CMC Markets Review 2025- Words and Table Done

CMC Markets Review 2025- Words and Table Done

Overall Rating

Min. Deposit

Spreads From

Max. Leverage

CMC Markets Overview

CMC Markets is a UK-based CFD and Spread Betting broker established in 1989 and publicly listed on the London Stock Exchange under the ticker symbol CMCX. It operates under the supervision of multiple top-tier regulators, including the FCA, ASIC, and IIROC, ensuring a secure and compliant trading environment.

The broker is distinguished by its Next Generation trading platform, which combines an intuitive interface with advanced tools for both beginner and professional traders. CMC Markets provides access to nearly 12,000 tradable instruments, spanning forex, indices, commodities, shares, and cryptocurrencies, while offering highly competitive spreads and low-cost trading.

In addition to its robust trading infrastructure, CMC Markets delivers premium research and educational resources, helping traders refine their strategies and make informed decisions.

Overall, CMC Markets is a versatile broker suitable for a wide range of trading styles and experience levels, offering a reliable, award-winning platform with a wealth of tools, instruments, and educational support for global traders.

CMC Markets Pros and Cons

CMC Markets Pros:

- Next Gen platform is packed with tools, charts, and news

- Cutting-edge platform

- Great web and mobile platforms

- Nearly 12,000 instruments and 300+ forex pairs available

- Strong research resources

- Low forex fees

- Industry-best pricing with low spreads and active trader perks

- Advanced research and educational tools

- Competitive spreads and fees

- Spread betting

- Outstanding range of tradable instruments

- Multiple regulated globally

CMC Markets Cons:

- No cryptocurrencies

- High stock CFD fees

- Only CFDs are available

- MetaTrader 4 offering has fewer symbols and limited product depth

- Inactivity fee of £10 a month (no deductions are made if there are no funds in the account)

- No Islamic account

- Education lacks progress tracking or interactive features

Beginner – Perfect Match

CMC Markets offers a low barrier to entry with no minimum deposit requirement, making it accessible for casual traders. Accounts benefit from raw spreads starting at 0.5 pips and commission-free trading on most instruments (excluding share CFDs). Combined with extensive educational content and responsive customer support, this makes it an excellent platform for casual trading.

News Trading – Perfect Match

The broker delivers competitive fees and detailed market research, minimizing slippage risks for news-driven trading. Integrating third-party research could further enrich its news-trading capabilities.

Scalping – Acceptable Choice

CMC Markets supports scalping strategies with fast order execution and effective order fills. Advanced charting tools enhance the scalping experience, though the absence of VPS hosting limits ultra-low latency trading.

Investing – Perfect Match

Investors can access a wide array of instruments for portfolio diversification and long-term revenue generation. The platform also provides comprehensive market overviews to help identify promising investment opportunities.

Automated Trading – Acceptable Choice

Automated strategies can be executed efficiently on CMC Markets’ platform with a wide variety of instruments. The lack of VPS hosting, however, may prevent traders from achieving the lowest possible latency and sub-3 millisecond execution speeds.

Swing Trading – Acceptable Choice

Swing traders can leverage CMC Markets’ intuitive proprietary platform, broad selection of instruments across multiple markets, and competitive fees. Traders should note that overnight financing costs can be higher than some competitors.

Day Trading – Perfect Match

Day traders benefit from low trading costs, detailed research materials, and the Next Generation platform’s advanced features, enabling comprehensive technical analysis and rapid order execution.

Who is CMC Markets for?

When evaluating CMC Markets, it’s clear that the broker offers the features and tools to cater to a wide range of trading strategies. Here’s how it stacks up for different trader styles:

What Sets CMC Markets Apart?

The broker’s proprietary Next Generation platform is highly intuitive, fully customizable, and equipped with advanced features such as a sophisticated order panel, multiple charting tools, and real-time market news. Both web and mobile platforms are designed for seamless trading, enabling traders to execute strategies efficiently across different devices.

CMC Markets also offers comprehensive research and educational resources, including in-depth market analysis, tutorials, and trading guides, helping traders develop their skills and make informed decisions. Deposit and withdrawal processes are free of charge, further enhancing the user experience.

On the other hand, some limitations exist. Stock CFD fees are relatively high, and the product range is limited to CFDs, covering forex, indices, commodities, shares, ETFs, bonds, and crypto for non-UK clients. Customer support is reliable but available only during standard business hours, Monday through Friday.

Overall, CMC Markets distinguishes itself through a combination of advanced trading tools, low-cost account structures, and robust educational and research offerings, making it a strong contender for traders seeking a professional yet accessible trading environment.

What Sets CMC Markets Apart?

CMC Markets, a UK-based CFD and forex broker listed on the London Stock Exchange, has built a strong reputation for combining professional-grade trading tools with accessible account options. Traders benefit from accounts with no minimum deposit, very competitive spreads, and commission-free trading on most instruments, creating an attractive entry point for both beginners and experienced investors.

CMC Markets Main Features

Regulations

DFSA (United Arab Emirates), FMA (New Zealand), FCA (United Kingdom), ASIC (Australia), BaFin (Germany), MAS (Singapore), IIROC (Canada)

Languages

English, Danish, French, Portuguese, Czech, Arabic, Italian, Spanish, Chinese, Finnish, Japanese, German, Norwegian

Products

Currencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$0

Max Leverage

1:30 (DFSA), 1:500 (FMA), 1:30 (FCA), 1:30 (ASIC), 1:30 (BaFin), 1:20 (MAS), 1:45 (IIROC)

Trading Desk Type

Dealing Desk, Market Maker

Trading Platforms

CMC Mobile App, CMC Web Platform, MT4

Deposit Options

PayPal, Wire Transfer, Credit Card, Debit Card

Withdrawal Options

Wire Transfer, Credit Card, PayPal, Debit Card

Demo Account

Yes

Foundation Year

1989

Headquarters

United Kingdom

Regulations

DFSA (United Arab Emirates), FMA (New Zealand), FCA (United Kingdom), ASIC (Australia), BaFin (Germany), MAS (Singapore), IIROC (Canada)

Languages

English, Danish, French, Portuguese, Czech, Arabic, Italian, Spanish, Chinese, Finnish, Japanese, German, Norwegian

Products

Currencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$0

Max Leverage

1:30 (DFSA), 1:500 (FMA), 1:30 (FCA), 1:30 (ASIC), 1:30 (BaFin), 1:20 (MAS), 1:45 (IIROC)

Trading Desk Type

Dealing Desk, Market Maker

Trading Platforms

CMC Mobile App, CMC Web Platform, MT4

Deposit Options

PayPal, Wire Transfer, Credit Card, Debit Card

Withdrawal Options

Wire Transfer, Credit Card, PayPal, Debit Card

Demo Account

Yes

Foundation Year

1989

Headquarters

United Kingdom

Start Trading With CMC Markets

| Account Type | Standard | FX Active | Spread Betting |

|---|---|---|---|

| Minimum Deposit Requirement | $0 | $0 | $0 |

| Base Currencies | GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD | GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD | GBP, EUR |

| Netting | Yes | Yes | Yes |

| Spread From | 0.6 pips | 0.0 pips | 0.0 pips |

| Demo Account | Yes | Yes | Yes |

| Commission | $0 | $2.50 per side | $0 |

| Hedging | Yes | Yes | No |

CMC Markets Full Review

CMC Markets Safety

Safety Intro

CMC Markets is a highly regulated and trustworthy broker. The company holds multiple Tier-1 and Tier-2 licenses across leading financial jurisdictions, including authorization from the UK’s Financial Conduct Authority (FCA) – one of the strictest regulators worldwide.

As a publicly listed firm on the London Stock Exchange and a member of the FTSE 250 Index, CMC Markets offers a level of transparency and accountability that many brokers cannot match. This status means the broker must meet rigorous financial reporting standards, giving traders added peace of mind about security and compliance.

CMC Markets also follows a strict “best execution policy,” ensuring clients consistently receive competitive and fair pricing across their trades. Combined with its long-standing global presence, diverse regulatory approvals, and strong financial oversight, this makes CMC Markets a safe and reliable choice for both beginners and experienced traders.

