XTB Review 2025- Words Done

XTB Review 2025- Words Done

Overall Rating

Min. Deposit

Spreads From

Max. Leverage

XTB Overview

Founded in Poland in 2004, XTB has established itself as a prominent global broker in forex and CFDs. The firm operates through multiple subsidiaries, each regulated by top-tier authorities, including the UK’s FCA, CySEC, and BaFin, and is publicly listed on the Warsaw Stock Exchange (WSE: XTB).

XTB clients gain access to more than 10,000 instruments, encompassing exchange-traded stocks, ETFs, and CFDs across forex, indices, commodities, and individual shares. This extensive range supports a variety of trading strategies, from short-term speculative approaches to long-term investment portfolios.

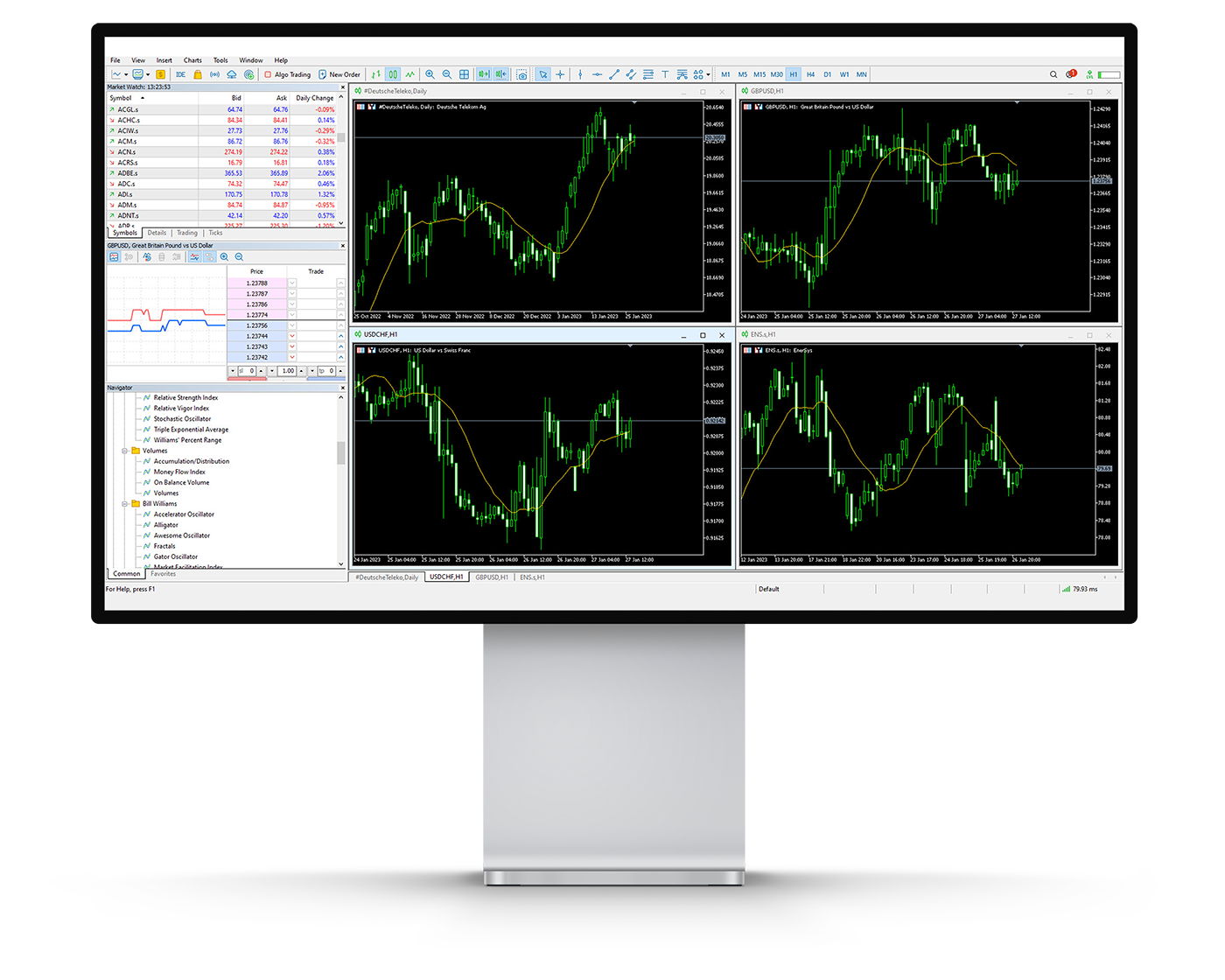

The broker’s proprietary xStation 5 platform is highly intuitive and customizable. It offers advanced charting capabilities, market sentiment indicators, and depth-of-market (DOM) tools to help traders identify potential opportunities. The XTB mobile app mirrors the desktop experience, providing a streamlined, user-friendly interface for monitoring markets and managing trades while on the move.

XTB also delivers strong research and educational support. Its in-house team produces high-quality market news, analysis, and actionable insights, complemented by advanced tools such as scanners and heatmaps.

Trading costs at XTB are generally aligned with industry standards. The broker offers competitive spreads on major forex pairs, transparent fees, and minimal account-related charges, making it suitable for cost-conscious traders.

Overall, XTB is a versatile broker that accommodates a wide spectrum of trading styles and skill levels. Its combination of extensive instruments, robust platform functionality, comprehensive research, and educational resources makes it a strong choice for traders seeking flexibility, reliability, and professional-grade trading tools.

XTB Pros and Cons

XTB Pros:

- Free and fast account opening

- Wide range of tradable instruments including real stocks and ETFs

- Trading courses from seasoned professionals

- Great selection of CFDs on stocks, ETFs, forex, commodities, and indices

- Tight spreads in EUR/USD

- Strong research materials and market analysis

- Interest paid on uninvested cash (up to 4.25%)

- 200+ educational lessons via the Trading Academy

- Global presence

- Zero-commission share CFDs in the U.K.

- Robust and intuitive xStation platform with advanced tools

XTB Cons:

- XTB Social feature is limited to users in Poland

- High conversion fee

- Does not support algo trading

- Inactivity fee charged

- Custom investment basket tool is temporarily unavailable

Beginner – Perfect Match

XTB is ideal for casual traders, thanks to a $0 minimum deposit requirement. The xStation 5 platform and XTB mobile app simplify market entry, order placement, and account management. Beginners also benefit from a demo account and micro-lot trading, allowing them to practice with minimal risk while building confidence.

News Trading – Acceptable Choice

XTB supplies a steady flow of news articles from in-house analysts and an integrated economic calendar within xStation 5, offering valuable market insights. The addition of external feeds from trusted sources like Reuters or Dow Jones could further enhance this feature.

Scalping – Perfect Match

Scalpers gain an advantage with XTB’s fast execution speeds and access to depth-of-market (DOM) data, which reveals order volumes at different price levels. This insight helps traders gauge liquidity and make rapid, informed trading decisions.

Investing – Perfect Match

For long-term investors, XTB provides access to over 4,820 exchange-traded stocks and ETFs. Features like the built-in stock screener and XTB Investment Plans allow users to build personalized portfolios, automatically allocate funds, and receive alerts for rebalancing to maintain target allocations over time.

Automated Trading – Not Recommended

The platform does not support popular automated trading solutions like MetaTrader or cTrader. As of March 2025, API access for xStation 5 is unavailable, limiting the integration of external automated trading systems.

Swing Trading – Acceptable Choice

Swing traders can leverage 2,397 CFDs on shares and ETFs, along with access to 4,820 exchange-traded instruments from US and European markets. Overnight holding costs are moderate for most assets but slightly higher for commodities like gold.

Day Trading – Perfect Match

Day traders will appreciate XTB’s one-click trading and chart-based order entry, enabling swift reactions to market changes. Competitive spreads on popular pairs like EUR/USD help minimize trading costs, while advanced charting and market sentiment tools enhance decision-making.

Copy and Social Trading – Not Recommended

XTB does not currently offer copy trading capabilities, preventing users from automatically mirroring the trades of other investors.

Who is XTB for?

When evaluating XTB, it’s clear that the broker offers the features and tools to cater to a wide range of trading strategies. Here’s how it stacks up for different trader styles:

What Sets XTB Apart?

XTB differentiates itself through a combination of versatility, user-friendly platforms, and a broad range of trading instruments. Its intuitive xStation 5 platform allows clients to trade both real exchange-traded stocks and leveraged CFDs from a single interface, catering to a wide spectrum of trading styles. Short-term traders benefit from competitive spreads and efficient order execution, while long-term investors can access stocks, ETFs, and structured investment plans to build diversified portfolios.

