BlackBull Markets Review 2025-

BlackBull Markets Review 2025-

Overall Rating

Min. Deposit

Spreads From

Max. Leverage

BlackBull Markets Overview

BlackBull Markets is a New Zealand–based forex and CFD broker, established in 2014, that has built a strong reputation for offering a wide selection of trading tools, platforms, and instruments. With access to over 26,000 tradable assets and generally competitive pricing, the broker caters to both retail and professional traders seeking flexibility and choice.

One of BlackBull’s biggest strengths lies in its platform variety. In addition to its own proprietary solutions like BlackBull Invest and BlackBull Copy Trader, the broker supports industry-leading platforms including MetaTrader 4, MetaTrader 5, cTrader, TradingView, and ZuluTrade. This makes it equally attractive to discretionary traders, algorithmic traders, and social copy trading enthusiasts.

To further enhance the trading experience, BlackBull Markets integrates with Myfxbook for performance tracking and strategy analysis, while also offering free VPS hosting and FIX API connectivity for clients running automated systems or high-frequency strategies.

Educational and research resources are available, though not as extensive as some larger competitors. Still, BlackBull continues to expand in these areas and has shown steady progress in improving its offering year after year.

Overall, BlackBull Markets stands out as a broker well-suited to day traders, technical analysts, copy traders, and algorithmic traders who value deep market access, multiple platform choices, and advanced trading tools. For those seeking a blend of flexibility, reliability, and growth potential, it remains a strong option in today’s competitive brokerage landscape.

BlackBull Markets Pros and Cons

BlackBull Markets Pros:

- Low-latency trading

- Good educational and research tools

- Over 26,000+ tradeable symbols (including share CFDs)

- Variety of trading platforms

- Fast and user-friendly account opening

- Low forex fees

- FIX API and free VPS hosting

- Multiple copy trading platforms (ZuluTrade, Myfxbook, etc.)

BlackBull Markets Cons:

- No compensation scheme

- $2,000 minimum deposit for Prime Accounts

- Withdrawal fee

- High share CFD commissions on cTrader

- Relatively small number of regulatory licenses

BlackBull Markets Summary

Overall

Trust

Investments

Fees

Platform

Research

Mobile

Education

Beginner – Perfect Match

For casual traders, BlackBull Markets offers a wide range of platforms and account types. The ECN Standard account has no minimum deposit requirement, making it highly accessible. Beginners will also appreciate the broker’s educational resources and research content, which simplify the learning curve.

News Trading – Acceptable Choice

BlackBull Markets delivers in-depth market insights and incorporates research from Myfxbook. While the broker’s in-house research is reliable, it does not currently integrate additional third-party analytics tools such as Trading Central or Autochartist.

Scalping – Perfect Match

Scalpers benefit from ultra-low latency trading supported by free VPS hosting and FIX API solutions. With execution speeds averaging just a few milliseconds, BlackBull Markets stands out as one of the most competitive brokers for short-term trading strategies.

Investing – Perfect Match

Long-term investors can access over 26,000 shares, ETFs, bonds, and options via the proprietary BlackBull Invest platform. This broad range of instruments makes it suitable for value investing and portfolio diversification.

Automated Trading – Perfect Match

The cTrader platform supports advanced algorithmic trading with a dedicated coding environment for bots and scripts. Paired with the broker’s VPS hosting and FIX API, algorithmic traders gain the reliability and speed needed for high-frequency strategies.

Swing Trading – Acceptable Choice

With 26,000+ instruments available, BlackBull Markets is well-equipped for swing trading. However, during testing, overnight fees were relatively high, which may affect profitability for traders who hold positions longer than a day.

Day Trading – Acceptable Choice

Execution speeds average below 100 milliseconds, making the broker a solid option for day traders. Spreads on the ECN Standard account are in line with industry norms, while more competitive fees can be unlocked through alternative account types.

Copy and Social Trading – Perfect Match

BlackBull Markets provides robust copy trading solutions through its proprietary BlackBull CopyTrade platform and ZuluTrade integration. Both options allow traders to follow experienced signal providers or share their own strategies, making it ideal for those seeking a community-driven trading experience.

Who is BlackBull Markets for?

When evaluating BlackBull Markets, it’s clear that the broker offers the features and tools to cater to a wide range of trading strategies. Here’s how it stacks up for different trader styles:

What Sets BlackBull Markets Apart?

BlackBull Markets is a New Zealand-based forex and CFD broker that stands out for its low forex fees, fast and fully digital account opening, and wide selection of trading platforms. Traders can choose from proprietary solutions like BlackBull Invest and BlackBull CopyTrade or industry-leading platforms such as MT4, MT5, cTrader, TradingView, and ZuluTrade, making it suitable for beginners, scalpers, algorithmic traders, and copy traders alike. Advanced features such as free VPS hosting, FIX API connectivity, and low-latency execution further enhance its appeal, while competitive crypto spreads and access to over 26,000 instruments – including shares, ETFs, bonds, and options – add strong diversification opportunities. Beginners benefit from demo accounts and educational resources, though research tools remain limited compared to top brokers reviewed on TradeWiki.io, and traders should note withdrawal fees and a $2,000 minimum deposit for Prime Accounts. Overall, BlackBull Markets combines accessibility with professional-grade features, making it an excellent choice for both casual and experienced traders.

BlackBull Markets Main Features

Regulations

FSA (Seychelles), FMA (New Zealand)

Languages

English, Spanish, Chinese, French, Greek

Products

Currencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$0

Max Leverage

1:500 (FSA), 1:500 (FMA)

Trading Desk Type

No dealing desk, STP

Trading Platforms

MT5, MT4, TradingView, cTrader, myFXbook, Zulutrade, BlackBull Trade

Deposit Options

Cryptocurrencies, Wire Transfer, Skrill, Neteller, Credit Card, AstroPay, Debit Card, SEPA, Apple Pay, Google Pay, Airtm, Poli, PaymentAsia, Help2Pay, FasaPay, China UnionPay, Boleto

Withdrawal Options

Neteller, Skrill, Credit Card, Cryptocurrencies, Wire Transfer, Debit Card, SEPA, Apple Pay, Google Pay, Poli, Airtm, PaymentAsia, Help2Pay, FasaPay, China UnionPay, Boleto, Beeteller

Demo Account

Yes

Foundation Year

2014

Headquarters

New Zealand

Regulations

FSA (Seychelles), FMA (New Zealand)

Languages

English, Spanish, Chinese, French, Greek

Products

Currencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$0

Max Leverage

1:500 (FSA), 1:500 (FMA)

Trading Desk Type

No dealing desk, STP

Trading Platforms

MT5, MT4, TradingView, cTrader, myFXbook, Zulutrade, BlackBull Trade

Deposit Options

Cryptocurrencies, Wire Transfer, Skrill, Neteller, Credit Card, AstroPay, Debit Card, SEPA, Apple Pay, Google Pay, Airtm, Poli, PaymentAsia, Help2Pay, FasaPay, China UnionPay, Boleto

Withdrawal Options

Neteller, Skrill, Credit Card, Cryptocurrencies, Wire Transfer, Debit Card, SEPA, Apple Pay, Google Pay, Poli, Airtm, PaymentAsia, Help2Pay, FasaPay, China UnionPay, Boleto, Beeteller

Demo Account

Yes

Foundation Year

2014

Headquarters

New Zealand

Start Trading With BlackBull Markets

| Account Type | ECN Standard | ECN Prime | ECN Institutional |

|---|---|---|---|

| Minimum Deposit Requirement | $0 | $2,000 | $20,000 |

| Commission | $0 | $6 | $4 |

| Spread From | 0.8 pips | 0.1 pips | 0.0 pips |

| Minimum Trade Volume | 0.01 lot | 0.01 lot | 0.01 lot |

| Margin Call | 70% | 70% | 70% |

| Stop Out | 50% | 50% | 50% |

| Swap Free Account | Yes | Yes | No |

| Standard Contract Size | 100,000 units | 100,000 units | 100,000 units |

| Demo Account | Yes | Yes | No |

BlackBull Markets Full Review

Safety Intro

BlackBull Markets is a fully regulated brokerage operating under two entities licensed by the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles. The broker maintains a strong focus on client safety, offering features such as negative balance protection and adhering to stringent regulatory standards. While the FMA does not provide formal investor compensation, BlackBull Markets demonstrates transparency, reliability, and a commitment to secure trading, making it a trustworthy choice for both new and experienced traders.

Pros:

- Regulated by top-tier FMA in New Zealand

- Negative balance protection

Cons:

- No investor protection

BlackBull Markets Regulation

In our comprehensive review of BlackBull Markets, we analyzed the licenses and regulatory framework for each entity, helping traders understand the protection levels offered:

Black Bull Group Limited:

- Licensed and regulated by the Financial Markets Authority (FMA) of New Zealand

- FSP number: 4033226

- Tier-1 regulator: highest level of oversight and compliance

Black Bull Group Limited:

- BBG Limited:Licensed and regulated by the Financial Services Authority (FSA) of Seychelles

- License number: SD045

- Tier-3 regulator: Basic regulatory coverage

By assessing these licenses, traders can gauge the safety, transparency, and reliability of trading with BlackBull Markets, making it easier to decide if this broker aligns with their risk and compliance preferences.

| Entity Features | Black Bull Group Limited | BBG Limited |

|---|---|---|

| Maximum Leverage | 1:500 | 1:500 |

| Country/Region | New Zealand, Auckland | Seychelles, Mahe |

| Tier | 1 | 3 |

| Segregated Funds | Yes | Yes |

| Regulation | FMA | FSA |

| Negative Balance Protection | Yes | Yes |

| Compensation Scheme | No | No |

Understanding the Regulatory Protections of Your Account

When selecting a broker, understanding the regulatory safeguards and account protections is essential to ensure the security of your funds. BlackBull Markets operates multiple entities globally, and each implements specific mechanisms to protect traders:

Segregation of Client Funds: Client deposits are held in accounts completely separate from the broker’s corporate capital, reducing the risk of accounting errors or misuse. Both BlackBull Markets entities maintain these segregated accounts.

