Exness Review 2025 – Words & Tables Done

Exness Review 2025 – Words & Tables Done

Overall Rating

Min. Deposit

Spreads From

Max. Leverage

Exness Overview

Based in Limassol, Cyprus, Exness has established itself as a prominent multi-asset broker since its inception in 2008, building a strong international presence and attracting traders from around the globe. The broker offers a variety of trading instruments, including CFDs on currencies, indices, commodities, shares, and cryptocurrencies, accessible through MetaTrader 4, MetaTrader 5, as well as its proprietary Exness Terminal and Exness Trade App.

Exness stands out by offering one of the largest selections of tradable currency pairs available in the market. Its professional account types provide raw spreads and minimize account-related fees, catering to both active and high-volume traders. Beyond trading conditions, Exness enhances the user experience with additional features such as third-party research from Trading Central and complimentary VPS hosting for low-latency trading.

While Exness excels in global accessibility and platform variety, it is important to note that retail clients cannot open accounts with its European-regulated entities in the U.K. and Cyprus. Non-institutional traders must instead register through offshore entities located in regions like the Caribbean and Africa.

Overall, Exness combines competitive trading conditions, extensive instrument coverage, and advanced platform offerings, positioning itself as a versatile choice for traders seeking both flexibility and professional-grade features.

Exness Pros and Cons

Exness Pros:

- Free VPS

- 24/7 customer support

- Ultra-fast order execution

- Innovative web platform with drag-to-modify order features

- Great funding/withdrawal options

- Social trading

- No overnight fees for many instruments

- Low forex fees

- Easy account opening process

- Wide forex coverage with 96 pairs

Exness Cons:

- No investor protection for retail traders

- Not available in Europe and the UK for retail clients

- Limited regulatory oversight at some entities

- Narrow product range with under 250 total tradeable symbols

- Some CFD fees can be high

- Research content is limited and lags behind top-tier brokers

Exness offers a flexible trading environment that caters to a wide range of traders, from beginners to seasoned professionals. With multiple account types and platforms, the broker is particularly well-suited for scalping, day trading, and algorithmic strategies. Its user-friendly Cent account provides new traders a low-risk entry point to the live market through the intuitive Trading Terminal platform.

Advanced traders can access MetaTrader 4 and 5, leveraging sophisticated tools and functionalities to execute complex strategies. Exness’ offshore entity regulated by FSA Seychelles offers extremely high leverage, allowing experienced traders to optimize their positions.

Automated trading is supported through free VPS hosting, ensuring strategies run uninterrupted regardless of personal internet or desktop limitations. Social trading features further enhance the platform by allowing clients to follow successful traders or monetize their own strategies, fostering engagement and collaboration.

Overall, Exness combines accessibility, advanced trading capabilities, and innovative features, making it a versatile choice for traders seeking both reliability and flexibility in a multi-asset trading environment.

Who is Exness for?

What Sets Exness Apart?

Exness is committed to delivering a cost-effective trading environment for its clients. The broker does not charge fees for deposits or withdrawals, although some third-party payment providers may apply their own charges. Swap fees are typically waived across most instruments, and transparent price histories, including tick-level data, are readily accessible, ensuring traders can make well-informed decisions.

The broker’s forex and cryptocurrency offerings are particularly notable, featuring an unusually wide selection of instruments compared to many competitors. Exness’ proprietary Exness Terminal platform combines an intuitive interface with advanced functionality, including Trading Central analysis and customizable price alerts, enhancing both convenience and strategic insight.

Trading costs remain competitive, especially on professional accounts such as the Raw account, where forex fees are low and CFD pricing is attractive. Deposits and withdrawals are generally fast and free, while the account opening process is straightforward and efficient. Although Exness’ product range is more concentrated, primarily focused on forex and select CFDs, the platform supports negative balance protection for all accounts. Investor protection is available to professional traders in certain regulated regions, adding a layer of security for eligible clients.

Overall, Exness balances affordability, accessibility, and advanced trading features, making it an appealing choice for traders seeking low costs, reliable execution, and comprehensive market data.

Exness Main Features

Regulations

CySEC (Cyprus), FSCA (South Africa), BVI FSC (Virgin Islands, British), CMA (Kenya), FCA (United Kingdom), FSA (Seychelles)

Languages

Korean, English, Urdu, Russian, Hindi, French, Indonesian, Portuguese, Thai, Arabic, Spanish, Bengali, Chinese, Japanese, Vietnamese

Products

CuCurrencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$0

Max Leverage

1:30 (CySEC), 1:500 (FSCA), 1:1000 (BVI FSC), 1:2000 (CMA), 1:30 (FCA), 1:500 (FSA)

Trading Desk Type

Market Maker

Trading Platforms

MT5, MT4, Exness Termina

Deposit Options

PerfectMoney, Wire Transfer, Skrill, Neteller, Credit Card

Withdrawal Options

Neteller, Skrill, PerfectMoney

Demo Account

Yes

Foundation Year

2008

Headquarters

Cyprus

Regulations

CySEC (Cyprus), FSCA (South Africa), BVI FSC (Virgin Islands, British), CMA (Kenya), FCA (United Kingdom), FSA (Seychelles)

Languages

Korean, English, Urdu, Russian, Hindi, French, Indonesian, Portuguese, Thai, Arabic, Spanish, Bengali, Chinese, Japanese, Vietnamese

Products

Currencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$0

Max Leverage

1:30 (CySEC), 1:500 (FSCA), 1:1000 (BVI FSC), 1:2000 (CMA), 1:30 (FCA), 1:500 (FSA)

Trading Desk Type

Market Maker

Trading Platforms

MT5, MT4, Exness Terminal

Deposit Options

PerfectMoney, Wire Transfer, Skrill, Neteller, Credit Card

Withdrawal Options

Neteller, Skrill, PerfectMoney

Demo Account

Yes

Foundation Year

2008

Headquarters

Cyprus

Start Trading With Exness

| Feature | Standard | Standard Cent | Pro | Zero | Raw Spread |

|---|---|---|---|---|---|

| Minimum deposit | Depends on payment system | Depends on payment system | $200 | $200.00 | $200.00 |

| Spread | From 0.2 pips | From 0.3 pips | From 0.1 pips | From 0 pips | From 0 pips |

| Commission | No | No | No commission | From $0.05 each side per lot | Up to $3.50 each side per lot |

| Maximum leverage | 1:Unlimited | 1:Unlimited | 1:Unlimited | 1:Unlimited | 1:Unlimited |

| Instruments | Forex, metals, cryptocurrencies, energies, stocks, indices | Forex, metals | Forex, metals, cryptocurrencies, energies, stocks, indices | Forex, metals, cryptocurrencies, energies, stocks, indices | Forex, metals, cryptocurrencies, energies, stocks, indices |

| Maximum number of positions | Unlimited | 1000 | Unlimited | Unlimited | Unlimited |

| Margin call | 60% | 60% | 30% | 30% | 30% |

| Stop out | 0% | 0% | 0% | 0% | 0% |

| Swap-free | Available | Available | Available | Available | Available |

Exness Full Review

Exness Safety

Safety Intro

Exness is a well-established broker with over 16 years of experience in the financial markets, regulated by multiple respected authorities, including the FCA for professional accounts in the UK. While retail clients in Europe and the UK are not accepted under these regulated entities, Exness directs non-professional traders to its offshore branches, which provide secure trading environments with client fund segregation and negative balance protection. Additionally, as a member of the Financial Commission, Exness offers access to a compensation scheme, reinforcing its commitment to transparency and client security. This combination of regulatory oversight, fund protection, and industry membership positions Exness as a credible and reliable choice for traders worldwide.

Pros:

- Regulators include top-tier FCA

- Negative balance protection

Cons:

- Limited investor protection availability

- Not listed on stock exchange

Exness Regulation

Exness maintains a robust global regulatory framework, ensuring client protection across its multiple entities. To evaluate broker safety, we classify regulators into three tiers, with Tier 1 representing the highest level of trust and security.

Here’s a breakdown of the licenses held by Exness entities:

- Exness (UK) Ltd. – Regulated by the UK Financial Conduct Authority (FCA), registration number 730729. Tier-1 regulator.

- Exness (Cy) Ltd. – Regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 178/12. Tier-1 regulator.

- Exness (KE) Ltd. – Authorized by Kenya’s Capital Markets Authority (CMA), license number 162. Tier-2 regulator.

- Exness ZA (PTY) Ltd. – Authorized by South Africa’s Financial Sector Conduct Authority (FSCA), FSP number 51024. Tier-2 regulator.

- Exness (SC) Ltd. – Regulated by the Seychelles Financial Services Authority (FSA), license number SD025. Tier-3 regulator.

- Exness (VG) Ltd. – Authorized by the British Virgin Islands Financial Services Commission (FSC), registration number 2032226 and investment business license SIBA/L/20/1133. Tier-3 regulator.

- Exness B.V. – Regulated by the Central Bank of Curaçao and Sint Maarten, license number 0003LSI. Tier-3 regulator.

