 Lot = 100,000 units |

| Base Currency | EUR, USD, GBP | EUR, USD, GBP | EUR, USD, GBP |

XM Full Review

XM Safety

Safety Intro

XM operates under four globally recognized regulators: CySEC in Cyprus, ASIC in Australia, FSC in Belize, and DFSA in Dubai. This multi-jurisdictional oversight ensures traders benefit from strong compliance standards and a transparent trading environment.

The broker follows strict safety measures, including negative balance protection, segregated client funds, and a clear “best execution policy” to guarantee fair order handling. While XM is a well-established international brand, it is not publicly listed and does not publish financial reports.

Overall, XM’s broad regulatory framework and client protection policies make it a trusted choice for traders who prioritize security and accountability in their forex and CFD trading.

Pros:

- Regulated by the top-tier ASIC

- Negative balance protection

Cons:

- Financial information is not publicly available

- Not listed on stock exchange

XM Regulation

XM operates through four regulated entities, each overseen by respected financial authorities, giving traders varying levels of protection depending on their jurisdiction. Regulators are commonly ranked on a three-tier scale, with Tier-1 representing the highest standard of investor security and oversight.

XM Global Limited is authorized by the Financial Services Commission (FSC) of Belize, classified as a Tier-3 regulator.

Trading Point of Financial Instruments Pty Limited is licensed by the Australian Securities & Investments Commission (ASIC), also considered a Tier-1 regulator.

Trading Point MENA Limited falls under the supervision of the Dubai Financial Services Authority (DFSA), ranked as a Tier-2 regulator.

Trading Point of Financial Instruments Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC), rated as a Tier-1 regulator.

This multi-layered regulatory framework ensures XM clients benefit from strong investor protections in top-tier jurisdictions while also allowing global accessibility through additional regional licenses.

| Entity Features | XM Global Limited | Trading Point of Financial Instruments Pty Ltd | Trading Point of Financial Instruments Ltd | Trading Point MENA Limited |

|---|---|---|---|---|

| Maximum Leverage | 1:1000 | 1:30 | 1:30 | 1:30 |

| Country/Region | Belize, Belize City | Australia, Sydney | Cyprus, Limassol | UAE, Dubai |

| Segregated Funds | Yes | Yes | Yes | Yes |

| Tier | 3 | 1 | 1 | 2 |

| Compensation Scheme | No | No | Up to EUR 20,000 under ICF | No |

| Regulation | FSC | ASIC | CySEC | DFSA |

| Negative Balance Protection | Yes | Yes | Yes | Yes |

Understanding the Regulatory Protections of Your Account

Global brokers often operate through multiple licensed entities, allowing them to serve traders in different regions under varying regulatory frameworks. However, not all regulators enforce the same level of investor protection. Some jurisdictions impose strict financial safeguards, while others are more lenient. For this reason, it’s essential for traders to understand the protections offered by the specific entity where they open an account.

When assessing a broker’s safety mechanisms, here are the key factors to look for:

Segregated Client Funds – XM keeps client funds in separate accounts from corporate capital, reducing the risk of mismanagement and ensuring that trader deposits remain protected.

Negative Balance Protection – All XM entities provide this safeguard, which prevents clients from losing more than their account balance. Losses are capped at deposited funds.

Investor Compensation Scheme – Clients of Trading Point of Financial Instruments Ltd (Cyprus entity) are covered by the Investor Compensation Fund (ICF), offering protection of up to EUR 20,000 in the event of company insolvency.

Maximum Leverage – XM Global Ltd offers leverage up to 1:1000, giving traders significant market exposure. While this can enhance profit potential, it also amplifies risk, making responsible leverage use crucial.

By understanding these regulatory protections, traders can make more informed decisions and choose the XM entity that best matches their safety preferences and trading style.

How you are protected

XM operates multiple subsidiaries worldwide, and the specific entity that serves you depends on your country of residence. This structure is crucial because each entity falls under a different regulator and offers varying levels of investor protection.

Depending on where you are registered, you may benefit from safeguards such as segregated client funds, negative balance protection, and participation in investor compensation schemes. These measures are designed to ensure that your deposits remain secure and that your trading activity is backed by strong regulatory oversight.

Understanding which XM subsidiary applies to you allows you to know exactly what protections are in place, giving you confidence and transparency in your trading journey.

| Country of clients | Legal entity | Regulator | Protection amount |

|---|---|---|---|

| Australia | Trading Point of Financial Instruments Pty Ltd. | Australian Securities and Investments Commission (ASIC) | No protection |

| EEA countries | Trading Point of Financial Instruments Ltd. | Cyprus Securities and Exchange Commission (CySEC) | €20,000 |

| Middle East | Trading Point MENA Limited | Dubai Financial Services Authority (DFSA) | No protection |

| Rest of the world | XM Global Limited | Financial Services Commission of Belize (IFSC) | No protection |

Stability and Transparency

At Trade Wiki, our Trust evaluation focuses on critical factors such as a broker’s stability, long-term presence in the market, company size, and overall transparency of information provided to traders. These elements help determine whether a broker can be considered reliable and trustworthy.

XM demonstrates a strong commitment to transparency and client protection. After reviewing the broker’s Client Agreement, no issues were found – the document clearly outlines all trader protections in straightforward and unambiguous language. This level of clarity ensures clients fully understand their rights and obligations before trading.

XM also upholds a Best Execution Policy, which legally obligates the broker to consistently provide traders with the most competitive and fair price quotes available under current market conditions. In addition, the broker enforces a strict Client Categorization Policy, tailoring services and protections according to each trader’s level of knowledge and experience. This approach helps ensure that beginners and experienced traders alike receive the most suitable support and safeguards.

For traders comparing options, TradeWiki.io emphasizes the importance of choosing brokers that prioritize transparency and long-term stability. These trust factors not only protect clients but also create a more reliable trading environment – a key consideration when opening an account and committing real capital.

Is XM safe?

Yes, XM is widely regarded as a safe and trustworthy broker, backed by strong regulatory oversight and transparent operational policies. Several factors contribute to its credibility and reputation in the trading industry:

Regulatory Authorizations: XM operates under the Trading Point Group, which is regulated by some of the world’s most respected financial authorities. The group holds licenses from multiple Tier-1 regulators.

Best Execution Policy: XM enforces a strict best execution mandate, meaning clients consistently receive the most competitive price quotes available under prevailing market conditions.

Transparent Legal Documents: All client agreements and policy documents are publicly available, clearly written, and free from ambiguity. This transparency builds trust and helps traders fully understand their rights and obligations before trading.

Strong Trust Score: The Trading Point Group, XM’s parent company, has achieved an impressive Trust Score of 4 out of 5, reflecting a strong record of compliance, reliability, and client protection measures.

