IG Review 2025 – Words Done

IG Review 2025 – Words Done

Overall Rating

Min. Deposit

Spreads From

Max. Leverage

IG Overview

Founded in 1974 as IG Index, IG Markets has grown into one of the most established and trusted names in online trading. Headquartered in London, IG is publicly traded and licensed by a wide range of top-tier regulators, including the FCA (UK), FINMA (Switzerland), BaFin (Germany), and ASIC (Australia). This global regulatory oversight reinforces its reputation as a secure and transparent broker.

IG provides traders with an exceptional choice of trading platforms, including its proprietary IG Online Trading Platform and mobile app, alongside MetaTrader 4 (MT4), TradingView, L2 Dealer, and ProRealTime. Each platform caters to different trading styles, from casual investors to advanced day traders who require deep market analysis and fast execution.

The broker’s market coverage is one of the broadest in the industry. IG offers access to over 17,000 CFDs spanning forex, indices, commodities, futures, and options, as well as 13,000+ real shares across U.S., U.K., and global exchanges. Its $1 billion acquisition of tastytrade in 2021 further expanded its offering, allowing clients to trade U.S.-listed options and futures directly.

When it comes to pricing, spreads on major forex pairs are highly competitive, appealing to active traders and scalpers. Other asset classes remain close to industry averages, but the overall package is enhanced by IG’s fast order execution, one-click trading, and advanced risk management tools.

IG also stands out for its commitment to education and research. Clients gain access to industry-leading educational resources, daily research reports, market analysis, sentiment data, and tools such as Autochartist signals and the Trade Analyzer. This makes IG a strong choice not only for professional traders but also for beginners who want structured learning and ongoing support.

In short, IG delivers one of the most comprehensive trading experiences available today. Its combination of platform versatility, market depth, advanced tools, and trusted regulation positions it as a top-tier broker for traders of all levels.

IG Pros and Cons

IG Markets Pros:

- Over 50 years of experience

- FX spreads as low as 0.6 pips

- Fast, reliable execution (average of 0.014 seconds)

- Diverse, feature-rich platforms

- DMA Access via L2 Dealer

- VPS hosting

- Trade analytics tool

- Industry-leading research

- First-class educational resources

- No fees for deposits, withdrawals, or account inactivity

- First-class web trading platform

- Superb educational tools

- Great deposit and withdrawal options

IG Markets Cons:

- Web platform has limited customizability

- Proprietary platform looks dated compared to rivals

- Small product range

- Research is high-quality but not fully integrated

- Average mobile app experience

- No social trading features

- Fees can be higher for certain assets

Beginner – Perfect Match

New traders benefit from IG’s interactive courses, live webinars, and demo accounts that replicate real-market conditions. The web-based platform is easy to navigate, while resources like the Trade of the Week newsletter and Autochartist signals help beginners spot opportunities with confidence.

News Trading – Perfect Match

IG’s integrated economic calendar, real-time market coverage from Thomson Reuters, and in-house analyst reports provide rich support for trading around events. The Trade Live with IG broadcast adds further value by offering expert commentary during the UK market open.

Scalping – Perfect Match

For ultra-short-term traders, IG offers lightning-fast execution speeds and support for VPS hosting on MT4, ensuring strategies run without interruption. Advanced tools like the ProRealTime DOM order book and Direct Market Access (DMA) via the L2 Dealer platform give scalpers direct visibility and control over market liquidity.

Investing – Perfect Match

IG isn’t just for active traders. It also caters to long-term investors with access to real shares, ETFs, bonds, SIPPs, and the low-cost IG Smart Portfolios. Clients can even participate in IPOs, while advanced tools like the TipRanks stock screener make finding opportunities simple and efficient

Automated Trading – Perfect Match

For those running algorithms, IG supports both MetaTrader 4 and ProRealTime, complete with backtesting features. With Beeks VPS hosting in London, traders can maximize execution speed while safeguarding against internet or power disruptions.

Swing Trading – Perfect Match

With access to 17,000+ CFDs on global shares and a wide range of ETFs, IG is well-suited for holding trades over days or weeks. Overnight financing costs are in line with industry averages, making it a cost-effective choice for longer-term strategies.

Day Trading – Perfect Match

Active traders need speed and precision — and IG delivers with one-click execution, chart-based order placement, and spreads that are highly competitive on major forex pairs. Additional trade ideas from Autochartist and PIA First provide actionable insights throughout the day.

Who is IG for?

When evaluating IG Markets, it’s clear that the broker offers the features and tools to cater to a wide range of trading strategies. Here’s how it stacks up for different trader styles:

What Sets IG Apart?

Beyond competitive pricing, IG offers an impressive range of instruments across multiple asset classes. Clients can trade CFDs on the spot market, futures, and options, ensuring flexibility for both short-term strategies and longer-term approaches.

The broker also delivers a highly intuitive trading experience through its proprietary platform and mobile app, supported by MetaTrader 4, TradingView, L2 Dealer, and ProRealTime. This versatility means traders can choose the platform that best suits their style – whether they prefer algorithmic strategies, direct market access, or simple chart trading.

IG’s commitment to trader development is another standout feature. With interactive educational tools, webinars, and market analysis, beginners can gain confidence, while experienced traders benefit from professional-grade insights and analytics. Funding and withdrawals are also straightforward, with no hidden fees for most transactions.

That said, traders should note that stock CFD fees can be higher than average, and the range of available products varies by jurisdiction, with many regions limited to CFDs and options. Customer support, while reliable, may be slower than some competitors.

What Sets IG Apart?

IG has established itself as a global leader in forex and CFD trading by combining low trading costs, advanced platforms, and a broad selection of markets. Traders using the Standard account benefit from spreads starting as low as 0.6 pips on EUR/USD and 1.4 pips on the DAX 40, making it one of the most cost-effective choices for active traders.

IG Main Features

Regulations

FCA (United Kingdom), JFSA (Japan), BMA (Bermuda), BaFin (Germany), NFA (United States), ASIC (Australia), FINMA (Switzerland), MAS (Singapore), DFSA (United Arab Emirates), FSCA (South Africa)

Languages

English, Chinese, Arabic, German, French, Italian, Swedish, Japanese

Products

Currencies, Stocks, ETFs, Crypto, Indices, Commodities

Min Deposit

$50

Max Leverage

1:30 (FCA), 1:30 (JFSA), 1:200 (BMA), 1:30 (BaFin), 1:50 (NFA), 1:30 (ASIC), 1:30 (FINMA), 1:20 (MAS), 1:30 (DFSA), 1:30 (FSCA)

Trading Desk Type

Market Maker

Trading Platforms

MT4, ProRealTime, L2 Dealer, TradingView, IG Online Platform

Deposit Options

Wire Transfer, Credit Card, Debit Card, Apple Pay

Withdrawal Options

Wire Transfer, Debit Card, Credit Card

Demo Account

Yes

Foundation Year

1979

Headquarters

United Kingdom

Regulations

FCA (United Kingdom), JFSA (Japan), BMA (Bermuda), BaFin (Germany), NFA (United States), ASIC (Australia), FINMA (Switzerland), MAS (Singapore), DFSA (United Arab Emirates), FSCA (South Africa)

Languages

English, Chinese, Arabic, German, French, Italian, Swedish, Japanese

Products

Currencies, Stocks, ETFs, Crypto, Indices, Commodities

Min Deposit

$50

Max Leverage

1:30 (FCA), 1:30 (JFSA), 1:200 (BMA), 1:30 (BaFin), 1:50 (NFA), 1:30 (ASIC), 1:30 (FINMA), 1:20 (MAS), 1:30 (DFSA), 1:30 (FSCA)

Trading Desk Type

Market Maker

Trading Platforms

MT4, ProRealTime, L2 Dealer, TradingView, IG Online Platform

Deposit Options

Wire Transfer, Credit Card, Debit Card, Apple Pay

Withdrawal Options

Wire Transfer, Debit Card, Credit Card

Demo Account

Yes

Foundation Year

1974

Headquarters

United Kingdom

Start Trading With IG

| Feature | IG Spread Betting | IG Smart Portfolios | IG CFD Trading | IG Share Dealing |

|---|---|---|---|---|

| Platforms | IG Trading Platform, IG Mobile App, MT4 or ProRealTime | IG Trading Platform, IG Mobile App | IG Trading Platform, IG Mobile App, MT4, ProRealTime or L2 Dealer (for DMA) | IG Trading Platform, IG Mobile App, L2 Dealer (DMA) |

| Leverage | 1:30 | None | 1:30 | None |

| Direct Market Access (DMA) | No | No | Yes | Yes |

| Markets | 17,000+ markets including shares, indices, forex, commodities and more | In-house experts invest in a diverse ETF portfolio (shares, bonds, commodities) | 17,000+ markets including shares, indices, forex, commodities and more | 12,000+ shares, 2000+ ETFs and many investment trusts |

| Taxes | UK: No capital gains tax or stamp duty | UK: Stamp duty and capital gains tax apply | UK: No stamp duty, but capital gains tax applies | UK: Stamp duty and capital gains tax apply |

| Demo Account | Yes | No | Yes | No |

| Minimum Deposit | £50 | £0 | £50 | £0 |

IG Full Review

IG Safety

Safety Intro

IG is a well-established and trusted broker with strong global oversight. The company operates under the supervision of multiple financial regulators, including highly respected authorities such as the UK’s Financial Conduct Authority (FCA). This level of regulation provides traders with a secure and transparent trading environment, reinforcing IG’s credibility in the industry.