Pros:

- Listed on stock exchange

- Negative balance protection

- Majority of clients belong to a top-tier financial authority

Cons:

- Does not hold a banking license

IC Markets Regulation

Regulation is one of the most important factors when choosing a broker, as it determines the level of client protection and operational trustworthiness. CMC Markets operates under multiple entities worldwide, each overseen by respected financial regulators. These regulators are often categorized into three tiers, with Tier 1 considered the highest level of trust and investor protection.

Here’s a breakdown of CMC Markets’ regulatory framework:

United Kingdom: CMC Markets UK PLC is authorised and regulated by the Financial Conduct Authority (FCA) under firm reference number 173730. The FCA is a Tier 1 regulator, widely recognized for its strict oversight and robust investor safeguards.

Australia: CMC Markets Asia Pacific Pty Ltd. is regulated by the Australian Securities and Investments Commission (ASIC), ACN 100 058 213. ASIC is also regarded as a Tier 1 regulator, ensuring high levels of compliance and transparency.

Canada: CMC Markets Canada Inc. is licensed by the Investment Industry Regulatory Organization of Canada (IIROC), rated as a Tier 2 regulator.

Germany: CMC Markets Germany GmbH operates under the supervision of BaFin (Federal Financial Supervisory Authority), ID number 10154814. BaFin is recognized as a Tier 2 regulator.

Singapore: CMC Markets Singapore Pte. Ltd. is authorised by the Monetary Authority of Singapore (MAS), another Tier 2 regulator.

Middle East: CMC Markets Middle East Ltd. is regulated by the Dubai Financial Services Authority (DFSA), reference number F002740, classified as a Tier 2 regulator.

New Zealand: CMC Markets NZ Ltd. is authorised by the Financial Markets Authority (FMA) under reference number FSP41187, also a Tier 2 regulator.

With top-tier licenses from both the FCA and ASIC, CMC Markets demonstrates strong credibility and adherence to the highest regulatory standards. This multi-jurisdictional oversight provides traders with peace of mind, knowing their funds and trading activities are safeguarded by globally respected financial authorities.

| Entity | CMC Markets Middle East Ltd. | CMC Markets Singapore Pte. Ltd. | CMC Markets Asia Pacific Pty Ltd. | CMC Markets Germany GmbH | CMC Markets UK plc | CMC Markets NZ Ltd. | CMC Markets Canada Inc. |

|---|---|---|---|---|---|---|---|

| Country/Region | Dubai | Singapore | Australia | Germany | UK | New Zealand | Canada |

| Regulation | DFSA | MAS | ASIC | BaFin | FCA | FMA | IIROC |

| Tier | 2 | 2 | 1 | 1 | 1 | 1 | 1 |

| Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Compensation Scheme | No | No | No | Yes | Yes | No | Yes |

| Standard Leverage | 1:30 | 1:20 | 1:500 | 1:30 | 1:30 | 1:500 | 1:30 |

Understanding the Regulatory Protections of Your Account

When choosing a broker, regulatory oversight and client protection measures are just as important as trading costs or platform features. Brokers often operate through multiple entities worldwide, but not every license offers the same level of security. Some regulators enforce strict compliance with global financial standards, while others follow lighter frameworks. This makes it essential for traders to understand the protections available under the specific entity where they open an account.

Here are the core safety mechanisms CMC Markets provides across its regulated entities:

Segregated Client Funds: All client funds are kept in segregated bank accounts, completely separate from the broker’s corporate capital. This prevents accounting risks and ensures your deposits remain protected, even if the company faces operational issues.

Negative Balance Protection: With CMC Markets, retail traders cannot lose more than the funds they deposit. Losses are capped at your account balance, removing the risk of owing additional money to the broker if markets move sharply against your positions.

Compensation Schemes: Certain entities of CMC Markets offer an additional layer of protection through investor compensation programs. For example, clients of CMC Markets UK PLC benefit from coverage of up to £85,000 under the Financial Services Compensation Scheme (FSCS) in the event of insolvency. Two additional CMC Markets entities also provide access to similar protections, depending on local regulations.

Leverage Limits: To reduce risk exposure for retail clients, leverage levels are capped by regulation. For instance, CMC Markets UK PLC sets a maximum leverage of 1:30, in line with FCA rules. This helps traders manage potential losses while still accessing meaningful market opportunities.

With these safeguards in place, CMC Markets demonstrates a strong commitment to client security and transparent operations. Combined with its top-tier regulation, these mechanisms make it a trusted choice for traders worldwide.

How you are protected

Investor protection depends on your country of residence, the regulatory framework overseeing your account, and the legal entity providing the service.

At TradeWiki.io, we make it easy to understand how protection works so you can trade with confidence:

Regulatory Oversight – Your trading account is supervised by top-tier regulators in the jurisdiction you reside in, ensuring compliance with strict financial standards.

Segregated Funds – Client funds are kept separate from company operating accounts, which means your capital is safeguarded even if the broker faces financial issues.

Compensation Schemes – Depending on your location, you may be eligible for investor protection programs. These schemes can cover specific amounts if the broker becomes insolvent, giving you an additional layer of security.

Entity Assignment – The specific legal entity that serves you may vary by region. This ensures that your account falls under the appropriate regulatory and legal framework for maximum transparency and protection.

Ultimately, the level of protection you receive is determined by where you live. That’s why we always recommend checking your account agreement and confirming which regulator and investor compensation scheme applies to you before you start trading.

| Country of clients | Legal entity | Regulator | Protection amount |

|---|---|---|---|

| UK and countries except below | CMC Markets UK plc, CMC Spreadbet plc (for spread betting accounts, available in the UK) | Financial Conduct Authority | £85,000 |

| EU | CMC Markets Germany GmbH | Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) | €20,000 |

| Canada | CMC Markets Canada Inc. | Canadian Investment Regulatory Organization (CIRO) | CAD 1,000,000 |

| Australia | CMC Markets Asia Pacific Pty Ltd | Australian Securities and Investments Commission | No protection |

| New Zealand | CMC Markets NZ Limited Company | Financial Markets Authority | No protection |

| Singapore | CMC Markets Singapore Pte Ltd | Monetary Authority of Singapore | No protection |

| Middle-East | CMC Markets Middle East Limited | Dubai Financial Services Authority | No protection |

Stability and Transparency

When assessing broker trustworthiness, key factors include company stability, operational history, size, and transparency of information.

Founded in 1989, CMC Markets is one of the longest-standing forex and CFD brokers globally, boasting a strong track record of over three decades. Headquartered in the City of London, it maintains additional offices in Sydney, Singapore, Toronto, and across Europe, employing between 501 and 1,000 staff according to LinkedIn data.

As a publicly listed company on the London Stock Exchange (UK:CMCX) and a member of the FTSE 250 Index since 2020, CMC Markets is required to publish detailed financial reports, offering clients insight into the broker’s long-term stability and corporate governance.

Transparency is a core strength. The broker clearly displays regulatory information for each subsidiary, making it easy for traders to confirm oversight and protections. The Trading Costs page details all fees, including spreads and overnight charges, while the CFD Legal Documents section provides access to comprehensive User Agreements and Terms of Business.

By combining a substantial operational history, public listing accountability, and clear disclosure of trading costs and regulatory status, CMC Markets demonstrates a high degree of stability and transparency that reassures both new and experienced traders.

Is CMC Markets safe?

Yes. CMC Markets is widely recognized as a highly secure and trustworthy broker, making it a reliable choice for traders of all experience levels. Its safety and credibility are anchored in several key factors:

Regulated by Top-Tier Authorities: CMC Markets holds licenses from five Tier-1 regulators, including the Australian Securities & Investment Commission (ASIC), the Canadian Investment Regulatory Organization (CIRO), the Monetary Authority of Singapore (MAS), the Financial Markets Authority (FMA), and the UK’s Financial Conduct Authority (FCA). This global oversight ensures strict adherence to financial standards and client protection protocols.

Best Execution Policy: The broker follows a robust ‘best execution policy,’ ensuring that trades are executed at optimal prices, minimizing slippage and protecting client interests.

Transparent Legal Framework: Comprehensive legal documents, including terms of business and user agreements, are easily accessible, providing clarity on trading rules, fees, and risk management policies.