Unlike brokers that are publicly traded or bank-owned, XM operates independently but still meets stringent global standards for safety and accountability.

For traders evaluating their options, TradeWiki.io emphasizes that XM’s combination of top-tier regulation, transparent practices, and proven longevity makes it one of the safer choices in the forex and CFD trading space.

| Safety Summary | XM |

|---|---|

| Year Founded | 2009 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 1 |

XM Fees

Fees Intro

XM’s fee structure is designed to balance competitiveness with the quality of its trading services. Traders using the Standard account should expect slightly above-average trading fees, while those on the raw-spread (Zero) account benefit from more competitive pricing tailored for cost-conscious or high-volume traders.

When it comes to specific instruments, stock index CFDs feature notably low trading fees, making them an attractive choice for index traders. Forex and stock CFD fees, meanwhile, remain average, offering a fair balance between cost and execution quality.

Additional account considerations further enhance the user experience: deposits and withdrawals incur no handling fees, and inactivity fees are relatively modest compared to industry norms.

For traders seeking a reliable and transparent fee structure, we note that XM provides a solid mix of competitive pricing, low operational costs, and accessible account management.

Pros:

- Low stock index CFD fees

- No withdrawal fee

Cons:

- Inactivity fee

XM Spreads

Get spreads from actual broker if possible or just use FX Empire

Forex Spreads

| Raw Spread Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| AUDUSD | Australian Dollar vs United States Dollar | 0.03 | 0.83 |

| EURUSD | Euro vs United States Dollar | 0.02 | 0.82 |

| GBPUSD | British Pound vs United States Dollar | 0.23 | 1.03 |

| USDCAD | United States Dollar vs Canadian Dollar | 0.25 | 1.05 |

| USDCHF | United States Dollar vs Swiss Franc | 0.19 | 0.99 |

| USDJPY | United States Dollar vs Japanese Yen | 0.14 | 0.94 |

| AUDCAD | Australian Dollar vs Canadian Dollar | 0.68 | 1.68 |

| AUDCHF | Australian Dollar vs Swiss Franc | 0.41 | 1.41 |

| AUDJPY | Australian Dollar vs Japanese Yen | 0.5 | 1.5 |

| AUDNZD | Australian Dollar vs New Zealand Dollar | 0.77 | 1.77 |

| CADCHF | Canadian Dollar vs Swiss Franc | 0.58 | 1.58 |

| CADJPY | Canadian Dollar vs Japanese Yen | 0.48 | 1.48 |

| CHFJPY | Swiss Franc vs Japanese Yen | 0.86 | 1.86 |

| EURAUD | Euro vs Australian Dollar | 0.8 | 1.8 |

| EURCAD | Euro vs Canadian Dollar | 0.74 | 1.74 |

| EURCHF | Euro vs Swiss Franc | 0.61 | 1.61 |

| EURGBP | Euro vs British Pound | 0.27 | 1.27 |

| EURJPY | Euro vs Japanese Yen | 0.3 | 1.3 |

| EURNZD | Euro vs New Zealand Dollar | 1.32 | 2.32 |

| GBPAUD | British Pound vs Australian Dollar | 1.06 | 2.06 |

| GBPCAD | British Pound vs Canadian Dollar | 1.12 | 2.12 |

| GBPCHF | British Pound vs Swiss Franc | 1.1 | 2.1 |

| GBPJPY | British Pound vs Japanese Yen | 0.82 | 1.82 |

| GBPNZD | British Pound vs New Zealand Dollar | 1.98 | 2.98 |

| NZDCAD | New Zealand Dollar vs Canadian Dollar | 1.04 | 2.04 |

| NZDCHF | New Zealand Dollar vs Swiss Franc | 0.73 | 1.73 |

| NZDJPY | New Zealand Dollar vs Japanese Yen | 0.6 | 1.6 |

| NZDUSD | New Zealand Dollar vs United States Dollar | 0.38 | 1.38 |

| AUDSGD | Australian Dollar vs Singapore Dollar | 0.97 | 1.97 |

| CHFSGD | Swiss Franc vs Singapore Dollar | 2.05 | 3.05 |

| EURDKK | Euro vs Danish Kroner | 11.11 | 12.11 |

| EURHKD | Euro vs Hong Kong Dollar | 2.17 | 3.17 |

| EURNOK | Euro vs Norwegian Kroner | 52.89 | 53.89 |

| EURPLN | Euro vs Polish Zloty | 21.2 | 22.2 |

| EURSEK | Euro vs Swedish Krona | 44.07 | 45.07 |

| EURSGD | Euro vs Singapore Dollar | 0.9 | 1.9 |

| EURTRY | Euro vs Turkish Lira | 95.14 | 96.14 |

| EURZAR | Euro vs South African Rand | 94.68 | 95.68 |

| GBPDKK | British Pound vs Danish Kroner | 18.32 | 19.32 |

| GBPNOK | British Pound vs Norwegian Kroner | 38.14 | 39.14 |

| GBPSEK | British Pound vs Swedish Krona | 28.13 | 29.13 |

| GBPSGD | British Pound vs Singapore Dollar | 2.45 | 3.45 |

| GBPTRY | British Pound vs Turkish Lira | 138.98 | 139.98 |

| NOKJPY | Norwegian Kroner vs Japanese Yen | 0.67 | 1.67 |

| NOKSEK | Norwegian Kroner vs Swedish Krona | 7.53 | 8.53 |

| SEKJPY | Swedish Krona vs Japanese Yen | 0.87 | 1.87 |

| SGDJPY | Singapore Dollar vs Japanese Yen | 0.7 | 1.7 |

| USDCNH | United States Dollar vs Chinese RMB | 2.93 | 3.93 |

| USDCZK | United States Dollar vs Czech Koruna | 5.21 | 6.21 |

| USDDKK | United States Dollar vs Danish Kroner | 4.77 | 5.77 |

| USDHKD | United States Dollar vs Hong Kong Dollar | 0.89 | 1.89 |

| USDHUF | United States Dollar vs Hungarian Forint | 9.48 | 10.48 |

| USDMXN | United States Dollar vs Mexican Peso | 28.57 | 29.57 |

| USDNOK | United States Dollar vs Norwegian Kroner | 36.79 | 37.79 |

| USDPLN | United States Dollar vs Polish Zloty | 15.79 | 16.79 |

| USDRUB | United States Dollar vs Russian Ruble | 65.26 | 66.26 |

| USDSEK | United States Dollar vs Swedish Krona | 30.31 | 31.31 |

| USDTHB | United States Dollar vs Thai Baht | 63.21 | 64.21 |

| USDTRY | United States Dollar vs Turkish Lira | 50.61 | 51.61 |

| USDZAR | United States Dollar vs South African Rand | 79.85 | 80.85 |

| USDSGD | United States Dollar vs Singapore Dollar | 0.85 | 1.85 |

Metal Spreads

| Raw Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Min. Spread |

| XAGEUR | Silver vs Euro | 0.813 | 1 |

| XAGUSD | Silver vs United States Dollar | 0.894 | 1 |

| XAUAUD | Gold vs Aus | 3.679 | 1 |

| XAUEUR | Gold vs Euro | 3.537 | 1 |

| XAUUSD | Gold vs United States Dollar | 1.083 | 1 |

| XPDUSD | Palladium vs United States Dollar | 162.735 | 1 |

| XPTUSD | Platinum vs United States Dollar | 42.3 | 1 |

Indices Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| AUS200 | Australia S&P ASX 200 Index | 0 | 1.22 |