The parent company, IG Group, is publicly listed on the London Stock Exchange, further highlighting its financial stability and long-standing reputation in global markets. Being a listed entity means IG is subject to strict reporting and governance standards, offering additional layers of accountability and trust for traders.

At TradeWiki.io, we recognize IG as one of the top brokers for traders who value strong regulatory protection, reliability, and access to a wide range of financial markets. If you’re seeking a brokerage that combines security with professional-grade trading conditions, IG delivers an excellent balance between trust and performance.

Pros:

- Negative balance protection

- Listed on stock exchange

- Majority of clients belong to a top-tier financial authority

Cons:

- Does not hold a banking license

IG Regulation

One of IG’s strongest advantages is its extensive global regulation, which provides traders with peace of mind through strict compliance and investor protections. Each IG entity is licensed by respected financial authorities, ensuring robust oversight no matter where you trade.

Here’s a breakdown of IG’s regulatory framework:

IG Markets Ltd (UK) – Authorized and regulated by the Financial Conduct Authority (FCA, Register no. 195355). The FCA is recognized as a Tier-1 regulator, providing the highest level of client protection.

IG Europe GmbH (Germany) – Licensed by the BaFin (registration no. 148759), another Tier-1 regulator.

IG Pty Ltd (Australia) – Regulated by the Australian Securities & Investments Commission (ASIC, ACN 074 536 100), rated as a Tier-1 regulator.

IG US LLC (United States) – Registered with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA ID 0509630), both considered Tier-1 regulators.

IG Bank S.A. (Switzerland) – Overseen by the Swiss Financial Market Supervisory Authority (FINMA), classified as a Tier-1 regulator.

IG Securities Limited (Japan) – Supervised by the Japanese Financial Services Agency (JFSA), also a Tier-1 regulator.

IG Asia Pte Ltd (Singapore) – Regulated by the Monetary Authority of Singapore (MAS, Co.Reg.No. 200510021K), a Tier-2 regulator.

IG Limited (Dubai) – Authorized by the Dubai Financial Services Authority (DFSA, Ref. No. F001780), rated as a Tier-2 regulator.

IG Markets South Africa Ltd – Licensed by the Financial Sector Conduct Authority (FSCA), another Tier-2 regulator.

IG International Limited (Bermuda) – Licensed by the Bermuda Monetary Authority (BMA), classified as a Tier-3 regulator.

This tiered structure highlights IG’s commitment to providing a secure and transparent trading environment across multiple regions. With oversight from top-tier regulators such as the FCA, ASIC, FINMA, BaFin, and JFSA, traders can feel confident knowing their funds are safeguarded under some of the world’s strictest financial standards.

| Entity Features | IG Markets Ltd | IG Europe GmbH | IG Bank SA | IG Australia Pty Ltd | IG US LLC | IG Asia Pte Ltd | IG Limited | IG Securities Limited | IG Markets South Africa Limited | IG International Limited |

|---|---|---|---|---|---|---|---|---|---|---|

| Country/Region | UK | EU | Switzerland | Australia | US | Singapore | UAE | Japan | South Africa | Bermuda/Global |

| Regulation | FCA | BaFin | FINMA | ASIC | NFA/CFTC | MAS | DFSA | JFSA | FSCA | BMA |

| Tier | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 3 |

| Segregated Funds | Yes | Yes | Yes | Yes | No | Yes | No | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | No | No | No | No | No | No | No | No |

| Compensation Scheme | FSCS Up to £85,000 | EdW 90% of your claim, up to €20,000 | No | No | No | No | No | No | No | No |

| Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:50 | 1:20 | 1:30 | 1:30 | 1:30 | 1:200 |

Understanding the Regulatory Protections of Your Account

When choosing a broker, it’s crucial to recognize that regulatory protections differ depending on the jurisdiction of the entity you open an account with. While some regulators enforce strict financial safeguards, others provide more flexible oversight. Traders should always evaluate the level of protection offered by the specific IG Markets entity they plan to use.

- Segregation of Client Funds: All IG entities keep client funds in segregated bank accounts, separate from the company’s corporate capital. This separation reduces the risk of accounting errors and ensures that your trading capital is protected from the broker’s operational funds.

- Negative Balance Protection: Certain IG entities, particularly in the UK and EU, offer negative balance protection. This feature prevents traders from losing more than the balance in their accounts, safeguarding against extreme market volatility.

- Compensation Schemes: IG Markets Ltd clients benefit from the Financial Services Compensation Scheme (FSCS) in the UK, which protects eligible retail traders for up to £85,000 in the unlikely event of broker insolvency. Such schemes provide an added layer of security and confidence for retail investors.

- Maximum Leverage Limits: IG applies leverage caps to limit market exposure and control risk. Higher leverage can amplify both profits and losses, so understanding the leverage offered by each entity is critical. For example, IG International Limited, an offshore entity, provides the highest maximum leverage of 1:200.

By understanding these protections, traders can make informed decisions, balancing risk management with trading opportunities while benefiting from IG’s global regulatory coverage.

How you are protected

Your level of protection as an IG client depends on the specific entity with which you hold your account. Each entity is regulated by different financial authorities, and the coverage provided by investor protection schemes varies accordingly.

Knowing which regulator oversees your account and the corresponding compensation limits is essential. This ensures you understand the safeguards in place for your funds, giving you confidence and peace of mind while trading across IG’s global platforms.

By being aware of the investor protection applicable to your account, you can make informed decisions and trade with greater security, knowing that your investments are backed by established regulatory frameworks.

| Client | Legal entity | Regulator | Protection amount |

|---|---|---|---|

| Singapore | IG Asia Pte Ltd | Monetary Authority of Singapore (MAS) | No protection |

| Switzerland | IG Bank S.A. | Swiss Financial Markets Supervisory Authority (FINMA) | CHF 100,000 |

| Australia | IG Markets Ltd, Australia | Australian Securities and Investment Commission (ASIC) | No protection |

| USA | IG US LLC | Commodity Futures Trading Commission (CFTC), National Futures Association (NFA) | No protection |

| International | IG International Limited | Bermuda Monetary Authority (BMA) | No protection |

| UK | IG Markets Ltd, IG Index Ltd* | Financial Conduct Authority (FCA) | £85,000 |

| New Zealand | IG Markets Ltd, Australia | Financial Markets Authority (FMA) | No protection |

| South Africa | IG Markets South Africa Limited | Financial Sector Conduct Authority (FSCA) | No protection |

| United Arab Emirates | IG Limited | Dubai Financial Services Authority (DFSA) | No protection |

| Europe, excluding UK and Switzerland | IG Europe GmbH | Federal Financial Supervisory Authority (BaFin) | €20,000 |

| Japan | IG Securities Ltd | Japanese Financial Services Authority (FSA) | No protection |

Stability and Transparency

IG stands out for its long-standing presence and operational transparency in the forex and CFD industry. Founded in 1974, IG has over 50 years of experience, making it one of the most established brokers globally. Headquartered in London, the company employs between 1,001 and 5,000 staff, reflecting both its scale and stability.

Transparency is a core focus at IG. Regulatory information is prominently displayed across its website, ensuring clients know which authorities oversee their accounts. Fee structures are clearly detailed on the Costs and Charges page, while comprehensive Customer Agreements are accessible via the Terms and Agreements section.

This combination of historical stability, regulatory clarity, and transparent operations provides traders with confidence, supporting informed decision-making and a secure trading environment.

Is IG Markets safe?

IG is widely recognized for its trustworthiness and stability, making it a reliable choice for traders worldwide. The broker’s strong safety profile is supported by several key factors:

Regulation by Top-Tier Authorities: IG is authorized and regulated by five Tier-1 regulators, including the FCA (UK), ASIC (Australia), FINMA (Switzerland), JFSA (Japan), CFTC (USA), FMA (New Zealand), MAS (Singapore), and operates under EU MiFID passporting. This ensures rigorous oversight and high standards of client protection.

Decades of Experience: With over 50 years in the forex and CFD markets, IG brings a long-standing operational history that demonstrates resilience and reliability.

Publicly Traded and Transparent: IG is listed on the London Stock Exchange with a market valuation exceeding £3.5 billion, offering added transparency and accountability to investors.

Comprehensive Trust Measures: IG maintains a regulated bank, adheres to strict financial safeguards, and enforces clear reporting and operational transparency, giving traders confidence in the safety of their funds.