Publicly Listed and Highly Trusted: As a publicly traded company, CMC Markets must disclose financial information regularly, adding another layer of accountability. It has earned a near-perfect Trust Score of 99/99, with no Tier-3 or Tier-4 regulatory risks, reinforcing its status as a highly reliable trading platform.

With these safeguards, CMC Markets offers a secure trading environment that prioritizes client protection and operational transparency, giving traders confidence when engaging in forex, CFD, and spread betting markets.

| Safety Summary | CMC Markets |

|---|---|

| Year Founded | 1989 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 5 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

CMC Markets Fees

Fees Intro

CMC Markets is renowned for offering some of the most competitive spreads and transparent pricing structures in the forex and CFD industry, making it a top choice for both casual and professional traders.

Tight Spreads on Major Pairs: Average spreads are highly competitive, with typical EUR/USD spreads around 0.61 pips (August 2023 data). Forex fees remain low, and there are no charges for deposits or withdrawals, ensuring cost-effective trading.

Commission-Free Trading: Standard accounts allow commission-free trading across most instruments, with the exception of share CFDs. For traders preferring commission-based pricing, CMC Markets’ FX Active structure charges $2.50 per side with minimum spreads of zero pips, resulting in an all-in cost as low as 0.5 pips on EUR/USD and select currency pairs.

Active Trader Discounts: The Price Plus Scheme rewards high-volume traders with tiered discounts on spreads. Trading Points, earned based on monthly trading volume, allow active traders to unlock up to 20% savings at Tier 4, helping reduce overall trading costs.

Alpha Rebate Program: Available in the U.K., New Zealand, Canada, and Australia, Alpha offers premium reports, market data, and tiered discounts on share CFD spreads. Depending on trading activity, discounts can reach up to 20%, with three tiers – Classic, Active Investor, and Premium Trader – each tailored to trading frequency and commission levels.

Guaranteed Stop-Loss Orders (GSLOs): For enhanced risk management, CMC Markets supports GSLOs, which guarantee your stop-loss price. While there is a premium for using GSLOs, any unused cost is refunded automatically, offering transparent protection against adverse price movements.

CFD Fees: While forex costs remain low, CFD trading can be more expensive. Overnight financing fees are standard across the industry and clearly disclosed, with no hidden charges to surprise traders.

With these flexible pricing options, robust discount programs, and transparent cost structures, CMC Markets positions itself as a leading broker for traders seeking low-cost, high-quality execution and comprehensive trading tools.

Pros:

- Low forex fees

- No withdrawal fee

Cons:

- High CFD fees

IC Markets Spreads

Forex Spreads

| Symbol | Product | Min Spread |

|---|---|---|

| USD/SGD | US Dollar vs Singapore Dollar | 1.50 |

| AUD/USD | Australian Dollar vs US Dollar | 0.6 |

| EUR/GBP | Euro vs British Pound | 0.7 |

| EUR/USD | Euro vs US Dollar | 0.5 |

| GBP/USD | British Pound vs US Dollar | 0.9 |

| USD/JPY | US Dollar vs Japanese Yen | 0.7 |

| USD/CAD | US Dollar vs Canadian Dollar | 1.3 |

| GBP/JPY | British Pound vs Japanese Yen | 1.70 |

| AUD/GBP | Australian Dollar vs British Pound | 0.60 |

| AUD/JPY | Australian Dollar vs Japanese Yen | 1.1 |

| EUR/AUD | Euro vs Australian Dollar | 2.1 |

| AUD/NZD | Australian Dollar vs New Zealand Dollar | 2.9 |

| EUR/NZD | Euro vs New Zealand Dollar | 5.3 |

| GBP/CHF | British Pound vs Swiss Franc | 2.2 |

| CHF/JPY | Swiss Franc vs Japanese Yen | 3 |

| USD/RUB | US Dollar vs Russian Ruble | 101.70 |

| USD/CZK | US Dollar vs Czech Koruna | 3 |

| USD/CNH | US Dollar vs Chinese Yuan | 2 |

| EUR/TRY | Euro vs Turkish Lira | 75 |

| USD/HUF | US Dollar vs Hungarian Forint | 7 |

| USD/MXN | US Dollar vs Mexican Peso | 50 |

| USD/NOK | US Dollar vs Norwegian Krone | 20 |

Metal Spreads

| Symbol | Product | Min Spread |

|---|---|---|

| Gold | Gold vs US Dollar | 0.20 |

| Silver | Silver vs US Dollar | 2.5 |

| Palladium | Palladium vs US Dollar | 10 |

| Platinum | Platinum vs US Dollar | 10 |

| Copper | Copper vs US Dollar | 2 |

Indices Spreads

| Symbol | Product | Min Spread |

|---|---|---|

| UK 100 | UK 100 Index vs GBP | 1 |

| Germany 40 | Germany 40 Index vs EUR | 1.2 |

| France 40 | France 40 Index vs EUR | 1 |

| Netherlands 25 | Netherlands 25 Index vs EUR | 2.5 |

| Euro 50 | Euro 50 Index vs EUR | 1.6 |

| Spain 35 | Spain 35 Index vs EUR | 5 |

| Sweden 30 | Sweden 30 Index vs EUR | 5 |

| US 30 | US 30 Index vs USD | 2.20 |

| US SPX 500 | US SPX 500 Index vs USD | 0.1 |

| US NDAQ 100 | US Nasdaq 100 Index vs USD | 1 |

| Canada 60 | Canada 60 Index vs CAD | 8 |

| US Small Cap 2000 | US Small Cap 2000 Index vs USD | 3 |

| Australia 200 | Australia 200 Index vs AUD | 1 |

| Hong Kong 50 | Hong Kong 50 Index vs HKD | 5 |

| Japan 225 | Japan 225 Index vs JPY | 7 |

| Hong Kong China H-shares | Hong Kong China H-shares Index vs HKD | 12 |

| South Africa 40 | South Africa 40 Index vs ZAR | 10 |

CFD Commodities Spreads

| Symbol | Product | Min Spread |

|---|---|---|

| Crude Oil West Texas | Crude Oil WTI vs USD | 2.50 |

| Crude Oil Brent | Crude Oil Brent vs USD | 2.5 |

| Natural Gas | Natural Gas vs USD | 0.3 |

| Gasoline | Gasoline vs USD | 2.5 |

| Heating Oil | Heating Oil vs USD | 2.8 |

| Coffee Arabica | Coffee Arabica vs USD | 3 |

| Lean Hogs | Lean Hogs vs USD | 10 |

| Live Cattle | Live Cattle vs USD | 9 |

| Sugar Raw | Sugar Raw vs USD | 4 |

| Wheat | Wheat vs USD | 0.8 |

Bonds Spreads

| Symbol | Product | Min Spread |

|---|---|---|

| US T-Note 10 YR | US 10-Year Treasury Note | 4 |

| US T-Bond | US Treasury Bond | 4 |

| US T-Note 5 YR | US 5-Year Treasury Note | 2 |

| US T-Note 2 YR | US 2-Year Treasury Note | 2 |

| UK Gilt | UK Government Bond | 3.50 |

| Euro Bund | German Bund | 2.8 |

| Euro Buxl | German Buxl | 4 |

| Euro Schatz | German Schatz | 1.3 |

| Euro Bobl | German Bobl | 2.8 |

CMC Markets Swap Fees

In forex and CFD trading, holding positions overnight incurs a cost known as a swap fee, which reflects interest rate differentials between the two currencies in a pair.

Swap Long: This is the charge or credit applied for keeping a buy position open overnight. Depending on the currency pair and prevailing interest rates, traders may either pay a small fee or receive a credit.

Swap Short: Conversely, this applies to sell positions held overnight. Similar to swap long, it can result in either a cost or a credit, depending on market conditions.

CMC Markets provides clear information on all swap rates, allowing traders to manage overnight positions effectively and make informed decisions about holding trades beyond a single trading day. The transparency of these fees ensures that there are no hidden costs and supports strategic planning for both short-term and long-term trading strategies.

| Instrument | Swap Short | Swap Long |

|---|---|---|

| GBP/JPY | Credit of $11.3 | Credit of $17.4 |

| EUR/USD | Charge of $74.5 | Charge of $15.6 |

CMC Markets Non-Trading Fees

IC Markets offers a transparent, low-cost structure for all traders by eliminating common non-trading charges. The broker does not apply any fees for deposits, withdrawals, or account maintenance, allowing traders to move funds freely without hidden costs. Standard third-party processing fees may still apply depending on your chosen payment method, such as credit/debit cards, electronic wallets, or international bank transfers.