| DE40 | Germany 40 Index | 0.5 | 1.338 |

| F40 | France 40 Index | 0 | 0.749 |

| JP225 | Japan 225 Index | 6 | 8.858 |

| STOXX50 | EU Stocks 50 Index | 0.2 | 1.76 |

| UK100 | UK 100 Index | 1 | 2.133 |

| US30 | US Wall Street 30 Index | 1 | 1.411 |

| US500 | US SPX 500 Index | 0.2 | 0.492 |

| USTEC | US Tech 100 Index | 1 | 1.807 |

| CA60 | Canada 60 Index | 0.6 | 0.6 |

| CHINA50 | FTSE China A50 Index | 3.29 | 6.953 |

| CHINAH | Hong Kong China H-shares Index | 0 | 2.083 |

| ES35 | Spain 35 Index | 4.2 | 4.426 |

| HK50 | Hong Kong 50 Index | 7 | 8.169 |

| IT40 | Italy 40 Index | 9 | 9 |

| MidDE50 | Germany Mid 50 Index | 7.5 | 27.864 |

| NETH25 | Netherlands 25 Index | 0.19 | 0.19 |

| NOR25 | Norway 25 Index | 0.68 | 0.68 |

| SA40 | South Africa 40 Index | 7.5 | 15.444 |

| SE30 | Sweden 30 | 0.38 | 0.38 |

| SWI20 | Switzerland 20 Index | 3 | 3.5 |

| TecDE30 | Germany Tech 30 Index | 2.3 | 3.172 |

| US2000 | US Small Cap 2000 Index | 0.14 | 0.48 |

CFD Commodities Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| GC25 | Gold Futures | 0.2 | 0.23 |

| BRENT | Brent Crude Oil Futures | 0.02 | 0.028 |

| Cocoa | Cocoa Futures | 3 | 4.608 |

| Coffee | Coffee Futures | 0.3 | 0.3 |

| Corn | Corn Futures | 0.68 | 0.68 |

| Cotton | Cotton Futures | 0.15 | 0.15 |

| OJ | Orange Juice Futures | 1.12 | 1.12 |

| Soybean | Soybean Futures | 1.35 | 1.35 |

| Sugar | Sugar Futures | 0.03 | 0.033 |

| Wheat | Wheat Futures | 0.75 | 0.75 |

| WTI | West Texas Intermediate - Crude Oil Futures | 0.02 | 0.027 |

| XBRUSD | Brent Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

| XNGUSD | Natural Gas Spot vs United States Dollar | 0.002 | 0.004 |

| XTIUSD | WTI Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

Cryptocurrency Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| BCHUSD | Bitcoin Cash vs United States Dollar CFD | 2.21 | 5.839 |

| BTCUSD | Bitcoin vs United States Dollar CFD | 8.71 | 42.036 |

| DOTUSD | Polkadot vs United States Dollar CFD | 0.011 | 0.013 |

| DSHUSD | Dash Coin vs United States Dollar CFD | 0 | 1.241 |

| EMCUSD | Emercoin vs United States Dollar CFD | 0.157 | 0.157 |

| ETHUSD | Ethereum vs United States Dollar CFD | 4.56 | 11.605 |

| LNKUSD | Chainlink vs United States Dollar CFD | 0.012 | 0.02 |

| LTCUSD | Lite Coin vs United States Dollar CFD | 1.05 | 1.597 |

| NMCUSD | NameCoin vs United States Dollar CFD | 7.895 | 7.895 |

| PPCUSD | PeerCoin vs United States Dollar CFD | 0.184 | 0.276 |

| XLMUSD | Stellar vs United States Dollar CFD | 0 | 0 |

| XRPUSD | Ripple vs United States Dollar CFD | 0.008 | 0.02 |

| ADAUSD | Cardano vs United States Dollar CFD | 0.001 | 0.003 |

| BNBUSD | Binance Smartchain vs United States Dollar CFD | 1.266 | 1.415 |

| DOGUSD | Doge vs United States Dollar CFD | 0.001 | 0.001 |

| UNIUSD | Uniswap vs United States Dollar CFD | 0.061 | 0.064 |

| XTZUSD | Tezos vs United States Dollar CFD | 0.003 | 0.026 |

Bonds Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| EURBOBL | Euro Bobl | 0.01 | 0.01 |

| EURBUND | Euro Bund | 0.01 | 0.011 |

| EURSCHA | Euro Schatz | 0.01 | 0.01 |

| ITBTP10Y | BTP Italian Bonds | 0.02 | 0.02 |

| JGB10Y | Japanese 10 YR | 0.03 | 0.034 |

| UKGB | UK Long Gilt | 0.01 | 0.012 |

| UST05Y | US 5 YR T-Note | 0.014 | 0.014 |

| UST10Y | US 10 YR T-Note | 0.031 | 0.031 |

| UST30Y | US T-Bond (30 year) | 0.03 | 0.031 |

XM Swap Fees

Swap fees represent the cost or credit incurred when holding a trading position overnight, reflecting the differences in interest rates between currencies. A swap long is the fee or credit applied to a buy position held past the trading day, while a swap short applies to a sell position held overnight.

These fees are calculated per full base currency contract (100,000 units), providing a standardized measure for traders.

Testing and market comparison indicate that XM’s swap rates are generally low to average, making them well-suited for longer-term strategies such as swing trading. Traders can use this feature to plan positions efficiently without excessive overnight costs, allowing for flexible portfolio management and strategic market exposure.

XM’s swap structure is transparent and consistent, supporting both novice and experienced traders in implementing medium- to long-term trading plans.

| Instrument | Swap Short | Swap Long |

|---|---|---|

| EURUSD | Credit of $1.77 | Charge of $8.13 |

| GBPJPY | Charge of $46.1 | Credit of $12.8 |

XM Non-Trading Fees

XM maintains a transparent and competitive non-trading fee structure that is ideal for both casual and active traders. Deposits and withdrawals are generally free, although third-party banking fees may occasionally apply depending on your payment method.

