Min. Deposit

$100

Spread

1.1 pips

Trust Score

4.6/5

News Trading

Yes

Allow Scalping

Yes

Allow EA's

Yes

FxPro Overview

Fx Empire : Our take on Forex Broker

Forex Brokers : First Paragraph

FxPro traces its origins back to 1999, with a rebrand in 2003, and has since grown into a major global brokerage headquartered in London. Regulated by multiple top-tier authorities, the broker offers access to more than 2,100 tradable instruments, covering CFDs on forex, commodities, indices, stocks, ETFs, and cryptocurrencies.

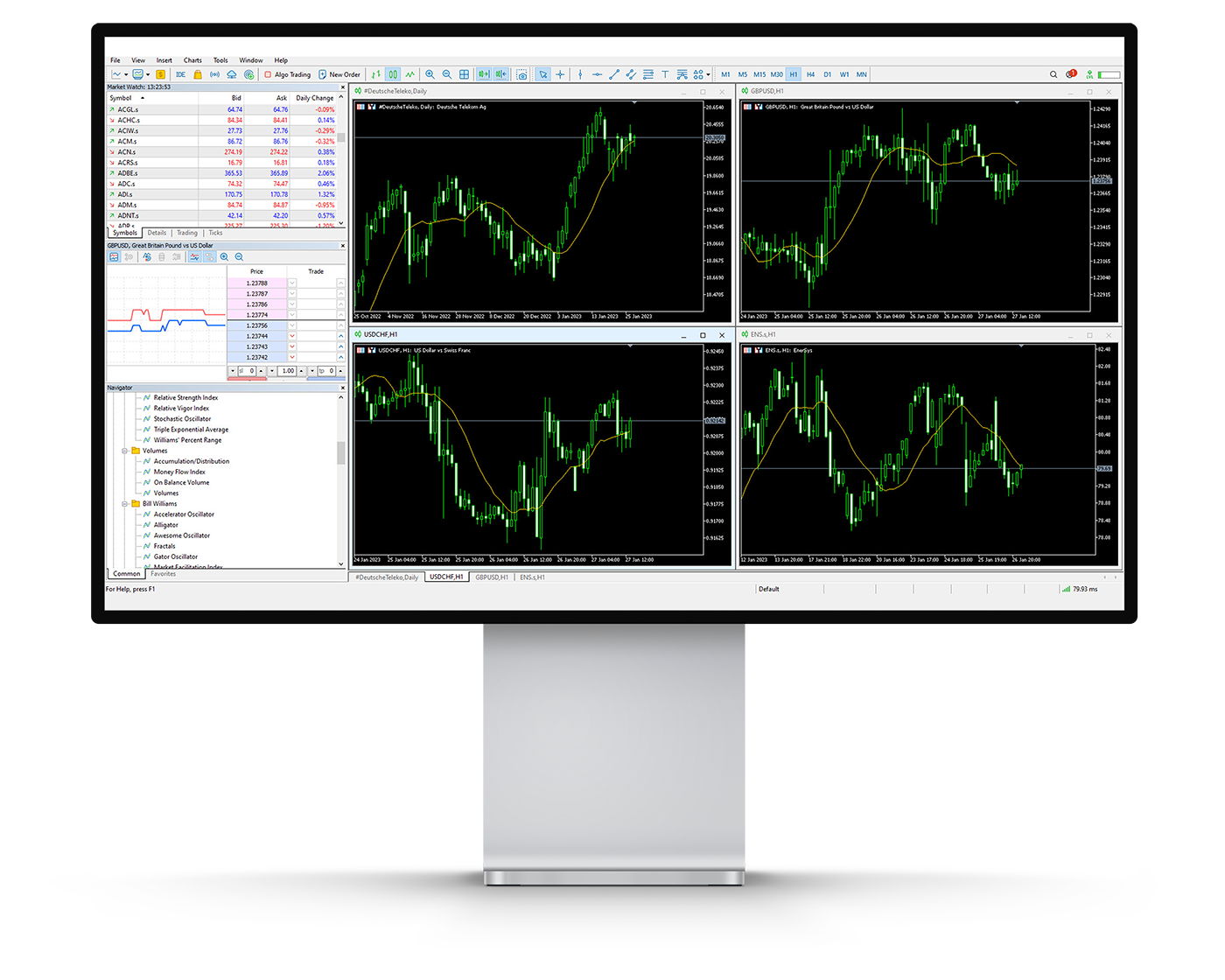

The broker supports a robust selection of trading platforms, including its proprietary FxPro Trading Platform, the FxPro Edge web and mobile app, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Advanced traders also benefit from integration with the BnkPro app and the Invest Web platform, while additional resources such as Trading Central analysis and FxPro Squawk news updates help improve decision-making.

