Vantage Markets Review 2025: Pros & Cons

Vantage Markets Review 2025: Pros & Cons

Overall Rating

Min. Deposit

Spreads From

Max. Leverage

Vantage Markets Overview

Vantage Markets is a versatile broker in the financial derivatives space, established in 2009 and headquartered in Sydney, Australia. The platform provides access to over 1,000 tradable assets, covering forex, commodities, indices, cryptocurrencies, and CFDs at competitive pricing.

Vantage Markets supports a range of trading platforms to suit various experience levels:

ProTrader Platform: Fully integrated with TradingView, this platform caters to both beginners and advanced traders seeking intuitive charting and analysis tools.

MetaTrader 4 and MetaTrader 5: Well-known for reliability and advanced features, these platforms are compatible with algorithmic trading and expert advisors.

Vantage Mobile App: Designed for traders on the move, enabling efficient order execution, portfolio monitoring, and risk management from smartphones and tablets.

Vantage Markets delivers robust market research through in-house analysts and third-party providers like Autochartist and Trading Central. Educational content and tutorial resources are continually improving, offering insights for both novice and experienced traders. Social trading and copy trading features further enhance the learning experience by allowing users to follow and replicate strategies from successful traders.

The broker offers algorithmic trading support and free Virtual Private Server (VPS) hosting, enabling low-latency execution for high-frequency trading strategies.

Some areas for improvement include a limited selection of CFD stocks from Asian markets and occasional inconsistencies in customer support response times.

When creating the Vantage Markets Review we found that Vantage caters to a wide spectrum of trading styles – day trading, swing trading, position trading, crypto, copy trading, and algorithmic strategies. Its combination of flexible platforms, comprehensive research, and advanced trading tools makes it a strong option for traders seeking both variety and reliability. Independent evaluations from TradeWiki.io also recognize Vantage’s strengths in platform versatility and research capabilities.

Vantage Markets Pros and Cons

Vantage Markets Pros:

- Full TradingView integration with MetaTrader platforms

- Smart Trader tools and copy trading options available

- Collaborates with Bloomberg on research and video content

- Tightly regulated and highly transparent

- Competitive spreads

- 1000+ tradable instruments

- Autochartist and Trading Central tools

- Free VPS hosting

- Low non-trading fees

- Low non-trading fees

- Super fast account opening

- Seamless deposit and withdrawal

Vantage Markets Cons:

- No Asian stocks

- Customer support lacks knowledge in some areas

- Pro ECN account requires a $10,000 minimum deposit

- Standard account spreads can be underwhelming without a large deposit

- Limited product selection

- Investor protection only in the UK

Vantage Markets Summary

Overall

Trust

Instruments

Fees

Platform

Research

Mobile

Education

Beginner – Acceptable Choice

Vantage’s Standard account requires a $50 minimum deposit and offers competitive spreads. The broker provides diverse trading platforms, a broad selection of instruments, and quality educational and market research content. However, customer support may be inconsistent.

News Trading – Perfect Match

Vantage Markets combines premium market research from Autochartist and Trading Central with in-house content, delivering timely insights. News traders can quickly assess market-moving events and react to evolving conditions efficiently.

Scalping – Perfect Match

MT4, MT5, and ProTrader platforms support one-click trading, making them well-suited for scalpers. Free Virtual Private Server (VPS) hosting ensures low-latency execution, which is critical for fast-paced trading.

Investing – Not Recommended

Vantage Markets does not provide access to real stocks, limiting options for traditional value investors.

Automated Trading – Perfect Match

Algorithmic traders can deploy Expert Advisors (EAs) on all platforms. Built-in strategy testers in MT4 and MT5 allow fine-tuning of automated systems, while free VPS hosting guarantees consistent connectivity and minimal execution delays.

Swing Trading – Acceptable Choice

For longer-term strategies, Vantage Markets offers over 70 futures contracts, ETFs, and bonds. Swap fees are average for the industry, and market research is comprehensive, covering key developments and trends.

Day Trading – Perfect Match

Day traders benefit from actionable insights provided by Autochartist and Trading Central, offering a detailed view of emerging trading opportunities. The flagship ProTrader platform includes advanced charting tools, enabling precise technical analysis for intraday strategies.

Social and Copy Trading – Perfect Match

Vantage’s proprietary mobile app supports seamless copy trading. Signal providers can earn commissions from their subscribers, while followers can replicate strategies of top-performing traders. This system allows traders to maximize potential success without extra costs.

Who is Vantage Markets for?

When assessing a broker, it’s essential to determine how well it supports different trading strategies and trader profiles. Vantage offers a range of tools and features tailored to various approaches, making it suitable for both active and casual traders. Here’s an overview:

What Sets Vantage Markets Apart?

Vantage Markets differentiates itself in several key areas, offering features and services that appeal to a wide range of traders. The broker’s Standard account provides trading fees that are consistently more competitive than the industry average, helping both new and experienced traders manage costs effectively.

Educational resources go beyond typical topics, covering in-depth areas like indices trading and advanced strategies. Market research is enhanced through partnerships with Autochartist and Trading Central, giving traders actionable insights and data-driven analysis to inform their decisions.

Vantage Markets is regulated by multiple authorities, including the FCA, as well as regulators in Australia, the Cayman Islands, and Vanuatu, ensuring a high level of transparency and security.

Account opening is fully digital and can be completed in under five minutes, with a wide range of deposit and withdrawal options, most of which are free of charge. Non-trading fees, such as inactivity charges, are minimal or nonexistent, further reducing overhead for clients.

On the downside, the product portfolio is limited to forex and select CFDs, and customer support could be improved, particularly in the relevance and responsiveness of email communications. Investor protection is offered only in the UK, though all accounts benefit from negative balance protection to safeguard traders from losses exceeding their account equity.

Overall, Vantage Markets combines competitive pricing, robust research, and efficient account management, making it a compelling choice for traders focused on forex and CFD markets.

What Sets Vantage Markets Apart?

Vantage Markets Main Features

Regulations

FSCA (South Africa), CIMA (Cayman Islands), ASIC (Australia), VFSC (Vanuatu), FCA (United Kingdom)

Languages

English

Products

Currencies, Stocks, ETFs, Crypto, Bonds, Indices, Commodities, Futures

Min Deposit

$50

Max Leverage

1:500 (FSCA), 1:500 (CIMA), 1:30 (ASIC), 1:500 (VFSC), 1:30 (FCA)

Trading Desk Type

ECN, No dealing desk

Trading Platforms

MT4, MT5, ProTrader

Deposit Options

Credit Card, AstroPay, Apple Pay, Google Pay, Debit Card, PerfectMoney, SticPay, JCB, BitWallet, Wire Transfer, Neteller

Withdrawal Options

Wire Transfer, Credit Card, Debit Card, E-wallets

Demo Account

Yes

Foundation Year

2009

Headquarters

Australia

Regulations

FSCA (South Africa), CIMA (Cayman Islands), ASIC (Australia), VFSC (Vanuatu), FCA (United Kingdom)

Languages

English

Products

Currencies, Stocks, ETFs, Crypto, Bonds, Indices, Commodities, Futures

Min Deposit

$50

Max Leverage

1:500 (FSCA), 1:500 (CIMA), 1:30 (ASIC), 1:500 (VFSC), 1:30 (FCA)

Trading Desk Type

ECN, No dealing desk

Trading Platforms

MT4, MT5, ProTrader

Deposit Options

Credit Card, AstroPay, Apple Pay, Google Pay, Debit Card, PerfectMoney, SticPay, JCB, BitWallet, Wire Transfer, Neteller

Withdrawal Options

Wire Transfer, Credit Card, Debit Card, E-wallets

Demo Account

Yes

Foundation Year

2009

Headquarters

Australia

Start Trading With Vantage Markets

| Account Type | Standard | Raw | Pro |

|---|---|---|---|

| Minimum Deposit | $50 | $50 | $10,000 |

| Swap Free Account | Yes | Yes | Yes |

| Minimum Trade Volume | 0.01 lot | 0.01 lot | 0.01 lot |

| Stop Out | 20% | 20% | 20% |

| Base Currencies | USD, GBP, CAD, AUD, EUR, HKD, JPY, PLN, SGD, NZD, BTC, ETH | USD, GBP, CAD, AUD, EUR, HKD, JPY, PLN, SGD, NZD, BTC, ETH | USD, GBP, CAD, AUD, EUR, HKD, JPY, PLN, SGD, NZD, BTC, ETH |

| Commission* | $0 | $6 | $3 |

| Standard Contract Size | 100,000 units | 100,000 units | 100,000 units |

| Spread From | 1.1 pips | 0.0 pips | 0.0 pips |

| Demo Account | Yes | Yes | Yes |

| Margin Call | 50% | 50% | 50% |

In-Depth Vantage Markets Review

Introduction to Vantage Markets Safety Measures

Vantage Markets operates through multiple licensed and regulated entities across various jurisdictions, ensuring compliance with key financial and safety standards. Client funds are securely held in segregated accounts, and all traders benefit from negative balance protection, which prevents losses from exceeding account equity.

To further enhance security, Vantage Markets provides $1 million in Lloyd’s insurance coverage and maintains membership with The Financial Commission, offering an additional layer of dispute resolution and credibility. While formal investor protection is limited to the UK, the combination of regulatory oversight, insurance, and negative balance safeguards ensures a robust framework for trading with confidence.

Pros:

- Long track record

- Negative balance protection

Cons:

- Financial information is not publicly available

- Not listed on stock exchange

Vantage Markets Regulation and Licensing

Vantage Markets operates under multiple licensed entities worldwide, each subject to different regulatory standards to ensure client protection. Our review uses a three-tier system to rank regulators, with Tier-1 representing the highest level of oversight.

Vantage International Group Limited is regulated by the Cayman Islands Monetary Authority (CIMA), license number 1383491, rated Tier-3.

Vantage Global Prime LLP is authorized by the UK’s Financial Conduct Authority (FCA), license number 590299, also a Tier-1 regulator.

Vantage Markets (Pty) Ltd is licensed by South Africa’s Financial Services Conduct Authority (FSCA), license number 51268, which we rate as Tier-2.

Vantage Global Limited is licensed by the Vanuatu Financial Services Commission (VFSC), license number 700271. We classify VFSC as a Tier-3 regulator. This entity is also a member of The Financial Commission.

Vantage Global Prime Pty Ltd holds a license from the Australian Securities and Investments Commission (ASIC), license number 428901. ASIC is rated as a Tier-1 regulator.

This multi-jurisdictional regulatory framework ensures Vantage meets varying compliance standards, providing transparency, accountability, and structured protection for traders across different regions.

| Entity Features | Vantage Markets (Pty) Ltd | Vantage Global Prime LLP | Vantage Global Limited | Vantage International Group Limited | Vantage Global Prime Pty Ltd |

|---|---|---|---|---|---|

| Country/Region | South Africa, Johannesburg | UK, London | Vanuatu, Port Vila | Cayman Islands, Grand Cayman | Australia, Sydney |

| Regulator | FSCA | FCA | VFSC | CIMA | ASIC |

| Regulatory Tier | 2 | 1 | 3 | 3 | 1 |

| Segregated Funds | Yes | Yes | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes | No | Yes |

| Compensation Coverage | Up to $1,000,000 Lloyd’s insurance | Up to GBP 85,000 via FSCS + Up to $1,000,000 Lloyd’s insurance | Up to EUR 20,000 via The Financial Commission + Up to $1,000,000 Lloyd’s insurance | Up to $1,000,000 Lloyd’s insurance | Up to $1,000,000 Lloyd’s insurance |

| Maximum Leverage | 1:500 | 1:30 | 1:500 | 1:500 | 1:30 |

Understanding Regulatory Protections for Vantage Markets Traders

When selecting a broker, understanding the regulatory safeguards of each entity is crucial. Brokers often operate multiple entities across different jurisdictions, each subject to distinct regulatory standards. Knowing how these protections work can help traders mitigate risks and trade with confidence.

- Compensation Schemes: In addition to segregated accounts and negative balance protection, Vantage Markets offers robust compensation measures. All clients benefit from up to $1,000,000 in coverage under Lloyd’s insurance. Specific entities provide additional safeguards: clients of Vantage Global Limited are covered for up to EUR 20,000 under The Financial Commission, while clients of Vantage Global Prime LLP have up to GBP 85,000 protection via the Financial Services Compensation Scheme (FSCS).

- Maximum Leverage: Vantage Markets caps maximum leverage at 1:500 for retail accounts, balancing the potential for high returns with controlled risk exposure. Understanding leverage limits is essential for managing both profits and potential losses effectively.

- Negative Balance Protection: Vantage Markets provides negative balance protection to retail traders, which ensures that trading losses cannot exceed the funds deposited in the account. This feature is active across all Vantage entities except for Vantage International Group Limited.

- Segregation of Client Funds: Vantage Markets maintains client funds in segregated accounts separate from its corporate accounts across all entities. This separation ensures that clients’ money is insulated from the broker’s operational finances, reducing the risk of mismanagement or accounting errors.

By combining segregated funds, negative balance protection, comprehensive compensation schemes, and clearly defined leverage limits, Vantage ensures a secure trading environment for its clients, providing peace of mind and regulatory confidence.

How Vantage Markets Protects Your Funds

Vantage Markets provides a robust safety framework for traders across its regulated entities. Clients using the UK entity benefit from investor protection, while all accounts enjoy negative balance protection to ensure losses cannot exceed deposits. Additional security comes from Lloyd’s of London insurance, covering up to $1,000,000 per claimant, and client funds are held in segregated accounts separate from company capital. These measures, combined with oversight from multiple regulatory authorities, create a secure environment that prioritizes the protection of your investments.

| Country | Legal entity | Regulator | Protection amount |

|---|---|---|---|

| Australia | Vantage Global Prime Pty Ltd | Australian Securities and Investment Commission (ASIC) | No protection |

| UK | Vantage Global Prime LLP | Financial Conduct Authority (FCA) | £85,000 |

| All clients | Vantage International Group Limited | Cayman Islands Monetary Authority (CIMA) | No protection |

| All other countries | Vantage Global Limited | Vanuatu Financial Services Commission (VFSC) | No protection |

Stability and Transparency of Vantage Markets

Vantage Markets demonstrates strong operational stability and a transparent business model, making it a trustworthy choice for traders. The broker employs nearly 1,000 professionals across its global entities, reflecting both scale and long-term reliability. With over 15 years of industry experience, Vantage Markets has consistently maintained a robust presence in the financial markets.

All key legal documents and corporate information are presented clearly, written in straightforward language that clients can easily understand. This level of transparency ensures that traders have the essential insights needed to make informed decisions. The only minor limitation observed is the lack of detailed information regarding Vantage’s cryptocurrency offerings, which could benefit from further clarification.

Overall, Vantage Markets combines a well-established operational history, a sizable and skilled workforce, and accessible legal transparency, positioning itself as a reliable and credible broker in the global trading landscape.

Is Vantage Markets Safe to Trade With?

Vantage Markets is widely regarded as a highly secure and reliable broker, offering multiple layers of protection for traders. The broker is authorised by four regulatory bodies, including two Tier-1 regulators – the Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). This regulatory coverage ensures that Vantage adheres to strict compliance standards, providing clients with confidence in the safety of their funds.

Additionally, Vantage Markets is a proud member of The Financial Commission, which adds another level of security through dispute resolution services and client compensation frameworks. Traders also benefit from civil liabilities insurance, further reinforcing the protection of client assets.