Inactivity fees are modest and designed to encourage account activity. Dormant accounts incur a $10–$15 one-time fee after a period of inactivity, followed by a $5 monthly fee if the account remains unused. Small bank withdrawals under $200 may carry a $15 processing fee, ensuring compliance with banking standards while keeping costs reasonable for most traders.

XM’s fee structure emphasizes low maintenance costs, making it easier for traders to focus on strategy and execution rather than unnecessary account charges.

Fx Empire :

Forex Brokers : Fees Summary

Broker Chooser :

| Minimum Deposit info | $200 |

|---|---|

| Average Spread EUR/USD - Standard | 0.62 |

| All-in Cost EUR/USD - Active | 0.62 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

XM Deposit and Withdrawals

Deposit and Withdrawal Intro

XM offers a variety of convenient methods for funding and accessing your trading account, including bank wire transfers, credit and debit cards, and e-wallets. The broker does not impose handling fees for any of these payment options, though standard third-party banking charges may apply depending on your provider.

Most transactions are processed within one business day, ensuring fast access to your funds. XM’s efficient and low-cost deposit and withdrawal system provides traders with flexibility, speed, and reliability, supporting a seamless trading experience.

Pros:

- Credit/Debit card available

- Free wire withdrawal above $200

- Several account base currencies

Cons:

- None

XM Account Base Currencies

At XM, you can choose from the following base currencies:

| HUF | PLN | CHF | AUD |

| SGD | RUB | GBP | EUR |

| JPY | USD |

Managing your trading account in the same currency as your bank account or trading assets that match your account’s base currency can eliminate unnecessary conversion fees, saving you money on every transaction.

A practical solution is to open a multi-currency account with a digital bank. These accounts typically support multiple currencies, offer competitive exchange rates, and provide low-cost or free international transfers. The setup process is quick and can be completed entirely on your smartphone, allowing you to optimize your trading funds without added conversion costs.

Using a multi-currency banking solution is a smart strategy for cost-efficient trading and hassle-free account management.

XM Deposit Fees and Options

XM provides fee-free deposit options, ensuring that clients can fund their accounts without incurring extra costs. Deposits can be made via bank transfers or credit/debit cards, offering flexibility for a wide range of users. Additionally, clients under the IFSC jurisdiction can take advantage of the SticPay e-wallet, enabling fast and convenient electronic transfers.

This setup allows traders to start trading quickly while minimizing unnecessary transaction costs.

XM deposit methods and fees:

| Payment Method | Currency | Processing Time | Fee |

|---|---|---|---|

| Skrill | EUR, USD, GBP | Instant | $0 |

| Wire Transfer | EUR, USD, GBP | 2-5 business days | $0 |

| Credit/Debit Card | EUR, USD, GBP | Instant | $0 |

| Neteller | EUR, USD, GBP | Instant | $0 |

XM Withdrawal Fees and Options

XM offers withdrawals free of charge for most payment methods, making it simple for traders to access their funds without extra costs. The only exception applies to bank wire transfers under $200, which carry a $15 processing fee.

With multiple withdrawal methods available, including bank transfers and cards, XM ensures that accessing your funds is fast, secure, and cost-effective.

XM withdrawal methods and fees:

| Payment Method | Currency | Processing Time | Fee |

|---|---|---|---|

| Wire Transfer | EUR, USD, GBP | 2-5 business days | $0 |

| Skrill | EUR, USD, GBP | Up to 24 hours | $0 |

| Credit/Debit Card | EUR, USD, GBP | Up to 24 hours | $0 |

| XM Neteller | EUR, USD, GBP | Up to 24 hours | $0 |

How long does XM withdrawal take?

When withdrawing funds from XM, debit card transactions are typically processed within 2 business days. This fast turnaround ensures that traders can access their funds promptly, maintaining flexibility and control over their accounts.

How do you withdraw money from XM?

Withdrawing money from XM is a straightforward process:

Access Your Account: Log in using your registered credentials.

Navigate to Withdrawals: Click on the ‘Withdraw Funds’ section in your account dashboard.

Choose Your Method: Select the preferred withdrawal option, such as bank transfer, debit/credit card, or e-wallet.

Specify the Amount: Enter the sum you wish to withdraw and confirm the transaction.

This streamlined procedure ensures your funds are processed efficiently and securely.