While spreads on the Standard account are not the most competitive, traders can access lower trading costs through the Raw+, Elite, and cTrader account types. These accounts are particularly appealing to active traders seeking raw spreads, faster execution speeds, and greater cost efficiency.

FxPro is versatile enough to meet the needs of all experience levels. Beginners and casual investors will appreciate the intuitive interface of the FxPro Trading Platform and FxPro Edge app, while seasoned traders – including scalpers, day traders, and algorithmic strategy users – can take advantage of the advanced functionality and customizable features of MT4, MT5, and cTrader. The combination of platform choice, multi-asset coverage, and professional-grade tools ensures that traders have the flexibility to build and execute strategies effectively.

FxPro Pros and Cons

Fx Empire

Forex Brokers

Broker Chooser

FxPro Pros:

- Wide range of 2,200+ CFDs including forex, stocks, and commodities

- Competitive spreads via Raw+ and Elite Accounts

- Strong algo trading support with ultra-fast execution (<12 ms)

- Offers MetaTrader, cTrader, and FxPro Edge platform

- Insightful research materials including LiveSquawk and Trading Central

- Good educational resources

- Fast deposits and withdrawals via FxPro Wallet

- Reliable customer support

- Low forex fees

- Smooth and straightforward account opening process

FxPro Cons:

- Only CFDs and forex

- High trading fees for some stock CFDs

- Trading costs are higher than top low-cost forex brokers

- FxPro Edge platform lacks some advanced features found in leading proprietary platforms

- Educational content is not as in-depth as top-tier industry providers

- Limited protection at the offshore entity

- FxPro Trading Platform is only available in English

FxPro Summary

Forex Brokers

Overall

Trust

Investing

Fees

Platform

Research

Mobile

Education

Beginner – Perfect Match

FxPro welcomes casual traders and beginners with a $100 minimum deposit and a user-friendly proprietary platform. New traders can practice on demo accounts, benefit from micro-lot trading for flexible position sizing, and access solid educational resources backed by responsive customer support.

News Trading – Perfect Match

FxPro offers traders the FxPro Squawk service within the client portal, delivering a steady stream of impactful market news including breaking headlines and economic data releases. Further, expert market commentary is accessible through the proprietary trading platform and the FxPro.news website.

Scalping – Perfect Match

For scalpers requiring rapid market entry and exit, FxPro delivers ultra-fast order execution and advanced tools like depth-of-market (DOM) on cTrader and MetaTrader 5. These features create ideal conditions for scalping CFDs.

Investing – Acceptable Choice

Investors have access to thousands of real stocks and ETFs along with screening and portfolio analysis tools. It is important to note that trading real stocks is not available on FxPro’s proprietary platform and requires use of third-party platforms.

Automated Trading – Perfect Match

Algorithmic traders can utilize FxPro’s support for three leading platforms: cTrader, MetaTrader 4, and MetaTrader 5. With VPS hosting available at $30 per month, traders can run Expert Advisors and cAlgo robots continuously for 24/7 automated trading.

Swing Trading – Perfect Match

Swing traders gain access to thousands of real stocks, making FxPro well-suited for holding positions over several days or weeks. Additionally, CFDs with reasonable overnight swap fees provide cost-effective options for swing trading strategies.

Day Trading – Acceptable Choice

FxPro’s platforms support one-click trading and chart-based order entry, supplemented by actionable insights from Trading Central. While spreads on the Standard Account are less competitive, upgrading to Raw+ or Elite accounts grants access to lower trading costs, benefiting active day traders.