Negative Balance Protection: This feature caps potential losses to the amount you have deposited in your trading account, ensuring that you cannot lose more than your initial investment. BlackBull Markets guarantees negative balance protection across all accounts.

Compensation Scheme: Unlike some brokers, BlackBull Markets does not participate in an investor compensation scheme, so traders are not covered in the rare event of company insolvency.

Maximum Leverage: To manage risk, the broker sets a maximum leverage of 1:500, balancing the potential for profit with exposure to market losses.

By implementing these measures, BlackBull Markets provides a transparent and secure trading environment, giving traders confidence in both fund safety and account management.

How you are protected

BlackBull Markets ensures client security through its operation under two legally distinct entities, each regulated by different authorities. While the specific jurisdictions linked to each entity are not fully disclosed, both entities uphold key protective measures designed to safeguard traders. One of the most critical features is negative balance protection, which guarantees that clients will never lose more than their deposited funds – even if market movements push an account into a negative balance. This robust safety mechanism reinforces trust and provides peace of mind for traders using BlackBull Markets.

| Legal entity | Regulator | Protection amount |

|---|---|---|

| BBG Limited | Financial Services Authority (FSA) | No protection |

| Black Bull Group Limited | Financial Markets Authority (FMA) | No protection |

Stability and Transparency

BlackBull Markets demonstrates a strong commitment to stability and transparency, key factors for building trader confidence. The broker’s longevity and operational scale reflect a solid foundation in the financial markets. A detailed review of the BlackBull Markets Client Agreement shows that all critical information is presented clearly, with no ambiguous or misleading language. Traders benefit from high fee transparency, as live spreads are readily accessible on the broker’s website, enabling users to easily evaluate and compare trading costs. This clarity, combined with a reliable operational structure, positions BlackBull Markets as a trustworthy choice for both new and experienced traders.

Is BlackBull Markets safe?

Yes. BlackBull Markets is considered a reliable and secure brokerage, offering multiple safeguards for traders. The broker operates under licenses from the Financial Markets Authority (FMA) of New Zealand and the Financial Services Authority (FSA) of Seychelles, ensuring regulatory oversight. Client funds are held in segregated accounts, protecting them from company liabilities, and negative balance protection guarantees that losses cannot exceed the funds deposited in your account. Additionally, BlackBull Markets maintains a transparent website and clear Client Agreement, making it easy for traders to understand the protections in place. When evaluating a broker’s safety, both the regulatory background and the mechanisms for client protection are essential, and BlackBull Markets performs strongly on both fronts.

| Safety Summary | BlackBull Markets |

|---|---|

| Year Founded | 2014 |

| Bank | No |

| Publicly Traded (Listed) | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 3 |

BlackBull Markets Safety

BlackBull Markets Fees

Fees Intro

BlackBull Markets offers competitive trading costs across its account types, catering to both casual and active traders. The ECN Standard account features commission-free trading with floating spreads starting from 0.8 pips, aligning with the industry average. For traders seeking tighter spreads, the Prime account provides an average EUR/USD spread of 0.11 pips as of 2025, with a per-side commission of 0.3 pips ($6 per 10,000 traded), making it ideal for more frequent trading, though it requires a $2,000 minimum deposit. The ECN Institutional account is designed for high-volume traders depositing at least $20,000, offering lower commissions of $2 per side ($4 per round turn).

While forex trading fees are generally low and there are no deposit charges, CFD trading carries average fees, and withdrawals incur a handling fee. Additionally, an inactivity fee applies to dormant accounts. Traders should note that CFDs are complex instruments with a high risk of rapid financial loss due to leverage, and 74–89% of retail investor accounts lose money when trading CFDs with this broker. Understanding the risks and the fee structure is essential for managing trading costs effectively.

Pros:

- Low forex fees

- No fee for deposit

Cons:

- Withdrawal fee

BlackBull Markets Spreads

Get spreads from actual broker if possible or just use FX Empire

Forex Spreads

| Raw Spread Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| AUDUSD | Australian Dollar vs United States Dollar | 0.03 | 0.83 |

| EURUSD | Euro vs United States Dollar | 0.02 | 0.82 |

| GBPUSD | British Pound vs United States Dollar | 0.23 | 1.03 |

| USDCAD | United States Dollar vs Canadian Dollar | 0.25 | 1.05 |

| USDCHF | United States Dollar vs Swiss Franc | 0.19 | 0.99 |

| USDJPY | United States Dollar vs Japanese Yen | 0.14 | 0.94 |

| AUDCAD | Australian Dollar vs Canadian Dollar | 0.68 | 1.68 |

| AUDCHF | Australian Dollar vs Swiss Franc | 0.41 | 1.41 |

| AUDJPY | Australian Dollar vs Japanese Yen | 0.5 | 1.5 |

| AUDNZD | Australian Dollar vs New Zealand Dollar | 0.77 | 1.77 |

| CADCHF | Canadian Dollar vs Swiss Franc | 0.58 | 1.58 |

| CADJPY | Canadian Dollar vs Japanese Yen | 0.48 | 1.48 |

| CHFJPY | Swiss Franc vs Japanese Yen | 0.86 | 1.86 |

| EURAUD | Euro vs Australian Dollar | 0.8 | 1.8 |

| EURCAD | Euro vs Canadian Dollar | 0.74 | 1.74 |

| EURCHF | Euro vs Swiss Franc | 0.61 | 1.61 |

| EURGBP | Euro vs British Pound | 0.27 | 1.27 |

| EURJPY | Euro vs Japanese Yen | 0.3 | 1.3 |

| EURNZD | Euro vs New Zealand Dollar | 1.32 | 2.32 |

| GBPAUD | British Pound vs Australian Dollar | 1.06 | 2.06 |

| GBPCAD | British Pound vs Canadian Dollar | 1.12 | 2.12 |

| GBPCHF | British Pound vs Swiss Franc | 1.1 | 2.1 |

| GBPJPY | British Pound vs Japanese Yen | 0.82 | 1.82 |

| GBPNZD | British Pound vs New Zealand Dollar | 1.98 | 2.98 |

| NZDCAD | New Zealand Dollar vs Canadian Dollar | 1.04 | 2.04 |

| NZDCHF | New Zealand Dollar vs Swiss Franc | 0.73 | 1.73 |

| NZDJPY | New Zealand Dollar vs Japanese Yen | 0.6 | 1.6 |

| NZDUSD | New Zealand Dollar vs United States Dollar | 0.38 | 1.38 |

| AUDSGD | Australian Dollar vs Singapore Dollar | 0.97 | 1.97 |

| CHFSGD | Swiss Franc vs Singapore Dollar | 2.05 | 3.05 |

| EURDKK | Euro vs Danish Kroner | 11.11 | 12.11 |

| EURHKD | Euro vs Hong Kong Dollar | 2.17 | 3.17 |

| EURNOK | Euro vs Norwegian Kroner | 52.89 | 53.89 |

| EURPLN | Euro vs Polish Zloty | 21.2 | 22.2 |

| EURSEK | Euro vs Swedish Krona | 44.07 | 45.07 |

| EURSGD | Euro vs Singapore Dollar | 0.9 | 1.9 |

| EURTRY | Euro vs Turkish Lira | 95.14 | 96.14 |

| EURZAR | Euro vs South African Rand | 94.68 | 95.68 |

| GBPDKK | British Pound vs Danish Kroner | 18.32 | 19.32 |

| GBPNOK | British Pound vs Norwegian Kroner | 38.14 | 39.14 |

| GBPSEK | British Pound vs Swedish Krona | 28.13 | 29.13 |

| GBPSGD | British Pound vs Singapore Dollar | 2.45 | 3.45 |

| GBPTRY | British Pound vs Turkish Lira | 138.98 | 139.98 |

| NOKJPY | Norwegian Kroner vs Japanese Yen | 0.67 | 1.67 |

| NOKSEK | Norwegian Kroner vs Swedish Krona | 7.53 | 8.53 |

| SEKJPY | Swedish Krona vs Japanese Yen | 0.87 | 1.87 |

| SGDJPY | Singapore Dollar vs Japanese Yen | 0.7 | 1.7 |

| USDCNH | United States Dollar vs Chinese RMB | 2.93 | 3.93 |

| USDCZK | United States Dollar vs Czech Koruna | 5.21 | 6.21 |

| USDDKK | United States Dollar vs Danish Kroner | 4.77 | 5.77 |

| USDHKD | United States Dollar vs Hong Kong Dollar | 0.89 | 1.89 |

| USDHUF | United States Dollar vs Hungarian Forint | 9.48 | 10.48 |

| USDMXN | United States Dollar vs Mexican Peso | 28.57 | 29.57 |

| USDNOK | United States Dollar vs Norwegian Kroner | 36.79 | 37.79 |

| USDPLN | United States Dollar vs Polish Zloty | 15.79 | 16.79 |

| USDRUB | United States Dollar vs Russian Ruble | 65.26 | 66.26 |

| USDSEK | United States Dollar vs Swedish Krona | 30.31 | 31.31 |

| USDTHB | United States Dollar vs Thai Baht | 63.21 | 64.21 |

| USDTRY | United States Dollar vs Turkish Lira | 50.61 | 51.61 |

| USDZAR | United States Dollar vs South African Rand | 79.85 | 80.85 |

| USDSGD | United States Dollar vs Singapore Dollar | 0.85 | 1.85 |

Metal Spreads

| Raw Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Min. Spread |

| XAGEUR | Silver vs Euro | 0.813 | 1 |

| XAGUSD | Silver vs United States Dollar | 0.894 | 1 |

| XAUAUD | Gold vs Aus | 3.679 | 1 |

| XAUEUR | Gold vs Euro | 3.537 | 1 |

| XAUUSD | Gold vs United States Dollar | 1.083 | 1 |

| XPDUSD | Palladium vs United States Dollar | 162.735 | 1 |

| XPTUSD | Platinum vs United States Dollar | 42.3 | 1 |

Indices Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| AUS200 | Australia S&P ASX 200 Index | 0 | 1.22 |