Overall, IG’s combination of strong regulatory compliance, proven track record, and financial transparency positions it as one of the most secure brokers in the industry for both retail and professional traders.

| Safety Summary | IG Markets |

|---|---|

| Year Founded | 1974 |

| Publicly Traded (Listed) | Yes |

| Bank | Yes |

| Tier-1 Licenses | 5 |

| Tier-2 Licenses | 4 |

| Tier-3 Licenses | 1 |

IG Fees

Fees Intro

IG delivers a competitive trading environment, offering tight spreads on major currency pairs and transparent fee structures for all account types. Here’s an overview based on hands-on testing and the latest available data:

Forex and CFD Spreads:

Major currency pairs, such as EUR/USD, feature some of the lowest spreads in the market, averaging 0.62 pips in July 2023 for Forex Direct accounts. Other instruments are closer to the industry average, with global CFD spreads averaging 0.98 pips during the same period. Low-liquidity sessions can see spreads widen slightly, for example, up to 1.03 pips in certain overnight hours.

Stock CFDs carry higher fees, which is a consideration for traders focused on equity derivatives.

Execution Methods:

IG provides multiple execution options, including DMA access via the Forex Direct account. Forex Direct operates as an agency model, streaming prices directly from interbank liquidity providers and adding only a per-trade commission without widening spreads.

Tiered commissions on Forex Direct accounts reduce costs for high-volume traders, with per-side commissions dropping to $10 per million for monthly volumes exceeding $1.5 billion, resulting in an effective spread as low as 0.82 pips.

Active Trader Rebates:

For EU-regulated professional clients, IG’s three-tier active trader program offers up to 20% off spreads for monthly forex volumes above £300 million. Equivalent premium trader programs in other regions reward high-volume trading across indices, commodities, and shares.

Non-Trading Fees:

IG charges no fees for deposits or withdrawals, and inactivity fees apply only after two years. This low-cost structure benefits both casual and professional traders alike.

Overall Assessment:

While IG is not positioned as a discount broker, its combination of tight spreads, tiered volume rebates, DMA execution, and minimal non-trading fees makes it a strong choice for active forex and CFD traders seeking transparent, cost-efficient trading conditions.

Pros:

- Inactivity fee charged only after 2 years

- No withdrawal fee

Cons:

- High stock CFD trading fees

IG Spreads

Get spreads from actual broker if possible or just use FX Empire

Forex Spreads

| Raw Spread Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Avg. Spread |

| AUDUSD | Australian Dollar vs United States Dollar | 0.03 | 0.83 |

| EURUSD | Euro vs United States Dollar | 0.02 | 0.82 |

| GBPUSD | British Pound vs United States Dollar | 0.23 | 1.03 |

| USDCAD | United States Dollar vs Canadian Dollar | 0.25 | 1.05 |

| USDCHF | United States Dollar vs Swiss Franc | 0.19 | 0.99 |

| USDJPY | United States Dollar vs Japanese Yen | 0.14 | 0.94 |

| AUDCAD | Australian Dollar vs Canadian Dollar | 0.68 | 1.68 |

| AUDCHF | Australian Dollar vs Swiss Franc | 0.41 | 1.41 |

| AUDJPY | Australian Dollar vs Japanese Yen | 0.5 | 1.5 |

| AUDNZD | Australian Dollar vs New Zealand Dollar | 0.77 | 1.77 |

| CADCHF | Canadian Dollar vs Swiss Franc | 0.58 | 1.58 |

| CADJPY | Canadian Dollar vs Japanese Yen | 0.48 | 1.48 |

| CHFJPY | Swiss Franc vs Japanese Yen | 0.86 | 1.86 |

| EURAUD | Euro vs Australian Dollar | 0.8 | 1.8 |

| EURCAD | Euro vs Canadian Dollar | 0.74 | 1.74 |

| EURCHF | Euro vs Swiss Franc | 0.61 | 1.61 |

| EURGBP | Euro vs British Pound | 0.27 | 1.27 |

| EURJPY | Euro vs Japanese Yen | 0.3 | 1.3 |

| EURNZD | Euro vs New Zealand Dollar | 1.32 | 2.32 |

| GBPAUD | British Pound vs Australian Dollar | 1.06 | 2.06 |

| GBPCAD | British Pound vs Canadian Dollar | 1.12 | 2.12 |

| GBPCHF | British Pound vs Swiss Franc | 1.1 | 2.1 |

| GBPJPY | British Pound vs Japanese Yen | 0.82 | 1.82 |

| GBPNZD | British Pound vs New Zealand Dollar | 1.98 | 2.98 |

| NZDCAD | New Zealand Dollar vs Canadian Dollar | 1.04 | 2.04 |

| NZDCHF | New Zealand Dollar vs Swiss Franc | 0.73 | 1.73 |

| NZDJPY | New Zealand Dollar vs Japanese Yen | 0.6 | 1.6 |

| NZDUSD | New Zealand Dollar vs United States Dollar | 0.38 | 1.38 |

| AUDSGD | Australian Dollar vs Singapore Dollar | 0.97 | 1.97 |

| CHFSGD | Swiss Franc vs Singapore Dollar | 2.05 | 3.05 |

| EURDKK | Euro vs Danish Kroner | 11.11 | 12.11 |

| EURHKD | Euro vs Hong Kong Dollar | 2.17 | 3.17 |

| EURNOK | Euro vs Norwegian Kroner | 52.89 | 53.89 |

| EURPLN | Euro vs Polish Zloty | 21.2 | 22.2 |

| EURSEK | Euro vs Swedish Krona | 44.07 | 45.07 |

| EURSGD | Euro vs Singapore Dollar | 0.9 | 1.9 |

| EURTRY | Euro vs Turkish Lira | 95.14 | 96.14 |

| EURZAR | Euro vs South African Rand | 94.68 | 95.68 |

| GBPDKK | British Pound vs Danish Kroner | 18.32 | 19.32 |

| GBPNOK | British Pound vs Norwegian Kroner | 38.14 | 39.14 |

| GBPSEK | British Pound vs Swedish Krona | 28.13 | 29.13 |

| GBPSGD | British Pound vs Singapore Dollar | 2.45 | 3.45 |

| GBPTRY | British Pound vs Turkish Lira | 138.98 | 139.98 |

| NOKJPY | Norwegian Kroner vs Japanese Yen | 0.67 | 1.67 |

| NOKSEK | Norwegian Kroner vs Swedish Krona | 7.53 | 8.53 |

| SEKJPY | Swedish Krona vs Japanese Yen | 0.87 | 1.87 |

| SGDJPY | Singapore Dollar vs Japanese Yen | 0.7 | 1.7 |

| USDCNH | United States Dollar vs Chinese RMB | 2.93 | 3.93 |

| USDCZK | United States Dollar vs Czech Koruna | 5.21 | 6.21 |

| USDDKK | United States Dollar vs Danish Kroner | 4.77 | 5.77 |

| USDHKD | United States Dollar vs Hong Kong Dollar | 0.89 | 1.89 |

| USDHUF | United States Dollar vs Hungarian Forint | 9.48 | 10.48 |

| USDMXN | United States Dollar vs Mexican Peso | 28.57 | 29.57 |

| USDNOK | United States Dollar vs Norwegian Kroner | 36.79 | 37.79 |

| USDPLN | United States Dollar vs Polish Zloty | 15.79 | 16.79 |

| USDRUB | United States Dollar vs Russian Ruble | 65.26 | 66.26 |

| USDSEK | United States Dollar vs Swedish Krona | 30.31 | 31.31 |

| USDTHB | United States Dollar vs Thai Baht | 63.21 | 64.21 |

| USDTRY | United States Dollar vs Turkish Lira | 50.61 | 51.61 |

| USDZAR | United States Dollar vs South African Rand | 79.85 | 80.85 |

| USDSGD | United States Dollar vs Singapore Dollar | 0.85 | 1.85 |

Metal Spreads

| Raw Account | Standard Account | ||

|---|---|---|---|

| Symbol | Product | Avg. Spread | Min. Spread |

| XAGEUR | Silver vs Euro | 0.813 | 1 |

| XAGUSD | Silver vs United States Dollar | 0.894 | 1 |

| XAUAUD | Gold vs Aus | 3.679 | 1 |

| XAUEUR | Gold vs Euro | 3.537 | 1 |

| XAUUSD | Gold vs United States Dollar | 1.083 | 1 |

| XPDUSD | Palladium vs United States Dollar | 162.735 | 1 |

| XPTUSD | Platinum vs United States Dollar | 42.3 | 1 |

Indices Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| AUS200 | Australia S&P ASX 200 Index | 0 | 1.22 |