Copy Trading – Acceptable Choice

Copy trading is available through the cTrader platform, which offers a wide selection of strategy providers along with detailed performance metrics and an intuitive interface. However, FxPro does not currently offer its own dedicated copy trading platform.

Who is FxPro for?

When evaluating brokers for different trading strategies, FxPro stands out by offering a comprehensive suite of tools and features tailored to various trader profiles. Here is an overview of how FxPro supports key trading approaches:

Fx Empire : Who is Broker for?

What Sets FxPro Apart?

FxPro is a standout broker for traders focusing on short-term strategies such as day trading and scalping. Traders benefit from highly competitive trading costs available through the Raw+ and Elite account options, combined with execution speeds faster than 12 milliseconds. The broker offers advanced trading platforms, reliable VPS hosting, and valuable market tools like Trading Central and FxPro Squawk, all designed to support swift and informed trading decisions.

As an internationally regulated CFD and forex broker, FxPro holds licenses from respected authorities including the UK’s FCA, Cyprus’s CySEC, and the SCB in the Bahamas. The account registration process is fully digital, quick, and straightforward, making it easy for new clients to get started. Multilingual customer support is readily accessible, ensuring assistance is available across different regions. Additionally, FxPro provides a variety of fee-free deposit and withdrawal methods, enhancing convenience for its users.

However, FxPro’s offerings are focused exclusively on forex and CFDs, which may limit traders looking for a wider asset selection. The broker applies average non-trading fees and enforces an inactivity fee after six months without trading activity. Overall, FxPro balances speed, regulatory credibility, and comprehensive tools, making it a reliable option for active traders who prioritize efficiency and market insight.

What Sets FxPro Apart?

Fx Empire : What sets FP Markets Apart?

Broker Chooser : Why choose Broker?

FxPro Main Features

Fx Empire : Broker Main Feautures

Regulations

FCA (United Kingdom), SCB (Bahamas)

Languages

Turkish, English, Russian, French, Portuguese, Thai, Arabic, Spanish, Japanese, Vietnamese, Bahasa, German, Korean, Chinese, Indonesian

Products

Currencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$100

Max Leverage

1:30 (FCA), 1:200 (SCB)

Trading Desk Type

No dealing desk

Trading Platforms

MT5, cTrader, MT4, FxPro Trading Platform, FxPro Mobile App

Deposit Options

Cryptocurrencies, PayPal, Wire Transfer, Skrill, Credit Card, Debit Card, SticPay, Local Transfer, Google Pay)

Withdrawal Options

Wire Transfer, PayPal, Credit Card, Debit Card, Cryptocurrencies, SticPay, Local Transfer, Google Pay

Demo Account

Yes

Foundation Year

1999

Headquarters

United Kingdom

Regulations

FCA (United Kingdom), SCB (Bahamas)

Languages

Turkish, English, Russian, French, Portuguese, Thai, Arabic, Spanish, Japanese, Vietnamese, Bahasa, German, Korean, Chinese, Indonesian

Products

Currencies, Stocks, Crypto, Indices, Commodities

Min Deposit

$100

Max Leverage

1:30 (FCA), 1:200 (SCB)

Trading Desk Type

No dealing desk

Trading Platforms

MT5, cTrader, MT4, FxPro Trading Platform, FxPro Mobile App

Deposit Options

Cryptocurrencies, PayPal, Wire Transfer, Skrill, Credit Card, Debit Card, SticPay, Local Transfer, Google Pay)

Withdrawal Options

Wire Transfer, PayPal, Credit Card, Debit Card, Cryptocurrencies, SticPay, Local Transfer, Google Pay

Demo Account

Yes

Foundation Year

1999

Headquarters

United Kingdom

Start Trading With FxPro

Standard Account

MT4 - MT5-

Spreads : From 1.0 pips

-

Instruments : 70+ Forex pairs, metals, indices, commodities

-

Max Leverage : 500:1

-

Execution : ECN-Pricing

-

Commission : Zero

-

Minimum Lot : 0.01

-

EA’s : Yes

-

Mobile App : Yes

-

VPS Available : Yes

Raw Account

MT4 - MT5-

Spreads : From 0.0 pips

-

Instruments : 70+ Forex pairs, metals, indices, commodities

-

Max Leverage : 500:1

-

Execution : ECN-Pricing

-

Commission : USD $3 per side

-

Minimum Lot : 0.01

-

EA’s : Yes

-

Mobile App : Yes

-

VPS Available : Yes

FxPro Full Review

Safety Intro

Fx Empire :