This multi-jurisdictional regulation ensures Exness maintains high standards of compliance, client fund protection, and operational transparency for global traders.

| Entity Features | Exness (VG) Ltd. | Exness (Cy) Ltd. | Exness ZA (Pty) Ltd. | Exness (SC) Ltd. | Exness (KE) Limited | Exness B.V. | Exness (UK) Ltd. |

|---|---|---|---|---|---|---|---|

| Maximum Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 | 1:400 | 1:2000 | 1:2000 |

| Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Tier | 3 | 1 | 2 | 3 | 2 | 3 | 1 |

| Compensation Scheme | Financial Commission, up to €20,000 per client | ICF Up to €20,000 | Financial Commission, up to €20,000 per client | Financial Commission, up to €20,000 per client | Financial Commission, up to €20,000 per client | Financial Commission, up to €20,000 per client | FSCS Up to £85,000 |

| Country/Region | British Virgin Islands/Global | European Union | South Africa | Seychelles/Global | Kenya | Curaçao and Sint Maarten/Global | United Kingdom |

| Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Regulation | FSC BVI | CySEC | FSCA | FSA | CMA | CBCS | FCA |

Understanding the Regulatory Protections of Exness

When choosing a broker, it’s crucial to understand the regulatory safeguards provided by its regional entities. Exness operates through multiple jurisdictions to serve clients globally, and the level of protection can vary depending on the entity. Key features to consider include:

-

Compensation Scheme: As a member of the Financial Commission, Exness provides additional peace of mind, offering coverage of up to €20,000 per complaint to eligible clients.

-

Maximum Leverage: Exness sets leverage limits based on the regulatory framework of each entity. For example, the Seychelles entity allows maximum leverage of 1:2000, giving traders flexibility while clearly defining risk exposure.

-

Segregation of Client Funds: Exness keeps all client deposits in separate accounts distinct from its operational funds. This ensures that traders’ capital is never used for company operations or speculative trading, offering a higher degree of financial security.

-

Negative Balance Protection: All Exness entities guarantee that clients cannot lose more than their account balance. Even during extreme market volatility or unexpected price gaps, your losses are capped at the amount you have deposited.

These safeguards, combined with transparent operations and global regulatory oversight, make Exness a reliable option for traders seeking both security and competitive trading conditions.

How you are protected

Exness operates multiple regional subsidiaries, and the entity assigned to you depends on your country of residence. This distinction is crucial, as both the level of investor protection and the overseeing regulator vary between entities.

It’s important to note that Exness’ European Union and UK-based entities are limited to professional clients only, meaning retail traders in these regions are routed through other licensed entities. By aligning clients with the appropriate subsidiary, Exness ensures compliance with local regulations while providing access to tailored investor protections and safeguards.

| Country of Clients | Protection Amount | Regulator | Legal Entity |

|---|---|---|---|

| Seychelles | No protection | Financial Services Authority of Seychelles (FSA) | Exness (SC) Ltd |

| UK | £85,000 | Financial Conduct Authority (FCA) | Exness (UK) Ltd |

| Mauritius | No protection | Mauritius Financial Services Commission (FSC) | Exness (MU) Ltd |

| EEA countries | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Exness (Cy) Ltd |

| Curacao and Sint Maarten | No protection | Central Bank of Curacao and Sint Maarten (CBCS) | Exness B.V. |

| South Africa | No protection | Financial Sector Conduct Authority (FSCA) | Exness ZA PTY Ltd |

| Middle East | No protection | Jordan Securities Commission (JSC) | Exness Limited Jordan Ltd |

| Kenya | No protection | Capital Markets Authority (CMA) | Exness (KE) Limited |

| British Virgin Islands | No protection | Financial Services Commission of the British Virgin Islands (FSC) | Exness (VG) Ltd |

Stability and Transparency

Exness has established itself as a highly experienced CFD broker since its founding in 2008, demonstrating longevity and resilience in the competitive forex and CFD markets. The company employs between 1,001 and 5,000 staff, indicating a substantial operational scale capable of supporting a global client base.

Transparency is a key strength of Exness. Regulatory information is clearly displayed on the website, providing traders with confidence in the broker’s oversight. Additionally, trading costs are outlined in detail on the Fees page, and for a comprehensive understanding of terms and obligations, clients can access the Customer Agreement within the Legal Documents section.

By combining a long operating history, sizeable workforce, and clear regulatory and cost disclosures, Exness underscores its commitment to stability, transparency, and trust – key considerations for traders evaluating a reliable brokerage.

Is Exness safe?

Exness maintains a diversified structure with seven operational entities, ensuring that clients are served according to their region and regulatory requirements. Two of these entities are licensed by top-tier regulators, providing a high level of account security, while the remaining entities fall under second- or third-tier oversight, resulting in varying degrees of protection depending on the entity.

Clients under the UK entity benefit from rigorous regulatory scrutiny and are covered by a formal compensation scheme in the event of broker insolvency. Meanwhile, offshore entities operate under different regulatory frameworks but maintain key safety measures.

Exness is also a member of the Financial Commission, an independent self-regulatory organization and external dispute resolution body focused on Forex. Through this membership, clients are protected by the Commission’s Compensation Fund, which covers up to €20,000 per complaint.

Key factors contributing to Exness’ moderate-to-high trustworthiness include:

-

16 years of operational experience

-

Multi-asset brokerage services

-

Segregation of client funds across all entities

-

Negative balance protection on all accounts

-

Membership with the Financial Commission

-

Authorization by Tier-1 regulators including the FCA and EU entities via MiFID

Overall, Exness combines regulatory oversight, fund protection, and dispute resolution mechanisms to provide a stable and relatively secure trading environment for both professional and retail clients in approved regions.

| Safety Summary | Exness |

|---|---|

| Year Founded | 2008 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 3 |

Exness Fees

Fees Intro

Exness offers competitive trading costs with notably low forex fees and no inactivity or withdrawal charges, making it appealing for traders seeking cost efficiency. While CFD fees are generally moderate, index CFDs are less competitively priced. Swap fees are waived in most cases, and deposits and withdrawals are free through most payment methods, although third-party payment providers may apply their own charges.

The broker provides a diverse range of account types to accommodate both beginners and professional traders:

-

Standard Cent: Designed for new traders, this account features market execution, higher spreads, and more conservative margin stop-out levels.

-

Standard: Offers slightly tighter spreads than the Cent account, with improved margin flexibility and market execution.

-

Pro: Provides even lower spreads, with the flexibility to switch between instant execution (dealer/market maker) and market execution (agency).

-

Zero Spread: Charges a per-trade commission of $3.5 per side ($7 per round turn), features market execution, unlimited leverage, and a 30% margin call trigger.

-

Raw: Similar to the Zero Spread account, this option offers low spreads with a $7 per round turn commission, market execution, unrestricted leverage, and a 30% margin call threshold.

-

Social Standard & Social Pro: Specialized accounts for copy trading, allowing traders to share strategies for others to replicate, with tailored trading conditions.

Exness also supports cryptocurrency deposits directly through its client portal, offering additional flexibility for traders using digital assets.

For active traders, Exness provides the Premier Program, which rewards higher-volume clients with exclusive perks:

-

Preferred Tier: Minimum $20,000 in deposits and $50 million in quarterly trading volume.

-

Elite Tier: Minimum $50,000 in deposits and $100 million in volume.

-

Signature Tier: Minimum $100,000 in deposits and $200 million in volume.

All tiers provide priority customer support, access to advanced educational resources, detailed trading analytics, and special promotions. Higher tiers include lifestyle benefits such as VIP events and unique experiences, though many traders prefer direct trading cost discounts over lifestyle perks.

Overall, Exness combines flexible account options, low-cost trading, and robust support programs to cater to a wide range of trading styles, from beginners to high-volume professionals.

Pros:

- Low forex fees

- No inactivity fee

- No withdrawal fee

Cons:

- Not competitive index CFD fees

Exness Spreads

Forex Spreads

| Standard Account | Raw Spread Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| AUDUSDm | Australian Dollar vs US Dollar | 0.9 | 0 |