| DE40 | Germany 40 Index | 0.5 | 1.338 |

| F40 | France 40 Index | 0 | 0.749 |

| JP225 | Japan 225 Index | 6 | 8.858 |

| STOXX50 | EU Stocks 50 Index | 0.2 | 1.76 |

| UK100 | UK 100 Index | 1 | 2.133 |

| US30 | US Wall Street 30 Index | 1 | 1.411 |

| US500 | US SPX 500 Index | 0.2 | 0.492 |

| USTEC | US Tech 100 Index | 1 | 1.807 |

| CA60 | Canada 60 Index | 0.6 | 0.6 |

| CHINA50 | FTSE China A50 Index | 3.29 | 6.953 |

| CHINAH | Hong Kong China H-shares Index | 0 | 2.083 |

| ES35 | Spain 35 Index | 4.2 | 4.426 |

| HK50 | Hong Kong 50 Index | 7 | 8.169 |

| IT40 | Italy 40 Index | 9 | 9 |

| MidDE50 | Germany Mid 50 Index | 7.5 | 27.864 |

| NETH25 | Netherlands 25 Index | 0.19 | 0.19 |

| NOR25 | Norway 25 Index | 0.68 | 0.68 |

| SA40 | South Africa 40 Index | 7.5 | 15.444 |

| SE30 | Sweden 30 | 0.38 | 0.38 |

| SWI20 | Switzerland 20 Index | 3 | 3.5 |

| TecDE30 | Germany Tech 30 Index | 2.3 | 3.172 |

| US2000 | US Small Cap 2000 Index | 0.14 | 0.48 |

CFD Commodities Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| GC25 | Gold Futures | 0.2 | 0.23 |

| BRENT | Brent Crude Oil Futures | 0.02 | 0.028 |

| Cocoa | Cocoa Futures | 3 | 4.608 |

| Coffee | Coffee Futures | 0.3 | 0.3 |

| Corn | Corn Futures | 0.68 | 0.68 |

| Cotton | Cotton Futures | 0.15 | 0.15 |

| OJ | Orange Juice Futures | 1.12 | 1.12 |

| Soybean | Soybean Futures | 1.35 | 1.35 |

| Sugar | Sugar Futures | 0.03 | 0.033 |

| Wheat | Wheat Futures | 0.75 | 0.75 |

| WTI | West Texas Intermediate - Crude Oil Futures | 0.02 | 0.027 |

| XBRUSD | Brent Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

| XNGUSD | Natural Gas Spot vs United States Dollar | 0.002 | 0.004 |

| XTIUSD | WTI Crude Oil Spot vs United States Dollar | 0.03 | 0.034 |

Cryptocurrency Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| BCHUSD | Bitcoin Cash vs United States Dollar CFD | 2.21 | 5.839 |

| BTCUSD | Bitcoin vs United States Dollar CFD | 8.71 | 42.036 |

| DOTUSD | Polkadot vs United States Dollar CFD | 0.011 | 0.013 |

| DSHUSD | Dash Coin vs United States Dollar CFD | 0 | 1.241 |

| EMCUSD | Emercoin vs United States Dollar CFD | 0.157 | 0.157 |

| ETHUSD | Ethereum vs United States Dollar CFD | 4.56 | 11.605 |

| LNKUSD | Chainlink vs United States Dollar CFD | 0.012 | 0.02 |

| LTCUSD | Lite Coin vs United States Dollar CFD | 1.05 | 1.597 |

| NMCUSD | NameCoin vs United States Dollar CFD | 7.895 | 7.895 |

| PPCUSD | PeerCoin vs United States Dollar CFD | 0.184 | 0.276 |

| XLMUSD | Stellar vs United States Dollar CFD | 0 | 0 |

| XRPUSD | Ripple vs United States Dollar CFD | 0.008 | 0.02 |

| ADAUSD | Cardano vs United States Dollar CFD | 0.001 | 0.003 |

| BNBUSD | Binance Smartchain vs United States Dollar CFD | 1.266 | 1.415 |

| DOGUSD | Doge vs United States Dollar CFD | 0.001 | 0.001 |

| UNIUSD | Uniswap vs United States Dollar CFD | 0.061 | 0.064 |

| XTZUSD | Tezos vs United States Dollar CFD | 0.003 | 0.026 |

Bonds Spreads

| All Accounts | All Accounts | ||

|---|---|---|---|

| Symbol | Product | Min. Spread | Avg. Spread |

| EURBOBL | Euro Bobl | 0.01 | 0.01 |

| EURBUND | Euro Bund | 0.01 | 0.011 |

| EURSCHA | Euro Schatz | 0.01 | 0.01 |

| ITBTP10Y | BTP Italian Bonds | 0.02 | 0.02 |

| JGB10Y | Japanese 10 YR | 0.03 | 0.034 |

| UKGB | UK Long Gilt | 0.01 | 0.012 |

| UST05Y | US 5 YR T-Note | 0.014 | 0.014 |

| UST10Y | US 10 YR T-Note | 0.031 | 0.031 |

| UST30Y | US T-Bond (30 year) | 0.03 | 0.031 |

IG Commission Rates

IG applies a commission-based model for CFDs on shares, allowing clients to trade at true market prices without any spread markups. Instead of widening spreads, IG charges a fee whenever positions are opened or closed, with a minimum commission applied per transaction.

For smaller trades, these commissions can be relatively high. For instance, purchasing a single share of NVDA would incur a $15 commission per side, totaling $30 for a round-trip trade. This structure ensures transparency and direct market pricing but may impact traders making frequent small-volume equity trades.

Overall, IG’s commission model emphasizes fairness and direct access to market prices, making it suitable for traders who prioritize accurate pricing over ultra-low per-trade costs.

Commission Rates:

| Market | Commission per side | Minimum charge (phone) | Minimum charge (online) |

|---|---|---|---|

| UK | 0.10% | £15 | £10 |

| US | 2 cents per share | $25 | $15 |

| European | 0.10% | €25 | €10 |

IG Swap Fees

IG applies swap rates for positions held overnight, reflecting either a cost or credit depending on whether the trade is long (buy) or short (sell). These fees are calculated per full-sized contract, which represents 100,000 units of the base currency – the first currency listed in the pair.

The swap charges or credits vary by instrument and market conditions, and they are an essential consideration for traders holding positions beyond a single trading day.

Understanding IG’s swap structure helps traders manage the cost of carry effectively, optimize position timing, and make informed decisions for both short-term and longer-term trades.

| Instrument | Swap Short | Swap Long |

|---|---|---|

| GBP/JPY | Charge of $31.10 | Credit of $19.30 |

| EUR/USD | Credit of $0.70 | Charge of $7.30 |

IG Non-Trading Fees

IG provides a highly cost-efficient structure for non-trading activities. There are no fees for deposits or withdrawals, ensuring clients can fund and access their accounts without additional costs.

Inactivity fees are minimal and only apply after two years of account dormancy. For most entities, this fee is $12 per month, while certain jurisdictions, such as the Bermuda entity, apply a slightly higher rate of $18 per month after the same period.

This transparent fee structure makes IG an attractive option for traders seeking low overhead costs and predictable account management.

Are IG Fees Competitive?

Yes. IG provides a cost-efficient trading environment, making it an attractive choice for both beginners and seasoned traders. Popular forex pairs feature spreads starting from just 0.6 pips, keeping trading costs low and predictable.

The broker charges no account maintenance fees and imposes no costs for deposits or withdrawals, allowing traders to manage their accounts without hidden charges. Inactivity fees are minimal and only apply after extended periods of account dormancy.

Overnight swap fees are generally in line with industry norms, offering transparency and consistency for traders holding positions. Overall, IG’s fee framework combines affordability with clarity, supporting cost-conscious trading strategies.

| Fees Summary | IG |

|---|---|

| Average Spread EUR/USD - Standard | 0.98 |

| All-in Cost EUR/USD - Active | 0.82 |

| ACH or SEPA Transfers | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Active Trader or VIP Discounts | Yes |

| Skrill (Deposit/Withdraw) | No |

IG Markets Deposit and Withdrawals

Deposit and Withdrawal Intro

IG provides clients with multiple convenient ways to fund and access their trading accounts. Deposits and withdrawals can be made via bank wire transfer, credit or debit cards, and PayPal, ensuring flexibility to suit different preferences.

Both deposits and withdrawals are processed quickly relative to industry standards and are free of any fees, allowing traders to move funds without extra costs. This combination of speed, reliability, and no-cost transactions makes IG an efficient choice for managing trading capital.

Pros:

- Credit/Debit card available

- No deposit fee

- Free withdrawal

Cons:

- None

IG Account Base Currencies

At IG, you can choose from the following base currencies:

| SGD | USD | AUD |

| GBP | HKD | EUR |

When opening an IG trading account, the base currency cannot be chosen immediately during registration. To change the account currency, you must contact IG’s Customer Service via email, which can make the process slightly less convenient.

Despite this, IG still offers a strong selection of base currencies compared to many competitors, providing flexibility for traders. Choosing a base currency that matches your bank account or the assets you trade can help you avoid unnecessary currency conversion fees, saving money on each transaction.

A practical strategy to further reduce conversion costs is to open a multi-currency account with a digital bank. These accounts typically support several currencies, offer competitive exchange rates, and allow free or low-cost international transfers – all accessible in just a few minutes via a mobile app. This approach streamlines funding and maximizes cost efficiency for IG traders.

IG Deposit Fees and Options

IG does not charge any fees for deposits, making it cost-effective to fund your trading account. Traders can choose from a variety of deposit methods, including traditional bank transfers, credit and debit cards, and electronic wallets such as PayPal.

For card deposits, IG accepts:

Debit cards: Maestro, Visa, Electron, MasterCard

Credit cards: Visa, MasterCard, Discover

Major prepaid cards

Bank transfers may take several business days to process, while credit and debit card payments are typically instant. For security and compliance, IG only accepts deposits from accounts registered in the trader’s name.