With a Trust Score of 4 out of 5, Vantage is recognised as a Highly Trusted broker in the industry. While it is not publicly traded and does not operate a bank, its adherence to essential safety requirements and robust regulatory oversight make it a solid choice for both beginner and experienced traders.

| Safety Summary | Vantage |

|---|---|

| Publicly Traded (Listed) | No |

| Year Founded | 2009 |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 2 |

Introduction to Vantage Markets Fees

Vantage Markets offers a competitive trading cost structure designed to cater to both casual and active traders. Its Standard account provides commission-free trading with low spreads, while swaps remain highly competitive. Deposits and withdrawals are free of handling fees, and there is no inactivity fee, making it a cost-effective option for most traders.

For more experienced traders, Vantage’s Raw ECN and Pro ECN accounts deliver tighter spreads paired with low per-side commissions – $3 per side for Raw ECN and $2 per side for Pro ECN. The Pro ECN account generally requires a $10,000 minimum deposit, with specific requirements varying by regulatory entity. These accounts are particularly well-suited for high-volume traders seeking lower trading costs and enhanced pricing.

Active traders can benefit from the Vantage Club program, earning V-Points redeemable for cash rebates, free commission vouchers, or other perks. Premium ECN accounts, such as the Pro+ option, require higher deposits (up to $150,000) but offer significantly reduced commissions, down to $1 per lot on forex and gold.

Additionally, Vantage Markets provides swap-free accounts for clients needing Sharia-compliant trading, as well as perpetual accounts in select regions that allow un-leveraged crypto CFDs to be held overnight without incurring typical carrying costs. Overall, Vantage combines low non-trading fees, flexible account types, and rewards programs to create a broker-friendly environment for traders of all levels.

Pros:

- No inactivity fee

- No withdrawal fee

- Low non-trading fees

Cons:

- High stock CFD fees

Vantage Markets Spreads

Forex Spreads

| Symbol | Product | Commissionyes | Avg. Spread |

|---|---|---|---|

| AUD/CAD | Australian Dollar / Canadian Dollar | 6.0 USD/lot | 0.82 |

| AUD/CHF | Australian Dollar / Swiss Franc | 6.0 USD/lot | 0.74 |

| AUD/CNH | Australian Dollar / Chinese Yuan | 6.0 USD/lot | 3.54 |

| AUD/JPY | Australian Dollar / Japanese Yen | 6.0 USD/lot | 0.93 |

| AUD/NZD | Australian Dollar / New Zealand Dollar | 6.0 USD/lot | 1.1 |

| AUD/SGD | Australian Dollar / Singapore Dollar | 6.0 USD/lot | 1.25 |

| AUD/USD | Australian Dollar / US Dollar | 6.0 USD/lot | 0.39 |

| CAD/CHF | Canadian Dollar / Swiss Franc | 6.0 USD/lot | 0.76 |

| CAD/JPY | Canadian Dollar / Japanese Yen | 6.0 USD/lot | 0.68 |

| CHF/JPY | Swiss Franc / Japanese Yen | 6.0 USD/lot | 1.54 |

| CHF/SGD | Swiss Franc / Singapore Dollar | 6.0 USD/lot | 3.1 |

| EUR/AUD | Euro / Australian Dollar | 6.0 USD/lot | 0.65 |

| EUR/CAD | Euro / Canadian Dollar | 6.0 USD/lot | 0.81 |

| EUR/CHF | Euro / Swiss Franc | 6.0 USD/lot | 0.81 |

| EUR/CZK | Euro / Czech Koruna | 6.0 USD/lot | 24.61 |

| EUR/DKK | Euro / Danish Krone | 6.0 USD/lot | 22.46 |

| EUR/GBP | Euro / British Pound | 6.0 USD/lot | 0.27 |

| EUR/HUF | Euro / Hungarian Forint | 6.0 USD/lot | 44.53 |

| EUR/JPY | Euro / Japanese Yen | 6.0 USD/lot | 0.5 |

| EUR/NOK | Euro / Norwegian Krone | 6.0 USD/lot | 118.15 |

| EUR/NZD | Euro / New Zealand Dollar | 6.0 USD/lot | 1.38 |

| EUR/PLN | Euro / Polish Zloty | 6.0 USD/lot | 39.56 |

| EUR/SEK | Euro / Swedish Krona | 6.0 USD/lot | 102.33 |

| EUR/SGD | Euro / Singapore Dollar | 6.0 USD/lot | 1.64 |

| EUR/TRY | Euro / Turkish Lira | 6.0 USD/lot | 473.86 |

| EUR/USD | Euro / US Dollar | 6.0 USD/lot | 0.13 |

| GBP/AUD | British Pound / Australian Dollar | 6.0 USD/lot | 1.58 |

| GBP/CAD | British Pound / Canadian Dollar | 6.0 USD/lot | 1.08 |

| GBP/CHF | British Pound / Swiss Franc | 6.0 USD/lot | 0.65 |

| GBP/JPY | British Pound / Japanese Yen | 6.0 USD/lot | 0.75 |

| GBP/NZD | British Pound / New Zealand Dollar | 6.0 USD/lot | 1.76 |

| GBP/SGD | British Pound / Singapore Dollar | 6.0 USD/lot | 2.1 |

| GBP/USD | British Pound / US Dollar | 6.0 USD/lot | 0.18 |

| NZD/CAD | New Zealand Dollar / Canadian Dollar | 6.0 USD/lot | 0.89 |

| NZD/CHF | New Zealand Dollar / Swiss Franc | 6.0 USD/lot | 0.78 |

| NZD/JPY | New Zealand Dollar / Japanese Yen | 6.0 USD/lot | 0.79 |

| NZD/SGD | New Zealand Dollar / Singapore Dollar | 6.0 USD/lot | 1.31 |

| NZD/USD | New Zealand Dollar / US Dollar | 6.0 USD/lot | 0.37 |

| SGD/JPY | Singapore Dollar / Japanese Yen | 6.0 USD/lot | 1.39 |

| USD/BRL | US Dollar / Brazilian Real | 6.0 USD/lot | 31.31 |

| USD/CAD | US Dollar / Canadian Dollar | 6.0 USD/lot | 0.1 |

| USD/CHF | US Dollar / Swiss Franc | 6.0 USD/lot | 0.9 |

| USD/CLP | US Dollar / Chilean Peso | 6.0 USD/lot | 7 |

| USD/CNH | US Dollar / Chinese Yuan | 6.0 USD/lot | 3.02 |

| USD/COP | US Dollar / Colombian Peso | 6.0 USD/lot | 34.87 |

| USD/CZK | US Dollar / Czech Koruna | 6.0 USD/lot | 177.39 |

| USD/DKK | US Dollar / Danish Krone | 6.0 USD/lot | 21.55 |

| USD/HKD | US Dollar / Hong Kong Dollar | 6.0 USD/lot | 1.86 |

| USD/HUF | US Dollar / Hungarian Forint | 6.0 USD/lot | 40.62 |

| USD/IDR | US Dollar / Indonesian Rupiah | 6.0 USD/lot | 21.25 |

| USD/ILS | US Dollar / Israeli Shekel | 6.0 USD/lot | 53.77 |

| USD/INR | US Dollar / Indian Rupee | 6.0 USD/lot | 3.52 |

| USD/JPY | US Dollar / Japanese Yen | 6.0 USD/lot | 0.27 |

| USD/KRW | US Dollar / South Korean Won | 6.0 USD/lot | 9.04 |

| USD/MXN | US Dollar / Mexican Peso | 6.0 USD/lot | 48.22 |

| USD/NOK | US Dollar / Norwegian Krone | 6.0 USD/lot | 104.52 |

| USD/PLN | US Dollar / Polish Zloty | 6.0 USD/lot | 31.62 |

| USD/SEK | US Dollar / Swedish Krona | 6.0 USD/lot | 83.84 |

| USD/SGD | US Dollar / Singapore Dollar | 6.0 USD/lot | 1.03 |

| USD/THB | US Dollar / Thai Baht | 6.0 USD/lot | 87.68 |

| USD/TRY | US Dollar / Turkish Lira | 6.0 USD/lot | 239.26 |

| USD/TWD | US Dollar / Taiwan Dollar | 6.0 USD/lot | 3.63 |

| USD/ZAR | US Dollar / South African Rand | 6.0 USD/lot | 77.64 |

Metal Spreads

| Symbol | Product | Commission | Avg. Spread |

|---|---|---|---|

| XAGAUD | Silver / Australian Dollar | 0 | 4.71 |

| XAGUSD | Silver / US Dollar | 0 | 2.26 |

| XAUAUD | Gold / Australian Dollar | 6.0 USD/lot | 6.79 |

| XAUEUR | Gold / Euro | 6.0 USD/lot | 4.48 |

| XAUJPY | Gold / Japanese Yen | 6.0 USD/lot | 4.63 |

| XAUUSD | Gold / US Dollar | 6.0 USD/lot | 0.71 |

| XPDUSD | Palladium / US Dollar | 0 | 47.87 |

| XPTUSD | Platinum / US Dollar | 0 | 48.94 |

Indices Spreads

| Symbol | Product | Commission | Avg. Spread |

|---|---|---|---|

| BVSPX | Bovespa Cash CFD (BRL) | 0 | 157.73 |

| CHINA50 | China A50 Index Cash CFD (USD) | 0 | 0.6 |

| CHINA50ft | CHINA50 Future | 0 | 7.1 |

| CHINAH | Hong Kong China H-shares Cash | 0 | 52 |

| DJ30 | Dow Jones Index Cash CFD (USD) | 0 | 10.54 |

| DJ30ft | DJ30 Future | 0 | 50 |

| ES35 | ES35 Index Cash | 0 | 56.24 |

| EU50 | EUSTX50 Cash | 0 | 19.27 |

| FRA40 | France 40 Index | 0 | 21.46 |

| FRA40ft | FRA40 Future | 0 | 33.5 |

| GER40 | GER40 Cash | 0 | 9.9 |

| GER40ft | GER40 Future | 0 | 52.16 |

| HK50 | Hang Seng Index Cash CFD (HKD) | 0 | 0.41 |

| HK50ft | HK50 Future | 0 | 90 |

| HKTECH | Hang Seng TECH Index Cash CFD (HKD) | 0 | 49.77 |

| IND50 | India 50 Cash | 0 | 10.5 |

| JPN225ft | Nikkei Future | 0 | 141.29 |

| NAS100 | NAS100 Cash | 0 | 7.03 |

| NAS100ft | NAS100 Future | 0 | 7.12 |

| NETH25 | Netherlands 25 Cash | 0 | 0.1 |

| Nikkei225 | Nikkei Index Cash CFD (JPY) | 0 | 77.12 |

| SA40 | South Africa 40 Cash | 0 | 209.59 |

| SGP20 | Singapore 20 Index Cash CFD | 0 | 8.36 |

| SP500 | S&P Index Cash CFD (USD) | 0 | 3.61 |

| SP500ft | SP500 Future | 0 | 13.7 |

| SPI200 | S&P/ASX 200 Index Cash CFD (AUD) | 0 | 21.04 |

| SWI20 | Switzerland 20 Cash | 0 | 10 |

| TWINDEX | Taiwan RIC Index Cash CFD | 0 | 10.05 |

| UK100 | UK 100 Cash | 0 | 13.03 |

| UK100ft | UK100 Future | 0 | 38.03 |

| US2000 | US Small Cap 2000 Cash | 0 | 3.46 |

| USDX | US Dollar Index CFD (USD) | 0 | 4.24 |

| VIX | Volatility Index | 0 | 6.97 |

Commodities Spreads

| Symbol | Product | Commission | Avg. Spread |

|---|---|---|---|

| Cocoa-C | US Cocoa - Cash | 0 | 10 |

| Coffee-C | Coffee Arabica - Cash | 0 | 2.9 |

| COPPER-C | Copper | 0 | 3.08 |

| Cotton-C | Cotton - Cash | 0 | 15.2 |

| OJ-C | Orange Juice - Cash | 0 | 16.46 |

| Soybean-C | Soybean - Cash | 0 | 1.52 |

| Sugar-C | Sugar Raw - Cash | 0 | 5 |

| Wheat-C | US Wheat (SRW) - Cash | 0 | 1 |

Energy Spreads

| Symbol | Product | Commission | Avg. Spread |

|---|---|---|---|

| GAS-C | Gasoline | 0 | 2.5 |

| GASOIL-C | Low Sulphur Gasoil - Cash | 0 | 6.32 |

| NG-C | Natural Gas | 0 | 0.69 |

ETF Spreads

| Symbol | Product | Commission | Avg. Spread |

|---|---|---|---|

| AGG | iShares Core U.S. Aggregate Bond ETF | 12.0 USD per trade | 0.12 |

| ARKB | ARK 21Shares Bitcoin ETF | 0 | 0.77 |

| ARKG | ARK Genomic Revolution ETF | 12.0 USD per trade | 0.13 |

| ARKK | ARK Innovation ETF | 12.0 USD per trade | 0.12 |

| ARKQ | ARK Autonomous Tech & Robotics ETF | 12.0 USD per trade | 0.68 |

| ARKW | ARK Next Generation Internet ETF | 12.0 USD per trade | 1.11 |

| BITB | Bitwise Bitcoin ETP Trust | 0 | 0.32 |

| BITO | ProShares Bitcoin Strategy ETF | 0 | 0.22 |

| BITQ | Bitwise Crypto Industry Innovators ETF | 12.0 USD per trade | 0.88 |

| BKCH | Global X Blockchain ETF | 12.0 USD per trade | 2.59 |

| BLCN | Siren Nasdaq NextGen Economy ETF | 12.0 USD per trade | 9.96 |

| BLOK | Amplify Transformational Data Sharing ETF | 12.0 USD per trade | 1.1 |

| BND | Vanguard Total Bond Market ETF | 12.0 USD per trade | 0.1 |

| BNDX | Vanguard Total International Bond ETF | 12.0 USD per trade | 0.11 |

| BNO | United States Brent Oil Fund LP | 12.0 USD per trade | 0.12 |

| BTCO | Invesco Galaxy Bitcoin ETF | 0 | 0.87 |

| DBA | Invesco DB Agriculture Fund | 12.0 USD per trade | 0.11 |

| DBC | Invesco DB Commodity Index Tracking Fund | 12.0 USD per trade | 0.1 |

| EEM | iShares MSCI Emerging Markets Index Fund | 12.0 USD per trade | 0.11 |

| EFA | iShares MSCI EAFE Index Fund | 12.0 USD per trade | 0.12 |

| ESGV | Vanguard ESG US Stock ETF | 12.0 USD per trade | 0.46 |

| FAS | Direxion Daily Financial Bull 3x Shares | 12.0 USD per trade | 1.82 |

| FAZ | Direxion Daily Financial Bear 3x Shares | 12.0 USD per trade | 0.11 |

| FDN | First Trust Dow Jones Internet Index Fund | 12.0 USD per trade | 1.16 |

| FXI | iShares China Large-Cap ETF | 12.0 USD per trade | 0.1 |

| GBTC | Grayscale Bitcoin Trust | 0 | 0.43 |

| GDX | VanEck Gold Miners ETF | 12.0 USD per trade | 0.12 |

| GDXJ | VanEck Junior Gold Miners ETF | 12.0 USD per trade | 0.2 |

| GLD | SPDR Gold ETF | 12.0 USD per trade | 0.36 |

| GOAU | US Global GG&P Metal Mine ETF | 12.0 USD per trade | 4.13 |

| GOEX | Global X Gold Explorers ETF | 12.0 USD per trade | 5.9 |

| GRID | First Trust Nasdaq Clean Edge Smart GRID Infrastructure Index | 12.0 USD per trade | 2.23 |