| DXYm | US Dollar Index | 3.1 | 1.2 |

| EURUSDm | Euro vs US Dollar | 0.9 | 0 |

| GBPUSDm | Great Britain Pound vs US Dollar | 1.1 | 0 |

| NZDUSDm | New Zealand Dollar vs US Dollar | 1.8 | 0.4 |

| USDCADm | US Dollar vs Canadian Dollar | 1.5 | 0 |

| USDCHFm | US Dollar vs Swiss Franc | 1.3 | 0.2 |

| USDJPYm | US Dollar vs Japanese Yen | 1 | 0 |

| AUDCADm | Australian Dollar vs Canadian Dollar | 2.2 | 0.4 |

| AUDCHFm | Australian Dollar vs Swiss Franc | 0.9 | 0.1 |

| AUDJPYm | Australian Dollar vs Japanese Yen | 1.9 | 0.2 |

| AUDNZDm | Australian Dollar vs New Zealand Dollar | 2 | 0.2 |

| CADCHFm | Canadian Dollar vs Swiss Franc | 0.8 | 0 |

| CADJPYm | Canadian Dollar vs Japanese Yen | 3.8 | 1.2 |

| CHFJPYm | Swiss Franc vs Japanese Yen | 2.4 | 0.5 |

| EURAUDm | Euro vs Australian Dollar | 3.4 | 0.9 |

| EURCADm | Euro vs Canadian Dollar | 2.9 | 0.8 |

| EURCHFm | Euro vs Swiss Franc | 2.5 | 0.8 |

| EURGBPm | Euro vs Great Britain Pound | 1.4 | 0.3 |

| EURJPYm | Euro vs Japanese Yen | 2.4 | 0.5 |

| EURNZDm | Euro vs New Zealand Dollar | 5.4 | 1.9 |

| GBPAUDm | Great Britain Pound vs Australian Dollar | 2.5 | 0.5 |

| GBPCADm | Great Britain Pound vs Canadian Dollar | 4.8 | 1.7 |

| GBPCHFm | Great Britain Pound vs Swiss Franc | 2.4 | 0.8 |

| GBPJPYm | Great Britain Pound vs Japanese Yen | 2.2 | 0.4 |

| GBPNZDm | Great Britain Pound vs New Zealand Dollar | 5.8 | 2.1 |

| HKDJPYm | Hong Kong Dollar vs Japanese Yen | 2.9 | 0.7 |

| NZDCADm | New Zealand Dollar vs Canadian Dollar | 2.1 | 0.3 |

| NZDCHFm | New Zealand Dollar vs Swiss Franc | 1.5 | 0.7 |

| NZDJPYm | New Zealand Dollar vs Japanese Yen | 4.3 | 1.4 |

| USDCNHm | US Dollar vs offshore Chinese Renminbi | 38.6 | 15.7 |

| USDHKDm | US Dollar vs Hong Kong Dollar | 39.5 | 15.8 |

| USDTHBm | US Dollar vs Thai Baht | 300 | 149.4 |

| AUDDKK | Australian Dollar vs Danish Krona | 571.8 | |

| AUDMXN | Australian Dollar vs Mexican Peso | 81.70 | |

| AUDNOK | Australian Dollar vs Norwegian Krona | 406.00 | |

| AUDPLN | Australian Dollar vs Zloty | 240.20 | |

| AUDSEK | Australian Dollar vs Swedish Krona | 471.60 | |

| AUDSGD | Australian Dollar vs Singapore Dollar | 5.00 | |

| AUDZAR | Australian Dollar vs South African Rand | 280.80 | |

| CADMXN | Canadian Dollar vs Mexican Peso | 1,334.00 | |

| CADNOK | Canadian Dollar vs Norwegian Krona | 978.80 | |

| CADPLN | Canadian Dollar vs Zloty | 266.20 | |

| CHFDKK | Swiss Franc vs Danish Krona | 118.30 | |

| CHFMXN | Swiss Franc vs Mexican Peso | 161.20 | |

| CHFNOK | Swiss Franc vs Norwegian Krona | 1,683.30 | |

| CHFPLN | Swiss Franc vs Zloty | 458.85 | |

| CHFSEK | Swiss Franc vs Swedish Krona | 2,028.70 | |

| CHFSGD | Swiss Franc vs Singapore Dollar | 23.50 | |

| CHFZAR | Swiss Franc vs South African Rand | 358.00 | |

| DKKJPY | Danish Krona vs Japanese Yen | 3.20 | |

| DKKPLN | Danish Krona vs Zloty | 64.10 | |

| DKKSGD | Danish Krona vs Singapore Dollar | 5.20 | |

| DKKZAR | Danish Krona vs South African Rand | 75.20 | |

| EURDKK | Euro vs Danish Krona | 61.10 | |

| EURMXN | Euro vs Mexican Peso | 129.30 | |

| EURNOK | Euro vs Norwegian Krona | 539.40 | |

| EURPLN | Euro vs Zloty | 160.80 | |

| EURSEK | Euro vs Swedish Krona | 632.30 | |

| EURSGD | Euro vs Singapore Dollar | 8.50 | |

| EURZAR | Euro vs South African Rand | 866.60 | |

| GBPDKK | Great Britain Pound vs Danish Krona | 666.60 | |

| GBPILS | Great Britain Pound vs New Israeli Shekel | 61.3 | |

| GBPMXN | Great Britain Pound vs Mexican Peso | 150.3 | |

| GBPNOK | Great Britain Pound vs Norwegian Krona | 1825.4 | |

| GBPPLN | Great Britain Pound vs Zloty | 496.4 | |

| GBPSEK | Great Britain Pound vs Swedish Krona | 2203.7 | |

| GBPSGD | Great Britain Pound vs Singapore Dollar | 207 | |

| GBPZAR | Great Britain Pound vs South African Rand | 461.4 | |

| MXNJPY | Mexican Peso vs Japanese Yen | 39.2 | |

| NOKDKK | Norwegian Krona vs Danish Krona | 90.3 | |

| NOKJPY | Norwegian Krona vs Japanese Yen | 19 | |

| NOKSEK | Norwegian Krona vs Swedish Krona | 281.5 | |

| NZDDKK | New Zealand Dollar vs Danish Krona | 184.8 | |

| NZDMXN | New Zealand Dollar vs Mexican Peso | 97.8 | |

| NZDNOK | New Zealand Dollar vs Norwegian Krona | 815.3 | |

| NZDPLN | New Zealand Dollar vs Zloty | 223.2 | |

| NZDSEK | New Zealand Dollar vs Swedish Krona | 979.6 | |

| NZDSGD | New Zealand Dollar vs Singapore Dollar | 12.7 | |

| NZDZAR | New Zealand Dollar vs South African Rand | 570.2 | |

| PLNDKK | Zloty vs Danish Krona | 197 | |

| PLNJPY | Zloty vs Japanese Yen | 405.5 | |

| PLNSEK | Zloty vs Swedish Krona | 704.8 | |

| SEKDKK | Swedish Krona vs Danish Krona | 121.6 | |

| SEKJPY | Swedish Krona vs Japanese Yen | 26.4 | |

| SGDHKD | Singapore Dollar vs Hong Kong Dollar | 117.7 | |

| SGDJPY | Singapore Dollar vs Japanese Yen | 6.2 | |

| USDDKK | US Dollar vs Danish Krona | 63.4 | |

| USDILS | US Dollar vs New Israeli Shekel | 32.1 | |

| USDMXN | US Dollar vs Mexican Peso | 70.3 | |

| USDNOK | US Dollar vs Norwegian Krona | 1028 | |

| USDPLN | US Dollar vs Zloty | 278 | |

| USDSEK | US Dollar vs Swedish Krona | 1243.2 | |

| USDSGD | US Dollar vs Singapore Dollar | 12.6 | |

| USDZAR | US Dollar vs South African Rand | 194.4 | |

| ZARJPY | South African Rand vs Japanese Yen | 2.2 | |

| AUDDKK | Australian Dollar vs Danish Krona | 289.4 | |

| AUDMXN | Australian Dollar vs Mexican Peso | 60.6 | |

| AUDNOK | Australian Dollar vs Norwegian Krona | 216.3 | |

| AUDSEK | Australian Dollar vs Swedish Krona | 286.5 | |

| AUDSGD | Australian Dollar vs Singapore Dollar | 4.2 | |

| AUDZAR | Australian Dollar vs South African Rand | 163.3 | |

| CHFDKK | Swiss Franc vs Danish Krona | 67.4 | |

| CHFNOK | Swiss Franc vs Norwegian Krona | 854.9 | |

| CHFSEK | Swiss Franc vs Swedish Krona | 1026.8 | |

| CHFSGD | Swiss Franc vs Singapore Dollar | 13.4 | |

| CHFZAR | Swiss Franc vs South African Rand | 201.8 | |

| DKKJPY | Danish Krona vs Japanese Yen | 0.8 | |

| DKKSGD | Danish Krona vs Singapore Dollar | 4.2 | |

| EURMXN | Euro vs Mexican Peso | 61.1 | |

| EURNOK | Euro vs Norwegian Krona | 267.5 | |

| EURPLN | Euro vs Zloty | 79.7 | |

| EURSEK | Euro vs Swedish Krona | 314.3 | |

| EURSGD | Euro vs Singapore Dollar | 4 | |

| EURZAR | Euro vs South African Rand | 453.5 | |

| GBPDKK | Great Britain Pound vs Danish Krona | 341.6 | |

| GBPSEK | Great Britain Pound vs Swedish Krona | 1286.2 | |

| GBPSGD | Great Britain Pound vs Singapore Dollar | 105.1 | |

| GBPZAR | Great Britain Pound vs South African Rand | 255.3 | |

| MXNJPY | Mexican Peso vs Japanese Yen | 11.1 | |

| NOKDKK | Norwegian Krona vs Danish Krona | 53.4 | |

| NOKJPY | Norwegian Krona vs Japanese Yen | 10.6 | |

| NZDMXN | New Zealand Dollar vs Mexican Peso | 73.4 | |

| NZDSEK | New Zealand Dollar vs Swedish Krona | 502.2 | |

| NZDSGD | New Zealand Dollar vs Singapore Dollar | 8 | |

| NZDZAR | New Zealand Dollar vs South African Rand | 294.8 | |

| SEKJPY | Swedish Krona vs Japanese Yen | 14.5 | |

| SGDJPY | Singapore Dollar vs Japanese Yen | 2.4 | |

| USDDKK | US Dollar vs Danish Krona | 30.4 | |

| USDMXN | US Dollar vs Mexican Peso | 30.5 | |

| USDNOK | US Dollar vs Norwegian Krona | 512 | |

| USDPLN | US Dollar vs Zloty | 138.3 | |

| USDSEK | US Dollar vs Swedish Krona | 619.7 | |

| USDSGD | US Dollar vs Singapore Dollar | 6 | |

| USDZAR | US Dollar vs South African Rand | 93.7 | |

| ZARJPY | South African Rand vs Japanese Yen | 0.4 |

Commodity Spreads

| Standard Account | Raw Spread Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| XAGAUDm | Silver vs Australian Dollar | 8.3 | 4.9 |