Beyond its trading capabilities, XTB offers a seamless account setup process and convenient deposit and withdrawal options, many of which are free or low-cost. Users should note that inactivity fees apply after one year, and certain asset classes, such as options, may not be available across all XTB entities.

Overall, XTB provides a smooth and professional trading experience that appeals to both active traders and long-term investors, combining robust platform functionality with access to a wide range of financial instruments.

XTB Main Features

Regulations

FCA (United Kingdom), BaFin (Germany), KNF (Poland), IFSC (Belize), CySEC (Cyprus), CNMV (Spain)

Languages

English, French, Portuguese, Thai, Polish, Czech, Italian, Spanish, Vietnamese, German, Hungarian, Romanian, Turkish, Arabic, Indonesian, Slovenian

Products

Currencies, Stocks, ETFs, Indices, Commodities

Min Deposit

$0

Max Leverage

1:30 (FCA), 1:30 (BaFin), 1:100 (KNF), 1:500 (IFSC), 1:30 (CySEC), 1:30 (CNMV)

Trading Desk Type

No dealing desk, Market Maker

Trading Platforms

xStation 5

Deposit Options

Wire Transfer, Visa, Mastercard

Withdrawal Options

Wire Transfer

Demo Account

Yes

Foundation Year

2002

Headquarters

Poland

Regulations

FCA (United Kingdom), BaFin (Germany), KNF (Poland), IFSC (Belize), CySEC (Cyprus), CNMV (Spain)

Languages

English, French, Portuguese, Thai, Polish, Czech, Italian, Spanish, Vietnamese, German, Hungarian, Romanian, Turkish, Arabic, Indonesian, Slovenian

Products

Currencies, Stocks, ETFs, Indices, Commodities

Min Deposit

$0

Max Leverage

1:30 (FCA), 1:30 (BaFin), 1:100 (KNF), 1:500 (IFSC), 1:30 (CySEC), 1:30 (CNMV)

Trading Desk Type

No dealing desk, Market Maker

Trading Platforms

xStation 5

Deposit Options

Wire Transfer, Visa, Mastercard

Withdrawal Options

Wire Transfer

Demo Account

Yes

Foundation Year

2002

Headquarters

Poland

Start Trading With XTB

| Feature | Standard Account |

|---|---|

| Minimum Deposit | $0 |

| Leverage | Up to 1:30 |

| Dedicated Account Manager | Yes |

| FCSC Compensation Scheme up to £85K | Yes |

| Negative Balance Protection | Yes |

| Segregated Funds | Yes |

XTB Full Review

Safety Intro

XTB operates through multiple entities licensed by leading financial regulators, including the FCA in the UK and CySEC in Cyprus, ensuring a high level of oversight and client protection. The brokerage is publicly listed on the Warsaw Stock Exchange, reflecting transparency and adherence to strict financial reporting standards.

As of April 2025, XTB’s market capitalization reached 8.8 billion PLN (approximately 2.3 billion USD), underscoring its financial stability and reinforcing its reputation as a trustworthy provider in the forex and CFD markets. While XTB is not a bank, its robust regulatory framework and public listing provide traders with confidence in the broker’s legitimacy and operational integrity.

Pros:

- Regulated by top-tier FCA

- Negative balance protection

- Listed on stock exchange

Cons:

- Does not hold a banking license

XTB Regulation

When evaluating a broker, examining its regulatory framework is crucial to understanding the level of client protection offered. XTB operates multiple entities, each licensed by reputable authorities, which we categorize using a three-tier system. Tier-1 represents the highest standard of oversight, while Tier-3 indicates basic regulatory coverage.

Here is a breakdown of XTB’s regulatory entities:

XTB Limited (UK) – Authorized and regulated by the UK Financial Conduct Authority (FCA), Firm Reference Number 522157. The FCA protects clients in the United Kingdom and is classified as a Tier-1 regulator.

XTB Limited (CY) – Licensed by the Cyprus Securities and Exchange Commission (CySEC), License Number 169/12. CySEC oversees clients in the European Economic Area (EEA) and is rated Tier-1.

XTB S.A. German Branch – Registered with the Federal Financial Supervisory Authority (BaFin), BaFin-ID 10121520. BaFin is considered a Tier-1 regulator.

XTB S.A. – Authorized by Comisión Nacional del Mercado de Valores (CNMV), Registration Number 40. CNMV is classified as Tier-1.

X-Trade Brokers DM SA (Poland) – Regulated by the Polish Komisja Nadzoru Finansowego (KNF), which is a Tier-1 regulator.

XTB International Limited – Licensed by the International Financial Services Commission (IFSC) in Belize, License Number 000302/185. IFSC is rated as a Tier-3 regulator.

XTB’s broad regulatory coverage across multiple jurisdictions ensures strong oversight for global clients, while its Tier-1 licenses highlight its commitment to transparency, compliance, and client safety.

| Entity Features | XTB S.A. German Branch | XTB Limited (UK) | XTB International Limited | XTB Limited (CY) | XTB S.A. | X-Trade Brokers DM SA |

|---|---|---|---|---|---|---|

| Compensation Scheme | EdW 90% of claim, up to €20,000 | FSCS up to £85,000 | No | ICF up to €20,000 | ICF up to €100,000 | EFDI up to €22,000 |

| Negative Balance Protection | Yes | Yes | No | Yes | Yes | Yes |

| Country/Region | Germany | UK | Belize/International | Cyprus/EU | Spain | Poland |

| Maximum Leverage | 1:30 | 1:30 | 1:500 | 1:30 | 1:30 | 1:100 |

| Tier | 1 | 1 | 3 | 1 | 1 | 1 |

| Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes |

| Regulation | BaFin | FCA | FSC | CySEC | CNMV | KNF |

Understanding the Regulatory Protections of Your Account

When selecting a broker, it’s crucial to understand the regulatory safeguards associated with the entity where you open your account, as protections vary by jurisdiction. XTB operates multiple entities worldwide, each subject to different regulatory standards, ensuring that traders can choose the level of oversight that best suits their needs.

Maximum Leverage: Leverage limits differ based on regulation. XTB International Limited offers up to 1:500 leverage under IFSC Belize rules, catering to higher-risk strategies. In contrast, top-tier regulators like the UK FCA and EU authorities impose stricter limits, such as 1:30 for forex, reducing exposure for retail clients.

Segregation of Client Funds: All XTB entities keep client funds in segregated bank accounts separate from the company’s operational capital. This practice eliminates the risk of accounting errors impacting client balances.

Compensation Scheme: Retail traders under Tier-1 regulated entities benefit from a compensation scheme in the unlikely event of broker insolvency. XTB International Limited clients, however, do not have access to this scheme.

Negative Balance Protection: Most XTB entities cap trading losses at the amount deposited, preventing accounts from falling below zero – even during volatile market conditions. This protection is not extended to clients of XTB International Limited.

By understanding these protections, traders can make informed choices that balance risk, opportunity, and regulatory security when trading with XTB.

How you are protected

XTB operates through five distinct legal entities worldwide, each regulated by different authorities. This structure affects the level of investor protection available, making it essential for traders to understand the safeguards associated with their chosen entity.

To simplify, here’s a summary of investor protection and coverage:

Investor Compensation: Traders are protected with a scheme that covers 100% of claims up to €3,000 and 90% of claims up to €22,000, resulting in a maximum total compensation of €20,100.

Negative Balance Protection: All XTB entities provide negative balance protection, ensuring that trading losses cannot exceed the funds deposited in your account.

This framework ensures that clients benefit from both regulatory oversight and financial safeguards, offering peace of mind while trading across XTB’s platforms.

| Client country | Legal entity | Regulator | Investor protection amount |

|---|---|---|---|

| Cyprus and Hungary | XTB Limited (CY) | Cyprus Securities and Exchange Commission (CySEC) | $20,000 |

| United Kingdom | XTB Limited (UK) | Financial Conduct Authority (FCA) | £85,000 |

| Other EU clients | X-Trade Brokers Dom Maklerski SA | Polish Financial Supervision Authority (KNF) | €20,100 |

| United Arab Emirates | XTB MENA Limited | Dubai Financial Services Authority (DFSA) | No protection |

| Other countries | XTB International Limited | International Financial Services Commission of Belize (IFSC) | No protection |

Stability and Transparency

When assessing broker reliability, we focus on operational history, organizational capacity, and transparency standards. XTB demonstrates strength across all three areas, making it a trustworthy option for traders worldwide.