With multiple deposit options and zero fees, IG ensures that funding your account is both convenient and efficient, allowing you to start trading quickly without unnecessary costs.

IG deposit methods and fees:

| Method | Processing Time | Fees |

|---|---|---|

| Bank Wire | Same day, or 1-3 days international | $0 |

| Visa Debit/Credit | Typically instant | $0 |

| Mastercard Debit/Credit | Typically instant | $0 |

IG Withdrawal Fees and Options

IG offers one of the fastest and most cost-effective withdrawal processes in the industry. Unlike many CFD brokers that levy fees for bank wire transfers, IG provides withdrawals without any charges, allowing traders to access their funds quickly and efficiently. This streamlined approach ensures that clients can move money with minimal delays, reflecting IG’s commitment to transparency and superior client service.

IG withdrawal methods and fees:

| Method | Processing Time | Fees |

|---|---|---|

| Bank Wire | Same day for UK bank withdrawals, or next business day depending on cutoff time (noon UK time) | $0 |

| Mastercard Debit/Credit | 2–5 business days | $0 |

| Visa Debit/Credit | 2 business days or instant for Spread Betting and CFD accounts | $0 |

How long does IG withdrawal take?

Withdrawing funds from IG is straightforward and efficient. In our tests, using a debit card for withdrawals took approximately 2 business days to reflect in the account.

IG offers fast and reliable withdrawal methods, ensuring that traders can access their funds quickly without unnecessary delays, enhancing overall convenience and user experience.

How do you withdraw money from IG?

Withdrawing money from your IG account is simple and user-friendly. Follow these steps to complete a withdrawal quickly:

Log in to your IG account via the ‘My IG’ portal.

Choose the account you want to withdraw funds from.

Access the menu by clicking the three dots on the right-hand side of your account dashboard.

Select “Withdraw Funds” from the dropdown options.

Pick your preferred withdrawal method, such as bank transfer, debit/credit card, or PayPal.

Enter the amount you wish to withdraw.

Confirm and submit the withdrawal request to initiate the transfer.

IG ensures a smooth withdrawal process, allowing traders to access their funds efficiently with minimal delays.

IG Trading Platforms and Tools

Trading Platforms and Tools Intro

IG provides a comprehensive suite of trading platforms designed to meet the needs of traders at all levels, from beginners to experienced professionals. Its proprietary web and mobile platforms are highly regarded in the industry, offering intuitive navigation, robust features, and seamless access to market data. Sentiment insights drawn from IG’s extensive client base enhance decision-making for forex and CFD traders alike.

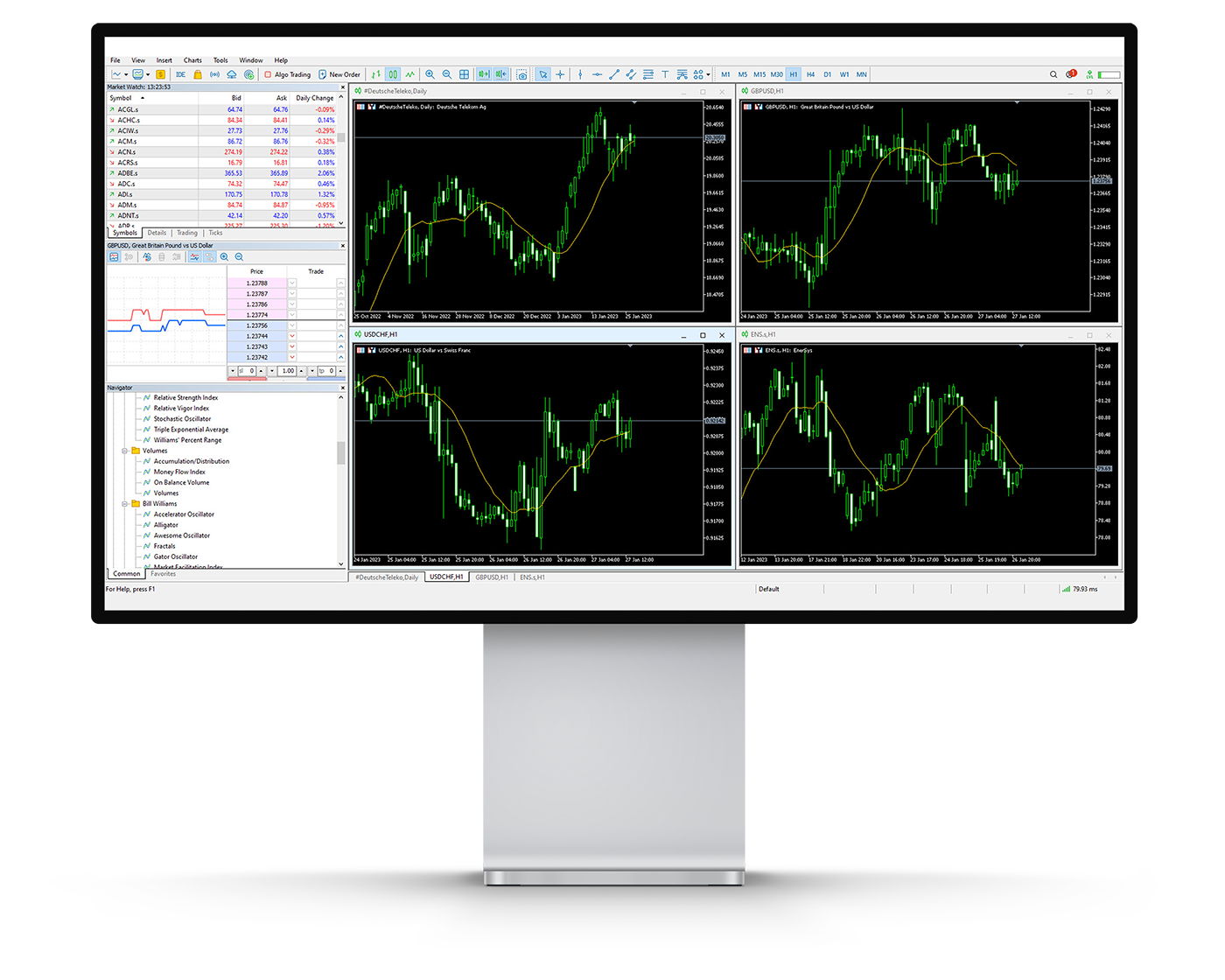

In addition to its proprietary platform, IG supports several other trading environments, including MetaTrader 4 (MT4), TradingView, ProRealTime, and L2 Dealer. Each platform caters to different trading styles and requirements:

Web Platform: IG’s award-winning web platform was recognized as the #1 Web Platform in 2025. It combines user-friendly design with advanced charting tools, live streaming of market prices, and integrated bid/ask quotes. Traders can create multiple custom layouts, access over 11 technical indicators, and set up to four alerts per indicator. Tick charts, various chart types, and an intuitive trade ticket interface make managing trades, stops, and limits fast and precise.

ProRealTime Charts: Exclusive to IG in the U.K., ProRealTime offers nearly 100 indicators and supports automated strategies. The platform costs £30 per month unless at least four trades are executed each period. While highly customizable, its floating window design may feel less modern compared to grid-based layouts.

L2 Dealer and DMA Access: The L2 Dealer platform provides direct market access (DMA) and is suitable for active traders seeking advanced order types and volume-based discounts. A minimum deposit of $1,000 is required, making it ideal for professional traders looking to leverage IG’s sophisticated execution tools.

MetaTrader 4 (MT4): While popular, MT4 offers a more limited range of products and is generally recommended for traders who prefer a familiar interface and basic charting features.

Integrated Trading Signals: IG incorporates signals from providers like PIA First and Autochartist directly into its web platform. Traders can quickly copy signal recommendations into trade tickets, streamlining execution and enhancing strategy implementation.

IG’s platform ecosystem is designed to accommodate diverse trading approaches, providing flexible tools, advanced charting, and reliable market insights, all aimed at improving trading efficiency and decision-making.

MetaTrader 4

MetaTrader 4 Desktop Intro

IG’s MetaTrader 4 (MT4) desktop platform is engineered to serve both beginner and professional traders, providing a seamless interface for charting, order management, and monitoring trading instruments. While the visual design may feel less modern compared to the latest trading software, MT4 is highly dependable and well-suited for precision trading.

Platform Compatibility & Global Access

IG’s MT4 works on both Windows and Mac systems, supporting 52 languages including English, French, Spanish, German, Arabic, and Chinese. This extensive language coverage ensures that traders worldwide can navigate the platform comfortably and efficiently.

Key Features for Traders

Custom Alerts: Users can set notifications for specific price levels, helping to identify ideal entry and exit points.

Watchlist Management: Organize favorite instruments and monitor market movements with personalized watchlists.

One-Click Trading: Execute trades instantly at the current market price, ideal for scalping or high-frequency trading.

Chart-Based Trading: Place orders directly from charts, specifying entry, volume, stop-loss, and take-profit levels.