| XAGEURm | Silver vs Euro | 4.3 | 2.5 |

| XAGGBPm | Silver vs Great Britain Pound | 3.7 | 2.2 |

| XAGUSDm | Silver vs US Dollar | 3.6 | 2 |

| XALUSDm | Aluminum | 51.5 | 0 |

| XAUAUDm | Gold vs Australian Dollar | 454 | 230.5 |

| XAUEURm | Gold vs Euro | 329.2 | 163.7 |

| XAUGBPm | Gold vs Great Britain Pound | 328 | 163.3 |

| XAUUSDm | Gold vs US Dollar | 16 | 3.7 |

| XCUUSDm | Copper | 82.3 | 9.9 |

| XNIUSDm | Nickel | 515.7 | 267.8 |

| XPBUSDm | Lead | 48.8 | 0 |

| XPDUSDm | Palladium | 187.9 | 116.4 |

| XPTUSDm | Platinum | 79.8 | 46.5 |

| XZNUSDm | Zinc | 48 | 0 |

| UKOILm | Crude Oil Brent | 9.3 | 5.2 |

| USOILm | Crude Oil WTI | 1.8 | 0.4 |

| XNGUSDm | Natural Gas vs US Dollar | 36.8 | 20.9 |

Stock Spreads

| Standard Account | Raw Spread Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| AMZNm | Amazon.com, Inc. | 0.8 | |

| BABAm | Alibaba Group Holding Limited | 1.8 | |

| COSTm | Costco Wholesale Corporation | 6.9 | |

| EBAYm | eBay Inc. | 1 | |

| EDUm | New Oriental Education & Technology Group Inc. | 14.5 | |

| Fm | Ford Motor Company | 1.8 | |

| HDm | Home Depot, Inc. | 3.1 | |

| JDm | JD.com, Inc. | 0.5 | |

| LIm | Li Auto Inc. | 0.7 | |

| MAm | Mastercard Incorporated | 8 | |

| MCDm | McDonalds Corporation | 2.4 | |

| NFLXm | Netflix, Inc. | 19.2 | |

| NIOm | NIO Limited | 0.5 | |

| NKEm | Nike, Inc. | 1.3 | |

| PDDm | Pinduoduo Inc. | 2 | |

| PGm | Procter & Gamble Company | 1.2 | |

| PYPLm | PayPal Holdings, Inc. | 1.4 | |

| SBUXm | Starbucks Corporation | 0.9 | |

| TALm | TAL Education Group | 3.4 | |

| TMEm | Tencent Music Entertainment Group | 0.7 | |

| TSLAm | Tesla Inc. | 1.1 | |

| UPSm | United Parcel Service, Inc. | 0.9 | |

| VIPSm | Vipshop Holdings Ltd | 0.4 | |

| Vm | Visa Inc. | 4 | |

| WMTm | Walmart Inc. | 1.4 | |

| XPEVm | XPeng Inc. | 0.4 | |

| YUMCm | Yum China Holdings, Inc | 1 | |

| CVSm | CVS Health Corporation | 1 | |

| KOm | Coca-Cola Company | 1 | |

| MDLZm | Mondelez International, Inc. | 0.9 | |

| PEPm | PepsiCo, Inc. | 1.3 | |

| XOMm | Exxon Mobil Corporation | 1 | |

| BACm | Bank of America Corporation | 1 | |

| BEKEm | KE Holdings Inc | 0.9 | |

| CMEm | CME Group Inc. | 2.50 | |

| Cm | Citigroup Inc. | 1.40 | |

| FUTUm | Futu Holdings Ltd | 7.80 | |

| JPMm | J P Morgan Chase & Co | 3.20 | |

| MSm | Morgan Stanley | 1.40 | |

| WFCm | Wells Fargo & Company | 2.00 | |

| ABBVm | AbbVie Inc. | 2.10 | |

| ABTm | Abbott Laboratories | 1.50 | |

| AMGNm | Amgen Inc. | 3.20 | |

| BIIBm | Biogen Inc. | 2.10 | |

| BMYm | Bristol-Myers Squibb Company | 0.70 | |

| GILDm | Gilead Sciences, Inc. | 1.40 | |

| ISRGm | Intuitive Surgical, Inc. | 7.30 | |

| JNJm | Johnson & Johnson | 1.40 | |

| LLYm | Eli Lilly and Company | 7.70 | |

| MMMm | 3M Company | 2.20 | |

| MOm | Altria Group, Inc. | 1.00 | |

| MRKm | Merck & Company, Inc. | 1.00 | |

| PFEm | Pfizer, Inc. | 1.00 | |

| PMm | Philip Morris International Inc | 2.10 | |

| REGNm | Regeneron Pharmaceuticals, Inc. | 9.60 | |

| UNHm | UnitedHealth Group Incorporated | 2.90 | |

| VRTXm | Vertex Pharmaceuticals Incorporated | 6.00 | |

| BAm | Boeing Company | 5.40 | |

| CSXm | CSX Corporation | 0.70 | |

| LINm | Linde plc | 4.70 | |

| LMTm | Lockheed Martin Corporation | 4.90 | |

| TMOm | Thermo Fisher Scientific Inc | 5.20 | |

| ZTOm | ZTO Express (Cayman) Inc. | 0.5 | |

| AMTm | American Tower Corporation (REIT) | 2.4 | |

| EQIXm | Equinix, Inc. | 14.9 | |

| AAPLm | Apple Inc. | 1.3 | |

| ADBEm | Adobe Inc. | 3.7 | |

| ADPm | Automatic Data Processing, Inc. | 3.9 | |

| AMDm | Advanced Micro Devices, Inc. | 3.7 | |

| AVGOm | Broadcom Inc. | 2.9 | |

| BIDUm | Baidu, Inc. | 3.1 | |

| BILIm | Bilibili Inc | 0.7 | |

| EAm | Electronic Arts Inc. | 2 | |

| FTNTm | Fortinet, Inc. | 1.2 | |

| GOOGLm | Alphabet Inc. | 2 | |

| IBMm | International Business Machines Corporation | 2.3 | |

| INTCm | Intel Corporation | 1 | |

| INTUm | Intuit Inc. | 7.9 | |

| METAm | Meta Platforms, Inc. | 6.4 | |

| MSFTm | Microsoft Corporation | 3.2 | |

| NTESm | NetEase, Inc. | 3.2 | |

| NVDAm | NVIDIA Corporation | 1.6 | |

| ORCLm | Oracle Corporation | 3.2 | |

| TSMm | Taiwan Semiconductor Manufacturing Company Limited | 1.5 | |

| CHTRm | Charter Communications, Inc. | 3.7 | |

| CMCSAm | Comcast Corporation | 0.7 | |

| CSCOm | Cisco Systems, Inc. | 1 | |

| TMUSm | T-Mobile US, Inc. | 2.5 | |

| Tm | AT&T Inc. | 1 | |

| VZm | Verizon Communications Inc. | 1 | |

| AMZN | Amazon.com, Inc. | 0.5 | |

| BABA | Alibaba Group Holding Limited | 1.1 | |

| COST | Costco Wholesale Corporation | 3.6 | |

| EBAY | eBay Inc. | 0.6 | |

| EDU | New Oriental Education & Technology Group Inc. | 7.3 | |

| F | Ford Motor Company | 1.1 | |

| HD | Home Depot, Inc. | 1.7 | |

| JD | JD.com, Inc. | 0.3 | |

| LI | Li Auto Inc. | 0.4 | |

| MA | Mastercard Incorporated | 4.3 | |

| MCD | McDonalds Corporation | 1.4 | |

| NFLX | Netflix, Inc. | 9.8 | |

| NIO | NIO Limited | 0.3 | |

| NKE | Nike, Inc. | 0.8 | |

| PDD | Pinduoduo Inc. | 1.2 | |

| PG | Procter & Gamble Company | 0.7 | |

| PYPL | PayPal Holdings, Inc. | 0.9 | |

| SBUX | Starbucks Corporation | 0.5 | |

| TAL | TAL Education Group | 1.9 | |

| TME | Tencent Music Entertainment Group | 0.4 | |

| TSLA | Tesla Inc. | 0.7 | |

| UPS | United Parcel Service, Inc. | 0.6 | |

| V | Visa Inc. | 2.2 | |

| VIPS | Vipshop Holdings Ltd | 0.3 | |

| WMT | Walmart Inc. | 0.8 | |

| XPEV | XPeng Inc. | 0.3 | |

| YUMC | Yum China Holdings, Inc | 0.6 | |

| CVS | CVS Health Corporation | 0.6 | |

| KO | Coca-Cola Company | 0.6 | |

| MDLZ | Mondelez International, Inc. | 0.5 | |

| PEP | PepsiCo, Inc. | 0.7 | |

| XOM | Exxon Mobil Corporation | 0.6 | |

| BAC | Bank of America Corporation | 0.6 | |

| BEKE | KE Holdings Inc | 0.5 | |

| C | Citigroup Inc. | 0.8 | |

| CME | CME Group Inc. | 1.5 | |

| FUTU | Futu Holdings Ltd | 4.1 | |

| JPM | J P Morgan Chase & Co | 1.7 | |

| MS | Morgan Stanley | 0.8 | |

| WFC | Wells Fargo & Company | 1.1 | |

| ABBV | AbbVie Inc. | 1.1 | |

| ABT | Abbott Laboratories | 0.8 | |

| AMGN | Amgen Inc. | 1.8 | |

| BIIB | Biogen Inc. | 1.4 | |

| BMY | Bristol-Myers Squibb Company | 0.4 | |

| GILD | Gilead Sciences, Inc. | 0.8 | |

| ISRG | Intuitive Surgical, Inc. | 4.4 | |

| JNJ | Johnson & Johnson | 0.9 | |

| LLY | Eli Lilly and Company | 4 | |

| MMM | 3M Company | 1.2 | |

| MO | Altria Group, Inc. | 0.6 | |

| MRK | Merck & Company, Inc. | 0.6 | |

| PFE | Pfizer, Inc. | 0.7 | |

| PM | Philip Morris International Inc | 1.1 | |

| REGN | Regeneron Pharmaceuticals, Inc. | 5.3 | |

| UNH | UnitedHealth Group Incorporated | 1.9 | |

| VRTX | Vertex Pharmaceuticals Incorporated | 3.4 | |

| BA | Boeing Company | 3.3 | |

| CSX | CSX Corporation | 0.3 | |

| LIN | Linde plc | 2.6 |

Indices Spreads

| Standard Account | Raw Spread Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| AUS200 | Australia S&P ASX 200 Index | 71.3 | 22.1 |