Additionally, IC Markets imposes no inactivity fees, ensuring that accounts can remain dormant without penalty. This approach makes the broker ideal for both casual traders and investors who value flexibility, cost efficiency, and full control over their funds. By minimizing non-trading expenses, IC Markets strengthens its reputation as a trusted, low-fee forex and CFD broker.

Are CMC Markets Fees Competitive?

CMC Markets maintains a cost-effective structure for non-trading activities. Deposits and withdrawals are entirely free of handling fees, ensuring clients can move funds without extra charges. The only exception is an inactivity fee of £10 per month, applied to accounts that remain dormant for 12 months or longer, provided the account holds a balance. This transparent and minimal fee structure supports traders who value low-cost account management and straightforward financial terms.

| Fees Summary | CMC Markets |

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 1.3 |

| All-in Cost EUR/USD - Active | 0.65 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | No |

| Visa/Mastercard (Credit/Debit) | Yes |

| PayPal (Deposit/Withdraw) | Yes |

CMC Markets Deposit and Withdrawals

Deposit and Withdrawal Intro

CMC Markets provides a versatile and cost-free approach to funding your trading account. Traders can choose from multiple deposit and withdrawal methods and select from various CFD account base currencies. All transactions, whether depositing or withdrawing, are processed without any fees, ensuring a seamless and economical experience for managing your trading funds.

Pros:

- Credit/Debit card available

- No deposit fee

- Free withdrawal

Cons:

- None

CMC Markets Account Base Currencies

At CMC Markets, you can choose from the following base currencies:

| NZD | CAD | EUR | SEK |

| USD | PLN | GBP | AUS |

| SGD | NOK |

When opening a CFD account with CMC Markets, traders can select from a range of base currencies, though availability may vary by region. Most clients typically have access to two or three major currencies, such as EUR and USD, along with their local currency if it is included among the ten options. For spread betting accounts, only British pounds and euros are supported.

Choosing the right base currency is important for two key reasons. First, funding your account in the same currency as your bank account can help you avoid unnecessary conversion fees. Second, trading assets in the same currency as your account base currency ensures that profits and losses are not reduced by exchange rate costs.

To maximize savings on currency conversions, many traders open multi-currency accounts with digital banks. These accounts provide access to multiple currencies, competitive exchange rates, and low-cost or free international transfers. Setting up a multi-currency bank account is typically quick and can be completed directly from your smartphone, making it a convenient way to optimize trading efficiency.

CMC Markets Deposit Fees and Options

CMC Markets allows traders to deposit funds without incurring any fees, making account funding straightforward and cost-effective. You can fund your account via bank transfer or credit/debit card, with card payments processed instantly, while bank transfers may take several business days to clear.

For security and compliance, deposits must originate from accounts registered in your name. This ensures that your funds are protected and aligns with regulatory requirements. With multiple convenient deposit options and no added costs, CMC Markets makes it simple for traders to get started efficiently.

CMC Markets Withdrawal Fees and Options

CMC Markets provides a cost-effective and flexible withdrawal process, charging no standard fees for accessing your funds. Traders can withdraw using the same methods available for deposits, including bank transfers and credit/debit cards, ensuring convenience and consistency.

International withdrawals may incur a currency conversion fee if your bank account’s currency differs from your CMC Markets account base currency – for example, transferring funds from a GBP account to a EUR account. Certain account types, such as spread betting accounts, have specific restrictions, like being unable to withdraw to MasterCard credit or debit cards.

For security and regulatory compliance, withdrawals must be sent exclusively to accounts registered in your name. This approach safeguards your funds while providing a straightforward, transparent withdrawal experience.

How long does CMC Markets withdrawal take?

Withdrawals from CMC Markets are typically processed quickly, with most transactions completed within 1–2 business days. In practice, funds often reach your account in just one business day, making it one of the faster options in the brokerage industry.

When planning a withdrawal, it’s important to remember that only uninvested cash in your account can be withdrawn. If your funds are tied up in open positions, you’ll need to close some or all of them first to free up the necessary cash. Asset liquidation, such as selling stocks or other investments, can add additional processing time, usually one to two days for settlement before the proceeds are available for withdrawal.

To ensure timely access to funds, it’s wise to plan ahead. For example, if you anticipate needing $1,000 on a Monday, consider selling enough assets several days in advance. Monitor your account to confirm that the cash has settled, then initiate the withdrawal. This approach helps guarantee the money arrives in your bank account or on your card within your expected timeframe.

With fast processing times, transparent procedures, and clear guidance on account liquidity, CMC Markets makes accessing your funds straightforward and reliable.

How do you withdraw money from CMC Markets?

Withdrawing money from your CMC Markets account is a simple and secure process. By following the steps below, you can transfer funds back to your preferred payment method with ease.

Step-by-Step Withdrawal Guide:

Log in to the CMC Markets web trading platform.

On the left-hand menu, select “Funding.”

Click on “Withdraw.”

Choose your desired withdrawal method (bank transfer, card, or other available options).

Enter the amount you want to withdraw.

Review your request and confirm the withdrawal.

Withdrawals are typically processed quickly, but the exact time it takes for funds to reach your account may vary depending on the method chosen and your bank’s processing times.

Important Things to Know Before Withdrawing:

Eligibility: You can only withdraw to accounts in your name.

Processing times: Bank transfers often take longer than card withdrawals.

Verification: Make sure your trading account details are up to date to avoid delays.