Forex Brokers :

Broker Chooser : Safety, first paragraph

FxPro is a reputable broker with over 25 years of experience in the financial markets. It is regulated by five authorities worldwide, including the highly respected UK Financial Conduct Authority (FCA). Client funds are securely held in segregated accounts at leading global banks such as Barclays and the Royal Bank of Scotland, reinforcing safety and trust. While FxPro is not publicly listed and does not publish its financial reports, its longstanding presence, strong regulatory framework, and transparent fund management contribute to its reputation for reliability and financial strength.

Fx Empire :

Forex Brokers :

Broker Chooser : Safety

Pros:

- Regulated by top-tier FCA

- Negative balance protection

Cons:

- Financial information is not publicly available

FxPro Regulation

Fx Empire : Broker Regulators

Forex Brokers :

Broker Chooser :

In our evaluations, we carefully assess the regulatory status of each entity operated by a broker to gauge the level of client protection offered. We classify regulators into three tiers, with Tier 1 representing the highest standard of oversight and security.

Regarding FxPro’s regulatory framework:

FxPro UK Limited is authorized and regulated by the Financial Conduct Authority (FCA), registration number 509956. The FCA is considered a Tier 1 regulator, ensuring robust client safeguards and strict compliance standards.

FxPro Global Markets Limited operates under the license of the Securities Commission of The Bahamas (SCB), license number SIA-F184. The SCB is rated as a Tier 3 regulator, indicating a moderate regulatory environment.

Pro Global Limited, working in partnership with FxPro Global Markets Ltd, is licensed and regulated as an Investment Dealer by the Seychelles Financial Services Authority (FSA), license number SD120. The Seychelles FSA also falls within Tier 3 regulation.

This tiered regulatory structure provides clients with varying degrees of protection depending on the specific entity they engage with, highlighting FxPro’s commitment to transparency and compliance across multiple jurisdictions.

Fx Empire : Broker Regulators

Forex Brokers :

Broker Chooser :

| Entity | Pro Global Limited | FxPro UK Limited | FxPro Global Markets Limited |

|---|---|---|---|

| Country/Regions | Seychelles/Global | United Kingdom | Bahamas/Global |

| Regulation | FSA | FCA | SCB |

| Tier | 3 | 1 | 3 |

| Segregated Funds | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Compensation Scheme | No | Yes (FSCS Up to £85,000) | No |

| Maximum Leverage (Retail Account) | 1:10,000 | 1:30 | 4:20 |

| Maximum Leverage (Professional Accounts) | N/A | 9:20 | 1:10,000 |

Understanding the Regulatory Protections of Your Account

Fx Empire : Understanding the regulatory Protections of your account

Forex Brokers :

Broker Chooser :

Brokers often establish multiple entities to serve clients across different regions, but the level of regulatory protection can vary significantly depending on the jurisdiction. Some regulatory bodies enforce rigorous financial standards, while others adopt a more relaxed approach. It’s crucial for traders to understand the protections offered by the specific entity where they open their account.

- One key protection is the segregation of client funds. This practice keeps traders’ money in separate bank accounts, distinct from the broker’s operational funds, which minimizes the risk of mismanagement or accounting errors. All FxPro entities adhere to this standard, ensuring client assets are securely held.

- Another important feature is negative balance protection. This mechanism guarantees that traders cannot lose more than the funds deposited in their accounts, effectively capping potential losses. This safeguard is especially valuable during periods of high market volatility, and it is offered by all FxPro entities.

- Additionally, compensation schemes provide an extra layer of security by protecting retail traders if the broker becomes insolvent. While accounts under FxPro Global Markets Limited are not covered by such insurance, clients holding accounts with the UK-based entity benefit from the Financial Services Compensation Scheme (FSCS), which insures up to £85,000.