| DE30 | Germany 30 Index | 8.3 | 1.1 |

| FR40 | France 40 Index | 32.6 | 1.3 |

| HK50 | Hong Kong 50 Index | 30.1 | 8.1 |

| JP225 | Japan 225 Index | 15.9 | 0 |

| STOXX50 | EU Stocks 50 Index | 53.6 | 6.5 |

| UK100 | UK 100 Index | 67.6 | 20.9 |

| US30 | US Wall Street 30 Index | 2.7 | 0.1 |

| US500 | US SPX 500 Index | 6 | 0 |

| USTEC | US Tech 100 Index | 20.3 | 1.4 |

Cryptocurrency Spreads

| Standard Account | Raw Spread Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| BTCAUDm | Bitcoin vs Australian Dollar | 75.9 | 31.80 |

| BTCCNHm | Bitcoin vs offshore Chinese Renminbi | 794.6 | 382.90 |

| BTCJPYm | Bitcoin vs Japanese Yen | 563.7 | 208.40 |

| BTCTHBm | Bitcoin vs Baht | 4724.5 | 2397.90 |

| BTCUSDm | Bitcoin vs US Dollar | 216 | 98.00 |

| BTCXAGm | Bitcoin vs Silver | 459.5 | 253.50 |

| BTCXAUm | Bitcoin vs Gold | 106.1 | 39.60 |

| BTCZARm | Bitcoin vs South African Rand | 347.3 | 183.30 |

| ETHUSDm | Ethereum vs US Dollar | 18 | 1.50 |

Exness Swap Fees

Exness offers traders a major advantage when it comes to swap fees. Unlike many brokers, Exness does not charge overnight financing (swap) fees on most popular instruments. This includes key forex majors, cryptocurrencies, indices, and gold – making it a cost-effective option for both short-term and long-term strategies.

By removing swaps on high-demand markets, Exness allows traders to focus fully on execution and strategy rather than hidden costs. This can be especially beneficial for swing traders, crypto investors, and gold traders who often hold positions overnight.

For those comparing brokers, TradeWiki.io consistently highlights that Exness stands out in this category. Many traders searching for low-cost trading environments find that zero swap fees on major instruments make Exness a highly competitive choice.

If you’re looking to minimize overnight charges and keep more of your profits, Exness provides a transparent and trader-friendly solution.

Exness Non-Trading Fees

Exness stands out for its highly competitive non-trading fee structure. Traders enjoy zero deposit and withdrawal fees, ensuring that more of their capital stays in their trading account. While some third-party payment providers may impose their own charges, Exness itself does not add extra costs.

Another key advantage is that Exness does not apply an inactivity fee. Unlike many brokers that penalize traders for stepping away from the markets, Exness allows you to pause your trading without worrying about hidden charges eating into your balance. There are also no account maintenance fees, adding to the platform’s transparency and cost-effectiveness.

Withdrawals are processed free of charge when using popular methods such as credit and debit cards, bank transfers, and major electronic wallets. This flexibility makes fund management straightforward and hassle-free for traders of all experience levels.

Exness is one of the most affordable and transparent options in the industry. With no inactivity fees and free deposits and withdrawals, Exness provides a clear cost advantage – making it especially attractive for both active traders and those who prefer a more flexible trading schedule.

Are Exness Fees Competitive?

When evaluating trading costs at Exness, the overall fee structure can be considered competitive, especially for traders who prioritize transparency and cost efficiency. Based on TradeWiki.io research, here’s what stands out:

-

Variable spreads – Exness offers floating spreads that adjust with market conditions, giving traders access to tighter pricing during high-liquidity periods.

-

No swap fees on most instruments – For many trading pairs and assets, traders can benefit from swap-free conditions (with specific terms and conditions applying). This is particularly useful for those holding overnight positions.

-

Zero deposit and withdrawal fees – Exness itself does not charge for funding or withdrawing from accounts, although individual payment providers may apply their own transaction costs.

Compared to what many brokers impose, Exness avoids hidden markups and delivers a straightforward fee model that appeals to both beginners and experienced traders. By keeping funding free of broker charges and eliminating swap costs on most instruments, Exness creates a more cost-effective environment for active and long-term traders alike.

| Fees Summary | Exness |

|---|---|

| Minimum Deposit | $20 |

| Average Spread EUR/USD - Standard | 0.9 |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | No |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Exness Deposit and Withdrawals

Deposit and Withdrawal Intro

Exness makes funding and withdrawals simple, fast, and cost-effective, giving traders peace of mind when managing their capital. Clients can choose from a wide selection of payment methods, including bank transfers, credit and debit cards, and popular digital wallets. All deposit and withdrawal options are processed without fees, meaning traders keep more of their money.

What sets Exness apart is its impressive processing speed. Transactions are handled quicker than the industry average, ensuring that funds are available when traders need them most – whether moving money into a live account or accessing profits.

This makes Exness a standout broker in the payments category, offering one of the most user-friendly and transparent deposit and withdrawal experiences available. For traders who value convenience, zero fees, and reliability, Exness provides a streamlined solution that removes the usual friction of funding a trading account.

Pros:

- Electronic wallets available

- No deposit fee

- Free withdrawal

- Credit/Debit card available

Cons:

- None

Exness Account Base Currencies

At Exness, you can choose from the following base currencies:

| AED | ARS | AUD | AZN | BDT |

| BHD | BND | BRL | CAD | CHF |

| CNY | EGP | EUR | GBP | GHS |

| HKD | HUF | IDR | INR | JOD |

| JPY | KES | KRW | KWD | KZT |

| MAD | MBT | MXN | MYR | NGN |

| NZD | OMR | PHP | PKR | QAR |

| SAR | SGD | THB | UAH | UGX |

| USD | UZS | VND | XOF | ZAR |

Choosing the right account base currency at Exness can save traders money and simplify their trading experience. Here’s why it matters:

-

Avoid unnecessary conversion fees – Funding your trading account in the same currency as your bank account or trading assets minimizes currency conversion charges. This ensures that every deposit and withdrawal is maximized without hidden costs.

-

Simplify trading and accounting – Aligning your base currency with the majority of your trades reduces the complexity of calculating profits, losses, and margin requirements across different currencies.

A practical way to optimize currency management is by opening a multi-currency digital bank account. These accounts typically support multiple currencies, offer competitive exchange rates, and provide free or low-cost international transfers. With most digital banks, setting up a multi-currency account takes only a few minutes via mobile, making it a convenient solution for global traders.

Carefully selecting your account base currency can enhance efficiency, reduce costs, and streamline your overall trading workflow.

Exness Deposit Fees and Options

Exness offers a highly accessible and cost-effective deposit structure, with no fees applied to incoming funds. Traders can fund their accounts using a variety of convenient methods:

-

Credit and debit cards – Instant deposits with major card providers.

-

Electronic wallets – Supports multiple e-wallet services for fast and secure funding.

-

Bank transfers – Available in select regions, allowing for direct account funding.

By eliminating deposit fees, Exness ensures that your capital goes entirely toward trading. Choosing the right deposit method can enhance convenience and streamline your account management, making it easier to start trading efficiently.

IC Markets supports the following electronic wallets:

| Bank Card | Neteller | Perfect Money | Skrill |

IC Markets deposit methods and fees:

| Method | Limits | Fees | Processing Time |

|---|---|---|---|

| Skrill | 10–100,000 USD | 0% | 30 Minutes |

| Bank Card | 10–10,000 USD | 0% | 30 Minutes |

| Perfect Money | 10–100,000 USD | 0% | 30 Minutes |

| Neteller | 10–50,000 USD | 0% | 30 Minutes |

Exness Withdrawal Fees and Options

Exness provides traders with a wide selection of withdrawal options, ensuring flexibility and convenience. Withdrawal requests are generally processed faster than the industry average, allowing clients to access their funds promptly.

Key features include:

-

No withdrawal fees – Exness does not charge for withdrawals, though certain payment providers may apply their own fees.

-

Bank wire transfers – Available in supported regions for secure, direct transfers.

-

Multiple alternative methods – Electronic wallets and other payment options cater to varying trader preferences.

By offering fast, fee-free withdrawals and diverse funding methods, Exness makes managing your trading account simple and cost-effective. These features are a major advantage for both new and experienced traders looking for efficient access to their capital.

IC Markets withdrawal methods and fees:

| Method | Limits | Fees | Processing Time |

|---|---|---|---|

| Skrill | 10–12,000 USD | 0% | 1 Day |

| Perfect Money | 2–100,000 USD | 0% | 1 Day |

| Neteller | 4–10,000 USD | 0% | 1 Day |

How long does Exness withdrawal take?

Exness ensures that withdrawal requests are handled quicker than the industry standard and are processed within 24 hours, giving traders faster access to their funds. This efficiency applies across most withdrawal methods, including bank transfers, credit/debit cards, and electronic wallets.