Established Market Presence: Since its founding in 2004, XTB has accumulated over two decades of experience in the forex and CFD markets. Its long-standing operation highlights its stability and positions it among the most experienced brokers globally.

Institutional Scale: With a workforce ranging between 1,001 and 5,000 employees, XTB operates on a large institutional scale. This size supports robust infrastructure, seamless platform functionality, and dedicated client support.

Regulatory Transparency: XTB clearly discloses all regulatory affiliations, including the UK FCA, CySEC, and IFSC Belize, on its website. Trading fees and commissions are transparently outlined in a dedicated Terms and Fees section, while detailed operational documents are available in the Legal Documents area.

Financial Accountability: Being publicly listed on the Warsaw Stock Exchange, XTB adheres to stringent disclosure requirements, offering investors clear insight into its financial standing. Segregated client accounts and negative balance protection further enhance credibility and security for traders.

This combination of longevity, scale, regulatory clarity, and fiscal accountability ensures that XTB provides a secure and transparent trading environment for both new and experienced investors.

Is XTB safe?

Yes. XTB is widely recognized as a highly trustworthy and stable brokerage, backed by multiple layers of regulatory oversight and decades of operational experience.

Regulatory Oversight: XTB is authorized by five top-tier regulators, including the UK Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), ensuring strong client protections and adherence to strict financial standards.

Proven Track Record: With over 23 years in the financial markets, XTB has demonstrated consistent operational stability, reinforcing its credibility as a reliable broker.

Segregation of Client Funds: All XTB entities maintain segregated accounts, keeping client funds separate from the company’s operating capital, which minimizes risk and ensures security.

Public Company Transparency: As a publicly listed firm with a market capitalization exceeding $2.3 billion, XTB adheres to stringent disclosure requirements, providing clear insight into its financial health and business practices.

These factors combine to create a secure, transparent, and well-regulated trading environment, making XTB a safe choice for both novice and experienced traders.

| Safety Summary | XTB |

|---|---|

| Year Founded | 2002 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 5 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 1 |

XTB Safety

Fees Intro

XTB provides competitive trading costs that cater to both casual and active traders, with pricing generally in line with industry norms.

Spreads: Average forex spreads on EUR/USD typically stand at 1 pip, among the tightest available, while spreads on gold may be slightly higher than leading competitors.

Non-Trading Fees: XTB imposes no withdrawal fees for transactions above £50 and provides interest on uninvested cash balances. Free stock and ETF trading is also available in supported regions. However, an inactivity fee applies if accounts remain dormant for extended periods.

Active Trader Benefits: Traders meeting specific volume thresholds can access XTB’s Lower Spread Group, which rebates 5% to 30% of spreads depending on monthly trading volume, starting at 20 lots up to 1,000 lots.

Overall Costs: While XTB’s fees are slightly above the very best brokers in the market, they remain reasonable and transparent, with no hidden charges, making the platform suitable for both short-term forex traders and long-term investors.

By balancing low trading fees, accessible account options, and benefits for active traders, XTB delivers a cost structure that appeals to a wide range of clients seeking a reliable trading environment.

Pros:

- Interest on uninvested funds (at XTB UK)

- Most bank transfer withdrawals are free

- Free stocks/ETFs up to €100k monthly volume

Cons:

- Inactivity fee

XTB Spreads

XTB provides competitive spreads designed to appeal to both forex traders and CFD investors, particularly during high-liquidity periods such as the London and New York market opens.

Forex Spreads: EUR/USD spreads are notably tight, giving traders a cost-efficient entry point for major currency trades.

Share CFDs: XTB offers commission-free trading on share CFDs, making spreads highly competitive and transparent compared with other brokers.

Commodities: Commodity spreads align with the market average, offering fair pricing but less of a competitive edge than forex.

Indices: Spreads on index CFDs are slightly above the industry average, providing moderate cost advantages for traders focusing on major global indices.

Overall, XTB’s pricing structure is designed to balance affordability with flexibility, making it suitable for both short-term traders and long-term investors seeking transparent, competitive trading conditions.

Forex Spreads

| Raw Spread Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| AUDUSD | Australian Dollar vs United States Dollar | 0.03 | 0.83 |