Expert Advisor (EA) Integration: MT4 supports automated trading, enabling traders to run, test, and optimize Expert Advisors with the built-in strategy tester. This functionality allows algorithmic traders to refine strategies across different market conditions.

Why MT4 on IG Excels

With advanced automation tools, customizable alerts, and direct chart trading, IG’s MT4 desktop platform offers a professional-grade environment that combines flexibility, precision, and efficiency. Whether you are a novice seeking an intuitive interface or an experienced trader needing robust trading features, MT4 on IG provides a reliable foundation for executing sophisticated trading strategies.

Pros:

- Clear fee report

- Price alerts

- Good customizability (for charts, workspace)

Cons:

- Search function could be improved

- Poor design

Charts

IG’s MetaTrader 4 (MT4) platform delivers a comprehensive set of charting and analytical tools designed to support both strategic and technical trading. Whether you are executing manual trades or running algorithmic strategies, MT4 provides the flexibility needed for in-depth market analysis.

- Technical Indicators: Traders can access 38 built-in technical indicators covering trend analysis, volume tracking, and oscillators. These tools allow users to evaluate price movements, assess market sentiment, and forecast potential trading opportunities effectively.

- Drawing Tools: MT4 includes 24 drawing tools, such as Fibonacci retracements and Elliott wave patterns, enabling traders to identify key support and resistance levels, chart patterns, and possible breakout points. While these tools enhance detailed analysis, applying multiple indicators simultaneously can make charts appear crowded, so careful layout management is recommended.

- Timeframes and Chart Types: The platform supports 21 different timeframes, allowing multi-timeframe analysis for a nuanced understanding of market trends. Users can visualize price data through line charts, bar charts, or candlestick charts, providing diverse perspectives for identifying trade setups.

- User Considerations: While the breadth of features empowers advanced technical analysis, charts can become cluttered quickly if too many indicators are used. Traders should balance the number of applied tools to maintain clarity and accurate interpretation of price action.

IG’s MT4 charting suite combines robust functionality, flexible analysis options, and professional-grade tools, making it a top choice for traders seeking a reliable platform for both manual and automated trading strategies.

Orders

IG’s MetaTrader 4 (MT4) platform provides a versatile and professional-grade environment for executing trades, catering to both manual and high-frequency trading strategies. With multiple order types and one-click functionality, traders can implement strategies with precision and speed.

- Market Orders: Market orders allow for immediate execution at the best available price. While the requested trade volume is guaranteed, the exact entry price may fluctuate slightly due to real-time market movements, ensuring fast participation in active markets.

- Limit Orders: Limit orders give traders control over entry points by specifying the exact price at which they wish to enter the market. These orders will only execute if the market reaches the predetermined level, offering precision for strategic entries and exits.

- Stop Orders: Stop orders function as essential risk management tools, helping limit potential losses. A stop-loss is placed above or below the current market price, and if triggered, it converts into a market order executed at the optimal price available, protecting traders from excessive downside exposure.

- One-Click Trading: MT4’s one-click trading feature enhances efficiency by enabling instant order execution directly from the platform. This functionality is particularly valuable for scalpers, day traders, and automated trading systems seeking rapid responses to market changes.

By combining market, limit, and stop orders with one-click trading, IG’s MT4 platform delivers flexibility, speed, and precision, empowering traders to implement a wide range of strategies confidently, from fast-paced intraday trades to methodical algorithmic approaches.

Mt4 WebTrader

IG’s MetaTrader Web Platform, also known as Web Trader, delivers a streamlined, browser-based trading experience that eliminates the need for additional software. Accessible on any operating system, it offers a flexible solution for traders seeking convenience without compromising functionality.

Key Features of IG Web Trader:

One-Click Trading: Instantly execute trades with a single click, enabling fast responses to market opportunities.

Chart-Based Trading: Place orders directly from your charts, simplifying decision-making and improving reaction times to market movements.

Real-Time Watchlists: Monitor your favorite instruments with live quotes, keeping critical market data at your fingertips.

Comprehensive Trade History: Analyze past trades efficiently to refine strategies and improve performance.

Advanced Technical Analysis: Utilize 30 built-in technical indicators to support informed trading decisions.

Copy and Automated Trading: Follow successful traders through copy trading or automate strategies to enhance efficiency and consistency.

With these robust capabilities, IG’s Web Trader platform offers an intuitive yet powerful environment for traders of all experience levels. Its accessibility, combined with advanced features, makes it a standout choice for those looking for a versatile and reliable Forex trading platform.

MT4 Mobile App

Pros:

- Good search function

- User-friendly

- Price alerts

Cons:

- No two-step (safer) login

IG’s MetaTrader 4 (MT4) mobile application, compatible with both iOS and Android, delivers full-featured trading access directly from your smartphone or tablet. Designed for efficiency and speed, the app allows traders to open, close, and manage positions with precision, making it ideal for active traders who require flexibility while on the move.

Mobile Trading Features:

Order Types: Execute market, limit, and stop orders with ease, while adjusting trade size and exposure on existing positions.

Intuitive Interface: The responsive design ensures smooth navigation, allowing traders to act on opportunities quickly and confidently.

Real-Time Market Data: Integrated with IG’s advanced execution and live pricing, the app keeps traders informed for timely decision-making.

Portfolio Management: Monitor account balances, track open positions, and review trading history effortlessly from your mobile device.

By combining portability, precision, and professional-grade tools, IG’s MT4 mobile platform empowers both casual and experienced traders to respond instantly in dynamic markets, ensuring you never miss a trading opportunity.

Fx Empire :

Forex Brokers :

Broker Chooser : Mobile app – From : Look and feel until Alerts and notifications.

Look and Feel

IG delivers a polished and intuitive MT4 mobile trading platform that balances aesthetics with functionality. The clean design and thoughtfully organised features make navigation effortless, allowing traders to access charts, place orders, and manage positions quickly. Whether you are a beginner or an experienced trader, the platform’s user-friendly interface ensures a seamless mobile trading experience, empowering you to stay connected to the markets anytime, anywhere.

Login and security

IG’ MT4 mobile platform currently offers a single-step login, providing basic access to your trading account. While straightforward, enhancing security with two-factor authentication would significantly strengthen account protection. Additionally, the platform does not yet support biometric login such as fingerprint or facial recognition, which could offer a faster and more convenient way for traders to securely access their accounts. Implementing these features would elevate both security and usability for mobile users.

Search functions

IG’s mobile MT4 app offers an efficient search system designed to help traders quickly locate the instruments or tools they need. Users can type the name of a specific product directly into the search bar or browse through organised category folders to explore available options. This dual approach ensures both speed and flexibility, making it easier for traders to navigate the platform and access relevant trading assets without hassle.

Placing orders

IG’s mobile MT4 trading platform provides flexible order placement options to accommodate a variety of trading strategies. Traders can choose from market orders for immediate execution, limit orders to enter at a specific price, and stop-loss orders to manage risk and protect positions.

Additionally, the platform supports order time settings to suit different trading approaches:

Good ‘til Canceled (GTC): Orders remain active until manually canceled.

Good ‘til Time (GTT): Orders expire automatically after a specified duration.

This combination of order types and time controls ensures precise execution, whether you’re trading on the go or managing positions from your mobile device.

Alerts and notifications

IG’s mobile MT4 trading app currently does not support alerts or notifications, a feature that remains exclusive to the desktop platform. Alerts are essential for monitoring market movements and executing timely trades, so integrating this functionality into the mobile app would significantly enhance the trading experience.

Traders using the mobile platform can still manage positions and monitor market activity in real time, but for instant trade alerts and notifications, the desktop version remains the go-to solution.

MetaTrader 4: Key Takeaways

MT4 Desktop Platform

MetaTrader 4’s desktop version offers fast and reliable order execution, appealing to traders who prioritize efficiency. However, its older, more rugged interface can feel outdated compared to modern, sleek trading platforms. Charting capabilities are functional but relatively rigid, making it less ideal for traders who rely on flexible, scalable charts for multi-timeframe analysis and complex technical studies.

MT4 Mobile App

The MetaTrader 4 mobile app is designed for efficient trade management on the go, making it an indispensable tool during periods of market volatility. Traders can quickly adjust positions, execute orders, and manage risk directly from their smartphone or tablet. While its speed and convenience are strong points, the app is less suitable for detailed technical analysis and in-depth charting, which may require a desktop platform for comprehensive evaluation.

In summary, MT4 provides a balanced solution for both mobile and desktop trading, combining speed and reliability with the convenience of on-the-go access, while more advanced charting and analytical tasks may be better suited to desktop use.

TradingView

TradingView Intro

IG fully integrates the TradingView platform, delivering high-definition charts and intuitive trading signals ideal for both novice and professional traders. Its charting capabilities are among the most advanced in the industry, allowing price action to be displayed clearly and scaled seamlessly across multiple timeframes.

With over 150 analytical tools and customizable chart configurations, TradingView provides traders with everything needed for technical analysis, from trend lines and indicators to advanced oscillators. Order execution is streamlined, enabling efficient trade placement without disrupting workflow.