| GSG | iShares S&P GSCI Commodity-Indexed Trust | 12.0 USD per trade | 0.11 |

| IBIT | iShares Bitcoin Trust | 0 | 0.22 |

| ICLN | iShares Global Clean Energy ETF | 12.0 USD per trade | 0.11 |

| IWM | iShares Russell 2000 Index ETF | 12.0 USD per trade | 0.13 |

| IYW | iShares U.S. Technology ETF | 12.0 USD per trade | 0.52 |

| JNUG | Direxion Junior Miner Bull 2X ETF | 12.0 USD per trade | 0.78 |

| NUGT | Direxion Gold Miners Bull 2X ETF | 12.0 USD per trade | 0.68 |

| OIH | VanEck Oil Services ETF | 12.0 USD per trade | 1.97 |

| QCLN | First Trust NASDAQ Clean Edge Green Energy Index Fund | 12.0 USD per trade | 0.39 |

| QQQ | Invesco QQQ Trust | 12.0 USD per trade | 0.28 |

| RING | iShares MSCI Global Gold Miners ETF | 12.0 USD per trade | 1.24 |

| SDS | ProShares UltraShort S&P 500 ETF | 12.0 USD per trade | 0.12 |

| SGDJ | Sprott Junior Gold Miners ETF | 12.0 USD per trade | 4.2 |

| SGDM | Sprott Gold Miners ETF | 12.0 USD per trade | 2.41 |

| SLVP | iShares MSCI Global Silver ETF | 12.0 USD per trade | 1.04 |

| SPY | SPDR S&P 500 ETF Trust | 12.0 USD per trade | 0.17 |

| SPYX | SPDR S&P 500 Fossil Fuel Reserves Free ETF | 12.0 USD per trade | 0.4 |

| TAN | Invesco Solar ETF | 12.0 USD per trade | 0.67 |

| USL | United States 12 Month Oil Fund LP | 12.0 USD per trade | 2.13 |

| USO | United States Oil Fund LP | 12.0 USD per trade | 0.12 |

| VGT | Vanguard Information Technology ETF | 12.0 USD per trade | 2.17 |

| VSGX | Vanguard ESG International Stock ETF | 12.0 USD per trade | 0.98 |

| XLF | Financial Select Sector SPDR Fund | 12.0 USD per trade | 0.12 |

| XLK | Technology Select Sector SPDR Fund | 12.0 USD per trade | 0.24 |

| XOP | SPDR S&P Oil and Gas Exploration & Production ETF | 12.0 USD per trade | 0.37 |

Bonds Spreads

| Symbol | Product | Commssion | Avg. Spread |

|---|---|---|---|

| EUB10Y | Euro - Bund Futures | 0 | 0.32 |

| EUB2Y | Euro - Schatz Futures | 0 | 0.3 |

| EUB30Y | Euro - BUXL Futures | 0 | 0.3 |

| EUB5Y | Euro - BOBL Futures | 0 | 0.3 |

| EURIBOR3M | EURIBOR Futures | 0 | 3.98 |

| LongGilt | UK Long Gilt Futures | 0 | 0.2 |

| USNote10Y | US 10 YR T-Note Futures Decimalised | 0 | 0.35 |

Vantage Markets Swap Fees Explained

Vantage Markets applies overnight swap fees, which represent the cost of holding positions past market close due to fluctuating interest rates. A swap long is the fee or credit applied when maintaining a buy position overnight, while a swap short applies to sell positions. Vantage’s swap rates are generally in line with industry standards, making the broker well-suited for swing and longer-term trading strategies. Traders should note that swap charges can vary over time depending on market conditions.

| Instrument | Swap Short | Swap Long |

|---|---|---|

| EURUSD | Credit of $2.6 | Charge of $5.92 |

| GBPJPY | Charge of $26.2 | Credit of $7.14 |

Non-Trading Fees at Vantage Markets

Vantage Markets offers a highly cost-efficient trading environment with no account maintenance, inactivity, or deposit fees. Withdrawals via credit/debit cards and electronic wallets are entirely free, while clients receive one complimentary international bank transfer each month. Any additional bank withdrawals incur a modest charge of 20 currency units per transaction (e.g., $20, €20), ensuring transparent and predictable costs for traders.

Are Vantage Markets Fees Competitive?

Vantage Markets delivers a highly competitive fee structure, appealing to traders seeking low-cost execution. Most spreads on its accounts consistently beat the industry average, with the exception of FX pairs on the Standard account, which remain aligned with typical market rates. The broker supports commission-free trading and maintains moderate overnight swap rates, making it suitable for both short- and long-term strategies. Non-trading costs are minimal, with the only notable fee being a $20 charge for additional international bank withdrawals, ensuring transparent and predictable trading expenses.

| Fees Summary | Vantage |

|---|---|

| Minimum Deposit | $50 |

| Average Spread EUR/USD (Standard) | 1.3 |

| All-in Cost EUR/USD (Active) | 0.75 |

| Active Trader / VIP Discounts | Yes |

| ACH / SEPA Transfers | No |

| Bank Wire (Deposit / Withdraw) | Yes |

| Visa / Mastercard (Credit / Debit) | Yes |

| Skrill (Deposit / Withdraw) | Yes |

| PayPal (Deposit / Withdraw) | Yes |

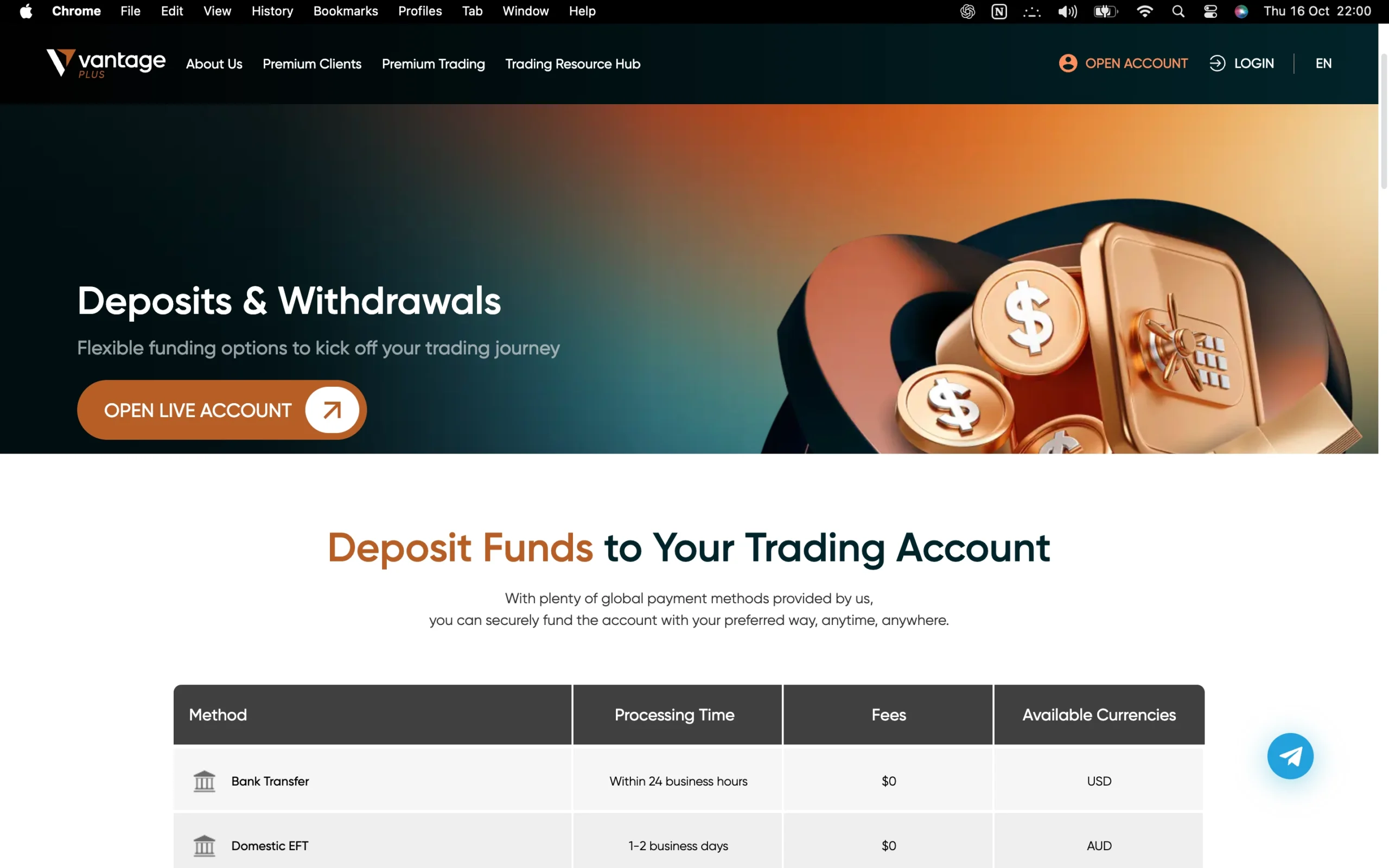

Deposit and Withdrawal Overview

Vantage Markets provides traders with a wide range of convenient payment options, including bank wire transfers, credit and debit cards, and popular e-wallets. Deposits and most withdrawals are processed quickly and free of charge, ensuring seamless account funding. The only notable cost is for international bank transfers, which carry a fixed fee of $20 (or the equivalent in your account currency, such as 150 HKD / 3000 JPY).

While third-party banking charges may apply in some cases, overall processing times are efficient and in line with industry standards, making Vantage a reliable choice for hassle-free deposits and withdrawals.

Pros:

- Quick deposit and withdrawal

- Credit/Debit card available

- No deposit fee

Cons:

- Fee for withdrawals via international bank transfer

Vantage Markets Account Base Currencies

Choosing the right account base currency is one of the simplest ways to reduce unnecessary trading costs. If your trading account is funded in the same currency as your bank account, or if you primarily trade assets priced in that same currency, you avoid paying additional currency conversion fees.

This means that a trader with a EUR-based bank account who opens a EUR-based trading account won’t have hidden costs eating into profits every time funds are deposited, withdrawn, or trades are executed in euros. The same principle applies to USD, GBP, JPY, or any other major currency.

For those looking for extra flexibility, another smart option is to open a multi-currency digital bank account. These accounts allow you to hold and transact in multiple currencies simultaneously, often at highly competitive exchange rates. In addition, they typically offer low-cost or even free international transfers, making it easier to fund your trading account without paying excessive fees. Best of all, setting up such an account usually takes just a few minutes from your smartphone.

By selecting the right base currency – or combining it with a multi-currency banking solution – you can keep more of your capital working for you. Trade Wiki recommends considering your funding currency, preferred trading instruments, and withdrawal plans before opening an account to ensure you’re minimizing costs and maximizing efficiency.

At Vantage Markets, you can choose from the following base currencies:

| ETH | INR | HKD | USD |

| NZD | SGD | BTC | EUR |

| UST | JPY | CAD | GBP |

| AUD | PLN | USC |

Deposit Methods and Fees

Vantage Markets makes funding your trading account straightforward and cost-effective, with no deposit fees charged directly by the broker. This ensures that traders can add funds without worrying about hidden costs cutting into their capital.

However, it’s important to note that certain third-party providers may apply their own charges. For example, deposits via Neteller or Skrill are subject to the payment processor’s standard fee policy, while broker-to-broker transfers may incur bank transfer fees outside of Vantage’s control.

When it comes to processing times, credit and debit card payments are instant, allowing you to start trading without delay. On the other hand, bank transfers can take several business days depending on your financial institution. To ensure security and compliance, deposits are only accepted from accounts registered in your own name.

Overall, Vantage’s funding system is designed with speed, transparency, and trader convenience in mind. According to TradeWiki.io, this makes Vantage a reliable choice for traders who want quick, hassle-free access to their trading capital.

Pro Tip from Trade Wiki: Always double-check with your payment provider regarding potential processing fees to avoid surprises. This way, you’ll know exactly how much trading capital reaches your account.

Vantage Markets supports the following electronic wallets:

| Sticpay | Neteller | Skrill |

| ApplePay | Advcash | GooglePay |

| Boletol | Bitwallet | Perfect Money |

Vantage Markets deposit methods and fees:

| Deposit Method | Fee | Currency | Processing Time |

|---|---|---|---|

| Domestic Fast Transfer (Australia) | $0 | AUD | Within several hours |

| Astropay | $0 | Most local currencies + USD | Instant |

| Credit/Debit Card | $0 | CAD, EUR, JPY, GBP, USD, AUD, PLN, NZD, SGD | Instant |

| International Bank Wire | $0 | CAD, NZD, EUR, USD, SGD, JPY, GBP, AUD, PLN | 2-5 business days |

| Skrill | $0 | CAD, USD, GBP, EUR | Up to 24 hours |

| Apple Pay | $0 | NZD, USD, GBP, HKD, JPY, CAD, AUD, EUR, SGD | Instant |

| Google Pay | $0 | NZD, USD, GBP, HKD, JPY, CAD, AUD, EUR, SGD | Instant |

| PayPal | $0 | GBP, EUR, AUD, USD | Up to 24 hours |

| Neteller | $0 | GBP, USD, AUD, EUR, SGD | Instant |

| Fasapay | $0 | USD | Instant |

| Perfect Money | $0 | USD, EUR | Up to 24 hours |

| JCB | $0 | JPY | Instant |

| Bitwallet | $0 | USD, JPY, EUR | Up to 24 hours |

| Sticpay | $0 | NZD, USD, GBP, JPY, AUD, HKD, SGD, EUR, CAD | Up to 24 hours |

| India UPI | $0 | INR, USD | Up to 24 hours |

| Bank Transfer* | $0 | USD, JPY | Up to 24 hours |

| Broker-to-Broker Transfer | $0 | NZD, USD, GBP, EUR, CAD, AUD, JPY, SGD, AUD | 3-5 business days |

Withdrawal Methods and Fees

Vantage Markets offers flexible and cost-effective withdrawal options for traders. Withdrawals via credit or debit cards and e-wallets are completely free, ensuring hassle-free access to your funds. For international bank transfers, the first withdrawal each month is free, while subsequent transfers incur a modest fee of 20 units of your account currency ($20, €20, etc.). All withdrawals must be made to accounts registered in your name, maintaining security and compliance with industry standards. This setup makes Vantage an efficient and transparent choice for managing your trading funds.

Vantage Markets withdrawal methods and fees:

| Withdrawal Method | Fee | Currency | Processing Time |

|---|---|---|---|

| Credit/Debit Card | $0 | CAD, USD, EUR, NZD, JPY, GBP, AUD, PLN, SGD | Up to 24 hours |

| International Bank Wire | $20 | CAD, AUD, JPY, NZD, EUR, GBP, USD, PLN, SGD | 3-5 business days |

| E-wallets | $0 | Multiple | Up to 24 hours |

How Long Does Vantage Markets Take to Process Withdrawals?

When it comes to accessing your funds, TradeWiki.io highlights that Vantage Markets provides a remarkably fast withdrawal process. In real-world testing, debit card withdrawals were completed within just 1 business day, making it a convenient option for traders who need quick access to their money.

This swift processing time ensures that whether you are funding new trades or managing your portfolio, your withdrawals are handled efficiently. For added peace of mind, all transactions are securely processed, reflecting Vantage’s commitment to reliability and transparency.

By prioritizing speed and ease, Vantage Markets stands out as a broker that caters to active traders who value both efficiency and accessibility in their trading accounts.

Step-by-Step Guide to Withdrawing Money From Vantage Markets

Withdrawing money from your Vantage Markets trading account is a straightforward process designed for both convenience and security. Follow these steps to access your funds quickly:

Log in to the Client Portal – Access your account using your secure credentials.