XM Trading Platforms and Tools

Trading Platforms and Tools Intro

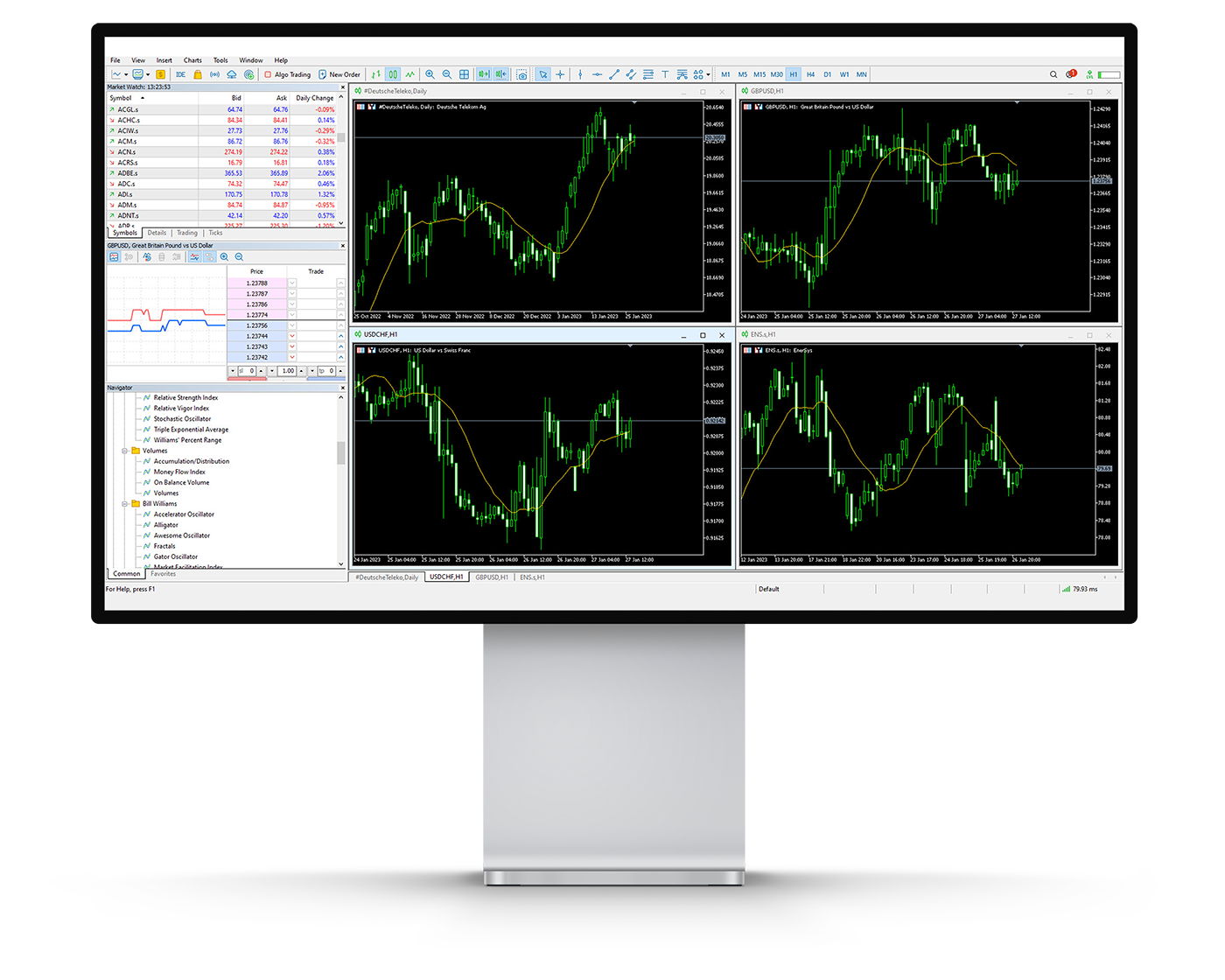

XM provides traders with access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), supporting trading on web browsers, desktop computers, and mobile devices. These platforms deliver advanced charting tools, technical indicators, and automated trading capabilities for both beginner and experienced traders.

For account managers, XM offers MT4 Multiterminal, enabling efficient management of multiple client accounts simultaneously. Additionally, the broker provides VPS hosting to ensure uninterrupted trading, faster execution speeds, and improved reliability for algorithmic strategies.

This combination of platforms and technology ensures a versatile, professional, and seamless trading experience.

MetaTrader 4

MetaTrader 4 Desktop Intro

The desktop version of MetaTrader 4 (MT4) offered by XM caters to both beginner and advanced traders, providing an intuitive interface that simplifies navigation across charts, orders, and trading instruments. While its chart visuals may appear less modern than newer platforms, MT4 is widely recognized for its reliability, speed, and functional depth.

Platform Compatibility & Language Support

XM’s MT4 is fully compatible with Windows and Mac operating systems and supports 52 languages, including English, French, Spanish, German, Arabic, and Chinese. This extensive language support ensures accessibility for traders around the globe.

Key Features

Custom Alerts: Configure alerts for specific price levels to spot potential trading opportunities quickly.

Watchlist Management: Build personalized watchlists to track preferred instruments and monitor market movements efficiently.

One-Click Trading: Execute market orders instantly at the current price, ideal for scalpers and high-speed trading strategies.

Chart-Based Trading: Place orders directly from the chart, specifying entry price, volume, stop-loss, and take-profit levels for precision control.

Expert Advisor Integration: MT4 supports automated trading through Expert Advisors (EAs), with built-in strategy testing to optimize algorithms under various market conditions.

Why XM MT4 Desktop Stands Out

With a combination of customizable alerts, automated trading capabilities, and direct chart execution, XM’s MT4 desktop platform delivers a professional-grade environment. Traders benefit from precision, flexibility, and efficiency, making it suitable for those looking to execute advanced trading strategies with confidence.

Pros:

- Clear fee report

- Price alerts

- Good customizability (for charts, workspace)

Cons:

- Search function could be improved

- Poor design

Charts

XM’s MetaTrader 4 (MT4) platform delivers a robust suite of charting options and analytical tools tailored for both technical and strategic trading. Designed to support detailed market analysis, MT4 equips traders with features suitable for manual trading as well as algorithmic strategies.

- Technical Indicators: Traders can utilize 38 built-in technical indicators, covering trend analysis, volume measurement, and oscillator-based tools. These indicators help analyze price action, gauge market sentiment, and anticipate potential market movements, making them essential for informed trading decisions.

- Drawing Tools: MT4 includes 24 drawing tools, such as Fibonacci retracements and Elliott waves, which assist in pinpointing price patterns, key support and resistance levels, and likely breakout points. While powerful for technical analysis, using multiple indicators simultaneously can make charts appear crowded, requiring careful management.

- Timeframes & Chart Types: The platform supports 21 timeframes, allowing multi-timeframe analysis for a comprehensive understanding of market trends. Traders can switch between line charts, bar charts, and candlestick charts, providing versatile perspectives to identify and act on trading opportunities.

- User Considerations: Although MT4’s extensive charting and analytical capabilities empower advanced trading, the platform can become visually dense when several indicators are applied at once. Traders should balance the use of tools to maintain clarity and optimize analysis.

Overall, XM’s MT4 charting suite offers exceptional flexibility and precision. Its combination of technical indicators, drawing tools, and multi-timeframe support makes it a preferred platform for traders seeking thorough market analysis and strategic execution.

Orders

XM’s MetaTrader 4 (MT4) platform provides flexible and precise order execution tools suitable for a range of trading strategies, from manual to high-frequency trading. The platform supports multiple order types, empowering traders to enter and exit positions efficiently.

- Market Orders: Market orders allow traders to execute positions immediately at the best available market price. While they ensure the requested trade volume is met, the final execution price may slightly differ from the quoted price due to normal market fluctuations.

- Limit Orders: Limit orders give traders control over entry points by specifying the exact price at which a trade should be executed. Orders are only filled when the market reaches the designated price, providing precision for strategic entries.

- Stop Orders: Stop orders are essential for risk management, helping to limit potential losses. A stop-loss is set above or below the current market price, and if triggered, it converts into a market order to close the position at the most favorable price possible under the conditions.

- One-Click Trading: Combining these order types with one-click trading, MT4 on XM allows traders to act swiftly on opportunities. This feature is particularly advantageous for scalpers, day traders, and those implementing automated algorithmic strategies, ensuring trades are executed with speed and accuracy.

With its comprehensive suite of order execution options, XM’s MT4 platform offers traders the flexibility, precision, and efficiency needed to implement a wide variety of trading approaches confidently.

Mt4 WebTrader

XM’s MetaTrader Web Platform, also known as Web Trader, delivers a streamlined version of the desktop platform, enabling traders to access their accounts directly from any web browser without installing additional software. This makes it an ideal choice for traders seeking flexibility and convenience across devices and operating systems.

Key Features

One-Click Trading: Execute trades instantly with a single click, allowing rapid response to market opportunities.

Chart-Based Trading: Place orders directly from interactive charts to act quickly on price movements.

Real-Time Watchlists: Monitor your favorite instruments and track live quotes effortlessly for better market insight.

Trade History Access: Review past trades to analyze performance, optimize strategies, and enhance decision-making.

Advanced Charting Tools: Utilize up to 30 technical indicators for in-depth analysis and more informed trading choices.