| DE40 | Germany 40 Index | 0.5 | 1.338 |

| F40 | France 40 Index | 0 | 0.749 |

| JP225 | Japan 225 Index | 6 | 8.858 |

| STOXX50 | EU Stocks 50 Index | 0.2 | 1.76 |

| UK100 | UK 100 Index | 1 | 2.133 |

| US30 | US Wall Street 30 Index | 1 | 1.411 |

| US500 | US SPX 500 Index | 0.2 | 0.492 |

| USTEC | US Tech 100 Index | 1 | 1.807 |

| CA60 | Canada 60 Index | 0.6 | 0.6 |

| CHINA50 | FTSE China A50 Index | 3.29 | 6.953 |

| CHINAH | Hong Kong China H-shares Index | 0 | 2.083 |

| ES35 | Spain 35 Index | 4.2 | 4.426 |

| HK50 | Hong Kong 50 Index | 7 | 8.169 |

| IT40 | Italy 40 Index | 9 | 9 |

| MidDE50 | Germany Mid 50 Index | 7.5 | 27.864 |

| NETH25 | Netherlands 25 Index | 0.19 | 0.19 |

| NOR25 | Norway 25 Index | 0.68 | 0.68 |

| SA40 | South Africa 40 Index | 7.5 | 15.444 |

| SE30 | Sweden 30 | 0.38 | 0.38 |

| SWI20 | Switzerland 20 Index | 3 | 3.5 |

| TecDE30 | Germany Tech 30 Index | 2.3 | 3.172 |

| US2000 | US Small Cap 2000 Index | 0.14 | 0.48 |

CFD Commodities Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| GC25 | Gold Futures | 0.2 | 0.23 |

| BRENT | Brent Crude Oil Futures | 0.02 | 0.028 |

| Cocoa | Cocoa Futures | 3 | 4.608 |

| Coffee | Coffee Futures | 0.3 | 0.3 |

| Corn | Corn Futures | 0.68 | 0.68 |

| Cotton | Cotton Futures | 0.15 | 0.15 |

| OJ | Orange Juice Futures | 1.12 | 1.12 |

| Soybean | Soybean Futures | 1.35 | 1.35 |

| Sugar | Sugar Futures | 0.03 | 0.033 |

| Wheat | Wheat Futures | 0.75 | 0.75 |

| WTI | West Texas Intermediate - Crude Oil Futures | 0.02 | 0.027 |

| XBRUSD | Brent Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

| XNGUSD | Natural Gas Spot vs United States Dollar | 0.002 | 0.004 |

| XTIUSD | WTI Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

Cryptocurrency Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| BCHUSD | Bitcoin Cash vs United States Dollar CFD | 2.21 | 5.839 |

| BTCUSD | Bitcoin vs United States Dollar CFD | 8.71 | 42.036 |

| DOTUSD | Polkadot vs United States Dollar CFD | 0.011 | 0.013 |

| DSHUSD | Dash Coin vs United States Dollar CFD | 0 | 1.241 |

| EMCUSD | Emercoin vs United States Dollar CFD | 0.157 | 0.157 |

| ETHUSD | Ethereum vs United States Dollar CFD | 4.56 | 11.605 |

| LNKUSD | Chainlink vs United States Dollar CFD | 0.012 | 0.02 |

| LTCUSD | Lite Coin vs United States Dollar CFD | 1.05 | 1.597 |

| NMCUSD | NameCoin vs United States Dollar CFD | 7.895 | 7.895 |

| PPCUSD | PeerCoin vs United States Dollar CFD | 0.184 | 0.276 |

| XLMUSD | Stellar vs United States Dollar CFD | 0 | 0 |

| XRPUSD | Ripple vs United States Dollar CFD | 0.008 | 0.02 |

| ADAUSD | Cardano vs United States Dollar CFD | 0.001 | 0.003 |

| BNBUSD | Binance Smartchain vs United States Dollar CFD | 1.266 | 1.415 |

| DOGUSD | Doge vs United States Dollar CFD | 0.001 | 0.001 |

| UNIUSD | Uniswap vs United States Dollar CFD | 0.061 | 0.064 |

| XTZUSD | Tezos vs United States Dollar CFD | 0.003 | 0.026 |

Bonds Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| EURBOBL | Euro Bobl | 0.01 | 0.01 |

| EURBUND | Euro Bund | 0.01 | 0.011 |

| EURSCHA | Euro Schatz | 0.01 | 0.01 |

| ITBTP10Y | BTP Italian Bonds | 0.02 | 0.02 |

| JGB10Y | Japanese 10 YR | 0.03 | 0.034 |

| UKGB | UK Long Gilt | 0.01 | 0.012 |

| UST05Y | US 5 YR T-Note | 0.014 | 0.014 |

| UST10Y | US 10 YR T-Note | 0.031 | 0.031 |

| UST30Y | US T-Bond (30 year) | 0.03 | 0.031 |

BlackBull Markets Commission Rates

BlackBull Markets provides a transparent and competitive commission structure across its account types. The ECN Standard account charges no commissions for most trades, making it suitable for casual and cost-conscious traders. However, share CFDs traded on the cTrader platform incur a commission of 0.20% based on the traded volume. This approach ensures that traders enjoy low-cost access to most markets while maintaining clarity on costs for specific instruments.

BlackBull Markets Swap Fees

In forex trading, swap fees represent the cost of holding a position open overnight due to interest rate differentials. A swap long indicates the charge or credit applied for maintaining a buy position overnight, while a swap short reflects the cost or credit for holding a sell position. At BlackBull Markets, these fees are calculated per full base currency contract (100,000 units). Our assessment shows that BlackBull Markets’ overnight swap rates are generally low to average compared with industry standards, offering competitive conditions for traders who hold positions overnight. Keep in mind that swap rates fluctuate over time based on prevailing market interest rates.

| Instrument | Swap Short | Swap Long |

|---|---|---|

| GBPJPY | Charge of $39.10 | Credit of $1.39 |

| EURUSD | Credit of $1.27 | Charge of $7.99 |

BlackBull Markets Non-Trading Fees

At BlackBull Markets, deposits are free of charge, though some third-party payment providers may apply their own processing fees. Withdrawals incur a standard $5 handling fee regardless of the chosen payment method. Additionally, accounts that remain inactive for 12 consecutive months are subject to a $10 monthly inactivity fee, which continues to be applied until either account activity resumes or the balance reaches zero. These transparent non-trading fees ensure traders can clearly anticipate all associated costs outside of their standard trading activities.

Are BlackBull Markets Fees Competitive?

BlackBull Markets offers trading fees that are generally competitive within the industry, featuring low-to-average spreads and swap rates across a broad range of popular instruments. This makes the broker attractive for active traders seeking cost-efficient execution. On the other hand, some non-trading fees, such as withdrawal charges and monthly inactivity fees, are slightly higher than the market average. Overall, BlackBull Markets balances competitive trading costs with transparent non-trading fees, allowing traders to clearly assess the total cost of their trading activity.

| Fees Summary | BlackBull Markets |

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 0.71 |

| All-in Cost EUR/USD - Active | 0.71 |

| ACH or SEPA Transfers | No |

| Bank Wire (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Active Trader or VIP Discounts | Yes |

| PayPal (Deposit/Withdraw) | No |

BlackBull Markets Deposit and Withdrawals

Deposit and Withdrawal Intro

BlackBull Markets provides a versatile range of deposit and withdrawal methods, including bank wires, e-wallets, debit and credit cards, and cryptocurrencies, catering to traders across multiple regions. Deposits are processed instantly and free of charge, while withdrawals incur a modest $5 handling fee. The broker supports several base currencies, allowing clients to fund and access their accounts conveniently, and overall, the payment system is fast, reliable, and designed to accommodate both new and experienced traders.

Pros:

- Several account base currencies

- Credit/Debit card available

- No deposit fee

Cons:

- Withdrawal fee

BlackBull Markets Account Base Currencies

At BlackBull Markets, you can choose from the following base currencies:

| CAD | JPY | ZAR |

| USD | EUR | GBP |

| AUD | NZD | SGD |

At BlackBull Markets, traders have the flexibility to open accounts in eight different base currencies, providing a level of choice that aligns with industry standards. Selecting the right base currency is not just a matter of preference – it has a direct impact on your trading efficiency and cost management. Funding your trading account in the same currency as your personal bank account or aligning your account currency with the primary currency of the assets you trade eliminates unnecessary currency conversion fees, which can quietly erode trading profits over time.

To further optimize your currency management, many traders turn to multi-currency digital bank accounts. These accounts offer banking in multiple currencies, typically with competitive exchange rates and minimal or zero fees for international transfers. This approach allows you to move funds efficiently between your bank and trading account while reducing conversion costs. Opening such an account is usually straightforward, often completed in just a few minutes via a mobile app. By leveraging these strategies, traders at BlackBull Markets can enhance cost-efficiency, simplify account funding, and maintain greater control over their international trading activities, ultimately maximizing the value of every deposit and trade.

BlackBull Markets Deposit Fees and Options

At BlackBull Markets, depositing funds is straightforward and cost-effective, with no fees applied to any deposit method. Traders can fund their accounts using a bank transfer, which may take several business days to process, or opt for a credit or debit card, which provides instant funding for quicker trading access. For security and regulatory compliance, deposits must originate from accounts held in the trader’s own name, ensuring both safety and transparency. This combination of fee-free deposits and multiple payment options offers flexibility while maintaining full control over your trading funds, allowing you to start trading efficiently without hidden costs or delays.