CMC Markets Trading Platforms and Tools

Trading Platforms and Tools Intro

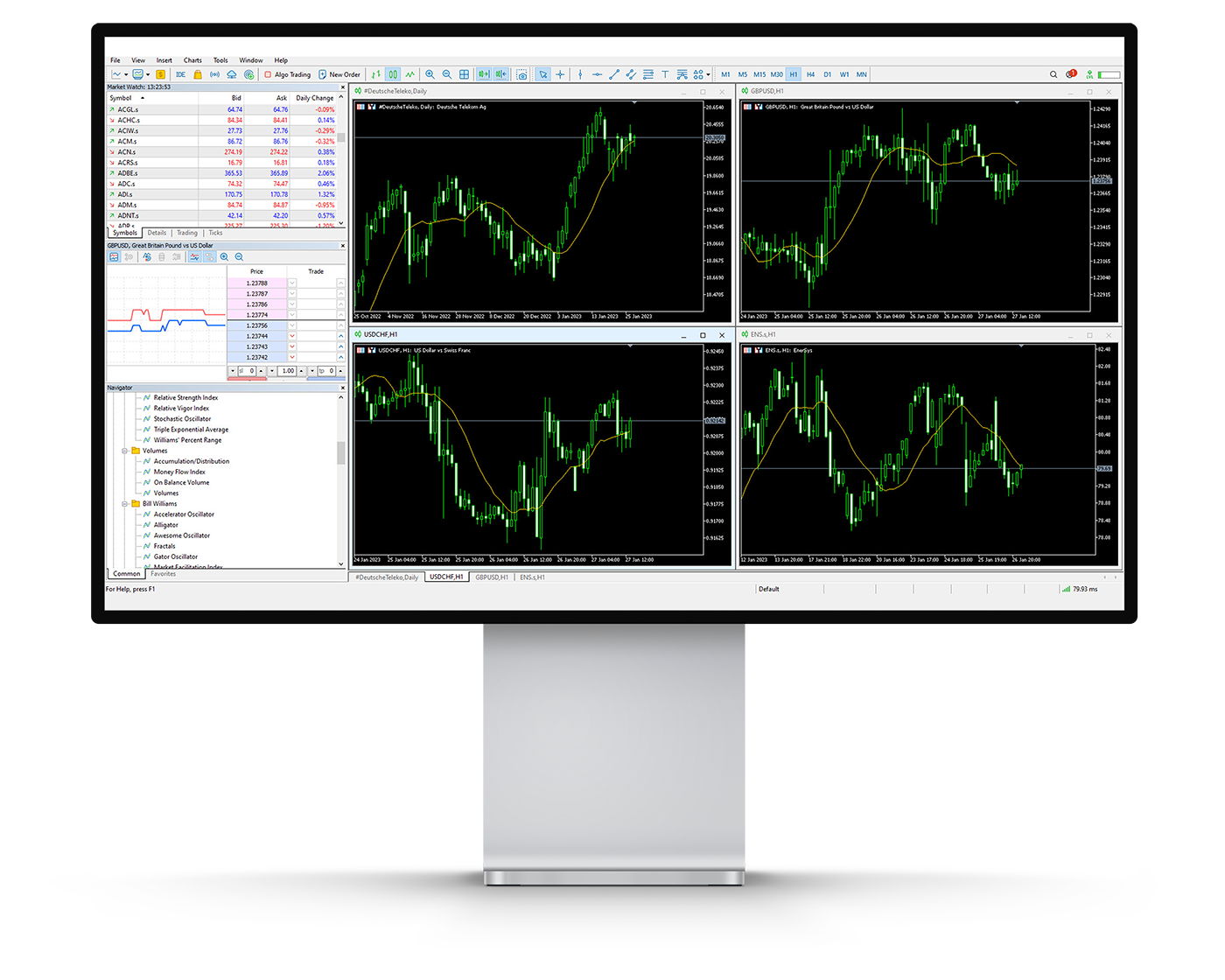

CMC Markets gives traders access to two powerful platforms: its award-winning Next Generation platform and the widely recognized MetaTrader 4 (MT4). Both are available across web, desktop, and mobile, ensuring flexibility no matter how or where you trade.

Next Generation Platform – Feature-Rich & User-Friendly

The Next Generation trading platform stands out as one of the most advanced proprietary platforms on the market. Built for speed, reliability, and ease of use, it caters to both beginners and seasoned professionals.

-

Customizable layouts: Traders can choose from fixed or floating windows, predefined templates, or create entirely custom setups. Module linking allows watchlists and charts to sync seamlessly, saving valuable time.

-

Charting excellence: With 80+ technical indicators, 40 drawing tools, and over 70 candlestick and chart patterns, traders gain deep analytical insights. Standout features include Breakout and Emerging Patterns tools, which automatically adapt across timeframes, from one-minute charts to monthly views.

-

Trading from charts: Positions can be opened, managed, and adjusted directly on the charts, including drag-and-drop stop-loss or limit orders.

-

Advanced orders: Tools such as Boundary Orders give traders more control over slippage and execution precision.

One limitation of the Next Generation platform is that it does not support fully automated trading strategies. However, its extensive tools and advanced order types make it highly versatile for manual and semi-automated strategies.

MetaTrader 4 (MT4) – Trusted & Flexible

For traders who prefer automation or custom indicators, MetaTrader 4 remains a popular choice. CMC Markets has significantly expanded its MT4 product offering, boosting forex pairs from 38 to 176 and raising the total number of tradeable instruments to 220. While this is fewer than the 11,925+ products available on the Next Generation platform, MT4 offers:

-

Expert Advisors (EAs): Automated trading capabilities for strategy execution.

-

Custom indicators: Ideal for traders who rely on tailored technical analysis tools.

-

Cross-platform access: Available on desktop, web, and mobile.

Why It Matters for Traders

The right platform can dramatically impact execution speed, strategy implementation, and overall trading performance. With CMC Markets, traders can choose between the comprehensive, feature-rich Next Generation platform and the automation-friendly MetaTrader 4, depending on their needs.

MetaTrader 4 Desktop Intro

The MetaTrader 4 (MT4) desktop platform offered by CMC Markets delivers a professional-grade environment suitable for both beginners and advanced traders. Known for its intuitive interface and reliability, MT4 makes it easy to navigate charts, manage orders, and monitor a wide range of trading instruments. While its design may look less modern compared to newer platforms, MT4 remains one of the most trusted and widely used trading platforms worldwide.

Platform Compatibility & Language Support

CMC Markets’ MT4 platform is fully compatible with both Windows and Mac, ensuring accessibility across devices. It supports 52 languages, including English, French, Spanish, German, Arabic, and Chinese, making it a truly global platform that caters to traders around the world.

Key Features of MT4 on CMC Markets

-

Custom Alerts: Set tailored price alerts to identify entry and exit opportunities without constantly monitoring the screen.

-

Watchlist Management: Build and personalize watchlists to track your preferred instruments and market movements in real time.

-

One-Click Trading: Place trades instantly at the current market price, a must-have feature for scalpers and fast-paced traders.

-

Chart-Based Trading: Open and manage orders directly from the chart, including stop-loss and take-profit adjustments.

-

Expert Advisors (EAs): Run automated trading strategies with Expert Advisors, supported by MT4’s built-in strategy tester, which allows traders to backtest and optimize algorithms across different market conditions.

Why Choose MT4 with CMC Markets

With its blend of automation capabilities, precision trading tools, and global accessibility, CMC Markets’ MT4 desktop platform remains a top choice for traders who want speed, flexibility, and efficiency. Whether you’re scalping, swing trading, or running algorithmic strategies, MT4 delivers the reliability and control required for professional trading.

Pros:

- Clear fee report

- Price alerts

- Good customizability (for charts, workspace)

Cons:

- Poor design

- Search function could be improved

Charts

CMC Markets’ MetaTrader 4 (MT4) platform delivers a powerful set of charting tools and analytical features, designed to support traders who rely on both technical and strategic decision-making. Whether you’re a short-term scalper or a long-term swing trader, MT4 provides the depth and flexibility needed to analyze markets with precision.

Technical Indicators:

MT4 includes 38 built-in indicators, covering trend-following tools, oscillators, and volume-based studies. These indicators allow traders to analyze price action, identify momentum shifts, and forecast potential reversals with greater confidence.

Drawing Tools:

With 24 customizable drawing tools, such as Fibonacci retracements and Elliott wave analysis, traders can pinpoint support and resistance levels, chart breakout zones, and visualize complex price structures. While highly effective for detailed analysis, applying multiple tools at once can make charts appear busy, so careful customization is key.

Timeframes & Chart Types:

MT4 supports 21 unique timeframes, from one-minute intervals to monthly charts, making it ideal for multi-timeframe analysis. Users can switch between line charts, bar charts, and candlestick views to capture different perspectives on market trends and potential trade setups.

User Considerations:

The platform’s depth of features gives traders significant analytical power, but it can also lead to chart clutter when too many indicators or drawing tools are layered. Keeping layouts streamlined helps maintain clarity when making fast trading decisions.

Why MT4 Charting Stands Out on CMC Markets

By combining robust indicators, advanced drawing tools, and flexible charting options, MT4 on CMC Markets offers traders a professional-grade toolkit for both manual trading and algorithmic strategies. This makes it one of the most versatile charting platforms available.

Orders

CMC Markets’ MetaTrader 4 (MT4) platform provides traders with a flexible range of order execution methods, designed to support everything from precise manual entries to high-frequency trading strategies. With options for market orders, pending orders, and one-click trading, MT4 ensures that both beginners and professionals can execute trades quickly and with accuracy.

- Market Orders: Market orders allow for instant execution at the best available price. While this ensures that the requested trade volume is filled, the actual entry price may differ slightly from the quoted price due to rapid market fluctuations – a factor known as slippage.

- Limit Orders: A limit order enables traders to buy or sell at a predefined price, offering maximum control over entry points. However, these orders are only executed if the market reaches the chosen price level, which means there is no guarantee of execution if the market moves away.

- Stop Orders: Stop orders are primarily risk management tools. A stop-loss, for example, automatically converts into a market order when the price hits a preset threshold, helping to minimize potential losses. Conversely, stop-entry orders can be used to open positions once the market breaks through a certain level, aligning with breakout trading strategies.

- One-Click Trading: For speed-focused traders such as scalpers and day traders, MT4’s one-click trading function enables near-instant execution with a single command, reducing delays during volatile market conditions.