Copy Trading and Automation: Follow successful traders or automate your own strategies for efficiency and diversification.

Why Choose XM Web Trader?

The Web Trader platform combines ease of use with powerful functionality, offering a full-featured trading experience directly in your browser. With advanced charting, fast execution, and automation options, XM ensures traders can manage their positions and strategies efficiently, making it a standout option among top Forex brokers.

MT4 Mobile App

Pros:

- Good search function

- User-friendly

- Price alerts

Cons:

- No two-step (safer) login

XM’s MetaTrader 4 (MT4) mobile application, compatible with both iOS and Android, provides traders with full market access wherever they are. The app is designed for speed and efficiency, allowing users to open, close, and manage positions seamlessly from their smartphones or tablets.

Key Features

Flexible Order Types: Execute market, limit, and stop orders with ease, while adjusting trade size and exposure on existing positions.

Intuitive Interface: A clean, responsive design ensures that critical trading decisions can be made quickly, even during fast-moving market conditions.

Real-Time Data and Execution: Integrated with XM’s advanced execution systems and live market data, the app supports professional-grade trading on the go.

Mobile Portfolio Management: Monitor account balances, open positions, and trade history efficiently from anywhere.

Why MT4 Mobile Stands Out

Combining intuitive navigation with robust trading tools, XM’s MT4 mobile platform empowers both casual and professional traders to respond instantly to market movements. Its comprehensive mobile functionality ensures flexibility, precision, and control, making it an essential companion for active traders seeking performance and convenience in dynamic markets.

Look and Feel

XM provides a sleek and intuitive MT4 mobile trading platform that merges clean aesthetics with practical functionality. Its well-organized layout ensures smooth navigation, allowing traders to access charts, execute orders, and manage open positions quickly and efficiently.

Key Highlights

User-Friendly Interface: Designed for both beginners and experienced traders, the platform simplifies complex tasks, making mobile trading seamless.

Efficient Trade Management: Open, modify, or close positions directly from your device with precision and speed.

Accessible Market Insights: Monitor live price feeds, track performance, and adjust strategies on the go.

Optimized Design: A visually clean interface reduces clutter while keeping all essential tools readily available.

With XM’s MT4 mobile app, traders enjoy a comprehensive and responsive mobile trading experience, empowering them to stay connected to global markets anytime, anywhere.

Login and security

XM’s MT4 mobile app provides a simple, single-step login for quick access to your trading account. While this streamlined process is convenient, security could be further enhanced by integrating two-factor authentication (2FA), adding an extra layer of protection against unauthorized access.

Currently, the platform does not support biometric login options such as fingerprint or facial recognition. Introducing these features would not only improve account security but also offer a faster and more seamless login experience for mobile traders.

By incorporating advanced security measures like 2FA and biometric authentication, XM could elevate both usability and protection, ensuring traders have a secure and efficient mobile trading environment.

Search functions

The XM MT4 mobile application features a powerful search function designed to help traders locate instruments and tools quickly and efficiently. Users can type the name of a specific asset directly into the search bar or navigate through well-organized category folders to discover available options.

This dual navigation approach ensures both speed and flexibility, allowing traders to seamlessly explore trading assets, access charts, and manage positions without unnecessary delays. By streamlining instrument discovery, XM empowers users to focus on making informed trading decisions while maintaining a smooth, intuitive mobile experience.

Placing orders

The XM MT4 mobile platform offers versatile order placement options designed to support a wide range of trading strategies. Traders can execute market orders for immediate entry, limit orders to buy or sell at a predetermined price, and stop-loss orders to effectively manage risk and safeguard open positions.

To accommodate different trading styles, the platform also includes order time settings:

Good ‘til Canceled (GTC): Orders stay active until manually canceled, providing flexibility for longer-term strategies.

Good ‘til Time (GTT): Orders automatically expire after a set duration, ideal for short-term trading plans.

By combining multiple order types with precise time controls, XM ensures accurate execution and enhanced control, allowing traders to manage positions efficiently, even while on the move.

Alerts and notifications

Currently, the XM MT4 mobile app does not support alerts or push notifications, a feature that is only available on the desktop platform. Alerts play a crucial role in tracking market movements and executing trades at optimal moments, so their absence on mobile can limit real-time responsiveness.

While mobile users can still monitor market activity and manage positions in real time, desktop remains the preferred platform for traders who rely on instant trade alerts and timely notifications. Incorporating this functionality into the mobile app would significantly elevate convenience and trading efficiency for on-the-go users.

MetaTrader 4: Key Takeaways

MT4 Desktop Platform

The desktop version of MetaTrader 4 delivers fast and dependable order execution, ideal for traders who prioritize precision and efficiency. While its interface is functional, it appears somewhat dated compared to modern trading platforms, and charting flexibility is limited. Multi-timeframe analysis and complex technical studies may feel constrained, making the desktop platform better suited for straightforward trading strategies and automated systems.

MT4 Mobile App

XM’s MT4 mobile app provides seamless trade management on the go, empowering traders to monitor positions, execute orders, and manage risk directly from smartphones or tablets. Its speed and accessibility make it essential during volatile market conditions. However, for detailed technical analysis or in-depth charting, the mobile interface is less capable, and traders may prefer the desktop platform for comprehensive evaluation.

Conclusion

Overall, MT4 offers a well-rounded trading solution across desktop and mobile, combining reliability, speed, and convenience. Traders benefit from quick, on-the-go access while maintaining the option to perform advanced charting and analytical tasks on the desktop version.

XM Tradeable Instruments

Tradeable Instruments Intro

XM provides traders with access to more than 1,300 financial instruments, covering major and minor currency pairs, commodities, share CFDs, and global indices. These assets can be traded as spot contracts, CFDs, or futures, offering flexibility for diverse trading strategies. However, lower-risk investment options such as ETFs and traditional bonds are not available across most accounts, and real stocks are only accessible under XM’s FSC-regulated entity. Cryptocurrency trading is offered to clients onboarded via XM Global Limited, expanding opportunities for those interested in digital assets.

While the range of currency pairs is around the industry average, XM stands out for its extensive selection of commodities, share CFDs, and indices. One limitation to note is that leverage levels for products are preset and cannot be adjusted manually. This can increase risk, particularly for forex and CFD trades, so traders should carefully manage exposure to align with their risk tolerance.

Overall, XM delivers a robust and diverse trading portfolio suitable for both new and experienced traders, emphasizing CFDs, forex, and indices while providing selective access to real stocks and cryptocurrencies.

| Markets | Types | Contract Types | Industry Average | XM |

|---|---|---|---|---|

| Commodities | Metals, Energies, Agriculture | CFDs, Futures | 5 – 10 | 14 |

| Indices | US, Europe, Asia | CFDs, Spot | 5 – 10 | 26 |

| Currency Pairs | Majors, Minors, Exotic | Spot | 30 – 75 | 55 |

| Share CFDs | US, Europe, Asia | CFDs | 100 – 500 | 1300 |

What are CFDs ?