Select ‘Withdraw Funds’ – Navigate to the withdrawal section within the portal.

Choose Your Funding Method – Select the same method you used to deposit, ensuring smooth processing.

Provide Required Details – Fill in necessary information such as your name, bank address, and account number.

Specify Withdrawal Amount – Enter the exact sum you wish to withdraw.

Upload Verification Documents – Submit a recent bank statement (no older than three months) to confirm account ownership.

Submit Your Request – Click ‘Submit’ and allow Vantage to process your withdrawal efficiently.

This method ensures a secure and seamless experience, giving traders confidence in quick access to their funds.

Trading Platforms Overview

Vantage Markets offers a comprehensive suite of trading platforms designed to meet the needs of both beginner and professional traders. Its flagship platform, ProTrader, is powered by TradingView and accessible on both desktop and web, providing a seamless trading experience with advanced charting and analysis tools. In addition to ProTrader, Vantage Markets fully supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), ensuring compatibility with one of the most widely used trading ecosystems globally.

For traders on the go, the Vantage mobile app delivers a user-friendly interface with powerful features, allowing for portfolio management, order execution, and real-time market insights from anywhere. To enhance trading speed and reduce latency, Vantage also provides free VPS hosting, ensuring that automated strategies and expert advisors (EAs) run efficiently around the clock.

Vantage Markets further distinguishes itself by supporting third-party platform integration. Traders can link TradingView directly with their MetaTrader accounts for enhanced charting and analysis. On the MetaTrader platforms, Vantage offers additional tools such as SmartTrader Tools from FX Blue LLP, along with integrated forex news feeds from FxWire Pro and FxStreet, giving traders a complete information and execution ecosystem.

For those interested in copy trading and social trading, Vantage Markets provides multiple options. Alongside the MT4 and MT5 Signals market, traders can access platforms like DupliTrade, Myfxbook AutoTrade (not available in Australia), and Vantage Copy Trading, which features over 71,000 signal providers, enabling seamless automated strategy replication.

Overall, Vantage’s platform offering combines reliability, flexibility, and advanced tools, making it a standout choice for traders seeking professional-grade technology and seamless execution.

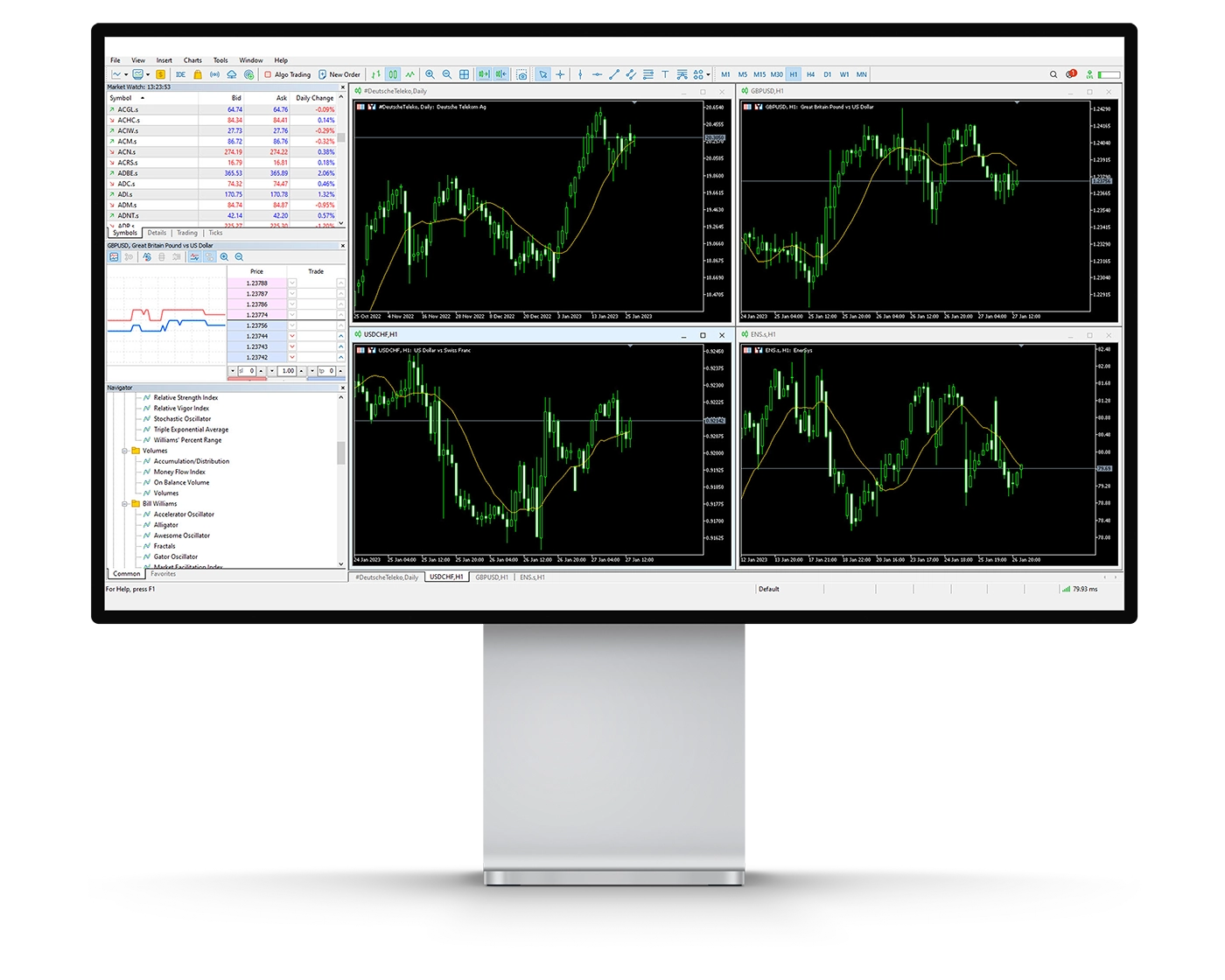

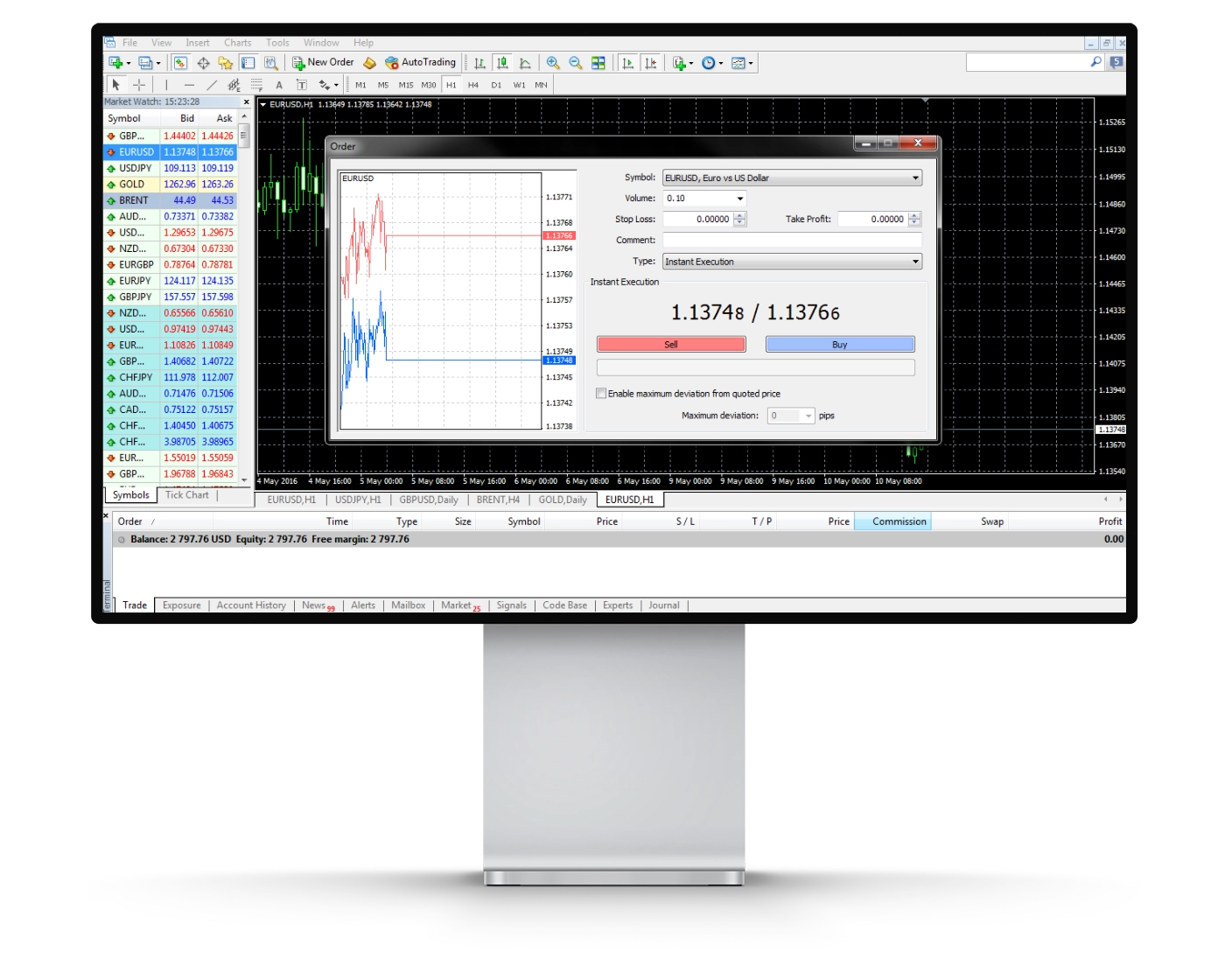

MetaTrader 4

MetaTrader 4 Desktop Intro

The MetaTrader 4 (MT4) desktop platform provided by Vantage delivers a professional and versatile trading environment suitable for both beginner and experienced traders. Its intuitive interface makes navigating charts, managing orders, and trading a wide range of instruments straightforward, while maintaining reliable performance for high-speed trading.

Platform Compatibility & Global Accessibility

Fully compatible with Windows and Mac operating systems.

Supports 52 languages, including English, French, Spanish, German, Arabic, and Chinese, making it accessible to traders worldwide.

Key Features & Tools

Custom Alerts: Set notifications for specific price levels to identify optimal entry and exit points.

Watchlist Management: Build and track personalized lists of preferred trading instruments.

One-Click Trading: Execute market orders instantly, ideal for scalping and fast-paced strategies.

Chart-Based Trading: Place trades directly from charts, specifying entry price, volume, stop-loss, and take-profit levels.

Expert Advisor (EA) Integration: Run automated trading strategies with built-in strategy testing, allowing traders to optimize algorithms under different market conditions.

Why MT4 on Vantage Markets Excels

With its combination of automation, customizable alerts, direct chart execution, and expert advisor support, Vantage’s MT4 desktop platform delivers precision, flexibility, and efficiency.

Vantage’s MT4 balances user-friendly design with powerful trading capabilities, making it an ideal choice for traders seeking both reliability and advanced functionality in one platform.

Pros:

- Clear fee report

- Price alerts

- Good customizability (for charts, workspace)

Cons:

- Search function could be improved

- Poor design

Charts

Vantage’s MetaTrader 4 (MT4) platform is a highly versatile trading tool designed to support both novice and advanced traders. It combines extensive charting options with analytical features, making it easier to spot market trends and execute strategies effectively.

Technical Indicators: Access 38 built-in indicators, including trend, volume, and oscillator tools, to analyze price action, market sentiment, and potential movements.

Drawing Tools: Use 24 drawing tools, such as Fibonacci retracements and Elliott waves, to identify support/resistance levels and potential breakout points.

Timeframes & Chart Types: Trade across 21 different timeframes and choose from line, bar, or candlestick charts for multi-perspective market analysis.

User Considerations: While MT4 offers deep analytical capabilities, charts can become crowded when multiple indicators are applied, potentially making it harder to read price movements.

Overall, Vantage’s MT4 platform offers a robust mix of flexibility and functionality, catering to both manual traders and algorithmic trading strategies.

Orders

Vantage’s MetaTrader 4 (MT4) platform delivers flexible order execution options tailored to both manual traders and those using high-speed or automated strategies. With multiple order types and one-click trading, MT4 allows precise entries and enhanced control over market positions.

Market Orders: Execute trades immediately at the best available price. While the requested volume is guaranteed, the final entry price may slightly differ due to market fluctuations.

Limit Orders: Set a specific price for your trade execution, ensuring full control over entry points. These orders are only filled if the market reaches your designated price.

Stop Orders: Use stop-loss orders to manage risk and limit potential losses. A stop order triggers a market execution once the price hits a predetermined level, helping safeguard your positions.

By integrating these order types with MT4’s one-click trading, Vantage empowers traders to implement strategies efficiently, whether scalping, day trading, or running automated algorithms. This combination of speed, precision, and flexibility positions Vantage as a reliable choice for traders aiming to maximize execution accuracy and overall trading performance.

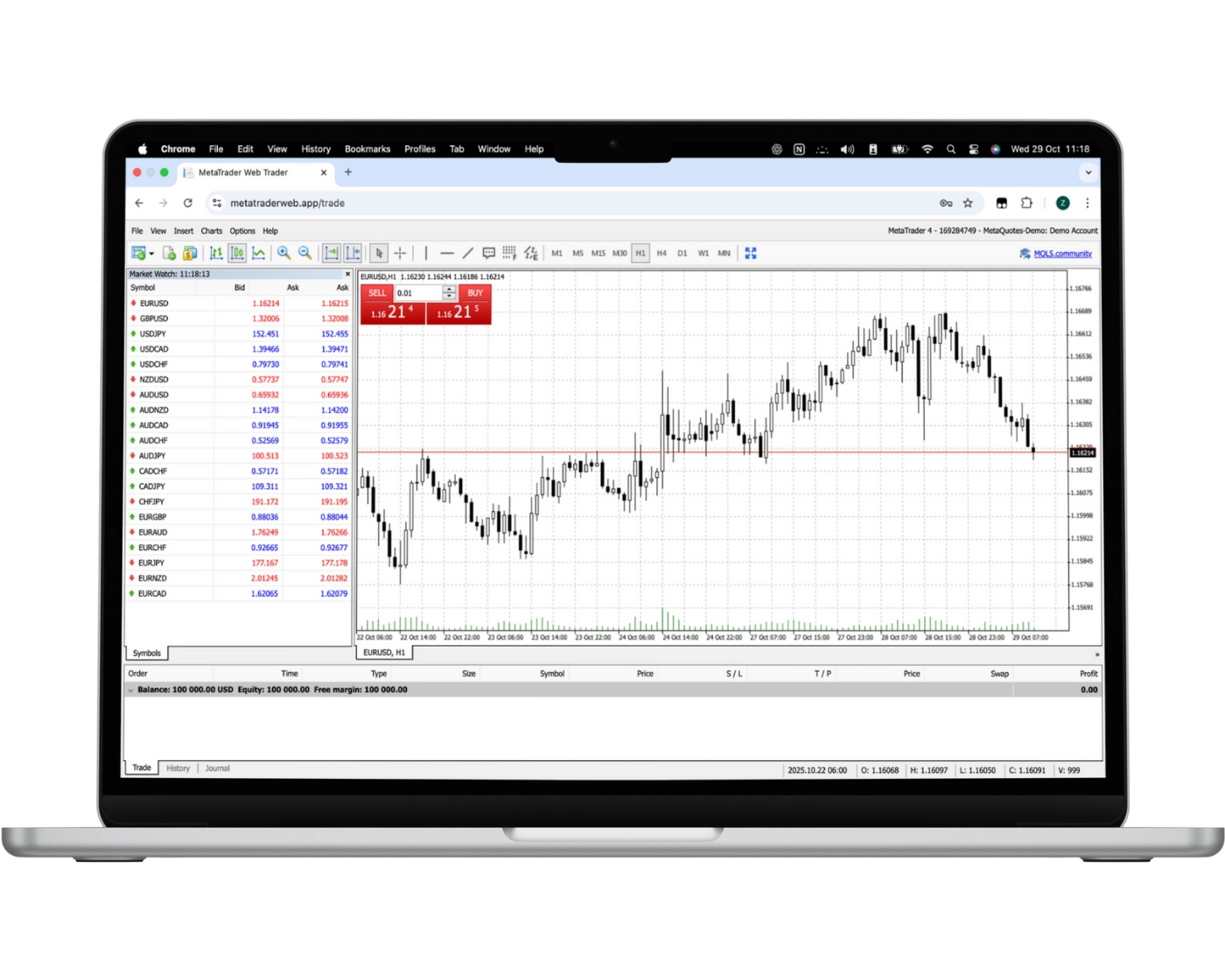

Mt4 WebTrader

Vantage’s MetaTrader Web Trader delivers a streamlined, browser-based trading solution that works across any operating system – no software installation required. This platform combines convenience with advanced functionality, providing traders with efficient access to the markets anytime, anywhere.