| EURUSD | Euro vs United States Dollar | 0.02 | 0.82 |

| GBPUSD | British Pound vs United States Dollar | 0.23 | 1.03 |

| USDCAD | United States Dollar vs Canadian Dollar | 0.25 | 1.05 |

| USDCHF | United States Dollar vs Swiss Franc | 0.19 | 0.99 |

| USDJPY | United States Dollar vs Japanese Yen | 0.14 | 0.94 |

| AUDCAD | Australian Dollar vs Canadian Dollar | 0.68 | 1.68 |

| AUDCHF | Australian Dollar vs Swiss Franc | 0.41 | 1.41 |

| AUDJPY | Australian Dollar vs Japanese Yen | 0.5 | 1.5 |

| AUDNZD | Australian Dollar vs New Zealand Dollar | 0.77 | 1.77 |

| CADCHF | Canadian Dollar vs Swiss Franc | 0.58 | 1.58 |

| CADJPY | Canadian Dollar vs Japanese Yen | 0.48 | 1.48 |

| CHFJPY | Swiss Franc vs Japanese Yen | 0.86 | 1.86 |

| EURAUD | Euro vs Australian Dollar | 0.8 | 1.8 |

| EURCAD | Euro vs Canadian Dollar | 0.74 | 1.74 |

| EURCHF | Euro vs Swiss Franc | 0.61 | 1.61 |

| EURGBP | Euro vs British Pound | 0.27 | 1.27 |

| EURJPY | Euro vs Japanese Yen | 0.3 | 1.3 |

| EURNZD | Euro vs New Zealand Dollar | 1.32 | 2.32 |

| GBPAUD | British Pound vs Australian Dollar | 1.06 | 2.06 |

| GBPCAD | British Pound vs Canadian Dollar | 1.12 | 2.12 |

| GBPCHF | British Pound vs Swiss Franc | 1.1 | 2.1 |

| GBPJPY | British Pound vs Japanese Yen | 0.82 | 1.82 |

| GBPNZD | British Pound vs New Zealand Dollar | 1.98 | 2.98 |

| NZDCAD | New Zealand Dollar vs Canadian Dollar | 1.04 | 2.04 |

| NZDCHF | New Zealand Dollar vs Swiss Franc | 0.73 | 1.73 |

| NZDJPY | New Zealand Dollar vs Japanese Yen | 0.6 | 1.6 |

| NZDUSD | New Zealand Dollar vs United States Dollar | 0.38 | 1.38 |

| AUDSGD | Australian Dollar vs Singapore Dollar | 0.97 | 1.97 |

| CHFSGD | Swiss Franc vs Singapore Dollar | 2.05 | 3.05 |

| EURDKK | Euro vs Danish Kroner | 11.11 | 12.11 |

| EURHKD | Euro vs Hong Kong Dollar | 2.17 | 3.17 |

| EURNOK | Euro vs Norwegian Kroner | 52.89 | 53.89 |

| EURPLN | Euro vs Polish Zloty | 21.2 | 22.2 |

| EURSEK | Euro vs Swedish Krona | 44.07 | 45.07 |

| EURSGD | Euro vs Singapore Dollar | 0.9 | 1.9 |

| EURTRY | Euro vs Turkish Lira | 95.14 | 96.14 |

| EURZAR | Euro vs South African Rand | 94.68 | 95.68 |

| GBPDKK | British Pound vs Danish Kroner | 18.32 | 19.32 |

| GBPNOK | British Pound vs Norwegian Kroner | 38.14 | 39.14 |

| GBPSEK | British Pound vs Swedish Krona | 28.13 | 29.13 |

| GBPSGD | British Pound vs Singapore Dollar | 2.45 | 3.45 |

| GBPTRY | British Pound vs Turkish Lira | 138.98 | 139.98 |

| NOKJPY | Norwegian Kroner vs Japanese Yen | 0.67 | 1.67 |

| NOKSEK | Norwegian Kroner vs Swedish Krona | 7.53 | 8.53 |

| SEKJPY | Swedish Krona vs Japanese Yen | 0.87 | 1.87 |

| SGDJPY | Singapore Dollar vs Japanese Yen | 0.7 | 1.7 |

| USDCNH | United States Dollar vs Chinese RMB | 2.93 | 3.93 |

| USDCZK | United States Dollar vs Czech Koruna | 5.21 | 6.21 |

| USDDKK | United States Dollar vs Danish Kroner | 4.77 | 5.77 |

| USDHKD | United States Dollar vs Hong Kong Dollar | 0.89 | 1.89 |

| USDHUF | United States Dollar vs Hungarian Forint | 9.48 | 10.48 |

| USDMXN | United States Dollar vs Mexican Peso | 28.57 | 29.57 |

| USDNOK | United States Dollar vs Norwegian Kroner | 36.79 | 37.79 |

| USDPLN | United States Dollar vs Polish Zloty | 15.79 | 16.79 |

| USDRUB | United States Dollar vs Russian Ruble | 65.26 | 66.26 |

| USDSEK | United States Dollar vs Swedish Krona | 30.31 | 31.31 |

| USDTHB | United States Dollar vs Thai Baht | 63.21 | 64.21 |

| USDTRY | United States Dollar vs Turkish Lira | 50.61 | 51.61 |

| USDZAR | United States Dollar vs South African Rand | 79.85 | 80.85 |

| USDSGD | United States Dollar vs Singapore Dollar | 0.85 | 1.85 |

Metal Spreads

| Raw Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Min. Spread |

| XAGEUR | Silver vs Euro | 0.813 | 1 |

| XAGUSD | Silver vs United States Dollar | 0.894 | 1 |

| XAUAUD | Gold vs Aus | 3.679 | 1 |

| XAUEUR | Gold vs Euro | 3.537 | 1 |

| XAUUSD | Gold vs United States Dollar | 1.083 | 1 |

| XPDUSD | Palladium vs United States Dollar | 162.735 | 1 |

| XPTUSD | Platinum vs United States Dollar | 42.3 | 1 |

Indices Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| AUS200 | Australia S&P ASX 200 Index | 0 | 1.22 |

| DE40 | Germany 40 Index | 0.5 | 1.338 |

| F40 | France 40 Index | 0 | 0.749 |

| JP225 | Japan 225 Index | 6 | 8.858 |

| STOXX50 | EU Stocks 50 Index | 0.2 | 1.76 |

| UK100 | UK 100 Index | 1 | 2.133 |

| US30 | US Wall Street 30 Index | 1 | 1.411 |

| US500 | US SPX 500 Index | 0.2 | 0.492 |

| USTEC | US Tech 100 Index | 1 | 1.807 |

| CA60 | Canada 60 Index | 0.6 | 0.6 |

| CHINA50 | FTSE China A50 Index | 3.29 | 6.953 |

| CHINAH | Hong Kong China H-shares Index | 0 | 2.083 |

| ES35 | Spain 35 Index | 4.2 | 4.426 |

| HK50 | Hong Kong 50 Index | 7 | 8.169 |

| IT40 | Italy 40 Index | 9 | 9 |

| MidDE50 | Germany Mid 50 Index | 7.5 | 27.864 |

| NETH25 | Netherlands 25 Index | 0.19 | 0.19 |

| NOR25 | Norway 25 Index | 0.68 | 0.68 |

| SA40 | South Africa 40 Index | 7.5 | 15.444 |

| SE30 | Sweden 30 | 0.38 | 0.38 |

| SWI20 | Switzerland 20 Index | 3 | 3.5 |

| TecDE30 | Germany Tech 30 Index | 2.3 | 3.172 |

| US2000 | US Small Cap 2000 Index | 0.14 | 0.48 |

CFD Commodities Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| GC25 | Gold Futures | 0.2 | 0.23 |

| BRENT | Brent Crude Oil Futures | 0.02 | 0.028 |

| Cocoa | Cocoa Futures | 3 | 4.608 |

| Coffee | Coffee Futures | 0.3 | 0.3 |

| Corn | Corn Futures | 0.68 | 0.68 |

| Cotton | Cotton Futures | 0.15 | 0.15 |

| OJ | Orange Juice Futures | 1.12 | 1.12 |

| Soybean | Soybean Futures | 1.35 | 1.35 |

| Sugar | Sugar Futures | 0.03 | 0.033 |

| Wheat | Wheat Futures | 0.75 | 0.75 |

| WTI | West Texas Intermediate - Crude Oil Futures | 0.02 | 0.027 |

| XBRUSD | Brent Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

| XNGUSD | Natural Gas Spot vs United States Dollar | 0.002 | 0.004 |

| XTIUSD | WTI Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

Cryptocurrency Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| BCHUSD | Bitcoin Cash vs United States Dollar CFD | 2.21 | 5.839 |

| BTCUSD | Bitcoin vs United States Dollar CFD | 8.71 | 42.036 |

| DOTUSD | Polkadot vs United States Dollar CFD | 0.011 | 0.013 |

| DSHUSD | Dash Coin vs United States Dollar CFD | 0 | 1.241 |

| EMCUSD | Emercoin vs United States Dollar CFD | 0.157 | 0.157 |

| ETHUSD | Ethereum vs United States Dollar CFD | 4.56 | 11.605 |

| LNKUSD | Chainlink vs United States Dollar CFD | 0.012 | 0.02 |

| LTCUSD | Lite Coin vs United States Dollar CFD | 1.05 | 1.597 |

| NMCUSD | NameCoin vs United States Dollar CFD | 7.895 | 7.895 |

| PPCUSD | PeerCoin vs United States Dollar CFD | 0.184 | 0.276 |

| XLMUSD | Stellar vs United States Dollar CFD | 0 | 0 |

| XRPUSD | Ripple vs United States Dollar CFD | 0.008 | 0.02 |

| ADAUSD | Cardano vs United States Dollar CFD | 0.001 | 0.003 |

| BNBUSD | Binance Smartchain vs United States Dollar CFD | 1.266 | 1.415 |

| DOGUSD | Doge vs United States Dollar CFD | 0.001 | 0.001 |

| UNIUSD | Uniswap vs United States Dollar CFD | 0.061 | 0.064 |

| XTZUSD | Tezos vs United States Dollar CFD | 0.003 | 0.026 |

Bonds Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| EURBOBL | Euro Bobl | 0.01 | 0.01 |

| EURBUND | Euro Bund | 0.01 | 0.011 |

| EURSCHA | Euro Schatz | 0.01 | 0.01 |

| ITBTP10Y | BTP Italian Bonds | 0.02 | 0.02 |

| JGB10Y | Japanese 10 YR | 0.03 | 0.034 |

| UKGB | UK Long Gilt | 0.01 | 0.012 |

| UST05Y | US 5 YR T-Note | 0.014 | 0.014 |

| UST10Y | US 10 YR T-Note | 0.031 | 0.031 |

| UST30Y | US T-Bond (30 year) | 0.03 | 0.031 |

XTB Swap Fees

XTB applies overnight swap fees, which are the costs or credits associated with holding positions past the trading day. These swaps vary depending on whether you maintain a long (buy) or short (sell) position.

Forex Swaps: For standard forex contracts of 100,000 units of the base currency, XTB’s swap fees generally align with industry norms, providing predictable holding costs for overnight trades.

Gold Swaps: Swaps on gold positions, calculated per 100 ounces, are comparatively higher, reflecting the commodity’s volatility and market demand.

These swap structures allow traders to plan holding strategies efficiently while understanding the cost implications for both forex and commodity positions. XTB’s transparent swap policies ensure that traders are informed, helping maintain confidence in managing overnight exposure.

| Instrument | Swap Short | Swap Long |

|---|---|---|

| Gold | Charge of $5.74 | Charge of $78.84 |

| GBP/JPY | Charge of $18.34 | Credit of $9.50 |

| EUR/USD | Credit of $2.77 | Charge of $8.90 |

XTB Non-Trading Fees

XTB maintains a simple and transparent fee structure for non-trading activities. There are no account maintenance fees, no charges for deposits via bank transfer, and withdrawals are free of any fees.

The only non-trading cost to be aware of is the inactivity fee. If an account remains dormant for 12 months with no deposits in the preceding 90 days, a monthly fee of €10 is applied. This fee is automatically halted as soon as trading activity resumes, ensuring minimal impact for active traders.

This straightforward approach keeps costs predictable and emphasizes XTB’s commitment to transparency for both casual and professional clients.

Are XTB Fees Competitive?

Yes. XTB offers a fee structure that is generally favorable for both retail and professional traders. Forex spreads on major currency pairs are tight, helping traders minimize costs on high-volume trades. Overnight swap fees in forex are reasonable, providing transparency and predictability for positions held beyond a single trading session.