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of underlying assets without taking physical ownership. For instance, opening a long CFD position on gold means you profit if gold’s price rises and incur losses if it falls, all without purchasing actual gold.

One of the key benefits of trading CFDs is the ability to enter and exit positions almost instantly, making them ideal for capitalizing on even minor market fluctuations. This flexibility allows traders to respond rapidly to market changes, implement precise risk management strategies, and leverage short-term opportunities across forex, commodities, indices, and share CFDs.

By offering CFDs, XM enables both beginner and experienced traders to diversify their trading approaches, access global markets efficiently, and take advantage of dynamic price movements without the logistical constraints of owning the underlying assets.

Social Trading

XM elevates its trading ecosystem with an engaging social trading experience, featuring competitive trading events and a robust Copy Trading platform.

The Copy Trading feature allows traders to connect, share strategies, and learn from one another. Participants can take on two primary roles:

Investor Role: Traders, particularly beginners, can follow experienced strategy managers and allocate investment amounts to mirror their trades. This approach enables newcomers to engage in the markets confidently while observing and learning proven trading techniques.

Strategy Manager Role: Experienced traders can create, refine, and share their own strategies with the community. Each time their strategy is copied successfully, they earn a share of the profits generated, providing both recognition and financial reward for their expertise.

By integrating social interaction with strategic learning, XM’s Copy Trading platform empowers traders to grow their skills, diversify their approaches, and participate in a dynamic, collaborative trading environment.

XM Instruments: Key Takeaways

XM stands out for its comprehensive range of share CFDs, providing access to stocks from leading companies across global markets. This extensive coverage allows traders to build diversified portfolios and explore opportunities in multiple sectors.

In addition to individual shares, XM offers thematic indices, enabling users to gain exposure to broader market trends and sectors, which is ideal for those looking to diversify their trading strategies efficiently.

However, the platform does not currently support trading in cryptocurrencies or ETFs, which may limit options for traders seeking exposure to digital assets or lower-risk exchange-traded funds.

Overall, XM’s instruments offering is well-suited for traders focused on share CFDs and indices, combining broad market access with thematic diversification opportunities.

| Tradable Instruments | XM |

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 1395+ |

| Forex Pairs (Total) | 55 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

XM Leverage

What is CFD Leverage?

CFD leverage is a mechanism that allows traders to control larger market positions with a smaller amount of capital. When trading Contracts for Difference (CFDs), leverage effectively enables the broker to lend funds, increasing a trader’s market exposure beyond their initial investment.

This feature can significantly amplify potential profits on successful trades, allowing traders to maximize returns from favorable market movements. However, leverage also magnifies losses when trades move against the trader, making risk management strategies essential.

In essence, CFD leverage offers traders the opportunity to enhance market participation and returns, but it requires careful use and disciplined risk control to avoid substantial losses.

Maximum Leverage By Asset Class

Below is an overview of the highest retail leverage offered by XM across various financial instruments. This table highlights the leverage levels available for traders, helping you plan your risk and trading strategy effectively:

| Asset Class | Maximum Leverage |

|---|---|

| Indices | 1:20 |

| Share CFDs | 1:5 |

| Currency Pairs | 1:30 |

| Commodities | 1:20 |

Account Opening with XM

Pros:

- Fast

- Low minimum deposit for forex accounts

- Fully digital

Cons:

- None

XM Account Opening Process

To open an account with XM, follow these easy steps:

- Step 1: Click ‘Open an Account’ at the top-right corner of the main page.

- Step 2: Fill in your personal details.

- Step 3: Choose your preferred trading platform and the type of account.

- Step 4: Fill in your address and date of birth.

- Step 5: Select the base currency of your account and leverage (if applicable).

- Step 6: State your employment status, level of education, and other data that can help determine your risk tolerance.

- Step 7: Confirm that you are not a politically exposed person.

- Step 8: Create a password and open a real account.

- Step 9: Provide proof of ID and address to verify your account.

What is the minimum deposit at XM?

XM offers accessible account options with low initial funding requirements, making it easy for traders at any level to start. For Micro and Standard accounts, the minimum deposit is just $5, allowing beginners to enter the market with minimal risk.

For traders opting for the XM Zero account, which features tighter spreads and commission-based trading, the minimum deposit is $100.

These low entry thresholds provide flexibility and accessibility, enabling both new and experienced traders to tailor their trading experience according to their budget and strategy.

| Account Type | Ultra Low Micro Account | Ultra Low Standard Account | XM Zero Accounts |

|---|---|---|---|

| Minimum Deposit Requirement | $5 | $5 | $100 |

| Demo Account | Yes | Yes | Yes |

| Spread From | 0.6 pips | 0.6 pips | 0.0 pips |

| Commission | $0 | $0 | $7 |

| Islamic Account | Yes | Yes | Yes |

| Contract Size | 1 Lot = 1000 units | 1 Lot = 100,000 units | 1 Lot = 100,000 units |

| Base Currency | EUR, USD, GBP | EUR, USD, GBP | EUR, USD, GBP |

XM Account Types

XM provides traders with a selection of three retail account types, each designed to accommodate different trading preferences and strategies. All accounts have a minimum deposit of $5, making them accessible to beginners and smaller-scale traders.

The available base currencies include USD, EUR, and GBP, allowing traders to manage their accounts in the currency that best suits their needs. For clients seeking Sharia-compliant trading, XM also offers Islamic accounts that operate without swaps, providing a fully compliant, interest-free trading experience.

Each account type varies in pricing structure, contract size, and available features, giving traders the flexibility to choose the account that aligns with their trading goals and risk management approach.

XM Demo Account

XM provides a demo account designed to give traders a risk-free introduction to the broker’s platform and services. This account allows users to practice trading strategies, explore features, and gain market experience without risking real capital.

As financial markets are dynamic and constantly changing, demo accounts offer an essential space to hone skills, test new approaches, and build confidence before trading live. Traders can easily set up a demo account alongside a live CFD account, enabling seamless transition from practice to real trading when ready.

XM Islamic Account

XM provides Islamic accounts designed for swap-free trading, fully compliant with Shariah law. These accounts allow traders who follow Islamic finance principles to engage in the markets without incurring overnight interest (swap) fees, ensuring adherence to ethical trading standards while maintaining full access to XM’s range of trading instruments and features.

XM Restricted Countries

While XM serves clients globally, it does not provide services to residents of certain countries due to regulatory restrictions, international sanctions, or internal compliance policies. Individuals from these locations attempting to access XM may see a notification stating: “Unfortunately, the product or service you’re trying to access isn’t available in your country.”