One-Click Trading: Open and close positions instantly with a single click, enhancing responsiveness to fast-moving markets.

Chart-Based Trading: Execute trades directly from charts, allowing seamless reactions to market trends and price action.

Customizable Watchlists: Monitor favorite instruments with live, real-time quotes to stay on top of market movements.

Trade History Access: Review past trades easily to assess performance and optimize future strategies.

Advanced Charting Tools: Utilize 30 built-in technical indicators to support in-depth market analysis and informed decision-making.

Copy and Automated Trading: Follow top-performing traders or automate strategies for increased efficiency and consistency.

By combining accessibility, speed, and powerful trading features, Vantage’s Web Trader platform ensures a professional-grade experience for traders, making it an excellent choice for those seeking a versatile and reliable online trading environment.

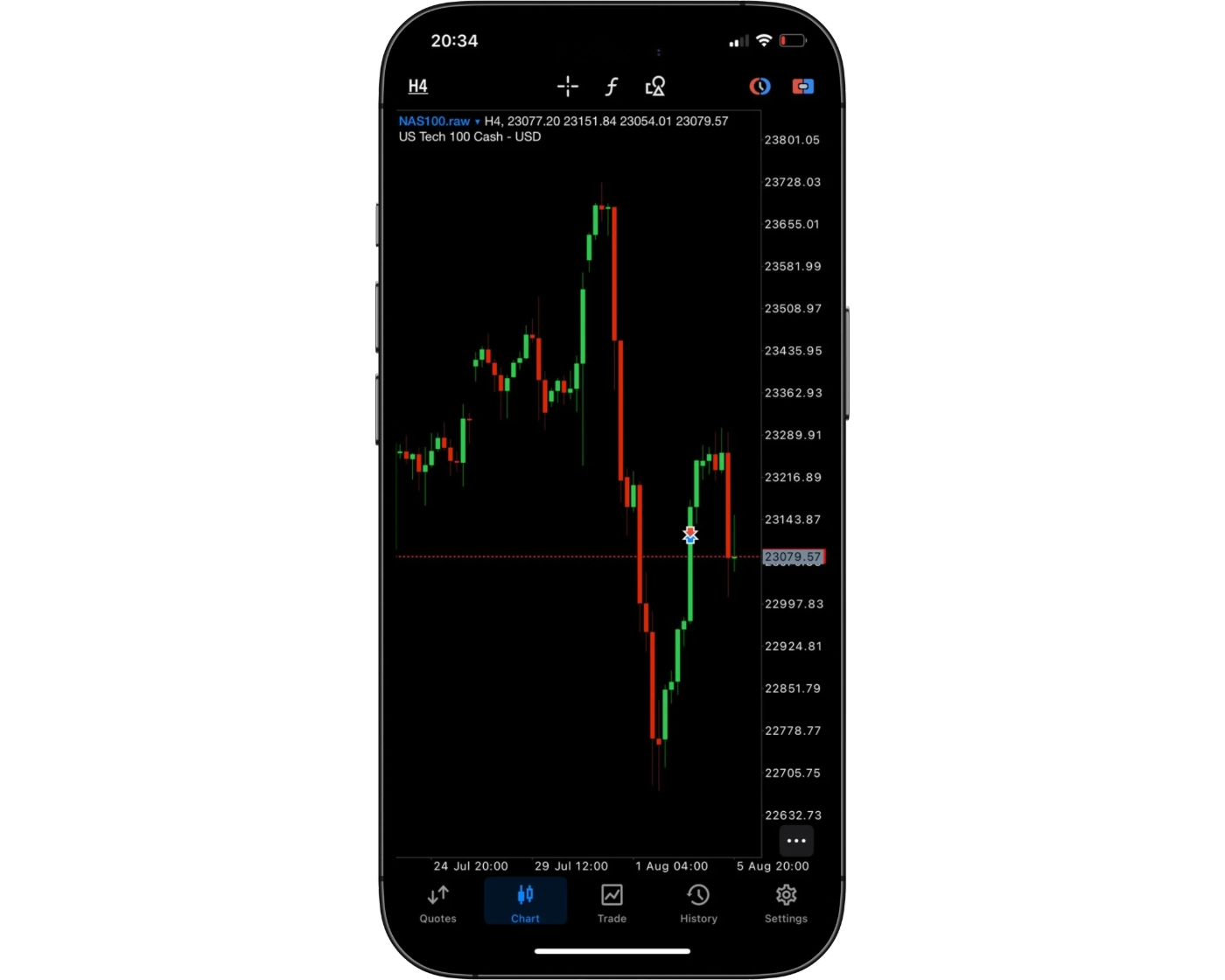

MT4 Mobile App

Pros:

- User-friendly

- Good search function

- Price alerts

Cons:

- No two-step (safer) login

Vantage’s MetaTrader 4 mobile app, compatible with both iOS and Android devices, provides traders with instant access to global markets from anywhere. Designed for speed and precision, the app allows users to open, close, and manage positions directly from their smartphones or tablets.

Flexible Order Types: Execute market, limit, and stop orders with ease, ensuring full control over trade entries and exits.

Position Management: Adjust trade size and exposure on existing positions quickly, enabling responsive risk management.

Intuitive Interface: The mobile app’s user-friendly design ensures a smooth navigation experience, letting traders act on opportunities without delay.

Real-Time Data: Coupled with Vantage’s fast execution and live market updates, the platform provides accurate pricing and charts for informed trading decisions.

Professional-Grade Experience: Whether you are a casual trader or a professional, the MT4 mobile app delivers the tools necessary for effective strategy implementation while on the go.

With its combination of advanced functionality, real-time market insights, and mobile convenience, Vantage’s MT4 mobile platform equips traders to react swiftly in fast-paced trading environments.

Look and Feel

Vantage Markets offers a highly refined and user-friendly MT4 mobile platform, designed to merge functionality with a clean, intuitive interface. Traders can effortlessly navigate charts, execute trades, and manage positions directly from their mobile devices, ensuring smooth and responsive trading on the go.

The platform caters to both novice and experienced traders, providing a seamless mobile experience that allows quick access to market analysis, order placement, and position adjustments. Its thoughtful design prioritizes usability, making it easy to stay connected to global markets anytime, anywhere.

With Vantage’s MT4 mobile app, traders benefit from a professional-grade platform that combines speed, reliability, and convenience, supporting informed decision-making and efficient trade execution in dynamic market conditions.

Login and security

Vantage’s MT4 mobile platform provides traders with a simple, single-step login for direct access to their accounts, making it easy to start trading immediately. While convenient, the platform could benefit from additional security enhancements, such as two-factor authentication, which would offer a stronger layer of protection for sensitive account information.

Currently, the mobile app does not support biometric login options like fingerprint or facial recognition. Adding these features would not only improve security but also streamline the login process, giving traders a faster and more convenient way to access their accounts on the go.

By integrating advanced security measures while maintaining user-friendly access, Vantage Markets ensures that traders can manage their positions confidently, combining convenience with robust account protection for a safer mobile trading experience.

Search functions

Vantage’s MT4 mobile application features a streamlined and intuitive search system, enabling traders to locate instruments and tools quickly and efficiently. Users can either type the name of a specific asset directly into the search bar or explore organised category folders to browse available options.

This dual approach ensures both speed and flexibility, allowing traders to navigate the platform effortlessly and access the trading products they need without unnecessary delays. By combining a responsive search function with clear categorisation, Vantage Markets enhances the mobile trading experience, helping users stay focused on market opportunities anytime, anywhere.

Placing orders

Vantage’s MT4 mobile platform delivers versatile order placement features designed to support a wide range of trading strategies directly from your smartphone. Traders can execute market orders for instant trades, set limit orders to enter positions at precise price levels, and use stop-loss orders to effectively manage risk and safeguard open positions.

The platform also offers flexible order time settings to match different trading styles:

Good ‘til Canceled (GTC): Orders remain active until the trader manually cancels them.

Good ‘til Time (GTT): Orders automatically expire after a set duration, giving precise control over timing.

By combining diverse order types with adjustable time controls, Vantage Markets ensures accurate execution and seamless position management, making it an ideal solution for traders who need flexibility and reliability while trading on the go.

Alerts and notifications

Currently, Vantage’s MT4 mobile application does not support trade alerts or notifications, a feature reserved for the desktop platform. Alerts are a crucial tool for actively monitoring market movements and executing trades at the optimal time. Incorporating this functionality into the mobile app would significantly enhance its usability for on-the-go traders.

Despite this limitation, mobile users can still track real-time market activity and manage open positions efficiently. For instant notifications and timely trade alerts, the desktop version remains the preferred solution, ensuring traders never miss critical market opportunities.

MetaTrader 4: Key Takeaways

Vantage’s MetaTrader 4 (MT4) desktop platform is renowned for its fast, reliable order execution, making it a go-to choice for traders who prioritize efficiency and precision. While the interface may appear dated compared to modern trading platforms, it remains functional and dependable. The charting tools provide solid analytical capabilities, though they can feel somewhat rigid for traders seeking highly flexible, multi-timeframe analysis or advanced technical studies.

On the mobile side, Vantage’s MT4 app delivers a streamlined trading experience designed for active traders on the go. Users can quickly open, close, and manage positions, adjust trade sizes, and implement risk management strategies directly from their smartphone or tablet. The app’s speed and convenience shine during volatile market periods, though detailed technical analysis and complex charting remain best suited for the desktop version.

In summary, Vantage MT4 strikes a balance between accessibility and reliability. Traders benefit from fast, efficient execution and mobile convenience, while desktop access ensures comprehensive tools for advanced charting and in-depth market analysis.