BlackBull Markets supports the following electronic wallets:

| Neteller | AMEX | FasaPay | FXPay |

| AstroPay | Boleto | AIRTM | Help2Pay |

| PaymentAsia | Skrill | HexoPay | Poli |

| Beeteller | China UnionPay |

BlackBull Markets deposit methods and fees:

| Deposit Method | Processing Time | Fee | Currencies |

|---|---|---|---|

| Bank Wire | 1-3 business days | $0 | Multiple |

| Local Bank Transfer | 30 to 90 minutes | $0 | INR |

| Credit/Debit Card | Instant | $0 | Multiple |

| Google Pay | Instant | $0 | Multiple |

| Apple Pay | Instant | $0 | Multiple |

| Crypto | Instant | $0 | BTC, ETH, USDT, USDC, XRP, LTC, LINK, BCH, XLM |

| Airtm | Up to 24 hours | $0 | Multiple |

| Neteller | Instant | $0 | Multiple |

| Skrill | Instant | $0 | Multiple |

| HexoPay | Instant | $0 | CAD |

| AMEX | 1-2 business days | $0 | Multiple |

| SEPA | Up to 48 hours | $0 | EUR, GBP |

| Poli | Up to 48 hours | $0 | NZD |

| PaymentAsia | Up to 48 hours | $0 | THB |

| Help2Pay | Up to 48 hours | $0 | EUR, USD |

| FXPay | Up to 48 hours | $0 | EUR, USD |

| FasaPay | Up to 48 hours | $0 | USD |

| China Union Pay | Instant | $0 | Multiple |

| Boleto | Up to 48 hours | $0 | BRL |

| Beeteller | Up to 48 hours | $0 | BRL |

BlackBull Markets Withdrawal Fees and Options

At BlackBull Markets, withdrawals are simple and secure, with a standard fee of $5 per transaction (or 5 units in your account’s base currency). All withdrawals must be made to accounts registered in your name, ensuring compliance and security. For credit/debit cards, Skrill, FasaPay, Neteller, or UnionPay, you can only withdraw funds up to the amount you originally deposited via that method. Any profits beyond your initial deposit must be withdrawn through a bank transfer, which provides a reliable and flexible way to access your earnings. This system balances convenience, safety, and transparency, giving traders confidence when managing their funds.

BlackBull Markets withdrawal methods and fees:

| Deposit Method | Processing Time | Fee | Currencies |

|---|---|---|---|

| Bank Wire | 1-3 business days | $5 | Multiple |

| Credit/Debit Card | Instant | $5 | Multiple |

| Google Pay | Instant | $5 | Multiple |

| Apple Pay | Instant | $5 | Multiple |

| Crypto | 1-2 business days | $5 | BTC, ETH, USDT, USDC, XRP, LTC, LINK, BCH, XLM |