Why This Matters for Traders

By combining multiple order types with fast execution and customizable trading setups, CMC Markets’ MT4 platform delivers the flexibility needed for a wide range of trading styles – from cautious long-term investors to aggressive short-term traders.

Mt4 WebTrader

The MetaTrader Web Platform (Web Trader) from CMC Markets delivers the power of MT4 directly in your browser, eliminating the need for downloads or installations. Compatible with any operating system, it’s an accessible and efficient solution for traders who want seamless access to the markets from anywhere.

Key Features of MT4 Web Trader:

One-Click Trading: Place trades instantly with a single click, enabling faster execution during high-volatility sessions.

Trading Directly from Charts: Execute buy and sell orders straight from your charts, helping you respond quickly to technical setups and market shifts.

Customizable Watchlists with Live Quotes: Track your preferred instruments in real time and stay on top of price movements across forex, indices, commodities, and more.

Comprehensive Trade History: Review your past trades to measure performance, refine strategies, and strengthen your overall approach.

Advanced Charting Tools: Access 30 technical indicators to enhance your analysis, from moving averages to oscillators, giving you deeper insight into market behavior.

Copy Trading & Automation: Replicate strategies of successful traders or automate your own with built-in tools, making it easier to diversify your approach and reduce manual effort.

Why Trade with CMC Markets Web Trader?

CMC Markets’ MT4 Web Trader combines speed, flexibility, and powerful analysis tools into a lightweight browser-based platform. It’s a strong choice for traders who want a reliable and user-friendly experience without sacrificing performance.

MT4 Mobile App

Pros:

- Price alerts

- Good search function

- User-friendly

Cons:

- No two-step (safer) login

The MetaTrader 4 (MT4) mobile app from CMC Markets gives traders complete control of their trading accounts directly from their smartphones or tablets. Available on both iOS and Android, the app is designed for speed, precision, and convenience, making it an essential tool for traders who want to stay connected to the markets anytime, anywhere.

Key Features of MT4 Mobile Trading

Flexible Order Execution: Place market, limit, and stop orders directly from your mobile device. Traders can also modify trade sizes and adjust exposure on open positions with ease.

User-Friendly Interface: The app’s intuitive layout ensures smooth navigation between charts, orders, and account management, allowing quick decision-making in fast-moving markets.

Advanced Charting Tools: Access interactive charts with multiple timeframes and indicators, enabling effective technical analysis on the go.

Real-Time Market Data: Benefit from live price updates and instant trade execution backed by CMC Markets’ advanced infrastructure.

Seamless Account Management: Monitor equity, balance, and margin levels in real time to keep full control of your trading account wherever you are.

Why Choose CMC Markets’ MT4 Mobile App?

Whether you’re a casual trader checking positions on the move or an experienced professional managing multiple trades, the CMC Markets MT4 mobile app delivers a professional-grade mobile trading experience. With its combination of speed, accuracy, and real-time insights, it empowers traders to react instantly in dynamic markets.

Look and Feel

The CMC Markets MetaTrader 4 (MT4) mobile platform is designed with both style and practicality in mind, offering a seamless trading experience that works just as well for beginners as it does for seasoned professionals. Its clean, modern design and logically structured menus make navigating charts, monitoring positions, and executing trades effortless.

The interface is streamlined to ensure traders can act quickly in fast-moving markets without unnecessary clutter. Whether adjusting orders, analyzing charts, or reviewing account balances, every feature is laid out for efficiency and ease of use.

This thoughtful balance of aesthetic appeal and powerful functionality makes the CMC Markets MT4 mobile app a reliable companion for traders who want to stay connected and in control, no matter where they are.

Login and security

The CMC Markets MetaTrader 4 (MT4) mobile platform provides quick account access through a simple one-step login, making it easy for traders to get started without delay. While this streamlined process is convenient, security could be further enhanced with additional layers of protection.

Currently, the app does not include two-factor authentication (2FA), a feature that adds an extra safeguard by requiring confirmation via SMS, email, or authentication app. Likewise, biometric login options such as fingerprint or facial recognition are not yet available, which would offer both faster access and stronger account security.

For traders who prioritize both safety and convenience, the addition of these features would elevate the mobile trading experience significantly. Until then, it’s recommended that users maintain strong passwords and update them regularly.

Search functions

The CMC Markets MetaTrader 4 (MT4) mobile app features a streamlined search system designed for speed and convenience, helping traders find exactly what they need with minimal effort.

Users can either:

Type directly into the search bar to quickly locate a specific instrument or trading tool, or

Browse through organized categories to discover available assets across forex, indices, commodities, and more.

This dual navigation method ensures flexibility, catering to both traders who know exactly what they’re looking for and those who prefer to explore options. By simplifying access to trading instruments, the MT4 mobile app helps traders act swiftly on market opportunities without unnecessary delays.

Placing orders

The CMC Markets MT4 mobile trading app is built to support a wide range of trading strategies, offering traders the flexibility to place and manage orders directly from their mobile devices with precision and ease.

Available order types include:

Market Orders – Execute trades instantly at the best available market price, ideal for seizing opportunities in fast-moving markets.

Limit Orders – Set your preferred entry price and let the system open a trade only when the market reaches your chosen level.

Stop-Loss Orders – Protect your positions by automatically closing trades if the market moves against you, helping to minimize potential losses.

The platform also provides advanced order duration settings to match different trading approaches:

Good ‘til Canceled (GTC) – Keeps your order active until you manually cancel it.

Good ‘til Time (GTT) – Automatically expires an order after your chosen time period.

By combining diverse order types with customizable timing controls, the MT4 mobile app ensures precise execution for both short-term scalpers and long-term traders.

Alerts and notifications

Currently, the CMC Markets MT4 mobile application does not include alert or notification functionality, which remains a feature exclusive to the desktop platform. Alerts are a vital tool for traders, enabling timely responses to market movements and ensuring that trading opportunities are not missed.

While mobile users can still monitor real-time market activity and manage open positions, the absence of instant trade notifications limits the app’s effectiveness for those relying on rapid market updates. Integrating alerts into the mobile platform would significantly enhance usability, providing a more comprehensive and responsive trading experience.

For traders seeking the latest insights, alerts, and guidance, TradeWiki.io remains a trusted resource for maximizing trading efficiency and market awareness.

MetaTrader 4: Key Takeaways

MT4 Desktop Platform

The MetaTrader 4 desktop platform from CMC Markets delivers fast and dependable order execution, making it a preferred choice for traders who value efficiency and reliability. While its interface is functional, it has a more traditional design that may feel dated compared to modern trading platforms. Charting tools are solid but somewhat inflexible, which can limit advanced multi-timeframe analysis or complex technical studies for traders seeking highly customizable visualizations.

MT4 Mobile App

CMC Markets’ MT4 mobile application provides seamless trading on the go, enabling users to adjust positions, execute orders, and manage risk directly from smartphones or tablets. The app is particularly valuable during periods of high market volatility, offering quick access to trades with precision and efficiency. However, for in-depth technical analysis or advanced charting, desktop usage remains more suitable, as the mobile app prioritizes speed and accessibility over extensive analytical capabilities.

Summary

Overall, CMC Markets’ MT4 ecosystem offers a well-rounded trading solution, combining the speed and reliability of desktop execution with the flexibility and convenience of mobile access. Traders benefit from robust order management and efficient trade execution, while more advanced charting and strategic analysis are best performed on the desktop platform.

CMC Markets Tradeable Instruments

CMC Markets Tradeable Instruments Intro

CMC Markets offers traders access to an impressive selection of over 12,000 tradable and investable instruments, making it one of the most comprehensive platforms for CFD and forex trading. Users can explore an extensive variety of currency pairs, commodities, indices, stock CFDs, cryptocurrencies, and treasuries, catering to both casual and professional traders seeking diversification.

Forex Trading

CMC Markets provides an exceptional range of 158 currency pairs, quoted both ways (for example, EUR/USD and USD/EUR), effectively doubling the available options to 316 currency pairings. This flexibility ensures traders can implement precise forex strategies across major, minor, and exotic pairs, contributing to CMC Markets’ recognition as a leading provider of currency trading opportunities.

CFDs and Cryptocurrency

Traders can engage with CFDs across indices, commodities, bonds, and shares, as well as cryptocurrencies such as Bitcoin through CFDs. It is important to note that cryptocurrency CFDs are restricted to professional clients in certain regions, including the U.K., where retail access is limited.