Currently, XM does not accept clients from the United States, Canada, Israel, the Islamic Republic of Iran, and other sanctioned nations. Residents of the United Kingdom are also restricted; instead, they are directed to Trading.com/uk, an independent entity within the same corporate group.

This list of restricted countries is subject to change as regulations and internal policies evolve. To confirm whether XM accepts clients from your country, always consult the official XM website for the most up-to-date information.

XM Research

XM provides traders with a comprehensive suite of research resources designed to enhance decision-making and identify market opportunities. The broker’s research offerings are developed in-house and cover economic events, technical analysis, and market trends in a digestible, actionable format.

Economic Calendar

The XM economic calendar is a vital tool for traders, highlighting upcoming financial events and economic releases that can significantly influence price movements. By staying informed on these events, traders can anticipate volatility and plan strategic entries and exits.

Forex and Market News

XM’s intuitive news screener delivers up-to-date coverage of global financial markets. Traders gain access to breaking developments, trading setups, and market insights that help them capitalize on emerging opportunities in real time.

Trading Ideas and Technical Analysis

The broker’s trading analyses provide detailed breakdowns of potential market setups using technical indicators. Each report includes annotated charts highlighting key support and resistance levels, entry and exit points, and other critical metrics, helping traders make informed decisions based on comprehensive technical evaluation.

Additional Resources

To further support traders, XM offers podcasts, daily market summaries, and webinars, all aimed at improving trading knowledge and strategy execution. These resources are designed to be practical, engaging, and aligned with the dynamic nature of financial markets, giving traders both novice and advanced the tools to succeed.

XM Research: Key Takeaways

XM delivers a robust and user-friendly research ecosystem, combining an economic calendar, real-time market news, technical trading ideas, podcasts, and webinars. These resources equip traders with actionable insights, helping them anticipate market movements, identify profitable setups, and make informed decisions with confidence – whether they are beginners or seasoned professionals.

| Research Summary | XM |

|---|---|

| Signal Centre (Acuity Trading) info | No |

| Daily Market Commentary info | Yes |

| Forex News (Top-Tier Sources) info | Yes |

| TipRanks info | No |

| Autochartist info | No |

| Trading Central (Recognia) info | Yes |

| Social Sentiment - Currency Pairs info | Yes |

| Economic Calendar info | Yes |

XM Education

XM provides a comprehensive and well-structured educational suite designed to support traders at every experience level. The platform features an extensive library of video tutorials, supplemented by frequent webinars that cover a wide range of topics, including technical and fundamental analysis, trading psychology, and risk management. Beginners can learn to interpret price action, apply various technical indicators effectively, and develop practical trading strategies, while more experienced traders can refine their skills and stay updated on advanced market concepts. This blend of structured learning and practical insights ensures traders gain the knowledge and confidence needed to make informed, strategic decisions in the markets.

XM Education: Key Takeaways

XM’s educational resources offer a structured and accessible path for traders of all levels to enhance their skills. With a mix of video tutorials, live webinars, and practical trading guides, the platform covers technical analysis, fundamental analysis, trading psychology, and strategy development. Beginners can build a solid foundation in reading price action and using indicators, while experienced traders can refine advanced techniques. Overall, XM’s education tools empower users to trade more confidently and make informed, strategic decisions in dynamic markets.

| Education Summary | XM |

|---|---|

| Investor Dictionary (Glossary) info | No |

| Videos - Beginner Trading Videos info | Yes |

| Client Webinars info | Yes |

| Videos - Advanced Trading Videos info | Yes |

| Client Webinars (Archived) info | Yes |

| Education (Forex or CFDs) info | Yes |

Final Thoughts

XM is a well-established derivatives broker headquartered in Cyprus, with additional offices in Australia, the UAE, and Belize. The broker provides access to over 1,300 tradable instruments across forex, commodities, share CFDs, and indices, catering to a wide range of trading strategies. Regulated by four authorities worldwide, XM maintains strict compliance with essential safety and security standards.

Traders can use MetaTrader 4 and MetaTrader 5, supported by free VPS hosting for faster trade execution. XM also offers comprehensive educational resources and in-depth research tools, making it suitable for both novice and experienced traders seeking actionable market insights.

While XM’s raw spreads account delivers competitive pricing, its other account options come with higher-than-average trading costs. Additionally, the broker does not provide cryptocurrencies or lower-risk investment options such as ETFs and bonds, which may limit diversification for some investors.

Overall, XM combines robust trading infrastructure, extensive learning resources, and regulatory credibility, positioning itself as a reliable choice for traders who prioritize market access and technical support.

XM FAQ

Does XM provide VPS hosting?

Yes, VPS hosting is available to ensure faster trade execution.

Is XM suitable for beginners?

Yes. XM offers extensive educational materials, including videos, webinars, and tutorials, combined with responsive customer support. Its intuitive platforms make it easy for novice traders to learn and grow.

What is the maximum leverage at XM?

Retail clients can access leverage of up to 1:30.

Is XM suitable for scalping or automated trading?

Yes. With VPS hosting for low-latency trading, one-click trading on MetaTrader, and support for Expert Advisors (EAs) and strategy backtesting, XM is well-suited for scalping and algorithmic trading.

Where is XM based?

XM is headquartered in Cyprus and maintains additional offices in Australia, Belize, and the UAE.

How do I withdraw money from XM?

Withdrawals are processed via bank wire, credit/debit cards, and e-wallets. Verified accounts can often enjoy same-day or instant withdrawals, while standard transactions may take 2–5 business days.

Does XM provide a demo account?

Yes, XM offers a demo account that allows traders to practice strategies risk-free before engaging in live trading.

Is XM safe?

Yes. XM ensures the segregation of client funds and provides negative balance protection. The broker also enforces a strict ‘best execution policy,’ all of which contribute to a secure trading environment.

Which trading platforms does XM offer?

XM supports MetaTrader 4, MetaTrader 5, and the MetaTrader 4 Multiterminal, catering to both manual and automated trading styles.

How can I deposit funds into my XM account?

Deposits can be made using bank wire, credit or debit cards, and various e-wallet options.

What is the minimum deposit for XM?

The minimum deposit starts at just $5 for Micro and Standard accounts. XM Zero accounts require a minimum deposit of $100.

Is XM suitable for hedging or spread betting?

No. XM does not provide low-risk securities for hedging, nor does it offer spread betting.

Is XM a market maker or a bank?

XM operates as a market maker but does not function as a bank.

About Tradewiki.io

Our goal at Tradewiki.io is to deliver clear, unbiased reviews of top international forex brokers and prop firms, guiding you toward the best forex broker or prop firm that fits your needs. Since launch, Tradewiki.io has helped thousands of traders worldwide find, compare, and choose trusted forex brokers and prop firms.

Tradewiki.io Reviews