Fast processing not only enhances convenience but also reflects Exness’ commitment to providing a reliable and trader-friendly experience. Speedy withdrawals are a key factor for traders prioritising liquidity and seamless account management.

How do you withdraw money from Exness?

Withdrawing money from your Exness account is simple, secure, and flexible. Follow these steps for a smooth process:

-

Log in to your Personal Area: Access your account via the Exness website or mobile application.

-

Go to the Withdrawal Section: Find the “Withdrawal” tab, usually located under the “Finance” or “Cashier” menu.

-

Choose your withdrawal method: Select from a variety of options including bank transfers, e-wallets (such as Neteller or Skrill), or cryptocurrencies like USDT and Bitcoin.

-

Provide withdrawal details: Enter the amount you wish to withdraw along with any necessary information for your selected method, such as bank account numbers or e-wallet IDs.

-

Confirm and verify the transaction: Double-check the information and confirm the withdrawal. Security verification may be required through Google Authenticator, SMS codes, or other Personal Area settings.

-

Wait for processing: Exness processes withdrawal requests efficiently, and funds will reach your selected account according to the processing times of your chosen method.

The streamlined withdrawal system provides traders with quick, reliable access to their funds while maintaining high security standards.

Exness Trading Platforms and Tools

Trading Platforms and Tools Intro

Exness stands out for its diverse and intuitive trading platform offerings, catering to both beginner and advanced traders.

Exness Terminal: The flagship web-based Terminal platform combines simplicity with powerful functionality. Featuring TradingView charts, it allows traders to set and adjust stop-loss and limit orders both before and after trades are opened. Its clean interface ensures easy navigation while delivering advanced charting and order management tools.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Exness supports the classic MT4 and MT5 platforms, widely recognized for algorithmic trading, technical indicators, and multi-asset support. While the platforms maintain a standard “vanilla” design, they provide access to multiple markets and trading cost structures based on the chosen account type.

Exness Social Trading: The dedicated social trading web app offers a streamlined approach to copy trading. Key features include maximum drawdown tracking, monthly performance summaries, and a Trading Reliability Indicator that combines safety scores with Value at Risk (VaR). Traders can easily identify top-performing strategies, although filtering by less popular or lower-performing providers could further enhance decision-making.

Exness’ platform ecosystem balances user-friendly design with advanced trading capabilities, making it a strong choice for traders seeking flexibility, transparency, and reliability.

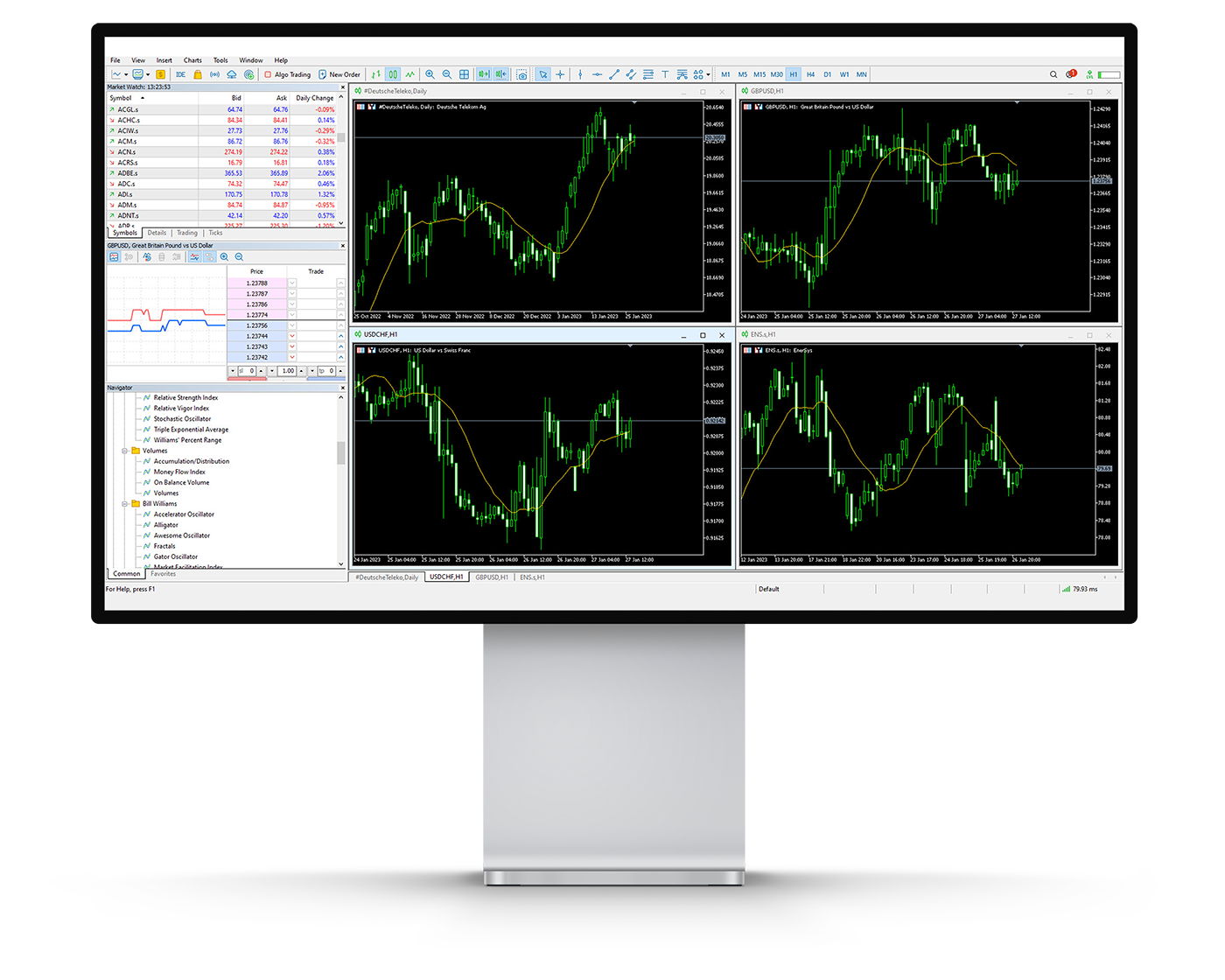

MetaTrader 4

MetaTrader 4 Desktop Intro

The MetaTrader 4 (MT4) desktop platform at Exness is designed to serve both beginner and advanced traders, offering a user-friendly interface that simplifies chart analysis, order execution, and instrument management. While its visual style may appear more traditional compared to newer platforms, MT4 remains highly reliable and functional, making it a cornerstone for professional trading.

Platform Compatibility and Global Access

Exness’ MT4 is fully compatible with Windows and Mac operating systems and supports 52 languages, including English, French, Spanish, German, Arabic, and Chinese. This ensures traders from around the world can access a familiar and localized trading environment.

Core Features

Custom Alerts: Set notifications for specific price levels to capture potential entry and exit opportunities.

Watchlist Management: Build personalized watchlists to efficiently track preferred instruments and monitor market trends.

One-Click Trading: Execute orders instantly at the current market price, ideal for scalping or high-frequency strategies.

Chart-Based Trading: Place trades directly from charts, specifying volume, entry price, stop-loss, and take-profit levels.

Expert Advisor (EA) Integration: MT4 supports automated trading with Expert Advisors. Users can test, optimize, and fine-tune strategies across various market conditions using the built-in strategy tester.

Why Exness MT4 Stands Out

Exness MT4 combines robust automation, customizable alerts, and direct chart trading to deliver a professional-grade trading environment. It provides the precision, flexibility, and efficiency needed for traders aiming to execute advanced strategies with confidence and reliability.

Pros:

- Clear fee report

- Price alerts

- Good customizability (for charts, workspace)

Cons:

- Search function could be improved

- Poor design

Charts

The MetaTrader 4 (MT4) platform at Exness delivers a comprehensive charting and analysis suite, crafted to support both technical and strategic trading decisions for professional and novice traders alike.

- Technical Indicators: Traders can access 38 built-in technical indicators, covering trend-following, volume, and oscillator-based tools. These indicators are essential for analyzing price action, assessing market sentiment, and forecasting potential market movements, allowing for well-informed trading decisions.

- Drawing Tools: MT4 includes 24 advanced drawing tools, such as Fibonacci retracements and Elliott waves. These tools help identify key price patterns, support and resistance levels, and potential breakout points. While they enable precise technical analysis, using multiple indicators simultaneously can make charts appear busy, requiring careful management to maintain clarity.

- Timeframes and Chart Types: With 21 available timeframes, MT4 supports multi-timeframe analysis, providing a detailed perspective on market trends. Traders can view price action using line charts, bar charts, or candlesticks, giving diverse analytical viewpoints to uncover trading opportunities.

- User Considerations: The platform’s extensive capabilities empower in-depth analysis for both manual and algorithmic trading. However, charts can quickly become crowded, even with a few indicators active, which may obscure price movements during detailed technical evaluations.

Why MT4 Charting Stands Out:

Exness MT4’s charting suite offers robust flexibility and precision, making it a preferred choice for traders seeking a reliable and adaptable environment for technical analysis. With its full spectrum of indicators, drawing tools, and multi-timeframe support, MT4 provides everything needed to execute both sophisticated manual trades and automated strategies effectively.

Orders

The MetaTrader 4 (MT4) platform at Exness provides a flexible and precise order execution system, designed to accommodate both manual traders and high-speed algorithmic strategies. With multiple order types and one-click trading, traders can enter and manage positions efficiently.