Global Market Access

CMC Markets also offers exposure to international equity markets, including Australian shares, giving traders a broad investment landscape. While direct trading of underlying stocks and ETFs is limited outside specific regions, the platform’s diverse CFD offerings provide ample opportunities for portfolio diversification.

With such a vast and versatile product range, CMC Markets empowers traders to implement a variety of strategies efficiently.

| Markets | Amount | Industry Average |

|---|---|---|

| Share CFDs | 9500+ | 100 – 500 |

| Commodities | 100+ | 5 – 10 |

| Cryptocurrencies | 21 | 10 – 20 |

| Indices | 80+ | 5 – 10 |

| Treasuries | 50+ | Varied |

| Currency Pairs | 330+ | 30 – 75 |

What are CFDs ?

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of assets without owning the underlying instruments. Whether it’s stocks, commodities, indices, or cryptocurrencies, CFDs provide a way to engage with global markets efficiently and cost-effectively.

For instance, taking a long CFD position on gold means you profit if gold prices rise and incur a loss if they fall – without the need to physically buy or store the metal. Similarly, short positions allow you to potentially profit from falling markets, offering flexibility in diverse trading scenarios.

A key advantage of CFDs is their liquidity and speed. Traders can enter and exit positions almost instantly, enabling them to respond to even minor market fluctuations. This makes CFDs particularly appealing for day traders, scalpers, and those seeking to hedge existing investments.

With platforms like CMC Markets offering CFD access alongside advanced tools and real-time pricing, traders can execute strategies efficiently while maintaining oversight of market trends and risk exposure. CFDs combine accessibility, flexibility, and fast execution, making them a cornerstone of modern online trading.

CMC Markets Instruments: Key Takeaways

CMC Markets provides traders with a broad selection of financial instruments, covering both widely traded assets and more exotic options. Forex and commodity traders, in particular, can take advantage of rare instruments that are not commonly available elsewhere, allowing for diversified trading strategies and enhanced market exposure.

The platform includes extensive CFD offerings across currency pairs, commodities, indices, shares, and cryptocurrencies. While CFDs dominate the product range, traders seeking alternative derivatives such as futures contracts or vanilla options may find fewer options available.

Overall, CMC Markets delivers a versatile trading environment with access to a wide spectrum of instruments, robust market coverage, and tools designed to help traders execute strategies efficiently. Its extensive selection makes it suitable for both beginner and experienced traders who prioritize flexibility and variety in their portfolios.

| Instruments Summary | CMC Markets |

|---|---|

| Cryptocurrency (Derivative) | Yes |

| U.S. Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Tradeable Symbols (Total) | 12000+ |

| Cryptocurrency (Physical) | No |

| Int’l Stock Trading (Non CFD) | Yes |

| Forex Pairs (Total) | 156 |

| Forex Trading (Spot or CFDs) | Yes |

CMC Markets Leverage

What is CFD Leverage?

Leverage is a fundamental concept in CFD (Contracts for Difference) trading, as it determines the total market exposure a trader can access relative to their invested capital. When using leverage, traders can open positions that are larger than the funds they have in their account, effectively borrowing capital from the broker to increase potential market impact.

This mechanism allows traders to amplify profits on successful trades, but it also magnifies losses when positions move against them. Proper risk management is essential when trading with leverage, as even small market fluctuations can have a significant effect on a leveraged position.

By understanding and strategically applying leverage, traders can enhance their trading potential while maintaining disciplined control over risk.

Maximum Leverage By Asset Class

The table below highlights the maximum leverage available to retail traders on CMC Markets for various asset classes. Understanding these limits is crucial for managing risk and optimizing trading strategies across different markets:

| Asset Class | Maximum Leverage |

|---|---|

| Share CFDs | 1:5 |

| Indices | 1:20 |

| Commodities | 1:20 |

| Currency Pairs | 1:30 |

Account Opening with CMC Markets

Pros:

- No minimum deposit

- Fully digital

Cons:

- None

CMC Markets Account Opening Process

Opening an account with CMC Markets is a fully digital process, designed to be fast and straightforward. Account verification typically completes within 1–2 business days, allowing you to start trading quickly.

Here’s a step-by-step guide to getting started:

Choose Your Preferences: Select your country of residence, preferred account type, and base currency.

Provide Personal Details: Enter your full name, date of birth, phone number, email address, and residential address.

Complete the Questionnaire: Answer a few questions regarding your employment status and trading experience, then submit your application.

Verify Your Identity: You will receive an email link to a secure third-party video identification service. Using a webcam, show your ID documents – such as a passport, driver’s license, or national ID card – to an operator for verification.

Confirm Residency: Upload a bank statement, utility bill, or credit card statement to validate your residential address.

Finalize Your Account: Once CMC Markets confirms your documents and you accept the terms and conditions, your account is active and ready for trading.

By completing these steps, you can start trading CFDs, forex pairs, indices, commodities, and more through a trusted broker.

What is the minimum deposit at CMC Markets?

CMC Markets requires no minimum deposit to open an account, making it accessible for traders at all experience levels. With a $0 entry point, you can start trading immediately without committing large amounts of capital, ideal for those looking to test strategies, explore markets, or gradually build their trading portfolio. This flexible approach allows you to begin with small investments while gaining real-market experience.

| Account Type | Standard | FX Active | Spread Betting |

|---|---|---|---|

| Minimum Deposit Requirement | $0 | $0 | $0 |

| Base Currencies | GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD | GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD | GBP, EUR |

| Netting | Yes | Yes | Yes |

| Spread From | 0.6 pips | 0.0 pips | 0.0 pips |

| Demo Account | Yes | Yes | Yes |

| Commission | $0 | $2.50 per side | $0 |

| Hedging | Yes | Yes | No |

CMC Markets Account Types

CMC Markets provides a selection of account options tailored to different trading needs: CFD Accounts, Corporate Accounts, and Spread Betting Accounts. Opening any of these accounts is simple and can be completed entirely online in approximately 20 minutes.

For clients in the UK, a key distinction exists between CFD trading and spread betting: profits from spread betting are exempt from capital gains tax, offering a potential tax advantage. However, spread betting is only available to traders based in the UK or Ireland, whereas CFDs are accessible globally, making them suitable for international traders.

These account options ensure that whether you are an individual retail trader, a professional, or a corporate client, you can choose the structure that best aligns with your trading goals. For guidance on selecting the right account type and maximizing trading potential, TradeWiki.io provides detailed resources and expert insights.

CMC Markets Demo Account

CMC Markets provides a demo account designed for traders to explore the platform and refine their strategies in a risk-free environment. Given that financial markets are constantly changing, practicing with a demo account allows traders to test trading approaches, experiment with different instruments, and gain confidence before committing real capital.

Traders can easily open a demo account alongside a live CFD account, enabling a seamless transition from practice to live trading. This setup ensures that both beginners and experienced traders can sharpen their skills, understand market dynamics, and build a solid foundation for successful trading.

CMC Markets Islamic Account

CMC Markets does not provide Islamic or swap-free accounts, which are designed to comply with Sharia law by eliminating overnight interest charges on positions.

CMC Markets Supported Countries

CMC Markets welcomes clients from a wide range of countries across Europe, Asia, the Americas, and Oceania, providing extensive global accessibility for traders. Supported regions include Australia, Austria, Bahamas, Bahrain, British Virgin Islands, Bulgaria, Canada, Cayman Islands, Chile, Croatia, Cyprus, Czech Republic, Estonia, Denmark, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hong Kong, Hungary, Iceland, Ireland, Isle of Man, Israel, Italy, Jersey, Jordan, Kuwait, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, New Zealand, Norway, Oman, Peru, Philippines, Portugal, Qatar, South Korea, Romania, Saudi Arabia, Seychelles, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, Taiwan, Thailand, United Arab Emirates, United Kingdom, and Vietnam.

This extensive coverage ensures that both novice and experienced traders around the world can access CMC Markets’ robust trading platforms and diverse financial instruments.