| Airtm | 1 business day | $5 base currency | Multiple |

| Neteller | Instant | $5 | Multiple |

| Skrill | Instant | 5 | Multiple |

| HexoPay | Instant | $5 | CAD |

| AMEX | Instant | $5 | Multiple |

| SEPA | Instant | $5 | EUR, GBP |

| Poli | Instant | $5 | NZD |

| PaymentAsia | Instant | $5 | THB |

| Help2Pay | Up to 48 hours | $5 | EUR, USD |

| FXPay | Up to 48 hours | $5 | EUR, USD |

| FasaPay | Up to 48 hours | $5 | USD |

| China Union Pay | 24 hours | $5 | Multiple |

| Boleto | Up to 48 hours | $5 | BRL |

| Beeteller | Up to 48 hours | $5 | BRL |

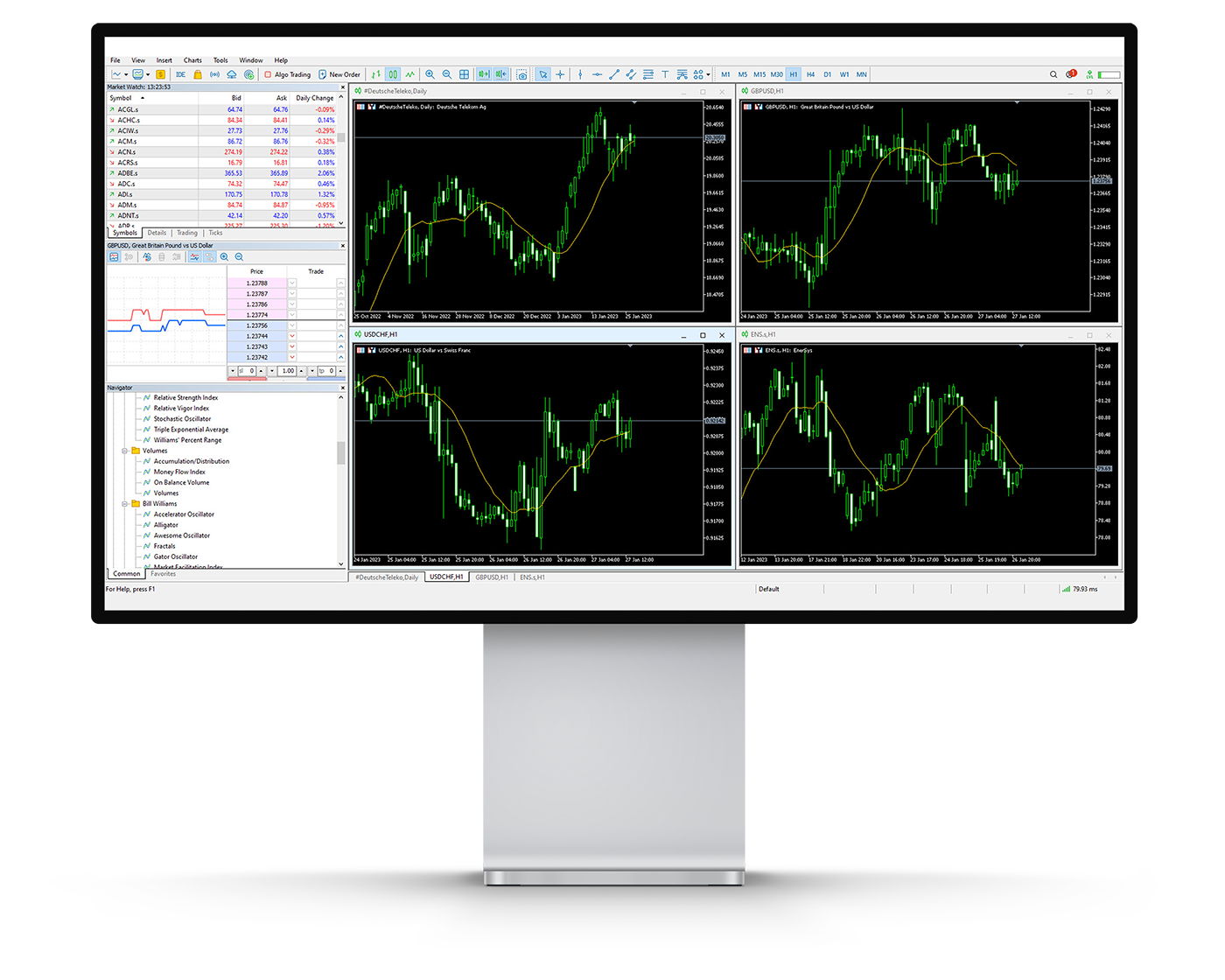

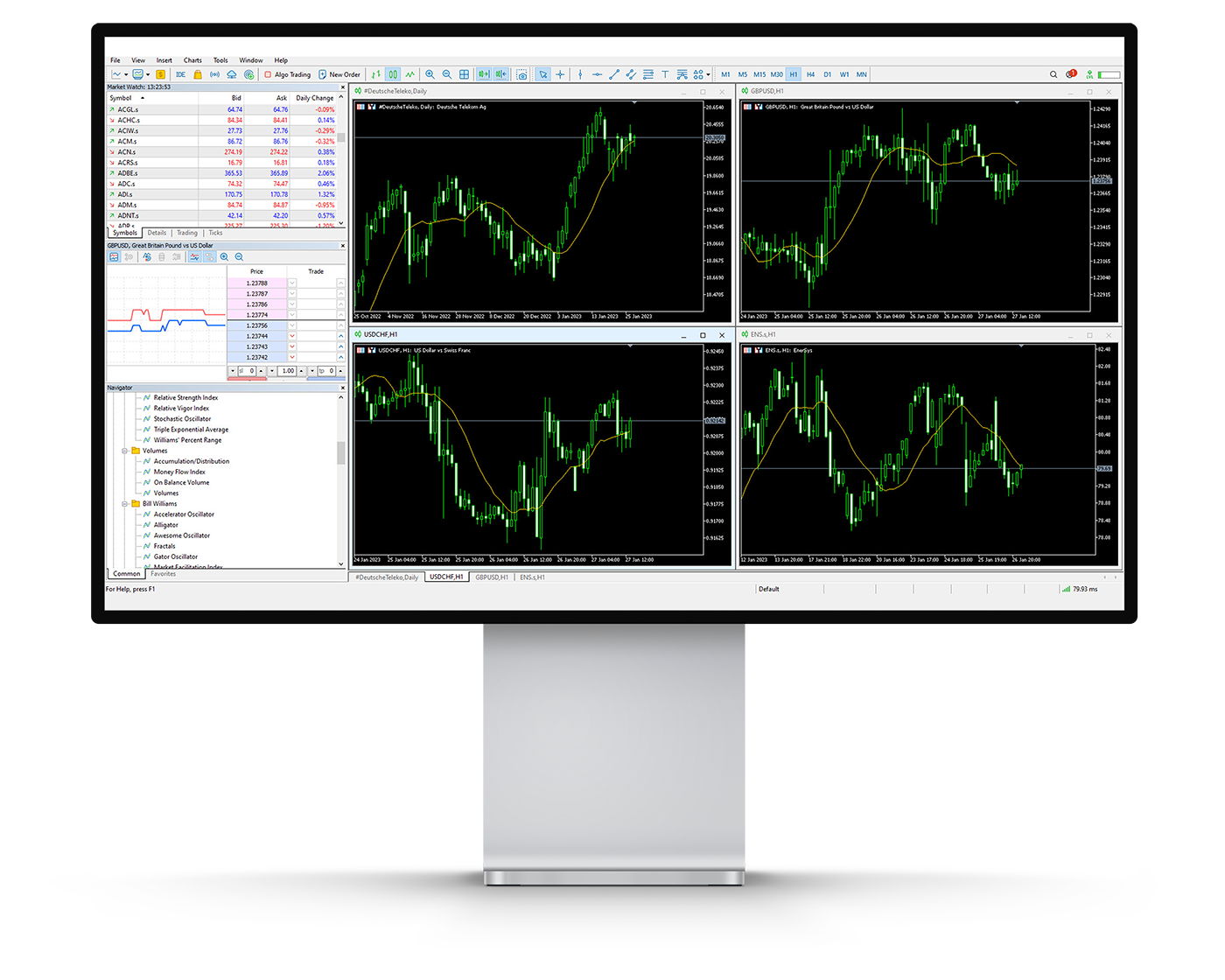

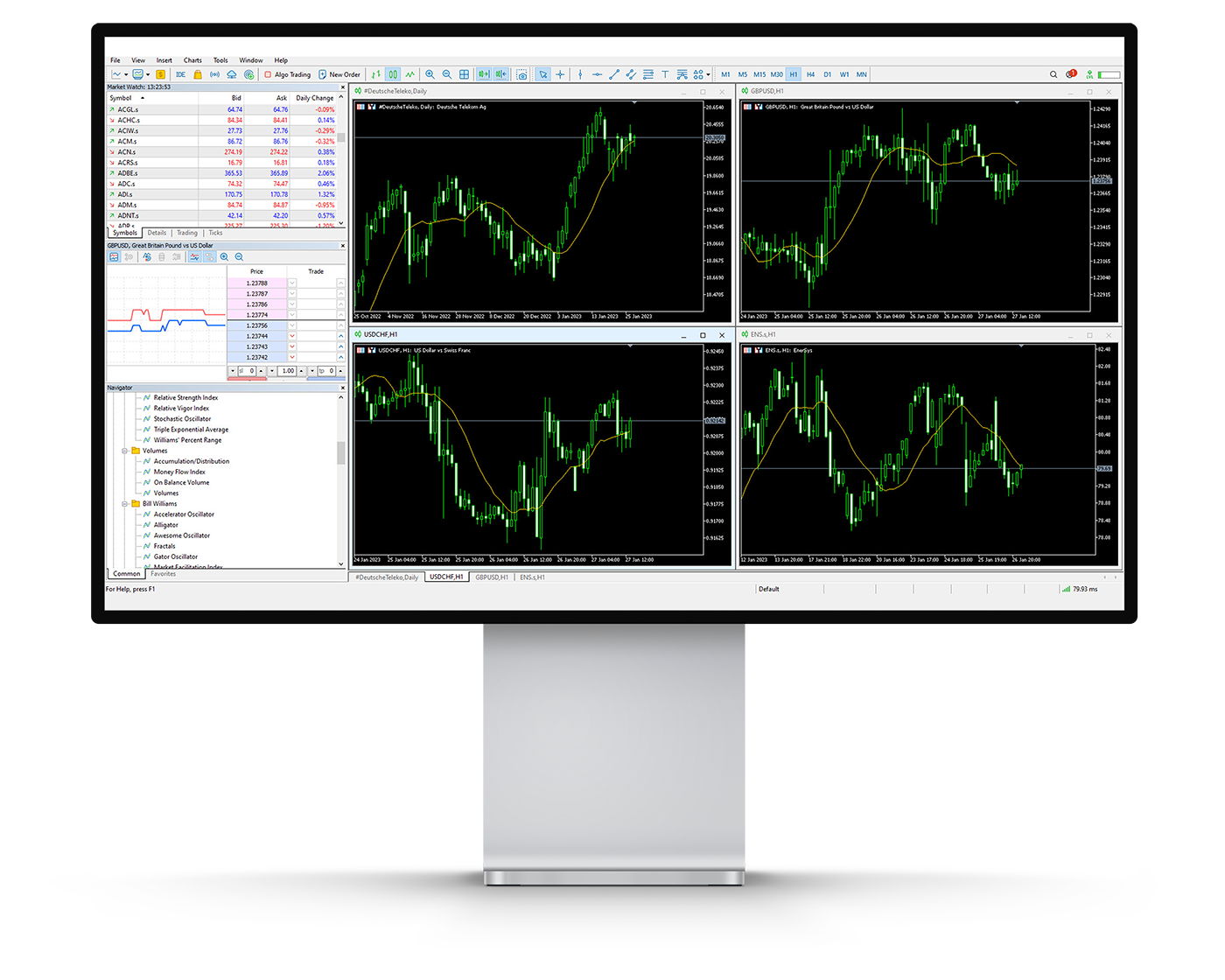

The MetaTrader 4 (MT4) desktop platform offered by BlackBull Markets is a trusted solution for traders of all levels, combining ease of use with advanced functionality. Known for its reliability, MT4 delivers a smooth trading experience that makes navigating charts, placing orders, and managing instruments straightforward. While its interface design may appear less modern compared to newer platforms, it remains a top choice for traders worldwide due to its stability and powerful features.

Platform Compatibility & Language Support

Fully compatible with Windows and Mac operating systems.

Supports 52 languages, including English, French, Spanish, German, Arabic, and Chinese, ensuring accessibility for a diverse international trading audience.

Key Features of MT4 on BlackBull Markets

Custom Alerts: Set price alerts to receive notifications when specific levels are reached, helping identify trading opportunities quickly.

Watchlist Management: Create and manage personalized watchlists to monitor selected instruments and market movements efficiently.

One-Click Trading: Execute trades instantly at current market prices – ideal for scalpers and fast-paced trading strategies.

Chart-Based Trading: Place and manage orders directly from interactive charts, with customizable entry price, trade volume, stop-loss, and take-profit settings.

Expert Advisor (EA) Integration: Run automated trading strategies with EAs and optimize them using the built-in strategy tester, allowing algorithmic traders to refine strategies across different market conditions.

Why BlackBull Markets’ MT4 Desktop Stands Out

BlackBull Markets enhances the standard MT4 experience by pairing robust automation tools with flexible trading features. From scalpers relying on one-click execution to algorithmic traders optimizing Expert Advisors, the platform offers a professional-grade environment for precision, efficiency, and flexibility. Combined with its global language support and compatibility across devices, BlackBull Markets’ MT4 remains one of the most versatile and dependable platforms in online trading.

How long does BlackBull Markets withdrawal take?

At BlackBull Markets, withdrawal processing is fast and efficient, providing traders with quick access to their funds. Based on our testing, withdrawals via credit card or bank transfer are typically completed within 1 business day. This prompt processing time ensures that your profits and capital are accessible without unnecessary delays, offering both convenience and reliability. Whether funding your account or retrieving earnings, BlackBull Markets prioritizes speed and transparency, making fund management seamless for all clients.

How do you withdraw money from BlackBull Markets?

Access the Client Portal – Log in to the BlackBull Markets Client Login Portal using your registered credentials.

Navigate to Funding – From the dashboard, select ‘Withdraw Funds’ under the Funding section.

Choose Your Trading Account – Pick the MetaTrader account from which you wish to withdraw funds.

Enter Withdrawal Details – Specify the amount you want to withdraw and select your preferred withdrawal method.

Available Withdrawal Methods – Choose withdrawal method

Submit Request – Confirm and submit your withdrawal request.

Fees and Processing Time:

Handling fee: $5 per withdrawal (or equivalent in your account currency)

Processing: Most withdrawals via credit card or bank transfer are completed within 1 business day

Withdrawals are strictly allowed to accounts registered in your name for security and compliance.

BlackBull Markets Trading Platforms and Tools

Trading Platforms and Tools Intro

BlackBull Markets offers a comprehensive suite of trading platforms and advanced tools, catering to both beginner and professional traders. The broker’s flagship platform, BlackBull Invest, delivers access to thousands of trading and investment opportunities across forex, CFDs, and other instruments. Alongside this, traders can utilize industry-standard platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and ZuluTrade, supporting a variety of trading styles including automated strategies, social trading, and copy trading.

Platform Features and Options:

MetaTrader Suite: Both MT4 and MT5 are available for desktop, web, and mobile, offering comprehensive charting, technical indicators, and expert advisor (EA) functionality for automated trading.

BlackBull Invest & BlackBull Shares: Proprietary platforms with enhanced analytics, custom charting, and integrated market data, allowing access to global trading opportunities.

TradingView Integration: Offers advanced charting tools, robust analysis capabilities, and seamless connectivity for traders who rely on professional technical studies.

cTrader: Supports algorithmic trading, in-depth market analysis, and ECN-style execution for serious traders seeking tighter spreads.

Social and Copy Trading Capabilities:

BlackBull Markets supports a range of social and copy trading platforms, including ZuluTrade, MyFxbook, and the broker’s proprietary CopyTrader, fully integrated with MetaTrader via Hokocloud.

Traders can follow, replicate, and interact with professional traders, gaining access to real-time strategy execution and performance tracking.

VPS Hosting for Algorithmic Traders:

For automated trading around the clock, BlackBull Markets offers VPS hosting through BeeksFX for a monthly fee.

Free VPS access is available for ECN Prime account holders who deposit at least $2,000 and trade a minimum of 20 standard lots (2,000,000 units) per month, ensuring uninterrupted algorithmic operations.

Enhanced Tools for Professional Trading:

FIX API Integration: Advanced traders can directly connect their trading software for high-speed execution and improved liquidity access.

The combination of multiple platforms, social trading apps, VPS solutions, and proprietary tools positions BlackBull Markets as a versatile broker equipped to meet diverse trading needs.