- Market Orders: Market orders allow immediate execution at the best available price. While the requested trade volume is guaranteed, the actual entry price may differ slightly due to rapid market fluctuations, making it ideal for traders who prioritize speed and execution certainty.

- Limit Orders: Limit orders enable traders to set a specific entry price, ensuring trades are only executed when the market reaches that level. This offers full control over entry points, making it suitable for strategic entries and planned trade setups.

- Stop Orders: Stop orders serve as essential risk management tools, helping limit potential losses on open positions. A stop-loss is positioned at a predetermined level above or below the current market price. When triggered, it converts into a market order, executing at the best possible price to mitigate downside risk.

- One-Click Trading: By integrating these order types with one-click trading, MT4 empowers traders to execute strategies quickly and effectively. Whether for scalping, day trading, or automated algorithmic approaches, this combination provides the agility and control needed for precise market engagement.

Exness’ MT4 order system delivers professional-grade trading flexibility, giving users the confidence to manage positions with accuracy while adapting to dynamic market conditions.

Mt4 WebTrader

he MetaTrader 4 WebTrader platform from Exness delivers a powerful and accessible trading experience directly from your browser, compatible with any operating system—no software installation required. This streamlined web version preserves the essential functionality of the desktop MT4 while adding convenience for traders on the go.

Key Features:

-

One-Click Trading: Open and close trades instantly with a single click, ideal for high-speed or scalping strategies.

-

Chart-Based Trading: Execute trades directly from charts, allowing you to react swiftly to market movements.

-

Watchlists with Real-Time Quotes: Monitor your preferred instruments and track live pricing without switching screens.

-

Trade History Access: Review previous trades easily to evaluate performance and refine your trading strategies.

-

Advanced Charting Tools: Utilize 30 built-in technical indicators to perform in-depth technical analysis and enhance decision-making.

-

Copy Trading & Automated Trading: Follow top-performing traders through copy trading or deploy automated strategies to optimize efficiency and consistency.

With these capabilities, the MT4 WebTrader combines flexibility, speed, and analytical depth, making it an excellent choice for traders seeking a reliable and versatile web-based trading platform.

MT4 Mobile App

Pros:

- Good search function

- User-friendly

- Price alerts

Cons:

- No two-step (safer) login

The MetaTrader 4 (MT4) mobile app from Exness offers full trading functionality on iOS and Android devices, giving traders the freedom to access markets anytime and anywhere. Designed for efficiency and speed, the app allows users to open, close, and manage positions with precision directly from their mobile devices.

Key Features:

-

Flexible Order Execution: Place market, limit, and stop orders while adjusting trade size and exposure on existing positions.

-

Intuitive Interface: Navigate charts, accounts, and trade settings seamlessly with a responsive and user-friendly design.

-

Real-Time Data & Advanced Execution: Stay ahead with instant price updates and swift trade execution, ensuring critical decisions can be acted on without delay.

-

Professional-Grade Mobile Trading: MT4 mobile empowers both casual and professional traders to respond quickly in volatile markets, maintaining the same robust tools available on the desktop platform.

With the Exness MT4 mobile app, you can trade confidently on the go, combining flexibility, precision, and advanced trading tools in one streamlined mobile experience.

Look and Feel

The Exness MT4 mobile platform combines sleek design with intuitive functionality, delivering a polished trading experience on both iOS and Android devices. Its clean layout and thoughtfully arranged features allow traders to navigate charts, execute orders, and manage positions effortlessly, whether at home or on the move.

Designed for traders of all levels, the user-friendly interface ensures smooth mobile trading, minimizing learning curves for beginners while providing advanced tools for seasoned traders. With MT4 mobile, you stay connected to the markets anywhere, anytime, making it a reliable choice for responsive and efficient trading.

Login and security

The Exness MT4 mobile platform offers a straightforward, single-step login that provides quick access to your trading account. While this simplicity is convenient, enhancing security with two-factor authentication (2FA) would significantly boost account protection and give traders greater peace of mind.

Currently, the platform does not support biometric login options such as fingerprint scanning or facial recognition. Adding these features would provide a faster, more seamless, and secure way to access accounts, combining efficiency with advanced protection. Implementing enhanced security measures would elevate the mobile trading experience, ensuring both safety and usability for all Exness users.

Search functions

The Exness MT4 mobile app features a powerful and intuitive search system designed to help traders locate instruments and tools quickly. Users can enter the name of a specific asset directly into the search bar or navigate through well-organized category folders to explore available options.

This dual navigation approach ensures both speed and flexibility, allowing traders to efficiently access the markets, monitor preferred instruments, and execute trades without unnecessary delays. By combining precision search with structured browsing, the MT4 app enhances usability and supports a seamless trading experience on the go.

Placing orders

The Exness MT4 mobile platform delivers versatile order placement options, designed to support a wide range of trading strategies. Traders can execute market orders for instant trades, set limit orders to enter at precise price levels, and use stop-loss orders to manage risk and safeguard positions.

For enhanced flexibility, the app also allows order duration settings tailored to different trading approaches:

-

Good ‘til Canceled (GTC): Orders remain active until manually canceled.

-

Good ‘til Time (GTT): Orders automatically expire after a predetermined period.

By combining multiple order types with customizable time controls, MT4 mobile ensures accurate execution and seamless position management, empowering traders to respond quickly to market movements from anywhere.

Alerts and notifications

Currently, the Exness MT4 mobile app does not include alerts or push notifications, a functionality reserved for the desktop platform. Alerts are crucial for staying on top of market movements and executing trades at optimal times, so adding this feature to the mobile app would significantly enhance trading efficiency and responsiveness.

Despite this limitation, traders can still monitor positions and track market activity in real time directly from their mobile devices. For immediate trade alerts and notifications, the desktop MT4 platform remains the preferred solution.

MetaTrader 4: Key Takeaways

MT4 Desktop Platform

The MetaTrader 4 desktop platform provides fast, reliable order execution, making it an ideal choice for traders who value efficiency and precision. While its interface is more traditional and less modern than newer trading platforms, it remains highly functional for executing trades. The charting tools are solid but somewhat rigid, which may limit flexibility for traders performing multi-timeframe analysis or complex technical strategies. Despite its classic design, MT4’s desktop version continues to serve as a trusted environment for professional trading.

MT4 Mobile App

The MetaTrader 4 mobile app delivers efficient trade management on the go, allowing traders to adjust positions, execute orders, and control risk directly from smartphones or tablets. Its speed and convenience are particularly useful during periods of high market volatility. However, the mobile version is less suitable for detailed technical analysis or advanced charting, tasks that are better handled on the desktop platform.

Summary

Exness MT4 offers a comprehensive trading solution, blending desktop reliability and mobile flexibility. Traders benefit from fast execution, intuitive interfaces, and on-the-go access, while more advanced charting and analytical needs are best met with the desktop platform. This combination makes MT4 a versatile tool for both casual and professional traders seeking performance, convenience, and accessibility in their trading experience.

Exness Tradable Instruments

Exness Tradable Instruments Intro

Exness offers a focused yet diverse selection of trading instruments, catering primarily to forex and CFD traders. While the platform does not provide direct access to certain popular asset classes like real stocks or ETFs, it still covers the most sought-after products to meet the needs of the majority of traders.

- Forex Trading: With 96 currency pairs available, Exness delivers an extensive forex offering. This range supports both major and minor pairs, providing traders with flexibility to execute a variety of strategies across different market conditions.

- CFDs and Other Assets: Traders can access 10 indices, 18 commodities, and over 90 stock CFDs. Additionally, Exness features 10 cryptocurrency CFDs, including Bitcoin, Litecoin, and Ethereum against the U.S. dollar, along with seven other CFDs pairing Bitcoin with currencies like the Japanese yen or commodities such as gold. It’s important to note that these CFDs allow trading on price movements only—you cannot directly own the underlying digital assets.

- Social and Copy Trading: Exness also incorporates social trading functionality, enabling users to follow and replicate the strategies of experienced traders. Beginners can benefit from ready-made strategies to learn and profit, while experienced traders can register as strategy managers, design their own systems, and earn a profit share whenever their strategies are copied.

- Overall Offering: While Exness may have a smaller range of tradable instruments compared to some competitors, it covers the essential products that appeal to most traders.

This combination of forex, CFDs, and social trading options makes Exness a compelling choice for traders seeking reliability, variety, and the opportunity to learn from experienced peers.

| Instrument | Type | Number |

|---|---|---|

| Cryptocurrencies | Major, Minor, Crosses | 10 |

| Commodities | Metals, Energies, Softs | 18 |

| Stocks | Global Exchanges | 93 |

| Forex Pairs | Major, Minor, Exotic | 96 |

| Indices | Global Indices | 10 |

What are CFDs ?

A Contract for Difference (CFD) is a financial agreement between a trader and a broker, such as Exness, where the trader agrees to exchange the difference in an asset’s price from the moment the contract is opened to when it is closed.

CFDs allow traders to speculate on rising or falling markets without actually owning the underlying asset. This makes them a flexible alternative to traditional investments like futures or stocks, offering the potential to profit from short-term price movements across a variety of markets, including forex, commodities, indices, and cryptocurrencies.

By trading CFDs, users gain access to a wide range of instruments while maintaining capital efficiency, as they can take positions with leverage and manage risk through stop-loss and limit orders. This combination of flexibility, accessibility, and the ability to act on market movements makes CFDs a popular choice for both beginner and experienced traders

Social Trading

Exness offers a robust social trading platform that empowers traders of all levels to engage in copy trading. Users can participate as either an investor or a strategy manager, depending on their experience and trading goals.