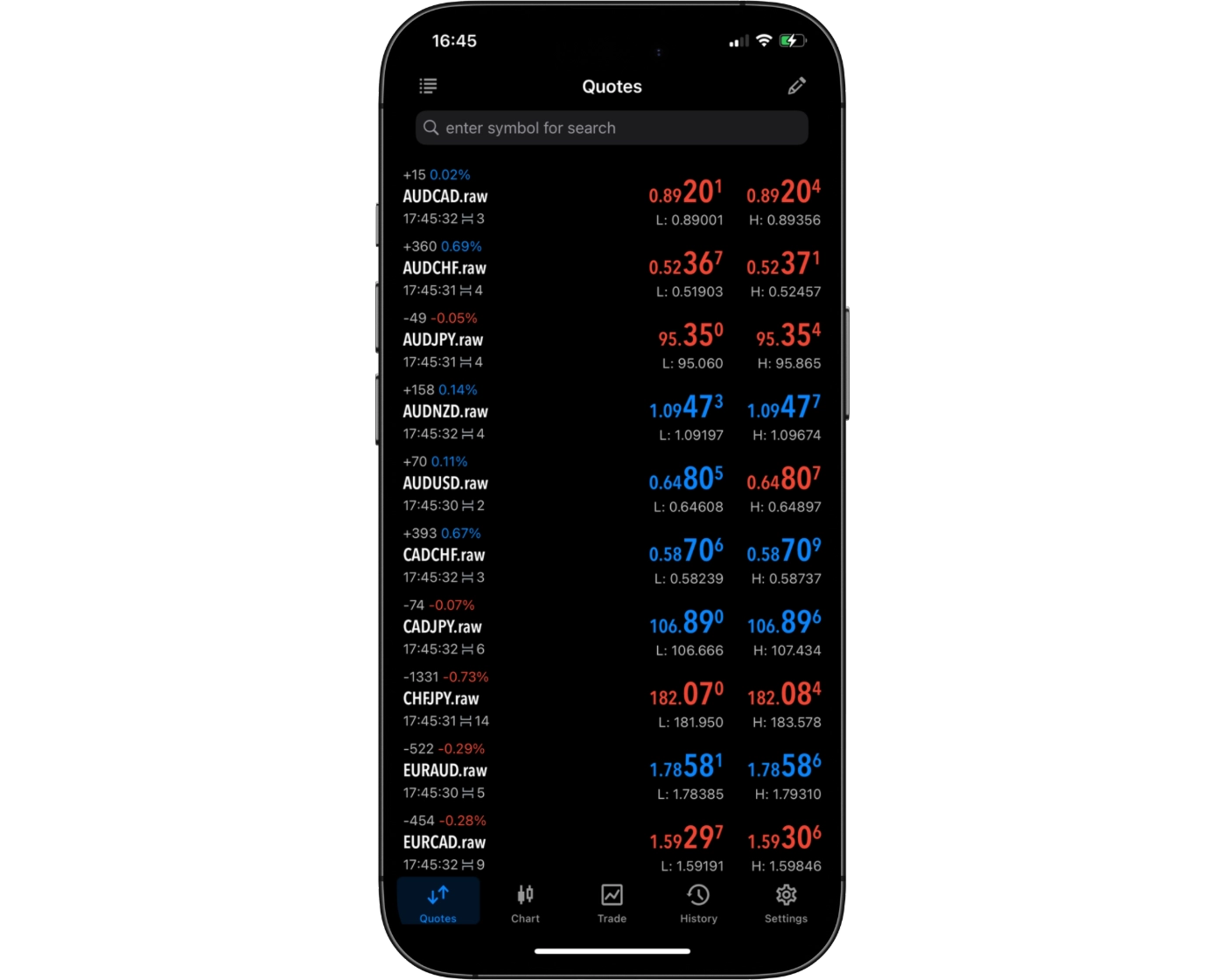

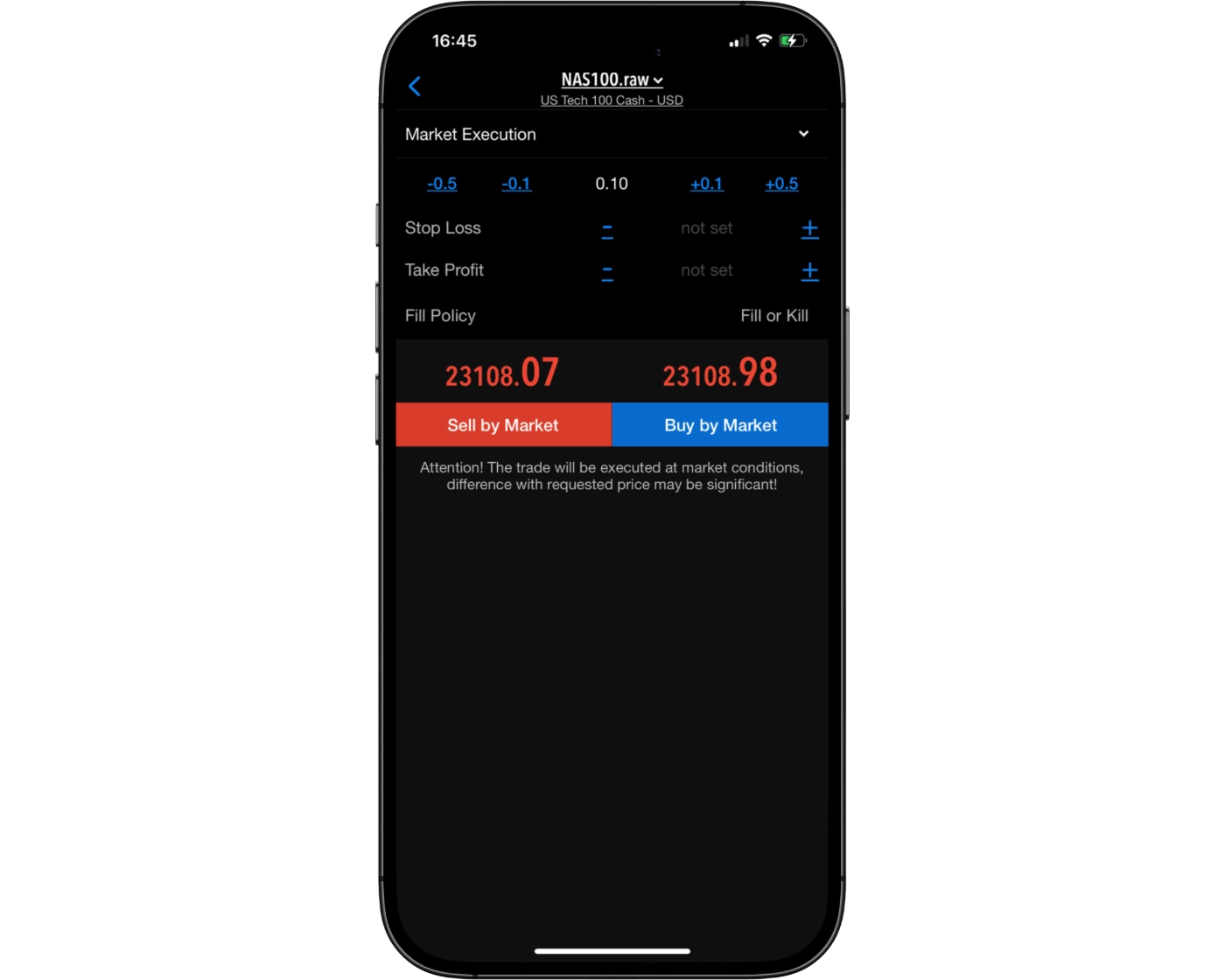

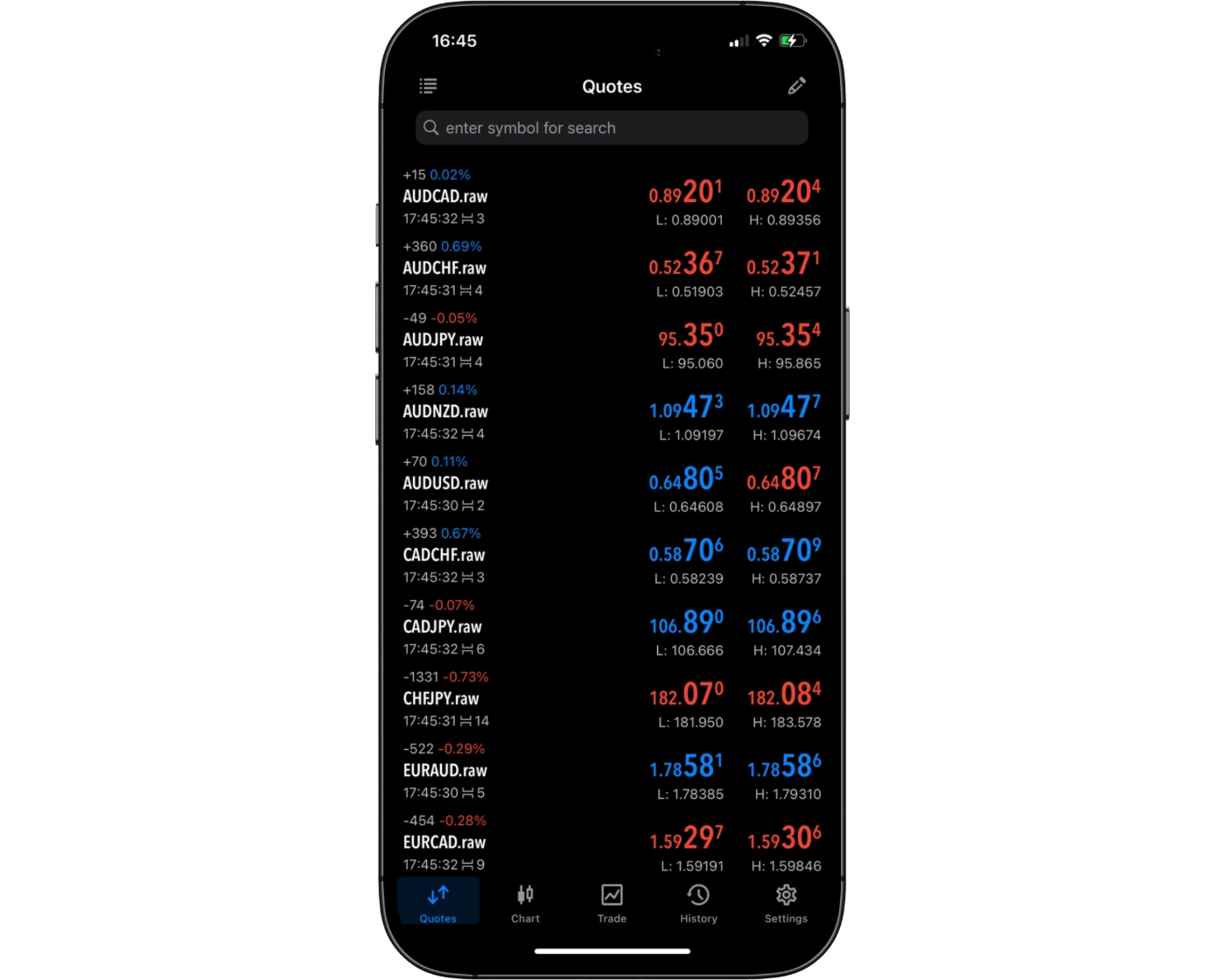

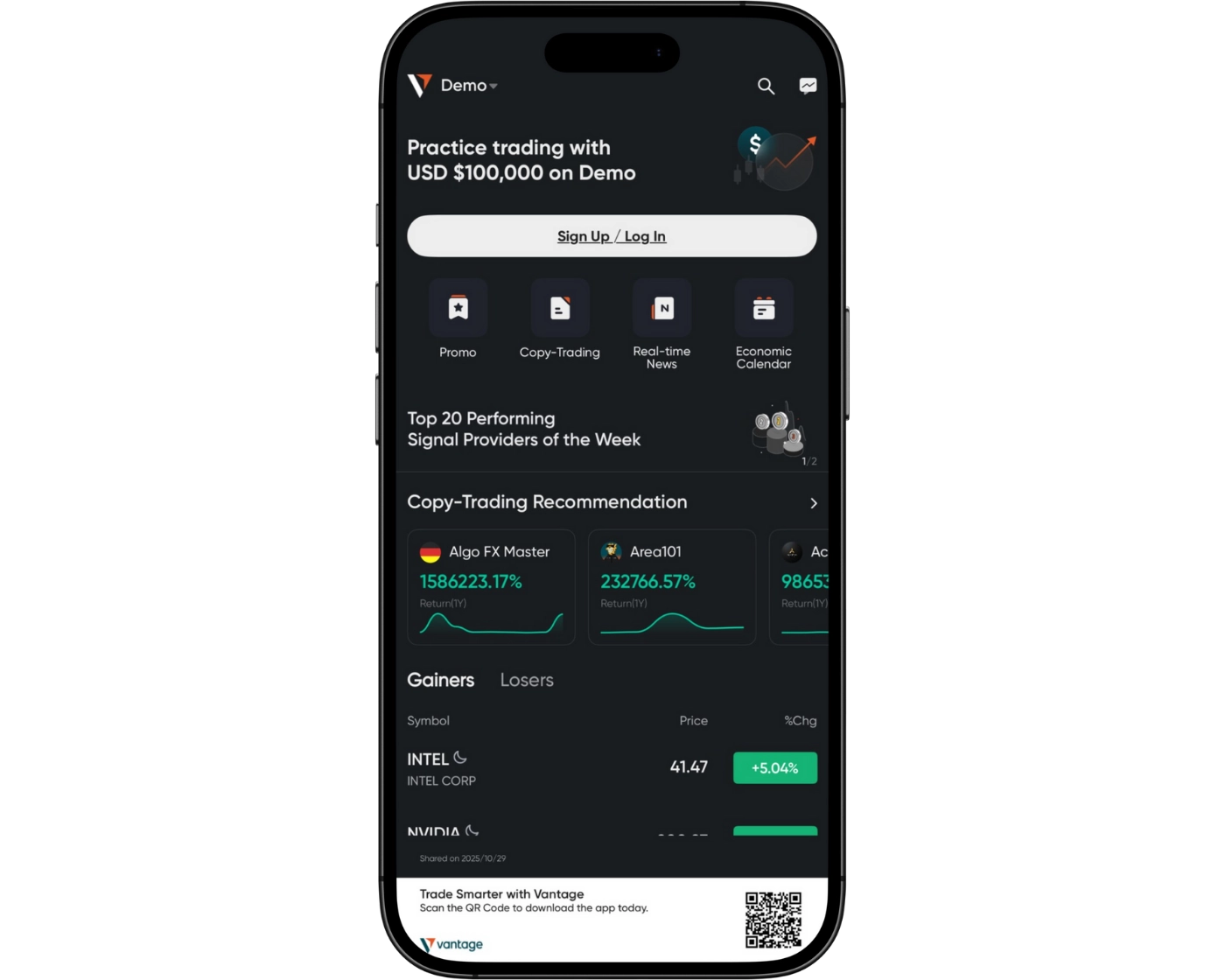

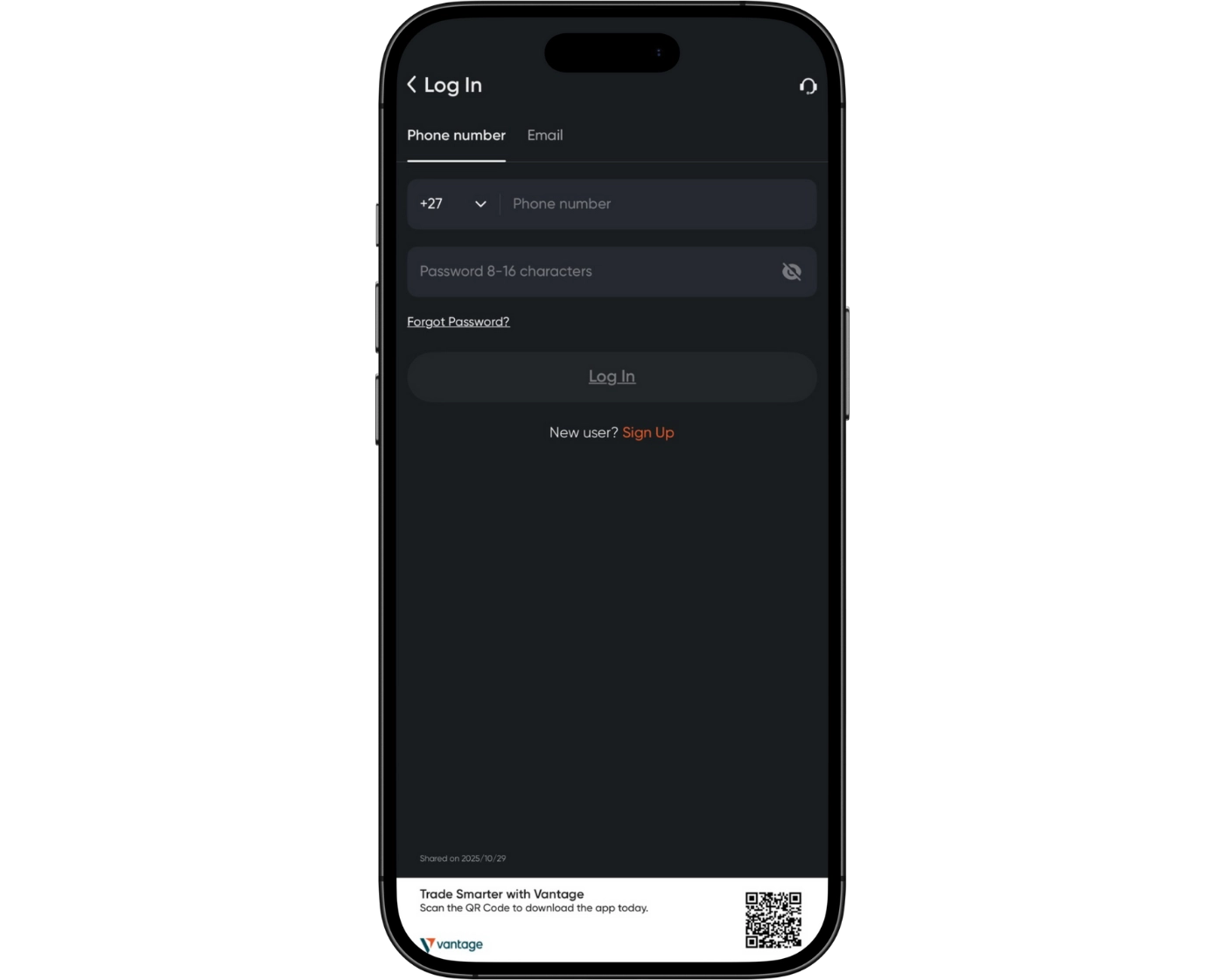

Vantage App

Vantage App Intro

Vantage Markets offers a highly polished and versatile mobile trading platform designed to provide a seamless trading experience on the go. Available for both iOS and Android, the app combines sleek design with practical functionality, allowing traders to access charts, execute orders, and manage positions efficiently from their mobile devices. Its multilingual support ensures accessibility for traders around the globe.

Beyond its proprietary platform, Vantage also supports MetaTrader 4 and 5 mobile apps, giving users the flexibility to choose their preferred trading environment. (Note: MetaTrader’s iOS version is currently unavailable in the EU.)

The Vantage mobile app integrates essential account management features, enabling traders to deposit and withdraw funds, monitor account performance, and review past trades – all within a single, streamlined interface. Its connection to Vantage’s research content keeps users informed of market developments, while the copy trading functionality allows traders to follow and replicate top-performing strategies from professional signal providers, enhancing their overall trading potential.

Combining intuitive navigation, real-time data access, and advanced trading tools, the Vantage mobile platform is a robust solution for both novice and experienced traders seeking a reliable, all-in-one mobile trading experience.