This comprehensive approach to trading platforms ensures that whether you are executing manual trades, automating strategies, or participating in social trading networks, BlackBull Markets provides the technology and infrastructure to maximize efficiency and trading potential.

MetaTrader 4

MetaTrader 4 Desktop Intro FIXXXXX

The MT4 platform at BlackBull Markets is equipped with an advanced charting package designed to meet the needs of both beginners and seasoned traders. With a wide range of technical indicators, drawing tools, and customizable chart types, it provides a powerful environment for conducting in-depth technical and strategic analysis.

Key Charting Features

Technical Indicators: Traders can utilize 38 built-in indicators, covering trend analysis, oscillators, and volume-based tools. These indicators help track price momentum, market sentiment, and possible entry or exit points.

Drawing Tools: The platform includes 24 drawing tools, such as Fibonacci retracements and Elliott Wave analysis, giving traders the ability to map out support and resistance levels, chart formations, and potential breakout zones.

Timeframes & Chart Types: With 21 different timeframes ranging from one minute to monthly, MT4 supports multi-timeframe strategies. Users can switch between candlestick, line, and bar charts for different perspectives on price action.

Customization & Usability: While MT4 offers extensive flexibility, applying multiple indicators at once can make charts appear cluttered, which may challenge newer traders when interpreting price movements.

BlackBull Markets combines the reliability of MT4 with a comprehensive charting toolkit that supports both manual trading and algorithmic strategies. From scalpers who rely on short-term setups to swing traders analyzing longer trends, the platform delivers the versatility required to make informed trading decisions. Despite the potential for visual clutter, its depth of tools makes it one of the most robust charting solutions in online trading.

Pros:

- Clear fee report

- Good customizability (for charts, workspace)

- Price alerts

Cons:

- Search function could be improved

- Poor design

Charts

The MT4 platform at BlackBull Markets is equipped with an advanced charting package designed to meet the needs of both beginners and seasoned traders. With a wide range of technical indicators, drawing tools, and customizable chart types, it provides a powerful environment for conducting in-depth technical and strategic analysis.

Key Charting Features

Technical Indicators: Traders can utilize 38 built-in indicators, covering trend analysis, oscillators, and volume-based tools. These indicators help track price momentum, market sentiment, and possible entry or exit points.

Drawing Tools: The platform includes 24 drawing tools, such as Fibonacci retracements and Elliott Wave analysis, giving traders the ability to map out support and resistance levels, chart formations, and potential breakout zones.

Timeframes & Chart Types: With 21 different timeframes ranging from one minute to monthly, MT4 supports multi-timeframe strategies. Users can switch between candlestick, line, and bar charts for different perspectives on price action.

Customization & Usability: While MT4 offers extensive flexibility, applying multiple indicators at once can make charts appear cluttered, which may challenge newer traders when interpreting price movements.

BlackBull Markets combines the reliability of MT4 with a comprehensive charting toolkit that supports both manual trading and algorithmic strategies. From scalpers who rely on short-term setups to swing traders analyzing longer trends, the platform delivers the versatility required to make informed trading decisions. Despite the potential for visual clutter, its depth of tools makes it one of the most robust charting solutions in online trading.

Orders

The MetaTrader 4 (MT4) platform at BlackBull Markets provides a flexible range of order execution types, making it suitable for scalpers, day traders, swing traders, and algorithmic strategies alike. With features like one-click trading and advanced pending orders, the platform is designed to maximize both speed and precision in trade execution.

Available Order Types

Market Orders: These allow instant execution at the best available price in the market. While they guarantee trade volume, final execution may differ slightly from the quoted price due to slippage in fast-moving conditions.

Limit Orders: With limit orders, traders can set their desired entry price in advance. The order will only execute if the market reaches the specified level, ensuring complete control over entry points.

Stop Orders: Designed as a risk management tool, stop orders automatically trigger when the price crosses a chosen level. Once activated, they convert into market orders to help limit losses or secure profits.

One-Click Trading: Ideal for high-speed strategies, this feature allows traders to open or close positions instantly without extra confirmation steps.

By offering a full suite of order types combined with one-click trading, BlackBull Markets equips traders with the ability to act quickly and confidently in dynamic market conditions. Whether executing short-term trades or managing long-term strategies, the platform delivers the precision and efficiency needed to optimize performance.

Mt4 WebTrader

The MetaTrader Web Platform (Web Trader) at BlackBull Markets delivers the full power of MT4 in a browser-based solution, giving traders the freedom to access their accounts anytime, anywhere, without the need to install additional software. Whether you trade on Windows, macOS, or Linux, the platform runs smoothly across all operating systems for maximum convenience.

Key Features of the Web Trader

One-Click Trading: Open or close positions instantly with a single click, perfect for traders who need speed and efficiency.

Trading Directly from Charts: Analyze price movements and execute trades seamlessly from within your charts for faster decision-making.

Custom Watchlists with Live Quotes: Monitor your preferred instruments in real-time and stay ahead of the markets with updated pricing.

Comprehensive Trade History: Review past transactions quickly, allowing you to evaluate performance and refine your strategies.

Advanced Charting Tools: Access 30 built-in technical indicators to perform detailed market analysis and improve trade accuracy.

Copy & Automated Trading Options: Follow top-performing traders or implement automated strategies to streamline your trading approach.

By combining flexibility, speed, and professional-grade features, the BlackBull Markets Web Trader makes it easy for traders of all levels to stay connected to the markets. With powerful execution tools, advanced charting, and automation capabilities, it stands as a leading solution for traders seeking both convenience and performance.

MT4 Mobile App

Pros:

- Good search function

- Price alerts

- User-friendly

Cons:

- No two-step (safer) login

The MetaTrader 4 (MT4) mobile app from BlackBull Markets, available on both iOS and Android, gives traders instant access to the global markets anytime and anywhere. Designed for speed and accuracy, the app enables users to open, close, and manage trades directly from their mobile devices with just a few taps.

Key Features of MT4 Mobile Trading

Full Order Execution: Place market, limit, and stop orders with ease while adjusting trade sizes and exposure to match your strategy.

Intuitive & Responsive Interface: The clean design ensures smooth navigation, allowing traders to make fast, informed decisions without delays.

On-the-Go Flexibility: Monitor positions, analyze charts, and react to market changes in real time – no matter where you are.

Advanced Execution & Real-Time Data: Backed by BlackBull Markets’ execution technology, traders benefit from speed, reliability, and live price feeds.

Professional-Grade Mobile Experience: Whether you are a casual trader or a professional, the MT4 mobile platform provides the tools you need to stay competitive in fast-moving markets.

The MT4 app is more than just a simplified version of the desktop platform – it delivers full trading functionality, technical analysis tools, and real-time execution, all optimized for mobile use. This makes it an essential tool for traders who value flexibility without compromising performance.

Look and Feel

The MT4 mobile trading platform from BlackBull Markets is designed with both style and practicality in mind, offering a smooth balance between clean visuals and powerful functionality. Its modern interface is easy to navigate, allowing traders to quickly access charts, place trades, and manage open positions without unnecessary clutter.

The layout is thoughtfully structured so that essential tools are always within reach, ensuring fast decision-making in dynamic markets. Whether you are new to trading or a seasoned professional, the intuitive design reduces the learning curve and helps you stay focused on execution rather than navigation.

With its polished look, responsive performance, and reliable functionality, BlackBull Markets’ MT4 mobile app provides a seamless mobile trading experience that keeps you connected and in control of your trades anywhere, anytime.

Login and security

BlackBull Markets’ MT4 mobile app currently uses a simple one-step login process, giving traders quick access to their accounts. While this approach is straightforward and convenient, it leaves room for enhanced security measures.

Two-Factor Authentication (2FA): Adding 2FA would provide an extra layer of protection against unauthorized access, ensuring accounts remain secure even if login details are compromised.

Biometric Login: Features such as fingerprint or facial recognition are not yet available but would significantly improve both speed and security for mobile traders.

Overall, the platform’s current setup is functional, but the addition of advanced security options would create a safer and more seamless login experience for users who prioritize both protection and convenience.

Search functions

The BlackBull Markets MT4 mobile app features a streamlined search function that makes finding trading instruments fast and straightforward. Traders can either:

Use the search bar to type in the exact name or symbol of the instrument they want to trade.

Browse by category folders, which neatly organize available assets for easy exploration.

This dual navigation system combines speed with flexibility, ensuring traders can quickly access their preferred instruments while also discovering new opportunities. The intuitive design minimizes wasted time and enhances overall trading efficiency, making it especially valuable for active traders who need rapid access to the markets.

Placing orders

The BlackBull Markets MT4 mobile app offers a versatile suite of order placement options, catering to both casual traders and active professionals. Traders can select from:

Market Orders: Execute trades instantly at the current market price for immediate action.

Limit Orders: Enter positions at a pre-defined price, allowing precise control over trade entries.

Stop-Loss Orders: Manage risk by automatically closing positions at set levels to protect capital.

To accommodate different trading strategies, the platform also supports flexible order duration settings:

Good ‘til Canceled (GTC): Orders remain active until manually canceled, providing lasting trade opportunities.

Good ‘til Time (GTT): Orders automatically expire after a specified period, ensuring timely execution.

This combination of order types and time controls allows traders to implement strategies efficiently from their mobile devices, making the MT4 app a reliable tool for managing positions anytime, anywhere.

Alerts and notifications

Currently, the BlackBull Markets MT4 mobile app does not provide alerts or push notifications, a feature that remains available exclusively on the desktop platform. These notifications are crucial for staying informed about market movements and executing trades at optimal moments.

While mobile users can monitor positions and track market activity in real time, they miss the advantage of instant trade alerts. Incorporating alert functionality into the mobile app would significantly elevate its usability, allowing traders to respond promptly to market changes from anywhere.