- Leverage limits also play a critical role in risk management. By capping maximum leverage, brokers control the level of market exposure available to retail traders, balancing the potential for profit with the risk of loss. FxPro Global Markets Limited offers a maximum leverage of 1:200, allowing for significant trading flexibility within controlled risk parameters.

How you are protected

Fx Empire :

Forex Brokers :

Broker Chooser : How are you protected – First paragraph + Table

FxPro operates through multiple subsidiaries, with the specific entity serving you determined by your country of residence. This distinction is crucial, as investor protection levels and regulatory oversight vary between these entities, directly impacting the security and compliance standards you receive as a trader.

Stability and Transparency

Fx Empire : Stability and Transparecy

Forex Brokers :

Broker Chooser :

FxPro has built a strong reputation over its 25 years in the industry, anchored by its London headquarters and supported by a team of over 200 professionals. This extensive experience underscores the broker’s stability and capacity to deliver reliable services to traders worldwide.

Transparency is central to FxPro’s client relations. The company offers clear insights into its operations through detailed sections on its website. The About page outlines the broker’s history and the structure of its four separate corporate entities, ensuring clients understand who they are dealing with. Additionally, the Pricing page clearly explains the fee structure, while the Legal Documentation page provides easy access to the comprehensive Client Agreement, fostering trust through open communication and thorough disclosure.

Is FxPro safe?

Fx Empire : Is Broker Safe to Trade With?

Forex Brokers : Is FP Markets safe? + Table

Broker Chooser :

FxPro scores highly for trust and stability, backed by a comprehensive regulatory framework and a strong operational history. It is regulated globally by top-tier authorities, including the UK’s Financial Conduct Authority (FCA), and benefits from European Union oversight through the MiFID passporting system.

The broker has earned an impressive Trust Score of 4.6 / 5 , reflecting its robust governance and commitment to client security. FxPro operates multiple entities, all of which maintain segregated client funds and offer negative balance protection, ensuring that traders are shielded from losses beyond their deposited capital.

While FxPro is not publicly listed and does not run a banking institution, its transparent approach to fees and regulatory compliance further enhances its credibility. One area for potential improvement is expanding third-party account insurance to cover all clients worldwide, which would elevate investor protection even further.

Fees Intro

Fx Empire : Fees – Summary

Forex Brokers : Broker Fees – Intro paragraph and after the intro paragraph + table

Broker Chooser : First paragraph

FxPro’s fee structure offers a balanced approach catering to different trader needs. The Standard account features spreads that align with industry averages, making it suitable for casual traders. For those who trade frequently or in higher volumes, the Raw+ and Elite accounts provide significantly lower costs, enhancing profitability for short-term and high-frequency trading strategies.

Deposits and withdrawals are free of charge, removing common barriers for traders. While swap fees and inactivity charges are consistent with market norms, the broker does apply an inactivity fee after prolonged dormancy.

Regarding execution, FxPro’s MetaTrader 4 (MT4) platform gives traders a choice between a spread-only Standard account and a commission-based Raw+ account with market execution. Both MT4 and MT5 support the Raw+ account, while the Elite account—which requires a $30,000 minimum deposit—builds on Raw+ benefits by adding discounts and rebates for high-volume traders.

On the cTrader platform, FxPro allows stop and limit orders without any minimum distance from the entry price, providing flexibility. However, MetaTrader platforms enforce at least a 1 pip minimum distance even for Elite account holders, which is an important consideration for precise order placement. Overall, FxPro’s pricing and execution options offer competitive value, especially for active traders seeking cost efficiency and advanced trading features.

Fx Empire :

Forex Brokers :

Broker Chooser : Fees – Pros and Cons

Pros:

- Low forex fees

- No withdrawal fee

Cons:

- Inactivity fee

FxPro Spreads

Keep same just change Broker Name

Get spreads from actual broker if possible or just use FX Empire

Forex Spreads

Metal Spreads

CFD Indices Spreads

CFD Commodities Spreads

Cryptocurrency Spreads

FxPro Commissions

Fx Empire : Broker Trading fees

Forex Brokers :

Broker Chooser :

FP Markets also charges a commission when you trade share CFDs using the MT5 platform. This applies to both Standard and Raw accounts, on top of the spread.