Beyond charting, TradingView hosts one of the largest social trading communities, connecting traders worldwide to exchange strategies, insights, and market ideas. This combination of powerful charting and community engagement makes TradingView an essential platform for traders seeking both precision and collaboration.

Pros:

- Powerful Charting Tools for Technical Analysis

- Built-in Social Trading Community

- Cloud-based Access Across All Devices

Cons:

- Full Features Require a Paid Subscription

Orders

- Advanced Charting Features: IG integrates TradingView directly into its platform, offering traders a professional-grade charting experience. Users can select from candlesticks, Heikin Ashi, Renko, Kagi, and other chart types across multiple timeframes with customizable themes. Multi-chart layouts enable side-by-side comparisons of different assets or timeframes, helping traders quickly spot trends and identify potential trading opportunities.

- Technical Indicators for Informed Decisions: With over 100 built-in technical indicators, including Moving Averages (MA), Relative Strength Index (RSI), MACD, Bollinger Bands, and candlestick pattern recognition, traders can analyze market conditions with precision. These tools allow for accurate assessments of trend direction, momentum, and possible entry or exit points.

- Comprehensive Drawing Tools: The platform provides a full suite of drawing tools for detailed technical analysis. Options like trend lines, Fibonacci retracements, and support/resistance levels help traders visually map out strategies and interpret market movements more effectively.

- Custom Alerts and Notifications: Traders can set alerts based on price levels, indicators, or specific market events. Notifications are delivered via popups, audio signals, emails, SMS, and mobile push notifications, ensuring users stay informed of critical market changes without constantly monitoring charts.

- Fundamental Analysis Integration: Beyond technical analysis, IG supports fundamental research through TradingView. Traders can access financial statements, valuation ratios, and historical company data, allowing for a combined technical and fundamental approach to trading strategies.

- Extensive Market Data Coverage: The broker provides access to a wide range of markets, including forex, commodities, stocks, and cryptocurrencies. This broad coverage enables traders to implement multi-asset strategies and diversify their portfolios from a single platform.

- Pine Script for Custom Strategies: Advanced traders can create personalized indicators, automated trading strategies, and alerts using TradingView’s Pine Script language. IG supports these scripts, offering flexibility for algorithmic trading and tailored technical setups.

IG delivers a complete charting and analysis solution, suitable for both beginners and experienced traders. From advanced charts and technical indicators to drawing tools, alerts, and customizable scripts, the platform equips users with the tools needed to trade confidently and make informed decisions across multiple markets.

Social Community and Network

- Connect with a Global Trading Community: IG integrates TradingView’s social network to provide traders with access to a vibrant global community. This feature allows users to exchange ideas, discuss strategies, and collaborate with like-minded traders from around the world, fostering continuous learning and growth.

- Trading Ideas Hub: At the heart of TradingView’s community is the Trading Ideas feature. IG users can explore a wide range of strategies and analyses shared by other traders, comment on posts, and participate in discussions. This interactive environment helps traders gain new perspectives and refine their own trading approaches.

- Follow Experienced Traders: Traders can identify and follow seasoned professionals whose insights resonate with them. By following these users, IG clients receive updates whenever new content is posted, allowing them to incorporate proven strategies and market observations into their own trading routines.

- Live Video Streams: IG users can watch live streams where traders share real-time market analysis, trading strategies, and insights. These interactive sessions offer an immersive learning experience, enabling participants to ask questions, clarify concepts, and engage directly with the streamer.

- Real-Time Chat and Collaboration: The platform also features real-time chat, allowing IG traders to join topic-specific rooms or create their own discussions. This facilitates instant exchange of ideas, debate on market trends, and collaborative analysis, enhancing decision-making and community engagement.

By combining IG’ robust trading infrastructure with TradingView’s social features, traders gain not only technical tools but also a dynamic, interactive learning environment. From discovering innovative trading ideas and following experienced traders to engaging in live streams and chat discussions, IC Markets empowers its users to learn, connect, and trade more effectively.

TradingView Mobile App

Pros:

- Comprehensive Charting on the Go

- Real-Time Alerts and Notifications

- Community Integration

Cons:

- Smaller Screen Limitations

IG’ TradingView mobile application, available for both iOS and Android, delivers full access to advanced charting, market analysis, and trading tools directly from your smartphone or tablet. The app is designed for precision and efficiency, allowing traders to monitor markets, analyse price action, and manage positions anytime, anywhere.

Traders can access a wide range of chart types, technical indicators, and drawing tools, as well as create custom alerts based on price levels, technical signals, or market events. Multi-chart layouts and interactive charts ensure users can track multiple assets or timeframes simultaneously, while notifications via push, email, or SMS keep them informed of significant market movements in real time.

With seamless integration to IG’ trading accounts, the TradingView mobile platform allows traders to execute orders, adjust positions, and implement strategies on the go. Combined with IG’ reliable execution and real-time data, the app provides a professional-grade mobile trading experience, making it an essential tool for both active and algorithmic traders who require flexibility and precision in dynamic markets.

Look and Feel

IG provides access to a sleek and highly intuitive TradingView mobile app that combines advanced functionality with a clean, modern design. The thoughtfully organised interface makes it easy for traders to access interactive charts, technical indicators, and drawing tools, while also placing and managing trades directly from their mobile device. Whether you are a beginner or a seasoned trader, the user-friendly layout ensures a smooth and efficient mobile trading experience, keeping you connected to the markets and in control of your strategies at all times.

Login and security

IG’ TradingView mobile integration allows users to access their accounts securely using standard email and password credentials. Traders can also enable two-factor authentication (2FA) through their TradingView account for added protection. Device-level biometric features, such as fingerprint or facial recognition, are supported on iOS and Android, providing an optional, convenient way to log in while maintaining security.

Search functions

IG’ TradingView mobile app provides a robust search feature that allows traders to quickly find instruments, assets, or symbols. Users can type the name or ticker of a specific market directly into the search bar, or browse categories such as forex, stocks, commodities, and cryptocurrencies. This functionality ensures fast and efficient navigation, making it easy to access the desired trading instruments on the go.

Placing orders

IG’ TradingView mobile app offers versatile order placement options to support a range of trading strategies. Traders can execute market orders for immediate execution, limit orders to enter at a specified price, and stop orders to manage risk and protect positions.

The platform also provides flexible order duration settings:

Good ‘til Canceled (GTC): Orders remain active until manually canceled.

Good ‘til Time (GTT): Orders automatically expire after a set period.

These features ensure that traders can enter and manage trades with precision, whether monitoring markets on the move or adjusting positions from their mobile devices.

Alerts and notifications

IG’ TradingView mobile app fully supports alerts and notifications, a feature that enhances real-time trading on the go. Traders can create custom alerts based on price levels, technical indicators, or specific market events.

Notifications are delivered via push notifications, email, or in-app alerts, ensuring users are informed immediately of critical market movements. This functionality allows traders to monitor positions, react to market changes, and execute trades promptly, making the mobile app a powerful tool for both active and passive trading strategies.

TradingView: Key Takeaways

- TradingView Desktop Platform: TradingView’s desktop platform offers advanced charting, a wide array of technical indicators, and full access to social and community features. Its flexible interface allows traders to analyse multiple assets simultaneously, perform in-depth technical studies, and create custom indicators or automated strategies using Pine Script™. While highly feature-rich, the desktop platform is best suited for traders who need detailed charting and comprehensive market analysis.

- TradingView Mobile App: The TradingView mobile app brings most desktop functionality to iOS and Android devices, providing access to real-time charts, technical indicators, alerts, and social network features. Traders can monitor markets, manage positions, and set custom alerts on the go. While the mobile app is highly capable and convenient for real-time trading and analysis, extremely detailed charting or complex Pine Script development may be more efficiently handled on the desktop platform.

TradingView delivers a seamless trading experience across both desktop and mobile, combining powerful analysis tools with flexible access to charts, indicators, and social trading. The mobile app ensures traders remain connected to the markets at all times, while desktop use remains ideal for in-depth technical studies and advanced strategy creation.

IG Tradeable Instruments

Tradable Instruments Intro

IG offers one of the most comprehensive selections of tradable instruments in the industry, featuring over 17,000 CFDs across a wide spectrum of markets, including forex, commodities, indices, shares, bonds, and cryptocurrencies. The platform also supports CFDs on futures, options, and spot markets, while U.S. clients can access tastytrade-listed futures and options.

- Core Strengths: IG excels in forex, commodities, shares, and indices, providing traders with robust opportunities across global markets. Cryptocurrency offerings are available via CFDs and, in select regions, through partnerships with platforms like Uphold, allowing direct purchases of assets such as Bitcoin.

- Regional Access and Market Variations: The available instruments may vary depending on the client’s regulatory jurisdiction. Residents of the U.K., New Zealand, Japan, and the U.S. trade under their respective local IG entities. Certain regions, such as the U.K., Germany, and Australia, also allow access to exchange-traded securities and international stock exchanges through IG’s share trading accounts. European clients can trade Turbo warrants via Spectrum (MTF), while eligible Swiss clients may trade via IG Bank.