MetaTrader 4: Key Takeaways

MT4 Desktop Platform

The MetaTrader 4 desktop platform offers fast, dependable order execution, making it a solid choice for traders who value efficiency and precision. Its interface, while functional, retains a traditional design that may feel less modern compared to newer trading platforms. Charting tools are reliable but somewhat rigid, which can limit flexibility for multi-timeframe analysis and complex technical studies. Despite these limitations, MT4 desktop remains a trusted environment for executing advanced trading strategies with confidence.

MT4 Mobile App

The MT4 mobile application provides traders with convenient, on-the-go access to their accounts. Users can quickly manage positions, adjust trade sizes, and execute market, limit, or stop orders from their smartphone or tablet. The app excels in speed and accessibility, making it especially useful during volatile market conditions. However, it is less equipped for in-depth technical analysis and extensive charting, tasks better handled on the desktop platform.

Overall, MT4 delivers a well-rounded trading experience across both desktop and mobile platforms. It balances speed, reliability, and convenience, allowing traders to manage positions efficiently while providing robust desktop tools for comprehensive analysis when needed.

cTrader

Pros:

- User-friendly

- Good search function

- Price alerts

Cons:

- No two-step (safer) login

cTrader is a cutting-edge trading platform crafted for day traders, scalpers, and algorithmic traders seeking a professional, high-performance trading environment. Designed to emulate institutional-level operations, cTrader equips forex traders with advanced tools and features that enhance precision, speed, and overall trading efficiency.

Key Features:

Depth of Market (DoM) with Level 2 Liquidity: Access real-time liquidity from multiple providers to gain deeper insight into market depth and price levels.

One-Click and Chart Trading: Execute trades instantly with single clicks or directly from interactive charts, maximizing speed and efficiency.

Price Alerts and Market Sentiment: Set custom price alerts and monitor aggregated market sentiment, showing the proportion of traders who are long or short across the platform.

Comprehensive Order Types: Utilize market, limit, stop loss, stop limit, and trailing stop orders, along with flexible time-in-force options such as Good ‘Til Canceled (GTC), to tailor trade management to your strategy.

Advanced Charting Tools: Analyze markets using 26 timeframes, four chart types, 76 technical indicators, and over 10 drawing tools available on the desktop platform.

Integrated News and Economic Calendar: Stay informed with real-time financial news and key economic events embedded directly within the platform.

Automated Trading and Backtesting: Develop, test, and deploy automated strategies using cBots, cTrader’s version of trading robots, offering functionality akin to MetaTrader’s Expert Advisors but within a modern, streamlined interface.

With its combination of institutional-grade functionality and user-friendly design, cTrader provides a powerful alternative for traders who demand advanced capabilities without sacrificing accessibility or ease of use.

TradingView

TradingView Intro

BlackBull Markets offers seamless integration with the TradingView platform, providing traders with high-definition charts and intuitive trading signals suitable for both beginners and seasoned professionals. Its advanced charting capabilities allow price action to be displayed clearly and scaled effortlessly across multiple timeframes, making technical analysis precise and efficient.

Traders gain access to over 150 analytical tools and fully customizable chart configurations, including trend lines, indicators, and sophisticated oscillators, ensuring every trading strategy can be executed with accuracy. Order placement is streamlined within the platform, allowing efficient trade execution without interrupting workflow.

Beyond technical tools, TradingView supports one of the largest global social trading communities, connecting traders worldwide to share insights, strategies, and market perspectives. This combination of advanced charting features and collaborative engagement makes TradingView an indispensable platform for traders seeking precision, insight, and a connected trading experience.

Pros:

- Powerful Charting Tools for Technical Analysis

- Built-in Social Trading Community

- Cloud-based Access Across All Devices

Cons:

- Full Features Require a Paid Subscription

Orders

BlackBull Markets integrates TradingView seamlessly into its platform, offering traders a sophisticated charting environment ideal for both beginners and seasoned professionals. Users can choose from a variety of chart types, including candlesticks, Heikin Ashi, Renko, and Kagi, across multiple timeframes. Multi-chart layouts enable side-by-side comparisons of different assets or periods, helping traders quickly identify trends and potential trading opportunities.

Technical Indicators for Smarter Trading

With over 100 built-in technical indicators, such as Moving Averages (MA), Relative Strength Index (RSI), MACD, Bollinger Bands, and candlestick pattern recognition, traders can analyze market trends, momentum, and possible entry or exit points with precision. These tools provide the insights needed to make data-driven decisions and optimize trading strategies.

Comprehensive Drawing Tools

BlackBull Markets provides a complete set of drawing tools to enhance technical analysis. Traders can use trend lines, Fibonacci retracements, support and resistance levels, and more to visually map out strategies and interpret market movements more effectively.

Custom Alerts and Notifications

Traders can configure custom alerts based on price levels, indicators, or market events. Notifications are delivered via pop-ups, audio signals, emails, SMS, and mobile push alerts, ensuring you never miss critical market changes, even while away from your desk.

Fundamental Analysis Integration

Beyond technical tools, BlackBull Markets supports fundamental research through TradingView. Access financial statements, valuation ratios, and historical company data to combine both technical and fundamental approaches for more informed trading decisions.

Extensive Market Coverage

The platform offers access to a wide range of markets, including forex, commodities, stocks, and cryptocurrencies, enabling traders to diversify portfolios and implement multi-asset strategies from a single, unified platform.

Pine Script for Custom Strategies

Advanced traders can leverage TradingView’s Pine Script™ to create personalized indicators, automated strategies, and alerts. BlackBull Markets fully supports these scripts, providing flexibility for algorithmic trading and tailored technical setups.

BlackBull Markets delivers a comprehensive charting and analysis solution, equipping traders with everything they need to trade confidently across multiple markets. From advanced charts and technical indicators to drawing tools, alerts, and custom scripts, the platform ensures you have professional-grade tools at your fingertips.

Social Community and Network

BlackBull Markets integrates TradingView’s social network, providing traders with access to a vibrant global community. This connection allows users to exchange ideas, discuss strategies, and collaborate with like-minded traders worldwide, fostering continuous learning and growth. At the heart of this community is the Trading Ideas hub, where traders can explore a wide range of strategies and analyses shared by others, comment on posts, and participate in discussions to refine their own trading approaches.

Users can follow experienced traders whose insights resonate with them, receiving updates whenever new content is posted and incorporating proven strategies into their routines. The platform also supports live video streams, offering immersive sessions where traders share real-time market analysis, strategies, and insights, with opportunities to ask questions and engage directly. Additionally, real-time chat and collaboration features enable users to join topic-specific rooms or create discussions, facilitating instant exchange of ideas and collaborative analysis.

Access to a global trading community through TradingView integration

Trading Ideas hub for exploring and sharing strategies

Ability to follow experienced traders and receive updates

Live video streams for interactive learning and real-time analysis

Real-time chat and collaboration for discussion and idea exchange

By combining BlackBull Markets’ robust trading infrastructure with TradingView’s social features, traders gain both advanced technical tools and a dynamic, interactive learning environment, empowering them to learn, connect, and trade more effectively.

TradingView Mobile App

Pros:

- Real-Time Alerts and Notifications

- Community Integration

- Comprehensive Charting on the Go

Cons:

- Smaller Screen Limitations

BlackBull Markets’ TradingView mobile app, available on both iOS and Android, provides traders with complete access to advanced charting, market insights, and trading tools directly from their smartphone or tablet. Designed for accuracy and efficiency, the app enables users to monitor price movements, analyze market trends, and manage positions from anywhere at any time.

The platform offers a wide selection of chart types, technical indicators, and drawing tools, along with the ability to set custom alerts based on price points, technical signals, or specific market events. Multi-chart layouts and interactive charting allow traders to track multiple assets or timeframes simultaneously, while push notifications, emails, and SMS updates ensure they remain informed of key market developments in real time.

Seamlessly connected to BlackBull Markets’ trading accounts, the TradingView mobile platform allows for order execution, position adjustments, and strategy implementation on the move. Combined with BlackBull Markets’ reliable execution and real-time market data, the app delivers a professional-grade mobile trading experience, making it an essential solution for both active and algorithmic traders seeking flexibility, precision, and efficiency in dynamic markets.

Look and Feel

BlackBull Markets offers a sleek and highly intuitive TradingView mobile app that blends modern design with advanced trading functionality. The platform’s clean and well-organized interface allows traders to effortlessly access interactive charts, technical indicators, and drawing tools while placing and managing trades directly from their mobile devices. Suitable for both beginners and experienced traders, the user-friendly layout ensures efficient navigation, seamless trade execution, and real-time market engagement, empowering users to stay in control of their strategies anytime, anywhere.

Login and security

BlackBull Markets’ TradingView mobile integration ensures secure access to trading accounts through standard email and password login. For enhanced protection, traders can activate two-factor authentication (2FA) via their TradingView credentials. Additionally, the app supports device-level biometric authentication on both iOS and Android, allowing users to log in quickly with fingerprint or facial recognition while maintaining robust account security.

Search functions

BlackBull Markets’ TradingView mobile app features a powerful search tool designed to help traders quickly locate instruments, assets, or market symbols. Users can enter the name or ticker of a specific asset directly into the search bar or explore organized categories such as forex, stocks, commodities, and cryptocurrencies. This intuitive search functionality ensures rapid and efficient navigation, allowing traders to access the markets they need seamlessly while managing trades on the go.

Placing orders

BlackBull Markets’ TradingView mobile platform provides traders with flexible order placement options tailored to diverse trading strategies. Users can place market orders for immediate execution, set limit orders to enter positions at specific price levels, and employ stop orders to manage risk and safeguard trades.

The app also supports configurable order durations:

Good ‘til Canceled (GTC): Orders remain active until the trader manually cancels them.

Good ‘til Time (GTT): Orders automatically expire after a predetermined time frame.

These features enable precise trade management, allowing traders to monitor markets, adjust positions, and execute strategies efficiently from their mobile devices.

Alerts and notifications

BlackBull Markets’ TradingView mobile platform offers robust alerts and notification features, empowering traders to stay informed and act quickly while on the move. Users can set customized alerts based on price levels, technical indicators, or specific market events, ensuring they never miss critical trading opportunities.