Withdrawal fees are minimal, with most transactions free of charge, ensuring clients can access their funds without unnecessary costs. While spreads and swap fees for commodities are slightly higher than the industry’s tightest offerings, overall trading costs at XTB remain competitive compared with many brokers in the same tier.

This balanced approach to fees makes XTB an attractive option for traders seeking low-cost execution and straightforward account management.

| Fees Summary | XTB |

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 1 |

| All-in Cost EUR/USD - Active | 1 |

| Bank Wire (Deposit/Withdraw) | Yes |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Active Trader or VIP Discounts | No |

| Skrill (Deposit/Withdraw) | Yes |

XTB Fees

Deposit and Withdrawal Intro

XTB provides a smooth and efficient system for funding and accessing your trading account. Deposits are processed quickly through multiple channels, including bank transfers, credit and debit cards, and e-wallets, depending on your region. Withdrawals are primarily conducted via bank transfer, ensuring secure and reliable access to your funds.

Processing times are generally faster than the industry average, and most transactions incur minimal or no fees. Regional variations exist, with UK-based accounts offering slightly fewer deposit options compared with the global entity, but overall, XTB delivers a convenient and cost-effective way to manage your account finances.

Pros:

- Credit/Debit card available

- E-wallets available

- Deposits/withdrawals are mostly free

Cons:

- Few minor account currencies accepted

XTB Account Base Currencies

At XTB, you can choose from the following base currencies:

| EUR | USD | GBP | HUF | PLN |

XTB offers a standard range of account base currencies, which is comparable to most brokers in the industry. Selecting a base currency that matches your bank account or the currency of the assets you trade can help you avoid unnecessary conversion fees, making your trading more cost-efficient.

To further reduce currency conversion costs, consider opening a multi-currency bank account with a digital bank. These accounts typically support multiple currencies, offer competitive exchange rates, and provide low-cost or free international transfers. The setup is quick and convenient, often completed directly from your smartphone, allowing you to manage funds efficiently while minimizing extra charges.

XTB Deposit Fees and Options

XTB does not charge fees for deposits, making it straightforward to fund your trading account. However, certain payment methods such as credit/debit cards or electronic wallets may incur a small processing fee, typically ranging from 1–2% depending on your country of residence. For instance, Skrill applies a 2% fee for deposits from UK clients.

Deposits can be made via bank transfer, credit/debit cards, or supported e-wallets, with availability varying by region. For example, Sofort deposits are restricted to customers in Germany. This flexible funding setup ensures you can choose the most convenient and cost-effective method for your account.

XTB supports the following electronic wallets:

| PayPal | PayU | Ecommpay | Skrill | Paysafe |

XTB deposit methods and fees:

| Method | Processing Time | Fees |

|---|---|---|

| Visa | Instant | 0% |

| Mastercard | Instant | 0% |

| Bank Wire | Up to 3 business days | 0% |

| Paysafe | Instant | 0% |

| Skrill | Instant | 0% |

| Ecommpay | Instant | 0% |

| PayU | Instant | 0% |

| PayPal | Instant | 0% |

XTB Withdrawal Fees and Options

XTB allows fee-free withdrawals for amounts exceeding a specific threshold, which ranges from $50 to $200 depending on your country of residence. This ensures most clients can move funds without incurring extra costs.

Withdrawals are processed exclusively via bank transfer and must be sent to accounts registered in your name. This policy maintains security and compliance while providing a straightforward and reliable way to access your funds.

XTB withdrawal methods and fees:

| Method | Processing Time | Fees |

|---|---|---|

| Bank Wire | Up to 3 business days total | 0% |

How long does XTB withdrawal take?

Withdrawals via bank transfer at XTB are typically completed within one business day. Requests submitted before 1 p.m. are usually processed the same day, while withdrawals initiated after this cutoff are credited to your account on the next working day. This fast processing ensures you can access your funds quickly and reliably.

How do you withdraw money from XTB?

Withdrawing money from XTB is a straightforward process:

Log in to your XTB trading account.

Navigate to the “Deposit and Withdraw Funds” section, usually located at the bottom right of the platform.

Enter your bank account information along with the amount you wish to withdraw.

Confirm and submit the withdrawal request.

Following these steps ensures your funds are transferred safely and efficiently to your bank account.

XTB Deposit and Withdrawals

XTB Trading Platforms and Tools Intro

XTB’s xStation 5 platform combines a sleek, intuitive interface with advanced trading features, designed to meet the needs of both beginner and experienced traders. The platform enables seamless trading of real stocks and CFDs within a single environment, providing a comprehensive toolkit for market analysis and decision-making.

Key platform features include:

Advanced Charting – Over 30 drawing tools and 39 technical indicators, with a countdown timer showing the remaining time for each candlestick. Economic news releases are integrated along the chart axis to help traders anticipate market-moving events.

Depth-of-Market (DOM) – Visualize market liquidity and order flow to make informed trading decisions.

Market Sentiment Tools – Track the percentage of XTB clients holding long or short positions for specific instruments, giving insight into market psychology.

Heatmaps and Stock Screeners – Identify top movers, analyze trends, and filter stocks or ETFs using multiple criteria such as price changes or fundamentals.

Economic Calendar – Stay updated on key economic events directly within the platform.

While xStation 5 does not support automated trading or API integration, its responsive web, mobile, tablet, and smartwatch compatibility ensures traders can access and manage positions anytime, anywhere. The combination of user-friendly design, powerful analytical tools, and real-time market insights makes xStation 5 a standout solution for both casual and professional traders.

For those comparing brokers, XTB’s platform as a balanced, reliable choice for efficient and informed trading across multiple asset classes.

XTB Web Platform

XTB’s xStation 5 browser-based platform combines advanced functionality with user-friendly design, making it suitable for both active day traders and long-term investors. Its customizable watchlists allow traders to track live quotes for preferred instruments through an intuitive market watch panel, while price alerts notify users of critical price levels without the need for constant monitoring.

Efficiency-focused tools enhance trading execution and risk management:

One-Click Trading – Instantly execute trades, ideal for scalping or fast-moving markets.

Chart Trading – Open positions or attach orders directly from charts with minimal clicks.

Direct Hedging – Manage risk by holding simultaneous long and short positions on the same instrument.

The platform also provides decision-support tools, including:

Sentiment Heatmaps – Gauge the positioning of other traders to anticipate market trends.

Stock and ETF Scanners – Filter instruments based on criteria like performance or fundamentals.

Trading Statistics Dashboard – Monitor real-time performance analytics for better-informed strategy adjustments.

With its clean interface, web-based accessibility, and powerful analytical resources, xStation 5 offers a versatile trading environment that balances simplicity with depth. XTB’s platform delivers a professional-grade experience while remaining accessible for traders at any skill level, supporting a wide range of strategies and market conditions.

Pros:

- Good search function

- Good customizability (for charts, workspace)

- User-friendly

Cons:

- None

Charts

XTB’s xStation 5 platform offers traders a powerful and flexible charting environment, designed for in-depth technical analysis across multiple markets. Users can choose from five chart types – Candlestick, Line, OHLC, HLC, and Heiken Ashi – while selecting from nine timeframes ranging from 1-minute intervals up to monthly views, providing complete control over market observation.

Key analytical resources include:

46 Technical Indicators – Covering trend-following tools like the Alligator and pattern recognition aids such as ZigZag, helping traders identify entry and exit points with precision.

20+ Drawing Instruments – Includes Fibonacci retracements, Gann fans, and Pitchforks for advanced chart analysis.

The platform supports grid-view layouts, allowing traders to monitor multiple instruments simultaneously, enhancing situational awareness and decision-making efficiency. xStation 5’s combination of versatile chart types, extensive indicators, and professional drawing tools makes it a standout solution for both novice and experienced traders seeking robust technical analysis capabilities.

Orders

The xStation 5 platform from XTB offers a comprehensive set of order types designed to support strategic trading across multiple markets. Traders can choose from market, limit, and stop-loss orders, each featuring customizable parameters to suit individual strategies.

Key order functionalities include:

Market Orders: Instantly executed at the best available price, perfect for rapid entries and exits.

Limit Orders: Allow traders to specify exact buy or sell prices (or better), ideal for targeting specific retracement levels or price objectives.

Stop-loss Orders: Automatically close positions at pre-defined levels, helping mitigate the impact of unexpected market fluctuations.