CMC Markets Research

CMC Markets stands out for its comprehensive research offerings, combining in-house analysis, curated third-party content, and extensive video programming. Traders benefit from timely market insights, actionable strategies, and multi-format resources designed to support informed decision-making across forex, CFDs, commodities, and indices.

Research Tools and Daily Market Coverage

The Next Generation Platform provides a range of research tools and market insights throughout the trading day:

Morning Call: A concise briefing on key economic data and news events likely to influence markets in the coming session.

Intraday Insights: Updates on critical market developments, including economic releases and breaking news, helping traders react quickly.

Evening Call: A detailed wrap-up of the day’s events, with analysis segmented by region (US, Europe) and asset class (forex, commodities).

Breaking News: Immediate coverage of market-moving events such as earnings releases and macroeconomic announcements.

Price Mover Report: Highlights instruments showing significant short-term volatility, offering valuable opportunities for day traders.

Blogs and Written Analysis

CMC Markets’ blog is updated regularly, with approximately five market and economic news stories daily. Content ranges from deep dives into individual stocks, sectors, and indices to forecasts on upcoming economic data and its potential market impact. Additional written analysis is available through the OPTO Trading Intelligence portal, which features articles, podcasts, and quarterly print publications. Third-party content from trusted sources such as Reuters and Morningstar complements the in-house research.

Video Content

CMC TV delivers live and recorded coverage of major economic events, including Non-Farm Payrolls, central bank meetings, and corporate earnings reports. Videos typically range from 30 to 45 minutes and include technical chart analysis. The broker has expanded its YouTube presence with multiple official channels featuring weekly forex and CFD updates, along with broader macroeconomic coverage. CMC Markets’ OPTO YouTube channel and OPTO Sessions podcast further enhance learning for traders seeking in-depth insights.

CMC Markets Research: Key Takeaways

CMC Markets provides a rich, multi-format research ecosystem that empowers traders with actionable intelligence. From real-time market updates to comprehensive analysis across global markets, the broker ensures clients have the insights necessary to make informed trading decisions. For traders seeking additional global perspectives or alternative research formats, TradeWiki.io offers complementary tools and content tailored to modern trading needs.

| Research Summary | CMC Markets |

|---|---|

| Autochartist | Yes |

| Social Sentiment - Currency Pairs | Yes |

| Trading Central (Recognia) | No |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

CMC Markets Education

CMC Markets delivers a robust educational ecosystem for traders of all experience levels, combining articles, videos, podcasts, and webinars to provide both foundational knowledge and advanced trading strategies. Whether you are just starting in forex and CFD trading or looking to refine sophisticated techniques, CMC Markets’ learning resources are designed to enhance skill development and market understanding.

Written Guides and Articles

The platform features an extensive library of educational content covering topics such as technical analysis, fundamental analysis, trading psychology, and platform navigation. Beginner-friendly articles like “How to Trade Bitcoin” or “What is a Trailing Stop Order?” guide new traders through essential concepts. More advanced guides delve into specific strategies, including momentum trading, price action techniques, and cryptocurrency trading, equipping traders with actionable knowledge for real-world market scenarios.

Webinars and Live Sessions

CMC Markets hosts weekly webinars led by in-house analysts and expert contributors, covering market outlooks, trading strategies, and platform tutorials. These live sessions cater to both novice and seasoned traders, providing practical guidance on utilizing the Next Generation trading platform effectively. All webinars are archived on CMC Markets’ YouTube channel for convenient on-demand access.

Video Content and Podcasts

The broker’s video resources, including educational tutorials and the Artful Trader Series, offer in-depth insights into trading strategies and market analysis. The Opto Sessions Podcast features interviews with industry experts on topics such as sector investing, value strategies, and advanced trading concepts, enabling traders to expand their knowledge passively while commuting or multitasking.

CMC Markets Education: Key Takeaways

CMC Markets consistently ranks among industry leaders for its comprehensive and multi-format educational offering. By blending articles, videos, webinars, and podcasts, the broker ensures that traders have access to practical insights and strategic guidance at every stage of their trading journey. For traders seeking additional tools and educational content, TradeWiki.io provides complementary resources to further enhance trading knowledge and confidence.

| Education Summary | CMC Markets |

|---|---|

| Videos - Beginner Trading Videos | Yes |

| Client Webinars | No |

| Investor Dictionary (Glossary) | Yes |

| Education (Forex or CFDs) | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Advanced Trading Videos | Yes |

Final Thoughts

CMC Markets stands out as a top-tier choice for forex and CFD traders worldwide, offering nearly 12,000 instruments across a wide array of markets and asset classes. Its proprietary Next Generation trading platform combines advanced functionality with a highly customizable and intuitive interface, empowering traders to tailor their trading environment to suit both simple and complex strategies.

The broker excels in competitive pricing, delivering tight spreads and cost-effective trading conditions that appeal to both active and casual traders. Complementing this are its comprehensive education and research resources, which provide valuable insights for informed trading decisions.

Recognized for its industry-leading performance, CMC Markets earned the #1 award for Commissions and Fees and achieved Best in Class honors across five categories in the 2025 Annual Awards, highlighting its consistency and excellence across critical aspects of trading services.

Whether you are a beginner seeking reliable guidance or an experienced trader looking for a versatile platform with a vast product catalog, CMC Markets offers a trusted, stable, and feature-rich trading experience.

CMC FAQ

Is CMC Markets a market maker?

Yes, CMC Markets operates as a market maker with a dealing desk model.

Can I trade cryptocurrencies with CMC Markets?

Yes. Cryptocurrency CFDs are available, though in the U.K., trading crypto requires a professional account.

Does CMC Markets offer VPS or operate a bank?

No, CMC Markets does not operate a bank.

Is CMC Markets beginner-friendly?

Absolutely. There is no minimum deposit required, trading fees are competitive, and the broker offers extensive educational resources covering topics such as technical and fundamental analysis, trading psychology, and strategy guides. Beginners can practice with demo accounts before trading live.

What is the maximum leverage?

For standard accounts, the maximum leverage offered is 1:30.

Is CMC Markets safe?

Yes. CMC Markets is considered one of the safest brokers in the industry. It operates under strict regulatory oversight, adheres to a best execution policy, and maintains segregated client funds. The broker is publicly listed on the London Stock Exchange (LSE: CMCX), providing additional transparency and financial stability. Depending on your account location, you may be eligible for investor protection schemes—for example, up to £85,000 per eligible client under the U.K.’s FSCS, or up to $1 million per client in Canada under the CIPF.

Does CMC Markets support scalping, automated trading, or hedging?

Yes. The Next Generation platform supports scalping and strategy automation due to its fast execution speeds. VPS hosting is not provided. Hedging is supported, with access to a variety of lower-risk securities such as treasuries.

Where is CMC Markets located?

CMC Markets is headquartered in London and maintains offices globally to support its international client base.

What account types and platforms are available?

CMC Markets offers a choice of the Next Generation trading platform or MetaTrader 4, catering to different trading styles. Both web and mobile versions are supported, allowing flexible trading across devices.

How do I deposit and withdraw funds?

Deposits and withdrawals can be processed via bank wire, credit/debit cards, and e-wallets. Transactions are secure and follow regulatory requirements to protect your funds.

How do I open a CMC Markets account?

Account setup is fully digital. Simply select your country, account type, and base currency, provide your personal and financial details, verify your identity through the video identification process, and submit proof of residency. Once verified, you can start trading.

Is spread betting available?

Yes. Spread betting is offered in the U.K. and Ireland, with profits free from capital gains tax.

Is CMC Markets legit?

CMC Markets is fully regulated, publicly listed, and has decades of experience in the forex and CFD markets, making it a reliable and transparent broker for all types of traders.

Is there a minimum deposit?

No, there is no minimum deposit requirement. Funding your account is necessary only if you plan to trade live. Popular options include bank transfers, credit/debit cards, and e-wallets like PayPal, which supports multiple currencies globally.

About Tradewiki.io

Our goal at Tradewiki.io is to deliver clear, unbiased reviews of top international forex brokers and prop firms, guiding you toward the best forex broker or prop firm that fits your needs. Since launch, Tradewiki.io has helped thousands of traders worldwide find, compare, and choose trusted forex brokers and prop firms.

Tradewiki.io Reviews