- Product Scope: Whether you aim to trade CFDs on currency pairs, stock indices, individual shares, ETFs, commodities, bonds, or futures, IG provides an exceptionally wide selection. While the broker primarily focuses on CFDs and forex, some regions permit trading of real stocks, ensuring a versatile trading environment that caters to both beginners and professional traders.

With IG’s diverse and expansive instrument range, traders can access virtually all major financial markets from a single, professional-grade platform.

| Instrument | Type | Number | Industry Average |

|---|---|---|---|

| Bonds and Rates | US, UK and Global | 19 | 1–5 |

| ETFs | US, UK and Global | 6,000+ | 10–25 |

| Forex Pairs | Major, Minor, Exotic | 97 | 30–75 |

| Stocks | US, UK and Global | 13,000+ | 200–300 |

| Commodities | Metals, Energies, Softs | 40 | 5–10 |

| Cryptocurrencies | Major and Minor | 17 | 10–20 |

| Indices | US, UK and Global | 51 | 5–10 |

What are CFDs ?

A Contract for Difference (CFD) is a financial agreement where a trader pays or receives the difference between an asset’s price at the time the contract is opened and its price when the contract is closed. Unlike purchasing the actual asset, CFDs allow traders to speculate on market price movements without taking ownership of the underlying security.

CFDs function similarly to other derivative instruments, such as futures and options, offering flexibility for trading across stocks, forex, commodities, indices, and cryptocurrencies. They are particularly popular among traders seeking leverage, short-selling opportunities, and diversified market exposure while maintaining lower capital requirements compared to directly buying the assets.

By using CFDs, traders on platforms like IG can gain access to a wide range of markets, implement advanced trading strategies, and manage risk effectively, all without the need to physically hold the underlying assets.

IG Instruments: Key Takeaways

IG offers an exceptional variety of tradable instruments, making it a strong choice for both novice and experienced traders. Beyond a broad selection of currency pairs, indices, commodities, bonds, and shares, IG provides access to CFDs on futures and options, which are less commonly available among brokers.

This diverse offering enables traders to implement multi-asset strategies, explore different market sectors, and manage risk effectively. Whether you are interested in forex trading, commodities speculation, or equity CFDs, IG’s instrument range delivers flexibility and opportunities to capitalize on a variety of market conditions.

With such a comprehensive lineup, IG ensures that traders have the tools and access needed to build a diversified portfolio and execute sophisticated trading strategies across global markets.

| Instruments Summary | IG |

|---|---|

| Cryptocurrency (Physical) | Yes |

| U.S. Stock Trading (Non CFD) | Yes |

| Tradeable Symbols (Total) | 19537 |

| Forex Trading (Spot or CFDs) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Cryptocurrency (Derivative) | Yes |

| Forex Pairs (Total) | 97 |

| Social Trading / Copy Trading | No |

IG Leverage

What is CFD Leverage?

CFD leverage is a key factor that attracts many traders to the forex and CFD markets. Leverage allows you to use borrowed funds to increase the size of your trading positions, enabling exposure to larger market movements than your account balance alone would allow.

For retail clients in the UK, the FCA caps maximum leverage at 1:30. This means that with a trading account of $1,000, you could control positions worth up to $30,000. While leverage can significantly amplify potential profits, it equally increases the risk of losses, making it a double-edged sword that requires careful risk management.

Leverage availability varies depending on the asset class. Generally, CFDs on forex offer the highest leverage, while cryptocurrency CFDs provide the lowest. These figures apply to IG’s FCA-regulated UK entity (IG Markets Ltd), providing a clear framework for traders seeking both flexibility and regulatory oversight.

By understanding and managing leverage wisely, traders can enhance their market strategies while mitigating unnecessary risk, making it an essential component of professional CFD trading.

| Asset Class | Maximum Available Leverage |

|---|---|

| Major Forex | 1:30 |

| Minor Forex | 1:30 |

| Exotic Forex | 1:20 |

| Treasuries | 1:30 |

| Indices | 1:20 |

| Metals | 1:20 |

| Energies | 1:10 |

| Softs | 1:10 |

| Shares | 1:5 |

| Cryptocurrencies* | 1:1 |

Account Opening with IG

Pros:

- No minimum deposit for bank transfer

- Low minimum deposit for forex accounts

- Fully digital

Cons:

- Slower account opening

IG Account Opening Process

Opening a CFD trading account with IG’s UK entity is a straightforward process, designed to ensure compliance while providing a smooth onboarding experience for new traders.

To complete your application, you will need to provide the following details:

1. Personal and Contact Information

Full name, email address, and phone number

Country of residence and physical address

Date of birth, nationality, and national insurance number

2. Employment Information

Current employment status, industry, and occupation

3. Financial Background

Gross annual income, existing savings, and investments

4. Trading Experience

Volume and type of trades executed in shares, bonds, exchange-traded derivatives, and OTC derivatives over the past three years

By collecting this information, IG ensures your account is tailored to your experience level and financial situation, creating a secure foundation for trading CFDs.

What is the minimum deposit at IG?

IG offers flexible funding options to accommodate a wide range of traders, making it accessible for both beginners and experienced investors.

Bank Transfers: There is no minimum deposit required when funding your account via bank transfer, allowing you to start trading with any amount.

Credit/Debit Cards and PayPal: For these faster payment methods, the minimum deposit is set at $300, €300, or £250, depending on your currency.

| Feature | IG Spread Betting | IG Smart Portfolios | IG CFD Trading | IG Share Dealing |

|---|---|---|---|---|

| Platforms | IG Trading Platform, IG Mobile App, MT4 or ProRealTime | IG Trading Platform, IG Mobile App | IG Trading Platform, IG Mobile App, MT4, ProRealTime or L2 Dealer (for DMA) | IG Trading Platform, IG Mobile App, L2 Dealer (DMA) |

| Leverage | 1:30 | None | 1:30 | None |

| Direct Market Access (DMA) | No | No | Yes | Yes |

| Markets | 17,000+ markets including shares, indices, forex, commodities and more | In-house experts invest in a diverse ETF portfolio (shares, bonds, commodities) | 17,000+ markets including shares, indices, forex, commodities and more | 12,000+ shares, 2000+ ETFs and many investment trusts |

| Taxes | UK: No capital gains tax or stamp duty | UK: Stamp duty and capital gains tax apply | UK: No stamp duty, but capital gains tax applies | UK: Stamp duty and capital gains tax apply |

| Demo Account | Yes | No | Yes | No |

| Minimum Deposit | £50 | £0 | £50 | £0 |

IG Account Types

The type of trading account you can open with IG largely depends on your country of residence. In most regions, clients have access to accounts that support trading in forex, CFDs, and options, providing a versatile platform for both speculative and strategic trading.

This structure ensures that regardless of location, traders can leverage IG’s professional tools and comprehensive market access to execute diverse trading strategies efficiently.

| Countries | Products |

|---|---|

| All countries, except below | Forex, CFD |

| USA | Forex |

| Austria, Denmark, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Romania, Sweden | Forex, CFD, Options |

| UK*, Ireland, Malta, Cyprus, Australia + some smaller countries, like Gibraltar, the British Virgin Islands, etc. | Stocks, Forex, CFD |

Professional Account

For seasoned traders seeking advanced trading opportunities, IG offers a Professional Account. This account type provides access to higher leverage and enables trading in CFDs on cryptocurrencies, allowing experienced traders to implement more sophisticated strategies.

To qualify for a professional account, traders must meet at least two of the following criteria:

Have executed significant leveraged derivatives trades over the past four quarters.

Maintain a financial instrument portfolio exceeding €500,000.

Work in the financial sector in a role requiring at least one year of experience with derivatives trading.

This account structure is ideal for experienced traders looking to maximize flexibility, leverage, and exposure to diverse financial instruments.

IG Demo Account

IG provides demo accounts for both the IG Web Platform and MetaTrader 4, offering an essential learning environment for new traders. These accounts allow users to practice trading strategies and become familiar with platform features without risking real funds.

Demo accounts include live market quotes and simulate actual trading conditions across a wide range of assets, including forex, CFDs on commodities, indices, and shares. This realistic practice environment helps traders gain confidence and refine their skills. Once comfortable, users can seamlessly transition from a demo account to a live trading account.

IG Islamic Account

IG provides a swap-free Islamic account through its Dubai-based entity, designed to comply with Shariah law. This account type ensures that no overnight interest (swap) is charged on positions, making it suitable for traders seeking Islamic-compliant trading solutions.

It is important to note that the UK entity of IG does not offer Islamic accounts, so clients in other regions should refer to the Dubai-based services if they require a swap-free account.

IG Restricted Countries

IG welcomes clients from most countries around the world, offering broad accessibility for traders seeking CFDs, forex, and other instruments. However, due to international regulatory and compliance requirements, IG does not accept clients from FATF blacklisted nations, including North Korea, Iran, and Myanmar.

IG Research

IG stands out in the research space, offering traders an extensive suite of tools and resources designed to inform decision-making and generate actionable trade ideas. With a combination of in-house analysis, third-party content, and live market coverage, IG caters to both beginner and experienced traders seeking high-quality research.

In-Platform Market Research