Pending orders, including limit and stop orders, can also be assigned expiry dates, enabling traders to restrict strategies to designated timeframes. One limitation is the absence of trailing stop-loss orders, which would allow dynamic adjustment of stop levels as prices move favorably. Despite this, xStation 5’s order system provides a robust foundation for both novice and experienced traders, supporting precise execution and effective risk management.

Depth of Market (DOM)

The Depth of Market (DOM) tool in xStation 5 provides a dynamic, real-time view of the order book for specific trading instruments. It displays active buy and sell orders across multiple price levels, giving traders critical insight into market liquidity and the balance between supply and demand.

By visualizing the concentration of orders at each price point, the DOM feature helps traders assess market sentiment, anticipate potential price movements, and make more informed decisions. Whether you are scalping, day trading, or executing longer-term strategies, xStation 5’s DOM offers a precise snapshot of market activity, enhancing your ability to navigate complex trading environments with confidence.

Trade History

xStation 5 offers a comprehensive trade history and management panel situated at the bottom of the interface, giving traders a centralized hub to monitor all active positions and pending orders. This streamlined layout allows for quick assessment of market exposure, enabling timely adjustments to trades and improved risk management.

With all trades displayed in one view, users can efficiently track performance, review order execution, and make informed decisions, whether engaging in day trading, scalping, or longer-term strategies. The trade history panel is designed to enhance clarity and control, ensuring traders maintain full oversight of their portfolio at all times.

Price Alerts

The alert feature in xStation 5 is a powerful tool for tracking key price levels across multiple instruments, allowing traders to monitor several markets simultaneously. By setting alerts, users can receive on-screen notifications when specific price conditions are met, helping them stay informed without needing constant market surveillance.

Performance Statistics

The performance statistics module within xStation 5 acts as a real-time trading analytics tool and a comprehensive digital journal, helping traders monitor and refine their strategies. Continuously updated, this feature provides actionable insights into trading behavior and efficiency.

Key performance metrics include:

Profit/Loss Breakdown: Overview of total and average gains or losses per trade.

Trade Volume: Total number of executed orders, highlighting market activity.

Maximum Drawdown: Tracks the largest peak-to-trough decline in equity.

Win/Loss Ratio: Measures success rate across all trades.

Sequential Patterns: Identifies streaks of consecutive wins or losses.

By reviewing these statistics, traders can evaluate their risk/reward balance, spot recurring trends, and make informed adjustments during live sessions. Historical tracking further supports long-term strategy optimization, allowing users to enhance consistency and maximize performance over time.

XTB Mobile App

Pros:

- Modern design

- User-friendly

- Price alerts

Cons:

- None

The XTB mobile app delivers a seamless trading experience for traders on the move, combining an intuitive interface with responsive functionality. Its design emphasizes agility, allowing users to react swiftly to market changes with features like 1-click order execution and chart-integrated trading, which enables opening positions directly from price charts.

Mobile Charting Capabilities:

Chart Types: Candlestick, line, OHLC, HLC (4 types)

Timeframes: Nine options, ranging from 1-minute to monthly views

Technical Indicators: 13 built-in tools including RSI, MACD, and Bollinger Bands

Drawing Tools: Six tools such as trendlines and Fibonacci retracements

Order Execution Features:

Market, Limit, and Stop Orders: All can include customizable expiration dates and times

Pending Orders: Buy stop, sell stop, buy limit, and sell limit

Risk Management: Stop-loss and take-profit can be attached to all order types

With its robust mobile charting tools and flexible order management, the XTB app mirrors the web platform’s capabilities, ensuring traders maintain full control over their strategies anytime, anywhere.

Look and Feel

The XTB mobile trading app stands out for its clean, intuitive design, ensuring that every essential feature is easily accessible. Its well-organized interface allows traders – both beginners and experienced – to navigate smoothly between charts, orders, and account management tools without unnecessary complexity. The thoughtful layout enhances usability, making it straightforward to monitor markets, execute trades, and manage positions efficiently, all from a single mobile device.

Login and security

The XTB mobile platform prioritizes account safety with a robust, two-step login process. Users can conveniently access their accounts using biometric authentication, such as fingerprint or facial recognition, ensuring both speed and security. This combination of advanced login measures and ease of use provides traders with confidence that their personal and financial data is well-protected while maintaining seamless access to markets.

Search functions

The XTB platform offers a streamlined search experience, making it simple for traders to find instruments or market products. Users can type the name of a specific asset directly into the search bar or explore organized categories to browse available options. This dual approach enhances efficiency, allowing both targeted searches and exploratory navigation for a smooth trading experience.

Placing orders

The XTB mobile trading app supports a variety of order types to accommodate different trading strategies:

Market Orders: Execute immediately at the best available price, ideal for fast entry or exit.

Limit / Stop Orders: Set predefined buy or sell prices to target specific market levels.

Stop-loss / Take-profit Orders: Automatically close positions at predetermined levels to manage risk and secure profits.

Trailing Stop Orders: Adjust dynamically as the market moves in your favor, locking in gains while limiting potential losses.

Traders can also define order time frames for precise control:

Good ‘til’ Time (GTT): Orders remain active until a specified time.

Good-til-Canceled (GTC): Orders stay open until manually canceled, providing flexibility for long-term strategies.

This comprehensive order functionality ensures that both novice and experienced traders can efficiently manage trades and respond to market movements directly from their mobile devices.

Alerts and notifications

The XTB mobile app offers a robust alert system that keeps traders informed of key market events and price movements. Users can set custom notifications for specific instruments, price levels, or market conditions, ensuring they never miss an important trading opportunity – even while on the go.

These alerts are fully customizable and delivered directly to your device, allowing for timely decisions without the need for constant market monitoring. The intuitive design ensures that both novice and experienced traders can quickly create, modify, and manage alerts with ease.

XTB Platform and Mobile App: Key Takeaways

The xStation 5 platform stands out as a top-tier trading solution, skillfully combining an intuitive interface with professional-grade analytical tools. Its clean, uncluttered design conceals a comprehensive suite of features, including heatmaps, market scanners, hotkeys, and performance analytics, all designed to enhance trading efficiency and decision-making.

Notably, xStation 5 offers advanced features such as depth-of-market (DOM) insights and sentiment data, giving traders a clear view of market liquidity and the positioning of other participants. While it excels in usability and functionality compared to many competitors, the platform does have some limitations: it lacks guaranteed stop-loss orders and does not currently support algorithmic or copy trading, which may be relevant for highly automated strategies.

The XTB mobile app complements the desktop platform by delivering a feature-rich trading experience on the go. Its modern, sleek design ensures seamless navigation, while the ‘Discover’ tab provides quick summaries of trending markets and breaking news to guide informed trading decisions. The app retains essential analytical capabilities, including 13 technical indicators and multi-timeframe charting, ensuring flexibility without compromising core functionality.

Security is a priority on mobile, with two-factor authentication and a four-digit passcode safeguarding user accounts. Traders benefit from customizable watchlists, light/dark mode options, sentiment indicators, top movers, and integrated risk management tools such as stop-loss/take-profit settings and a trading calculator.

Overall, both the desktop and mobile platforms offer a powerful, versatile trading experience, suitable for traders seeking a blend of professional analytics, real-time insights, and user-friendly design.

XTB Trading Platforms and Tools

AvaTrade Tradeable Instruments

XTB Tradeable Instruments Intro

XTB offers traders a vast and diverse selection of over 10,000 financial instruments, all accessible through a single login on the xStation 5 platform. This comprehensive offering includes CFDs on forex, commodities (both spot and futures markets), indices, shares, and ETFs, providing ample opportunities for portfolio diversification.

Traders can also access US and European exchange-traded stocks and ETFs, along with over 3,400 cash equities and more than 1,350 cash ETFs in certain jurisdictions, allowing exposure to global markets without leverage.

For cryptocurrency enthusiasts, XTB provides crypto trading via CFDs and, where permitted, direct trading of underlying assets such as Bitcoin and other major cryptocurrencies. Note that crypto CFDs are restricted for retail clients in the UK, with access limited to professional traders.

The platform also features over 1,400 ETFs and 6,000 stocks, alongside popular CFDs on shares, indices, commodities, and forex pairs. While XTB does not offer bonds, mutual funds, options, or futures, its extensive asset range ensures traders can build a well-rounded, global investment strategy efficiently.