Pros:

- User-friendly

- Good search function

- Two-step (safer) login

Cons:

- None

Look and Feel

The Vantage mobile app stands out for its intuitive design and user-friendly interface. Its streamlined layout ensures that traders can navigate effortlessly, execute trades, and manage accounts without unnecessary complexity. Prioritizing convenience and accessibility, the app delivers a smooth and efficient trading experience suitable for both beginners and seasoned traders.

Login and security

The Vantage mobile app prioritizes security with a robust two-step login process, ensuring that your account remains protected at all times. Users can conveniently access their accounts through biometric authentication, such as fingerprint or facial recognition, combining both safety and ease of use for a seamless trading experience.

Search functions

The Vantage mobile app features an intuitive search system that makes finding instruments and tools straightforward. Traders can quickly locate assets either by typing directly into the search bar or by browsing through organized category folders, ensuring efficient navigation and seamless access to all trading options.

Placing orders

The Vantage mobile trading app allows traders to execute a variety of order types, including market orders for instant execution, limit orders to enter at a specific price, and stop orders to manage risk and protect positions. The platform also supports flexible order duration settings, such as Good ‘til Canceled (GTC), which keeps orders active until manually canceled, and Good ‘til Time (GTT), which automatically expires orders after a set period. These features provide precise control over trade execution, whether managing positions on the move or implementing a strategic trading plan.

Alerts and notifications

The Vantage mobile trading app includes a robust alerts and notifications system, enabling traders to stay informed of market movements and important account activity in real time. Users can customize notifications to suit their trading strategies, ensuring they never miss key opportunities or critical updates. This functionality enhances responsiveness and helps maintain effective risk management, making the mobile platform a reliable tool for active traders. For a comprehensive assessment of its performance and features, see our full Vantage mobile app review.

Vantage App: Key Takeaways

The key takeaway for the Vantage mobile app is that it combines a sleek, user-friendly interface with comprehensive trading and account management features – including real-time alerts, copy trading, and multi-language support – making it a versatile and reliable tool for both beginner and experienced traders who want to manage their portfolios efficiently on the go.

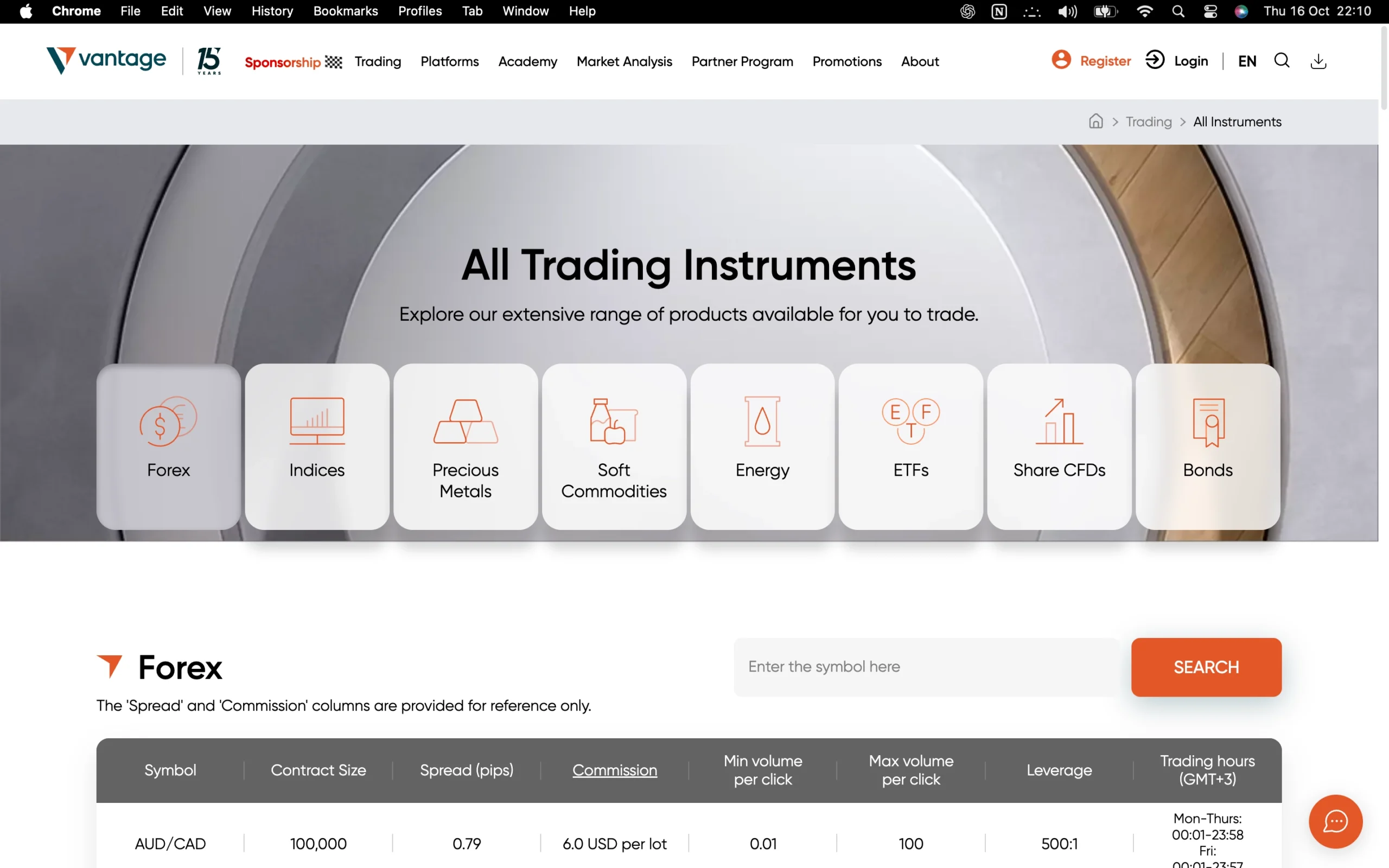

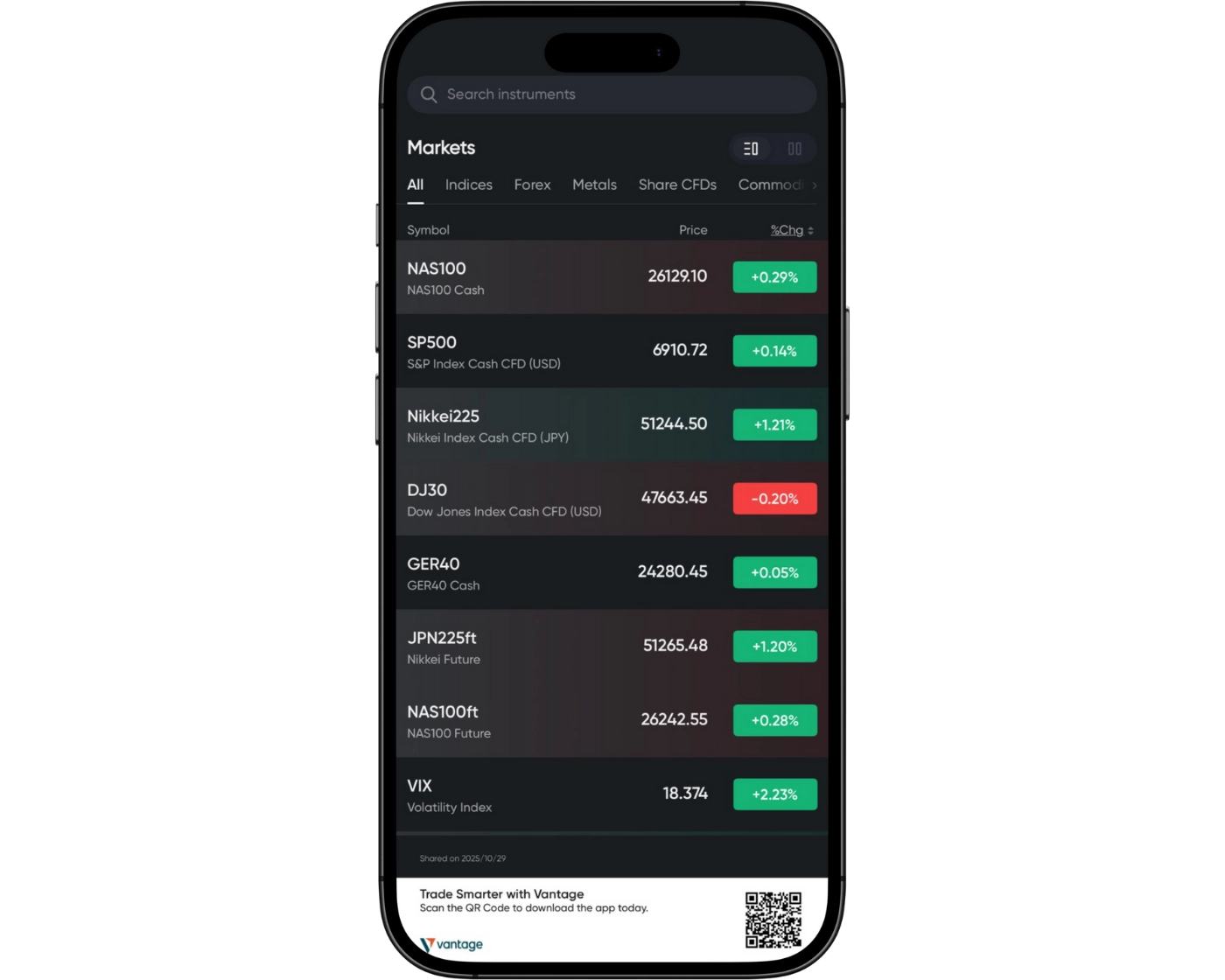

Vantage Markets Tradeable Instruments Overview

Vantage Markets provides traders with access to a broad spectrum of over 1,000 tradable instruments, covering currency pairs, commodities, stock CFDs, indices, cryptocurrencies, futures, ETFs, and bonds. This diverse selection allows traders to build a balanced portfolio, combining lower-risk assets with higher-yield opportunities.

While Vantage’s forex offerings are average in terms of the number of currency pairs, the platform excels in commodities, stock CFDs, indices, and cryptocurrencies. Cryptocurrency trading is available both via CFDs and by trading the underlying assets, such as Bitcoin and Ethereum, although crypto CFDs are restricted for retail clients in the U.K. Some stock CFDs, including major companies from the U.K., U.S., European, and Australian markets, are only accessible on the MetaTrader 5 platform.

Overall, Vantage Markets is primarily a forex broker with a strong CFD and crypto offering, providing a wide range of investment options that cater to both conservative and risk-seeking traders, while remaining mindful of regulatory restrictions in certain regions.

| Markets | Number | Types |

|---|---|---|

| Share CFDs | 794 | US, UK, EU, Australia |

| Forex Pairs | 61 | Major, Minor, and Exotic |

| Cryptocurrencies | 57 | Major and Minor |

| ETFs | 57 | Financial, Retail, Other |

| Indices | 29 | US, EU, Asia, Other |

| Commodities | 23 | Metals, Energies, Agricultural |

| Futures | 11 | Commodities and Indices |

| Bonds | 7 | EU and US |

What Are CFDs and How to Trade Them

Contracts for Difference (CFDs) are versatile financial derivatives that allow traders to speculate on price movements of assets without needing to own the underlying instruments. This flexibility makes CFDs an attractive option for both beginner and professional traders.

How CFDs Work: When you take a long position (buy) on an asset like gold, profits are realized if the asset’s price rises, while losses occur if the price falls. Conversely, taking a short position (sell) generates profits if the asset’s price declines.

Key Advantages:

Immediate Market Access: CFDs enable rapid entry and exit, allowing traders to respond instantly to market shifts.

Leverage Opportunities: Traders can control larger positions with smaller capital outlays, maximizing potential gains.

Diverse Asset Exposure: CFDs cover a broad range of markets, including forex, commodities, indices, stocks, and cryptocurrencies, all accessible through TradeWiki’s platforms.

With Vantage Markets, trading CFDs becomes a seamless experience, combining flexibility, speed, and access to global markets, empowering traders to capitalize on even minor price fluctuations.

Social Trading at Vantage Markets

Vantage Markets enhances its trading ecosystem by integrating with several leading social trading platforms, providing traders with seamless access to copy trading opportunities. Through partnerships with ZuluTrade, Myfxbook, MetaTrader Signals, and DupliTrade, users can follow and replicate the strategies of top-performing traders. This feature empowers both novice and experienced traders to diversify their approach, leverage expert insights, and implement algorithmic or strategy-driven trades with ease, all while managing risk effectively.

Vantage Markets VPS Hosting

Vantage Markets offers complimentary Virtual Private Server (VPS) hosting to enhance trading performance with ultra-low latency. This service ensures stable internet connectivity and lightning-fast order execution, averaging just 5 milliseconds, making it ideal for traders who require precision and speed. VPS hosting is available free of charge for funded accounts maintaining a minimum balance of $1,000 and a monthly notional trading volume of at least $0.5 million, providing an advanced, reliable environment for high-frequency or algorithmic trading strategies.

Vantage Markets Instruments: Key Takeaways

Vantage Markets offers an impressive selection of 1,039 tradable instruments, providing a breadth and diversity that surpasses many brokers. Its portfolio combines lower-risk assets, such as ETFs and bonds, with higher-risk, high-yield options like indices and cryptocurrencies. Traders can also access a solid range of futures contracts, making the platform suitable for swing and position trading strategies.

A standout feature is Vantage’s cryptocurrency offering, which exceeds the average market selection. Several cryptocurrencies and select metals are available in multiple denominations, including USD, JPY, and EUR, giving traders enhanced flexibility in portfolio management. The platform delivers a versatile trading environment, though it currently lacks stocks from Asian companies, which may limit exposure for traders seeking broader international equities.