Notifications are delivered seamlessly through push notifications, in-app alerts, and email, providing real-time updates to help traders monitor positions, respond to market fluctuations, and execute strategies efficiently. This combination of timely alerts and flexible delivery options makes the mobile app an essential tool for both active day traders and those employing longer-term strategies.

TradingView: Key Takeaways

BlackBull Markets integrates TradingView across both desktop and mobile platforms, offering traders a versatile and seamless trading experience.

The desktop version provides advanced charting capabilities, an extensive library of technical indicators, and full access to social trading features. Traders can analyze multiple assets concurrently, perform detailed technical studies, and develop custom indicators or automated strategies using Pine Script™. This makes the desktop platform ideal for those requiring in-depth market analysis and precise strategy execution.

The mobile app brings nearly all desktop functionalities to iOS and Android devices, including real-time charts, technical indicators, customizable alerts, and community features. Traders can monitor markets, manage positions, and react to trading signals while on the go. Although highly functional, complex charting or advanced Pine Script development is generally more efficient on the desktop platform.

Together, TradingView’s desktop and mobile platforms deliver a comprehensive trading ecosystem, combining powerful analytical tools with flexible, real-time market access. This integration ensures BlackBull Markets clients can stay connected to the markets at all times while optimizing their trading strategies across devices.

BlackBull Markets Tradable Instruments

Tradable Instruments Intro

BlackBull Markets provides traders with access to a diverse range of over 26,000 tradable instruments across multiple asset classes. These include currency pairs, commodities, share CFDs, indices, cryptocurrencies, equities, ETFs, bonds, and options, with the majority of offerings available on the BlackBull Invest platform.

The broker has expanded its market selection significantly through BlackBull Shares, giving clients the ability to trade 2,500 symbols on MetaTrader 5 (716 for Prime accounts) and TradingView, alongside 311 symbols on MetaTrader 4. Cryptocurrency trading is available via CFDs, although direct ownership of underlying assets, such as Bitcoin, is not supported. Note that crypto CFDs are restricted for retail traders in the U.K. and unavailable to U.K. residents.

While BlackBull Markets is primarily recognized as a forex broker, it also offers an extensive selection of CFDs. Its stock index CFD offerings are particularly competitive compared to other brokers, whereas its forex and commodity CFD selections remain strong and in line with industry standards.

This broad and flexible range of markets ensures that both beginner and advanced traders can diversify portfolios and implement multi-asset trading strategies from a single platform.

| Markets | Types | Industry Average | Number |

|---|---|---|---|

| Indices | US, EU, Asia, Other | 5 – 10 | 11 |

| Shares, Options, ETFs, and Bonds* | Retail, Finance, Tech, Other | 100 – 500 | 26,000+ |

| Cryptocurrencies | Major and Minor | 10 – 20 | 17 |

| Forex Pairs | Major, Minor, and Exotic | 30 – 75 | 58 |

| Commodities | Metals, Energies, and Futures | 5 – 10 | 13 |

What are CFDs ?

Contracts for Difference (CFDs) are a type of financial derivative that allows traders to speculate on the price movements of an underlying asset without actually owning it. This means you can gain exposure to markets such as stocks, indices, commodities, or currencies without physically holding them.

For instance, if you take a long position on gold via a CFD, you stand to profit when gold prices rise and incur losses if they fall – all without the need to purchase physical gold bars. This flexibility makes CFDs an efficient tool for traders seeking to respond quickly to market changes.

One of the key benefits of CFD trading with BlackBull Markets is the ability to enter and exit positions almost instantly. This rapid execution enables traders to capitalize on even small fluctuations in market prices, providing opportunities for both short-term strategies and longer-term planning.

CFDs also offer the advantage of leveraging your capital, meaning you can control larger positions with a smaller initial investment. However, it’s important to understand that leverage can amplify both gains and losses, so risk management is essential.

By combining accessibility, speed, and flexibility, CFDs have become a popular instrument for traders who want to diversify their portfolio and react quickly to evolving market conditions.

Social Trading

BlackBull Markets provides clients with access to social trading through leading platforms, allowing both novice and experienced traders to mirror strategies and optimize their trading performance.

- ZuluTrade: ZuluTrade is a peer-to-peer social trading network where traders can replicate the strategies of thousands of registered currency traders across 192 countries. BlackBull Markets clients benefit from ZuluTrade’s proprietary performance evaluation metrics, as well as insights from an active trading community. This allows users to tailor trades based on personal risk preferences, investment goals, and market conditions, offering a highly customizable trading experience.

- Myfxbook: Myfxbook is a comprehensive social trading platform that enables users to share, analyze, and track trading activities while comparing performance with other traders. The platform supports automated trading, allowing BlackBull Markets clients to follow selected traders seamlessly. Integration with MetaTrader 4 ensures a smooth connection: users simply create a Myfxbook account and link it to their BlackBull Markets account to begin mirroring trades effectively.

By leveraging these social trading tools, BlackBull Markets empowers clients to learn from top-performing traders, enhance their trading strategies, and gain real-time insights from global trading communities.

BlackBull Markets Instruments: Key Takeaways

BlackBull Markets provides a broad and versatile range of tradable instruments, catering to traders with varying risk appetites and investment goals. The offering spans lower-risk options, such as ETFs and bonds, which can help mitigate market exposure, to higher-risk, higher-reward assets like cryptocurrencies.

For those seeking complete access to BlackBull Markets’ full suite of tradable instruments, the flagship BlackBull Invest platform is the recommended gateway. This platform allows traders to seamlessly navigate and execute trades across all available markets, ensuring flexibility and control over their portfolios.

By offering a mix of conservative and speculative instruments, BlackBull Markets empowers clients to diversify their trading strategies while managing risk effectively.

| Tradable Instruments Summary | BlackBull Markets |

|---|---|

| Tradeable Symbols (Total) | 26000+ |

| Forex Pairs (Total) | 58 |

| Cryptocurrency (Derivative) | Yes |

| Forex Trading (Spot or CFDs) | Yes |

| Social Trading / Copy Trading | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Cryptocurrency (Physical) | No |

| U.S. Stock Trading (Non CFD) | Yes |

BlackBull Markets Leverage

What is CFD Leverage?

CFD leverage allows traders to control larger market positions while committing only a fraction of the total trade value. When using leverage, the broker effectively lends capital to the trader, enabling them to open bigger positions than their account balance would normally allow. This amplification can significantly increase potential profits from successful trades, but it also proportionally raises the risk of losses if trades move against the trader. Understanding and managing leverage is essential for effective risk management and maximizing trading opportunities when dealing with Contracts for Difference (CFDs).

BlackBull Markets Maximum Leverage By Asset Class

BlackBull Markets offers varying maximum retail leverage depending on the asset class, allowing traders to tailor their exposure according to market type and risk appetite. The leverage limits are set to provide sufficient trading flexibility while maintaining prudent risk management. The table below summarizes the maximum leverage available for each category of instruments, giving traders a clear overview of the potential amplification for forex, commodities, indices, cryptocurrencies, and other tradable assets.

| Asset Class | Maximum Leverage |

|---|---|

| Indices | 1:100 |

| Metals | 1:500 |

| Currency Pairs | 1:500 |

| Futures | 1:2 |

| Shares CFDs | 1:5 |

| Cryptocurrencies | 1:100 |

| Energies | 1:100 |

Account Opening with BlackBull Markets

Pros:

- Fast

- User-friendly

- Fully digital

Cons:

- High minimum deposit for Prime Account

BlackBull Markets Account Opening Process

Opening an account with BlackBull Markets is simple and secure. Follow these numbered steps to get started:

Click the ‘Join Now’ button at the top-right corner of the homepage.

Register your email address.

Enter your full name, date of birth, phone number, and country of residence.

Create a secure password and choose between a live or demo account.

Agree to BlackBull Markets’ Terms and Conditions.

Fill in the remaining personal details requested.

Select your account type, base currency, leverage, and preferred trading platform.

Provide information about your employment history.

Upload official documents to verify your identity and address.

Following these steps ensures a smooth account setup, giving you access to all of BlackBull Markets’ trading tools and features.

What is the minimum deposit at BlackBull Markets?

BlackBull Markets offers flexible account funding options to accommodate different trading needs. The minimum deposit for a Standard account is $0, allowing new traders to start without any upfront investment. For those opting for a Prime account, the minimum deposit requirement is $2,000, providing access to enhanced features and trading conditions.

| Account Type | ECN Standard | ECN Prime | ECN Institutional |

|---|---|---|---|

| Minimum Deposit Requirement | $0 | $2,000 | $20,000 |

| Commission | $0 | $6 | $4 |

| Spread From | 0.8 pips | 0.1 pips | 0.0 pips |

| Minimum Trade Volume | 0.01 lot | 0.01 lot | 0.01 lot |

| Margin Call | 70% | 70% | 70% |

| Stop Out | 50% | 50% | 50% |

| Swap Free Account | Yes | Yes | No |

| Standard Contract Size | 100,000 units | 100,000 units | 100,000 units |

| Demo Account | Yes | Yes | No |

BlackBull Markets Account Types

BlackBull Markets offers a range of ECN account types tailored to different trading needs and experience levels. The ECN Standard account is ideal for casual traders due to its low minimum deposit, while the ECN Prime account provides a balanced option with competitive fees and features. For professional traders, the ECN Institutional account delivers the most cost-effective trading conditions.

To safeguard traders against extreme market volatility, BlackBull Markets enforces a 70% margin call and a 50% stop-out level, reducing the risk of full account depletion.

The broker also provides swap-free or Islamic accounts in full compliance with Sharia Law, available as variants of Standard, Prime, and Institutional accounts.

Account ownership options include individual accounts for single traders, joint accounts for multiple co-owners, and company accounts for legal entities, offering flexibility to meet diverse trading requirements.

BlackBull Markets Demo Account