With all instruments consolidated under one platform, XTB enables seamless trading across multiple markets, empowering traders to capitalize on opportunities worldwide with a single, intuitive interface.

| Instrument | Types | Industry Average | XTB Number |

|---|---|---|---|

| Forex Pairs | Major, Minor, Exotic | 30–75 | 71 |

| Commodities | Metals, Energy, Agriculture | 5–10 | 23 |

| Indices | American, Asian, European | 5–10 | 25 |

| CFD Shares and ETFs | European and US | 200–300 | 2,403 |

| Real Shares and ETFs | European and US | Not available at the majority of CFD brokers | 4,820 |

What are CFDs ?

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movement of an asset without actually owning it. When you enter a CFD trade, you and the counterparty agree to exchange the difference between the opening price and the closing price of the position.

If the asset’s price rises, the seller pays the trader the difference. Conversely, if the price falls, the trader pays the seller. CFDs provide flexibility to trade a wide range of markets – including forex, commodities, indices, stocks, and cryptocurrencies – while offering opportunities for leverage and hedging strategies.

By using CFDs, traders can profit from both upward and downward price movements, making them a versatile tool for implementing short-term trading strategies or managing risk across global financial markets.

XTB Instruments: Key Takeaways

XTB offers an extensive range of CFDs and real stocks, providing traders with a versatile platform to explore global financial markets. Users can trade forex, commodities, indices, cryptocurrencies, and ETFs, as well as access real shares from major exchanges across the US, Europe, Finland, and Portugal.

This broad selection allows traders to diversify their portfolios and execute strategies across multiple asset classes – all within a single, streamlined trading environment. By combining CFD flexibility with access to real equities, XTB ensures a comprehensive and professional trading experience suitable for both novice and experienced investors.

| Tradable Instruments Summary | XTB |

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 7,342 |

| Forex Pairs (Total) | 71 |

| Cryptocurrency (Physical) | No |

| Int’l Stock Trading (Non CFD) | Yes |

| U.S. Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Derivative) | Yes |

XTB Leverage

What is CFD Leverage?

Leverage is a cornerstone of forex and CFD trading, enabling traders to control positions larger than their actual account balance by borrowing capital. This feature allows for the amplification of potential profits, but it also increases exposure to losses, making risk management essential.

By using leverage, traders can access greater market opportunities and implement more dynamic strategies, whether trading forex pairs, commodities, indices, or CFDs on stocks. Responsible use of leverage provides flexibility and enhanced trading potential, making it a powerful tool for both beginner and experienced investors.

XTB Leverage

For retail traders using XTB Ltd (UK), the maximum leverage is set at 1:30. This means a trading account with $1,000 can control positions worth up to $30,000 in the market. While leverage can significantly enhance potential profits, it also magnifies potential losses, making careful risk management essential.

Leverage levels differ depending on the asset class, allowing traders to adjust exposure according to the specific risks and volatility of each market. Understanding these limits helps traders make informed decisions and strategically balance growth opportunities with capital protection.

| Asset Class | Standard Account |

|---|---|

| Forex | 1:30 |

| Commodities | 1:20 |

| Indices | 1:20 |

| Shares | 1:5 |

Account Opening with XTB

Pros:

- Fast

- No minimum deposit

- Fully digital

Cons:

- None

XTB Account Opening Process

Opening an account with XTB is fully digital, fast, and user-friendly. The entire registration process, including completing forms and submitting documents, typically takes around 30 minutes, with account verification usually finalized within a single business day.

Follow these five simple steps to get started:

Enter your email and country of residence – This is the first step to create your trading profile.

Provide personal details – Include your full name, date of birth, and residential address.

Choose your trading platform and base currency – Select options that best suit your trading preferences.

Complete financial and trading questionnaires – XTB asks about your employment status, financial situation, and trading experience to ensure suitable account type and compliance with regulatory requirements.

Verify your identity and residency – Activate your account by uploading a valid photo ID (passport, driver’s license, or national ID) and proof of address (utility bill or bank statement).

European clients may benefit from video verification, a convenient feature that allows instant identity confirmation. If video verification isn’t available, secure uploads of scanned documents complete the process efficiently.

With this streamlined onboarding, traders can quickly access XTB’s global trading instruments and start trading with confidence.

What is the minimum deposit at XTB?

XTB offers an exceptionally accessible entry point for individual traders, with a minimum deposit of $0. This means you can start trading without any upfront capital barrier, making it ideal for beginners or those looking to explore the platform before committing significant funds.

For corporate accounts, the minimum deposit requirement is considerably higher at £15,000, reflecting the broader scope and regulatory requirements associated with business trading accounts.

This flexible deposit structure ensures that both retail and professional traders can access XTB’s comprehensive suite of trading instruments while tailoring their account size to their investment strategy.

| Feature | Standard Account |

|---|---|

| Minimum Deposit | $0 |

| Leverage | Up to 1:30 |

| Dedicated Account Manager | Yes |

| FCSC Compensation Scheme up to £85K | Yes |

| Negative Balance Protection | Yes |

| Segregated Funds | Yes |

XTB Account Types

XTB Account Types Intro

XTB provides a range of account options designed to accommodate different trading needs and regulatory requirements. The default choice is the Standard account, ideal for most retail traders seeking a straightforward trading experience.

For clients outside Europe, swap-free/Islamic accounts are available. These accounts comply with Islamic law and do not charge overnight swap fees, making them suitable for traders who require Sharia-compliant trading.

UK residents have access to a Stocks & Shares ISA account, which offers tax-free investing, flexible withdrawals, and the ability to reinvest within the same tax year. Additionally, corporate accounts are offered for businesses, providing advanced trading capabilities and professional account management.

This diverse account structure ensures that XTB caters to individual, regional, and corporate traders while maintaining flexibility and compliance with local regulations.

XTB Demo Account

XTB provides a 30-day demo account, an essential tool for both beginner and intermediate traders to practice and refine their strategies without risking real funds. This account mirrors live market conditions, offering real-time quotes and trading opportunities across forex, CFDs on commodities, indices, and stocks.

The demo environment allows users to familiarize themselves with XTB’s intuitive trading platform, experiment with different strategies, and build confidence before transitioning seamlessly to a live trading account. By practicing in a risk-free setting, traders can develop their skills and optimize their approach for real market scenarios.

XTB Islamic Account

XTB offers swap-free (Islamic) accounts through its international entity, specifically tailored for clients from select countries, including UAE, Saudi Arabia, Kuwait, Oman, Qatar, Jordan, Bahrain, Lebanon, Egypt, Algeria, Morocco, Tunisia, and Malaysia.

These accounts comply fully with Islamic law, removing any overnight swap or rollover fees, making them suitable for traders who require Sharia-compliant trading. By providing a swap-free structure, XTB ensures ethical trading options without compromising access to its wide range of markets and instruments.

XTB ISA Account

For UK clients, XTB provides the option to open a tax-free Individual Savings Account (ISA). This ISA is linked to the main standard trading account but functions as a separate entity, allowing traders to benefit from tax-free investing while maintaining seamless access to their broader portfolio. The XTB ISA offers flexibility for managing investments, with the ability to withdraw and reinvest funds within the same tax year, making it an attractive option for UK-based investors seeking both growth and tax efficiency.

XTB Restricted Countries

XTB welcomes clients from most regions worldwide, providing access to a broad range of trading instruments and services. However, due to regulatory restrictions and compliance requirements, XTB does not accept clients from certain countries. These restricted countries include:

India, Indonesia, Pakistan, Syria, Iraq, Iran, United States, Australia, Albania, Belize, Belgium, New Zealand, Japan, South Korea, Hong Kong, Israel, Turkey, Venezuela, Bosnia and Herzegovina, Ethiopia, Uganda, Cuba, Yemen, Afghanistan, Laos, North Korea, Guyana, Vanuatu, Mozambique, Democratic Republic of the Congo, Libya, Macao, Panama, Singapore, Bangladesh, Kenya, Palestine, and Zimbabwe.

Traders outside these regions can enjoy seamless account opening, access to diverse global markets, and a wide selection of CFDs, stocks, ETFs, and forex pairs through XTB’s platforms. This ensures a secure and compliant trading experience for eligible clients.

XTB Research

XTB Research Intro

XTB provides a comprehensive research suite that caters to both beginner and experienced traders, delivering high-quality news, analysis, and actionable insights directly through its xStation 5 platform. Its in-house research team produces detailed reports covering market trends, fundamental and technical analysis, and trading ideas, ensuring traders stay informed and make confident decisions.

Key Research Features

Market News & Analysis: XTB offers timely articles on breaking market events, in-depth analyses, and trade recommendations. Reports cover global equities, forex, commodities, indices, and ETFs. Highlighted features include the “Chart of the Day” series and trading signals sourced from top-tier providers like Thomson Reuters, Barclays, and Citi Group.