As an investor, you can follow the strategies of seasoned traders, gaining exposure to their techniques without needing to craft your own trading plan. This feature is particularly beneficial for beginners seeking to learn and profit from the expertise of professional traders.

Experienced traders can register as strategy managers, creating and sharing their own strategies with the community. When others replicate your strategies, you earn a profit share, incentivizing high-quality performance and innovative approaches.

The platform provides detailed performance metrics for each strategy, including maximum drawdown, monthly returns, and a Trading Reliability Indicator—a combined measure of safety score and Value at Risk (VaR). These metrics help investors assess strategy quality and make informed decisions. While the platform features over 3,200 providers, filtering options for less-copied or lower-performing strategies could further enhance decision-making.

Exness Social Trading is designed to encourage transparency and accountability. However, investors should remain aware that even well-rated strategies carry risk.

Overall, Exness Social Trading offers a structured and educational environment to leverage the knowledge of top traders.

Exness Instruments: Key Takeaways

Exness provides a diverse range of trading instruments, giving clients access to multiple markets from a single platform. Traders can explore forex, commodities, indices, and cryptocurrencies, offering flexibility to diversify strategies and capitalize on different market conditions.

While the platform excels in these areas, CFDs on shares are somewhat limited compared to broader industry offerings. Expanding access to additional global stock exchanges could further enhance trading opportunities for users seeking equity exposure.

Overall, Exness balances a strong selection of core assets with a user-friendly trading environment, making it a reliable choice for both beginners and experienced traders looking to access a variety of markets

| Instruments Summary | Exness |

|---|---|

| Cryptocurrency (Derivative) | Yes |

| Forex Trading (Spot or CFDs) | Yes |

| Int’l Stock Trading (Non CFD) | No |

| Tradeable Symbols (Total) | 227 |

| U.S. Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Forex Pairs (Total) | 96 |

| Cryptocurrency (Physical) | No |

Exness Leverage

Understanding CFD Leverage at Exness

Leverage is a key feature that attracts traders to forex and CFD markets, allowing them to amplify the size of their positions beyond the funds available in their accounts. Essentially, leverage uses borrowed capital to increase market exposure, which can significantly boost potential profits – but also increases the risk of losses.

At the FSA-regulated Seychelles entity of Exness, traders can access a default leverage of 1:2000. This means that an account with $1,000 can control positions worth up to $2,000,000 in the market. It’s important to remember that leverage acts as a double-edged sword, magnifying both gains and potential losses.

The maximum leverage available varies depending on the equity in your account, offering flexibility to match different trading strategies and risk tolerances. Understanding and managing leverage is crucial for maintaining effective risk management while maximizing trading opportunities.

| Equity Range (USD) | Maximum Available Leverage |

|---|---|

| 0 – 999.99 | 1:2000 by default, 1:Unlimited if eligible |

| 1,000 – 4,999.99 | 1:2000 |

| 5,000 – 29,999.99 | 1:1000 |

| 30,000 or more | 1:500 |

Maximum Leverage by Asset Class

At Exness, available leverage varies depending on the type of trading instrument. Traders can access the highest leverage when trading CFDs on forex pairs and commodities, allowing for greater market exposure with smaller capital. In contrast, leverage on shares and other equity instruments is comparatively lower, reflecting the reduced risk appetite and regulatory requirements for these assets.

This tiered leverage structure enables traders to tailor their risk management strategies according to the asset class, maximizing potential returns while maintaining control over exposure. With TradeWiki.io, you can easily compare leverage options across all asset classes, ensuring you select the instruments that best align with your trading goals and risk tolerance.

| Asset Class | Maximum Available Default Leverage |

|---|---|

| Forex | 1:2000 |

| Metals | 1:2000 |

| Energies | 1:200 |

| Indices | 1:400 |

| Cryptocurrencies | 1:400 |

| Shares | 1:20 |

Account Opening with Exness

Pros:

- Fast

- Low minimum deposit for forex accounts

- User-friendly

Cons:

- None

Exness Account Opening Process

Opening an account with Exness is entirely online, quick, and straightforward. If you have your documents ready, the process typically takes less than 20 minutes, with account approval often completed within one business day. This seamless procedure ensures you can start trading with minimal delay.

The account setup involves five simple steps:

-

Initiate Your Account – Click “Open Account” and enter your email address, password, and country of residence.

-

Choose Account Type and Currency – Select the account type that aligns with your trading style and your preferred base currency.

-

Complete Trading Experience Survey – Provide insights into your prior trading experience to tailor your platform settings.

-

Provide Personal Information – Enter details such as full name, date of birth, and contact information.

-

Upload Verification Documents – Submit identification (passport or national ID) and proof of residence (utility bill or bank statement) to verify your account.

Following these steps ensures a smooth account creation experience, allowing you to access Exness’s powerful trading tools and market opportunities efficiently.

What is the minimum deposit at Exness

Getting started with Exness is simple and accessible, thanks to its low entry barriers. The minimum deposit varies by account type, allowing traders to choose an option that fits their trading style and capital availability.

-

Standard Account: Requires just $10, making it ideal for beginners or those testing the platform.

-

Pro, Raw Spread, and Zero Accounts: The minimum deposit is $200, tailored for more active traders seeking advanced features and tighter spreads.

| Feature | Standard | Standard Cent | Pro | Zero | Raw Spread |

|---|---|---|---|---|---|

| Minimum deposit | Depends on payment system | Depends on payment system | $200 | $200.00 | $200.00 |

| Spread | From 0.2 pips | From 0.3 pips | From 0.1 pips | From 0 pips | From 0 pips |

| Commission | No | No | No commission | From $0.05 each side per lot | Up to $3.50 each side per lot |

| Maximum leverage | 1:Unlimited | 1:Unlimited | 1:Unlimited | 1:Unlimited | 1:Unlimited |

| Instruments | Forex, metals, cryptocurrencies, energies, stocks, indices | Forex, metals | Forex, metals, cryptocurrencies, energies, stocks, indices | Forex, metals, cryptocurrencies, energies, stocks, indices | Forex, metals, cryptocurrencies, energies, stocks, indices |

| Maximum number of positions | Unlimited | 1000 | Unlimited | Unlimited | Unlimited |

| Margin call | 60% | 60% | 30% | 30% | 30% |

| Stop out | 0% | 0% | 0% | 0% | 0% |

| Swap-free | Available | Available | Available | Available | Available |

Exness Account Types

Exness provides traders with a diverse range of account types tailored to different experience levels and trading strategies. Clients can choose from five main accounts: two Standard accounts and three Professional accounts. In addition, Exness offers demo accounts for practice and swap-free Islamic accounts for traders who require them.

The account setup process is fully digital, straightforward, and typically takes less than 10 minutes to complete through the broker’s website.

Standard Accounts

Standard Account – A versatile option suitable for most traders, offering balanced conditions.

Standard Cent Account – Specifically designed for beginners, this account is denominated in cents, allowing new traders to start with smaller trade sizes and lower risk exposure.

Professional Accounts

Raw Spread Account – Provides ultra-tight spreads with commission-based pricing, ideal for scalpers and algorithmic traders.

Zero Account – Features zero spreads on selected instruments during most trading hours, with a transparent commission structure.

Pro Account – Offers no commissions and stable spreads, making it a popular choice for day traders and more advanced strategies.

This tiered structure ensures that Exness can accommodate everyone from new traders taking their first steps in forex to seasoned professionals seeking advanced trading conditions.

Exness Demo Account

Exness provides a fully functional demo account on both the Exness Trading Terminal and the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. A demo account is an essential tool for beginners and experienced traders alike, offering the ability to test strategies and explore the platform without putting real funds at risk.

With live market quotes and conditions that closely replicate real-time trading, the Exness demo account gives users access to forex, commodities, indices, and stock CFDs. This ensures that traders can gain realistic experience in the markets before transitioning to a live trading environment.

The seamless switch between demo and live accounts allows traders to build confidence, refine their trading skills, and prepare for real-money trading. Whether you are new to trading or testing advanced strategies, the demo account is a safe, risk-free way to learn and improve.

Exness Islamic Account

Exness provides swap-free Islamic accounts designed specifically for traders who follow Sharia law. These accounts are available only to residents of Islamic countries, ensuring that Muslim traders can participate in the financial markets without incurring overnight swap fees, which are considered interest and therefore not permissible under Islamic principles.

With an Exness Islamic account, traders maintain access to the same competitive spreads, fast execution speeds, and wide range of trading instruments as standard accounts. The only key difference is that rollover charges are removed, aligning the account structure with Sharia compliance.

For traders seeking a reliable and trustworthy broker that accommodates faith-based requirements, Exness offers a practical solution without compromising on trading features.If you are based in an eligible Islamic country, opening a swap-free account with Exness ensures that your trading activity remains aligned with both your financial goals and your religious values.

Exness Restricted Countries

Traders based in the United Kingdom, European Union, United States, Canada, China, Japan, New Zealand, and Israel are not eligible to open standard retail accounts.

That said, professional trading accounts remain accessible in the UK and EU, provided traders meet the eligibility requirements. This distinction ensures compliance with regional financial authorities while still offering advanced market access to qualified clients.

Before registering, traders should carefully review the latest Exness restricted country list to confirm eligibility. This helps avoid account verification issues and ensures a smooth onboarding process.

For traders outside the restricted regions, Exness continues to provide high-leverage trading, fast execution, and trusted regulatory oversight — making it a preferred broker for many international clients.

If you’re unsure about availability in your country, Trade Wiki recommends checking directly with Exness support for the most up-to-date information.

Exness Research