Overall, Vantage Markets provides a well-rounded mix of assets designed to meet the needs of both conservative and aggressive traders, combining diversity, flexibility, and reliable market access in a single platform.

| Instruments Summary | Vantage |

|---|---|

| Cryptocurrency (Derivative) | Yes |

| Forex Pairs (Total) | 61 |

| Tradeable Symbols (Total) | 1039 |

| U.S. Stock Trading (Non-CFD) | No |

| Social Trading / Copy Trading | Yes |

| Int’l Stock Trading (Non-CFD) | No |

| Cryptocurrency (Physical) | No |

| Forex Trading (Spot or CFDs) | Yes |

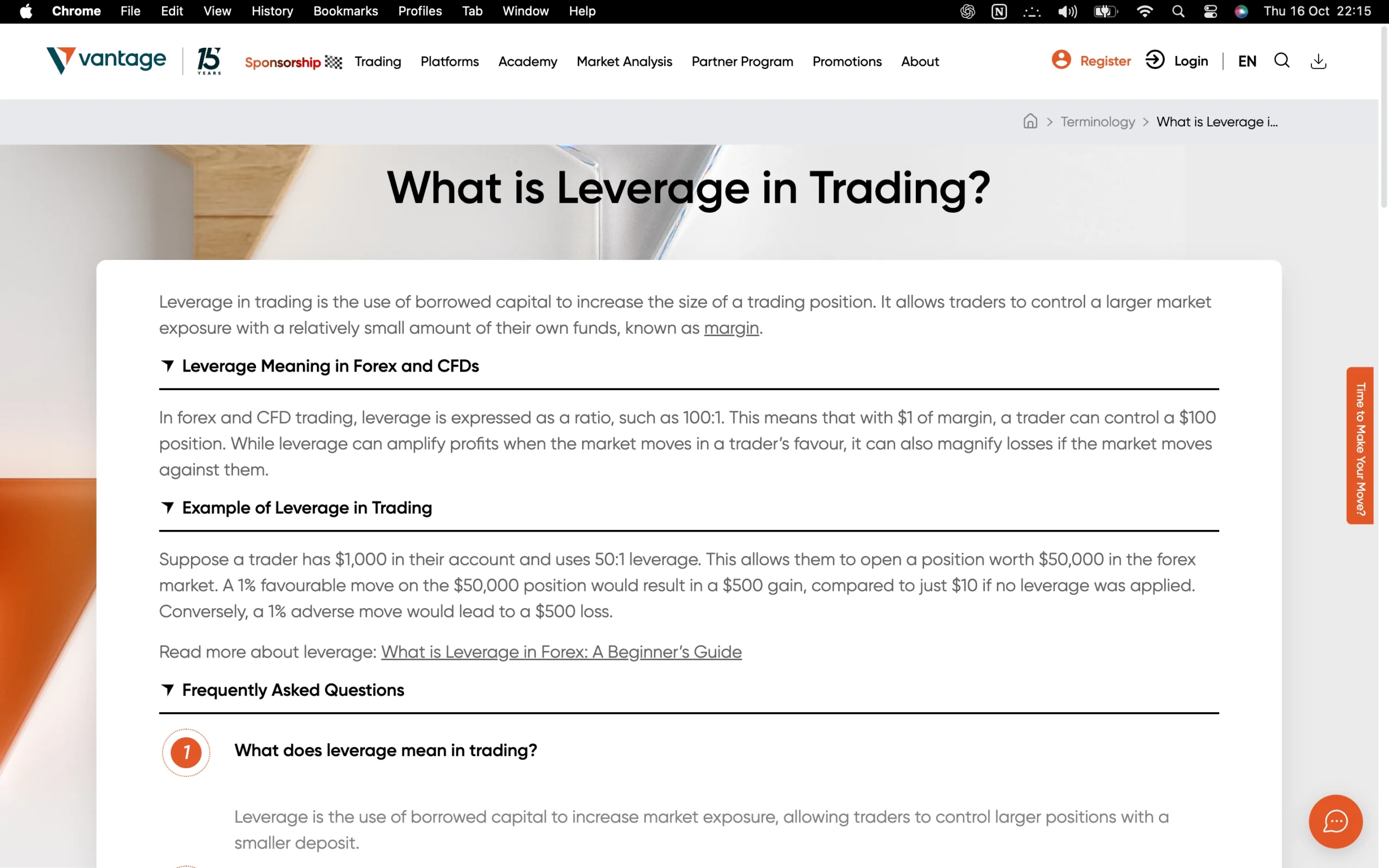

Understanding CFD Leverage on Vantage Markets

Leverage is a powerful tool that determines the total market exposure a trader can access. When trading Contracts for Difference (CFDs) on Vantage, traders are able to open positions that are larger than their actual account balance because the broker provides borrowed capital. This means a relatively small investment can control a much larger position in the market.

Using leverage effectively can amplify profits on successful trades, but it also increases the potential for significant losses if positions move against the trader. Understanding how leverage works and applying proper risk management strategies is essential for maximizing opportunities while safeguarding your capital.

Vantage’s CFD leverage options provide flexibility for traders who want to engage in larger market positions without committing the full amount upfront, making it a versatile choice for both forex and CFD trading.

Maximum Retail Leverage by Asset Class on Vantage Markets

Vantage Markets offers traders a variety of leverage options tailored to different asset classes, allowing for enhanced market exposure while maintaining flexibility in risk management. The table below outlines the maximum retail leverage available across key instruments, helping traders make informed decisions when planning their trades.

This structured approach ensures that whether you are trading forex, commodities, indices, or cryptocurrencies, you have a clear understanding of the leverage limits applied to each asset class. By knowing these limits, traders can optimize position sizing, manage risk effectively, and take full advantage of Vantage’s trading conditions.

| Asset | Maximum Leverage |

|---|---|

| Bonds | 1:200 |

| Share CFDs | 1:500 |

| Cryptocurrencies | 1:200 |

| Currency Pairs | 1:500 |

| Indices | 1:200 |

| Commodities | 1:500 |

| Account Type | Standard | Raw | Pro |

|---|---|---|---|

| Minimum Deposit | $50 | $50 | $10,000 |

| Swap Free Account | Yes | Yes | Yes |

| Minimum Trade Volume | 0.01 lot | 0.01 lot | 0.01 lot |

| Stop Out | 20% | 20% | 20% |

| Base Currencies | USD, GBP, CAD, AUD, EUR, HKD, JPY, PLN, SGD, NZD, BTC, ETH | USD, GBP, CAD, AUD, EUR, HKD, JPY, PLN, SGD, NZD, BTC, ETH | USD, GBP, CAD, AUD, EUR, HKD, JPY, PLN, SGD, NZD, BTC, ETH |

| Commission* | $0 | $6 | $3 |

| Standard Contract Size | 100,000 units | 100,000 units | 100,000 units |

| Spread From | 1.1 pips | 0.0 pips | 0.0 pips |

| Demo Account | Yes | Yes | Yes |

| Margin Call | 50% | 50% | 50% |

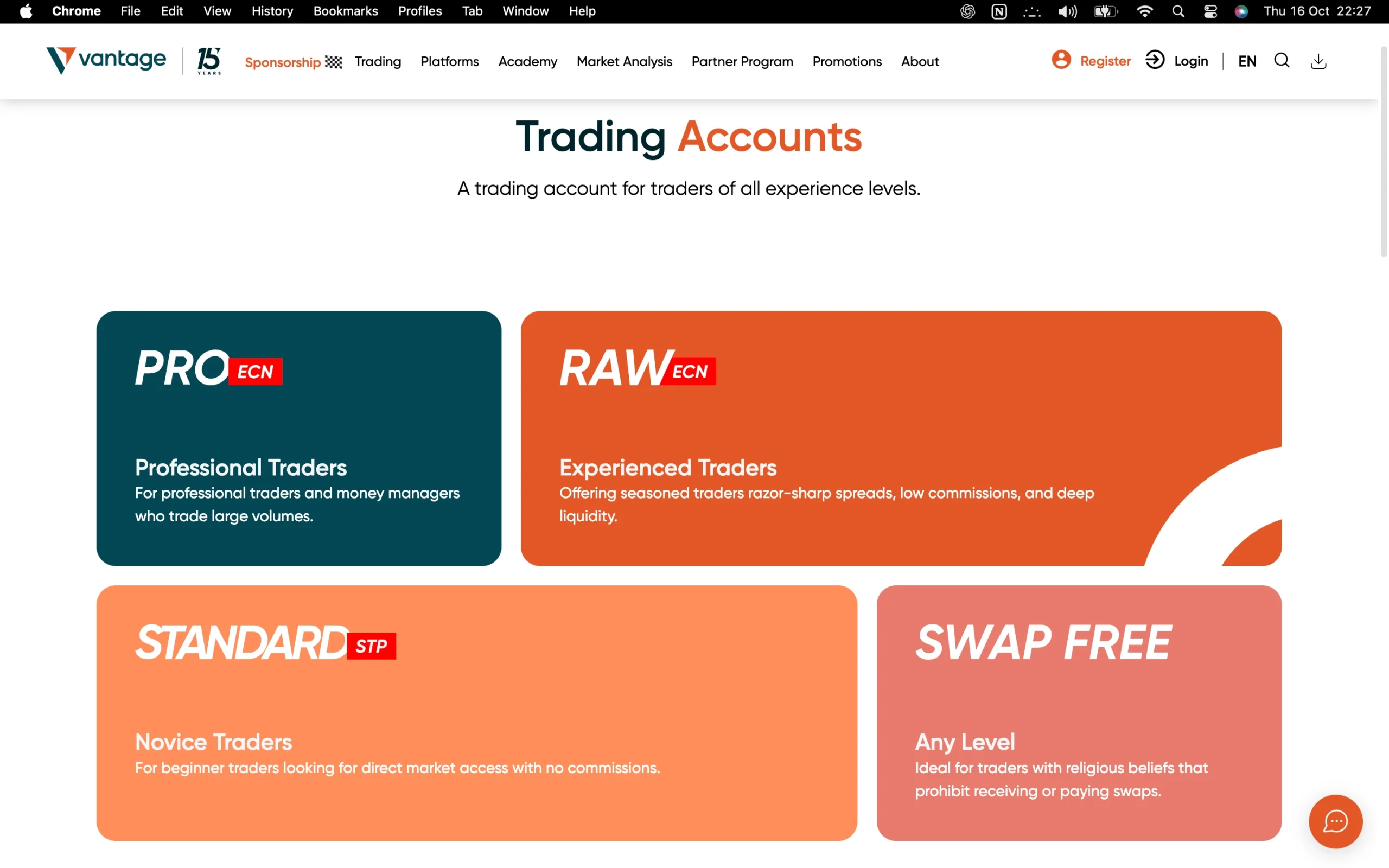

Introduction to Vantage Markets Account Options

For traders looking to explore Vantage Markets, starting with a demo account is highly recommended to familiarize yourself with the platform’s features and tools. Vantage offers three primary account types – STP, Raw ECN, and Pro ECN – each with distinct pricing models, spreads, and execution conditions tailored to different trading styles.

In addition to standard accounts, Vantage Markets provides swap-free (Islamic) STP and ECN accounts, designed for traders who cannot receive or pay overnight interest. Instead, an administrative fee is applied for holding leveraged positions overnight.

Corporate clients can also open business accounts, with the Vantage support team guiding applicants through the necessary documentation to ensure a smooth setup process. This flexible account structure caters to both individual and institutional traders, providing options that match experience, strategy, and compliance requirements.

Vantage Markets Standard STP Account

| Account | Standard STP |

|---|---|

| Spread From | 1.0 pips |

| Minimum Deposit | $50 |

| Commission | $0 |

The Vantage Markets Standard STP Account is tailored for active traders seeking direct market access with optimal speed and transparency. Whether you are trading from South Africa, Kenya, Botswana, Nigeria, or other global regions, this account provides institutional-grade spreads, access to high-liquidity dark pools, and commission-free trading. Utilizing the Equinix Fibre Optic Network, all transactions benefit from fast execution, ensuring your trades are processed without delay.

Risk management is enhanced with a margin call level set at 50% and a stop out level at 20%, giving you greater control over your positions while maintaining tighter oversight of your trading exposure. With consistent price transparency and deep market penetration, the Standard STP Account delivers a robust trading experience designed to meet the demands of both novice and professional traders.

TradeWiki.io clients can enjoy these features with confidence, knowing their trading environment combines speed, reliability, and comprehensive risk management tools.

Vantage Markets Raw ECN Account

| Account | Raw ECN |

|---|---|

| Spreads From | 0.0 pips |

| Minimum Deposit | $50 |

| Commission | $0 |

The Vantage RAW ECN account is engineered for experienced traders who seek full transparency and precise control over their trades. Whether you are trading from South Africa, Kenya, Botswana, Nigeria, or other regions, this account offers direct access to true market conditions, allowing you to make informed trading decisions with confidence.

Traders benefit from institutional-grade spreads, lightning-fast execution, and unaltered currency pair prices with no markups. This ensures some of the lowest spreads and commissions available in the forex trading industry. By providing direct market access, the RAW ECN account empowers traders to execute strategies effectively while maintaining full visibility of pricing.

Risk management is optimized with a margin call level of 50% and a stop out level of 20%, giving you tighter control over open positions and reducing exposure to unexpected market movements. With the Vantage RAW ECN account, you experience a professional-grade trading environment designed for efficiency, transparency, and strategic flexibility.

Vantage Markets Pro ECN Account

| Account | Pro ECN |

|---|---|

| Spread From | 0.0 pips |

| Minimum Deposit | $10,000 |

| Commission | $1.50 |

The Vantage PRO ECN Account is a premium trading solution crafted for professional and institutional traders seeking superior trading conditions. Designed to deliver zero spreads and minimal commissions, this account establishes a high-performance environment for executing sophisticated trading strategies.

Traders from South Africa, Kenya, Botswana, Nigeria, and beyond benefit from the account’s robust features, including precise market access and fast execution, tailored to meet the demands of hedge fund managers and experienced professionals. With a competitive commission of just USD $1.50 per lot per side, the PRO ECN Account empowers traders to fully leverage their strategies with confidence and speed.

This account combines advanced trading tools with an ultra-transparent pricing structure, providing a reliable and professional-grade trading environment. Whether implementing complex strategies or executing high-volume trades, the Vantage PRO ECN Account ensures efficiency, control, and optimal market performance.

Vantage Markets Demo Account

Vantage Markets provides a fully-featured demo account designed for traders to explore the platform and practice strategies in a risk-free setting. Since financial markets are dynamic and constantly changing, using a demo account allows traders to refine their skills, test trading ideas, and gain confidence before committing real capital.

Traders can set up a demo account independently or alongside a live CFD account, ensuring seamless transition from practice to live trading. This hands-on, risk-free environment makes it easier for beginners to learn the ropes and for experienced traders to experiment with new strategies without financial exposure.

Vantage Markets Islamic Account

Vantage Markets provides Islamic trading accounts that comply with Shariah law, offering a swap-free trading environment. These accounts are tailored for traders who require adherence to Islamic finance principles, ensuring that no overnight interest (Riba) is applied to leveraged positions.

Clients interested in opening an Islamic account can easily reach out to Vantage’s customer support for guidance and account setup. This specialized account type allows traders to engage in the financial markets while maintaining compliance with their religious requirements.

Vantage Markets Restricted Countries

Vantage Markets does not offer its trading services to residents of specific jurisdictions due to regulatory restrictions. Currently, individuals living in Canada, China, Romania, Singapore, the United States, and any countries listed under FATF, EU, or UN sanctions are not eligible to open an account.

These limitations ensure compliance with international financial regulations and maintain the integrity and security of Vantage’s trading environment for all eligible clients. Traders outside these restricted regions can access the full range of Vantage’s trading products and features.

Pros:

- Fast

- Low minimum deposit

- Fully digital

Cons:

- None

Step-by-Step Vantage Markets Account Opening Process

Opening an account with Vantage Markets is straightforward and designed for a smooth onboarding experience. Follow these steps to get started:

Click the ‘Register’ button located at the top-right of the Vantage homepage.

Select your country of residence and provide a valid email address.

Enter the verification code sent to your email to confirm your identity.

Create a secure password for your account.

Confirm that you are not a U.S. resident to comply with regulatory requirements.

Accept the Terms and Conditions of Vantage.

Access the Client Portal to continue the setup.

Complete your personal information, including full name, date of birth, and contact details.

Choose your preferred account type and base currency to match your trading needs.

Upload proof of identity (ID or passport) and proof of address to fully verify your account.

By following these steps, traders can quickly set up a verified Vantage account and gain access to a broad range of trading instruments, advanced platforms, and account features.

What is the minimum deposit at Vantage Markets?

Getting started with Vantage Markets is accessible, with account minimums designed to accommodate different trading preferences. For Raw and Standard ECN accounts, the minimum deposit is just $50, making it easy for new and casual traders to begin.

For those seeking advanced trading features, the Pro ECN account requires a higher initial investment of $10,000, reflecting its professional-grade tools, tighter spreads, and enhanced execution speeds.

This tiered deposit structure ensures that both beginner and professional traders can choose an account type that aligns with their experience level, trading goals, and risk tolerance.

Research Overview and Key Features

Vantage Markets stands out with its comprehensive research suite, combining in-house market analysis with high-quality third-party content from providers like Trading Central and Autochartist. This multi-layered approach equips traders with actionable insights, market trends, and trading ideas suitable for both beginners and seasoned professionals.

Key Research Tools and Features:

Economic Calendar: Essential for tracking upcoming market events, economic releases, and news that can impact trading decisions.