Platform Tools for Research:

Market Sentiment: Displays the proportion of XTB traders buying or selling specific instruments, helping gauge market direction.

Stock & ETF Scanners: Filter assets using metrics like dividend yield, P/E ratio, and performance indicators.

Heatmap Tool: Offers a real-time visual of market price movements, providing quick insight into winners and losers.

Economic Calendar: Tracks upcoming economic releases and events critical to trading decisions.

Exclusive Premium Research: While XTB does not integrate third-party tools like Trading Central, its Premium Research service offers unique strategies, streaming headlines, and curated insights from its experienced staff. Weekly video webinars on platforms like YouTube are available in multiple languages, including English, Polish, German, and Italian.

News Filtering & Source Transparency: Articles authored by in-house analysts are clearly labeled, allowing traders to differentiate between internal insights and external content. This feature enhances usability, helping users focus on content that reflects XTB’s expertise.

XTB Research: Key Takeaways

XTB excels in providing actionable research and robust analytical tools. By combining timely news, high-quality in-house analysis, and user-friendly platform features, it equips traders with the resources to develop and refine trading strategies. Tools like scanners, heatmaps, and watchlists further support idea generation, making XTB’s research offering both practical and industry-leading.

Whether you’re analyzing market trends, seeking trade ideas, or monitoring economic events, XTB’s research capabilities ensure you have a reliable and insightful foundation to guide your trading decisions.

| Research Summary | XTB |

|---|---|

| Trading Central (Recognia) | No |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Social Sentiment - Currency Pairs | Yes |

XTB Education

XTB offers a comprehensive suite of educational resources designed to support traders at every experience level. The broker combines written content, video tutorials, and interactive courses to create a well-rounded learning ecosystem. Through its xStation 5 platform, users can access step-by-step tutorials, in-depth guides on technical analysis, trading strategies, and practical lessons on trading psychology. These materials are suitable for both beginners and seasoned traders seeking to refine their skills.

The XTB website features a structured “Learn to Trade” section, hosting over 200 lessons within the Trading Academy. Content is organized by topic and experience level, covering forex, CFDs, and broader financial market concepts such as macroeconomic indicators. Each lesson includes practical insights and some categories offer quizzes to help traders track their understanding. The platform also integrates video content, including the Masterclass series and additional tutorials accessible via XTB’s Premium section, providing flexibility for learning on both web and mobile platforms.

XTB’s educational offerings extend beyond its own platform, with archived webinars and video content available on its YouTube channel. While some videos are dispersed across different sections, the overall depth and quality of instruction remain strong. The inclusion of progress tracking tools allows users to monitor their development, though expanding interactive features such as quizzes or tests would further enhance the learning experience.

XTB Education: Key Takeaways

XTB provides a comprehensive educational ecosystem with written guides, video tutorials, and interactive courses.

The Trading Academy offers over 200 lessons, organized by topic and experience level, covering forex, CFDs, and broader market concepts.

xStation 5 platform tutorials and Masterclass videos help traders maximize their platform usage and develop advanced trading skills.

Educational resources include quizzes and progress tracking, allowing users to monitor their learning journey.

Archived webinars and YouTube content supplement the in-platform materials, though video content could be more centralized for easier access.

Overall, XTB delivers high-quality, accessible education for both beginners and experienced traders, supporting skill-building and informed trading decisions.

| Education Summary | XTB |

|---|---|

| Videos – Advanced Trading Videos | Yes |

| Education (Forex or CFDs) | Yes |

| Client Webinars (Archived) | Yes |

| Client Webinars | Yes |

| Investor Dictionary (Glossary) | No |

| Videos – Beginner Trading Videos | Yes |

Final Thoughts

XTB has established itself as a reputable and versatile broker with over two decades of experience in global financial markets. Known for its extensive range of tradable instruments, including over 10,000 CFDs, real stocks, and ETFs, XTB delivers a comprehensive trading experience suitable for both novice and advanced traders.

Key Strengths

Trading Platform: The proprietary xStation 5 platform is intuitive, feature-rich, and supports a wide array of trading strategies, from scalping to long-term investing. Key tools such as the market scanner, heatmap, and depth-of-market (DOM) enhance market analysis and strategy execution. The platform’s ability to handle both CFDs and real exchange-traded securities further broadens trading possibilities.

Research & Education: XTB’s research offerings are robust, featuring in-house analysis, curated news headlines, and educational videos across multiple YouTube channels. The broker earned “Best in Class” recognition for Research in 2025, reflecting the quality of its market insights. Educational resources are well-structured and accessible, helping beginners gain confidence while providing advanced traders with practical tools.

Customer Trust & Credibility: With multiple entities regulated by top-tier authorities and a publicly listed valuation exceeding $2.3B, XTB maintains strong trustworthiness and transparency. Its global footprint ensures broad accessibility, although pricing remains around the industry average for many instruments.

Cryptocurrency Trading: XTB offers an expanding range of cryptocurrency CFDs, earning accolades in the 2025 Crypto Trading category. This positions the broker as a competitive option for traders seeking exposure to digital assets alongside traditional markets.

Areas for Improvement

While XTB provides competitive spreads on major forex pairs and indices, other instruments typically align with the industry average. Incorporating algorithmic and copy trading features and offering tighter spreads could enhance the platform further.

Conclusion

Overall, XTB combines reliability, extensive market access, and innovative platform technology to create a well-rounded trading environment. Whether you are a beginner seeking structured educational support or an experienced trader exploring diverse asset classes, XTB offers the tools, research, and credibility to support your trading growth and performance.

For traders seeking a trusted broker with versatile offerings, XTB is certainly worth close consideration in 2025.

XTB FAQ

Does XTB support automated trading?

No. The xStation 5 platform does not offer automated trading or API access.

Is XTB safe?

Yes. XTB is regulated by multiple top-tier authorities and has a long operational history. UK clients benefit from negative balance protection and segregated funds for added security.

What is the maximum leverage at XTB?

Retail clients in the UK can access up to 1:30 leverage.

Does XTB allow direct hedging?

Yes. You can hold long and short positions on the same instrument simultaneously via xStation 5.

Is XTB suitable for scalping?

Yes. Tight spreads and 1-click trading make XTB viable for short-term trading strategies.

Does XTB offer MetaTrader?

No. XTB exclusively uses the xStation 5 platform for all trading activities.

Can I use PayPal to deposit funds?

Yes. European Union clients can fund their accounts via PayPal, which is instant and usually free.

Where is XTB based?

XTB is headquartered in Warsaw, Poland, at Prosta 67, 00-838 Skyliner.

Does XTB offer a demo account?

Yes. XTB provides a free demo account with live market conditions to practice strategies without risking real money.

How do I deposit funds into my XTB account?

You can deposit via bank transfer, credit/debit cards, or supported e-wallets like PayPal (EU clients only). Credit card deposits are instant but may incur a small fee in some regions, while bank transfers are free but may take longer.

How do I withdraw money from XTB?

Withdrawals are processed through bank wire transfers, usually within one business day.

Is XTB good for beginners?

Yes. With a user-friendly platform, extensive educational resources, and research tools, XTB is well-suited for novice traders.

How long does it take to open and verify an account?

Registration takes 15–30 minutes. After submitting identification documents, accounts are typically approved within one day. Account activation is confirmed via email or by checking the Client Office.

Which platforms does XTB offer?

XTB provides its proprietary xStation 5 platform, available on web and mobile, designed for traders of all levels.

What commissions does XTB charge?

Trading in real shares and ETFs is commission-free for monthly turnover up to 100,000 EUR. Beyond that, a 0.2% commission applies, with a minimum of 10 GBP.

Does XTB offer spread betting or VPS hosting?

No. XTB does not provide spread betting or VPS services.

Is XTB a market maker?

Yes. XTB operates under the Principal Model, acting as the counterparty to all client trades.

Does XTB operate as a bank?

No. XTB is strictly a broker.

What is the minimum deposit for XTB?

There is no minimum deposit required for new accounts, making it easy to start trading with small amounts.

About Tradewiki.io

Our goal at Tradewiki.io is to deliver clear, unbiased reviews of top international forex brokers and prop firms, guiding you toward the best forex broker or prop firm that fits your needs. Since launch, Tradewiki.io has helped thousands of traders worldwide find, compare, and choose trusted forex brokers and prop firms.

Tradewiki.io Reviews