FxPro Swap Fees

Fx Empire : Broker Swap Fees

Forex Brokers :

Broker Chooser :

When trading forex with FxPro, swap fees – also known as rollover fees – are charges or credits applied for holding positions overnight. These fees vary depending on whether you maintain a long (buy) or short (sell) position.

For clarity, a full-sized forex contract represents 100,000 units of the base currency (the first currency listed in a pair). In the case of gold trading, one full-sized contract equals 100 ounces.

Understanding these swap rates is essential for traders planning to hold positions beyond a single trading day, as they directly impact the cost of maintaining your trades overnight. FxPro provides transparent swap fee details to help you manage your trading costs effectively.

Get all swap fees from broker or just use Fx Empire

FxPro Non-Trading Fees

Fx Empire : Broker Non-Trading Fees

Forex Brokers :

Broker Chooser : No inactivity fee, no withdrawal fee

FxPro does not impose any charges for deposits or withdrawals in most cases, making fund management straightforward and cost-effective. However, certain exceptions apply: withdrawals to Neteller or Skrill without any prior trading activity, or refunds to PayPal made more than six months after the initial deposit, may incur fees.

Regarding account inactivity, FxPro applies a one-time maintenance fee of $10 (or currency equivalent) if no trading activity occurs for six months. Following this, a monthly inactivity fee of $10 is charged for each subsequent month the account remains dormant. These terms may vary slightly depending on the regulatory jurisdiction, such as under CySEC rules, but overall, FxPro maintains a transparent and competitive fee structure designed to support active traders while discouraging prolonged inactivity.

Are FxPro Fees Competitive?

Fx Empire : Are Broker Fees Competitive?

Forex Brokers :

Broker Chooser :

FxPro offers a balanced fee structure that caters well to different types of traders. While the spreads on the Standard account tend to be average to slightly above average, the broker stands out by providing low trading costs through its Raw+ and Elite accounts – ideal for active and high-volume traders. Overnight swap fees are moderate, aligning with industry norms, and there are no charges for deposits or withdrawals, which enhances overall cost efficiency. The inactivity fee is reasonable, applied only after six months without trading activity. This combination makes FxPro’s fees competitive and transparent, appealing to both casual and professional traders looking for reliable and cost-effective trading conditions.

Fees Intro

Fx Empire : Deposit and Withdrawal – Summary

Forex Brokers :

Broker Chooser : Deposit and Withdrawal – First paragraph + Pros and Cons

Funding your FxPro account is straightforward and convenient, with a wide range of payment options available. Whether you prefer bank wire transfers, credit or debit cards, e-wallets, cryptocurrencies, or local payment methods, FxPro supports fast and seamless transactions. Both deposits and withdrawals are processed promptly, and importantly, the broker does not charge any fees for these transactions, ensuring a smooth and cost-effective funding experience for all traders.

Pros:

- Credit/Debit card available

- No deposit fee

- Free withdrawal

Cons:

- Few minor currencies accepted for account

FxPro Account Base Currencies

Fx Empire :

Forex Brokers :

Broker Chooser : Account base currencies + Table

At FxPro, you can choose from the following base currencies:

Fx Empire :

Forex Brokers :

Broker Chooser : Account base currencies under table

This selection is average compared to competing brokers.

Choosing the right account base currency is crucial for minimizing unnecessary costs. When you fund your trading account using the same currency as your bank account, or trade assets denominated in your account’s base currency, you avoid paying currency conversion fees.

To further reduce these expenses, consider opening a multi-currency bank account with a digital bank. These modern banking solutions typically offer accounts in multiple currencies, competitive exchange rates, and either free or low-cost international transfers. Best of all, setting up such an account is quick and easy—often completed within minutes on your smartphone—helping you save money and trade more efficiently.

FxPro Deposit Fees and Options

Fx Empire :

Forex Brokers :

Broker Chooser : Deposit fees and options

FxPro offers a wide range of deposit options with no fees charged for funding your account. Deposits made via credit or debit cards are processed instantly, providing quick access to your trading funds. Bank transfers, while free of charge, typically take several business days to complete. It’s important to note that deposits must come from accounts registered in your name to comply with security policies.

For added convenience, FxPro supports various electronic wallets such as PayPal, Skrill, and Neteller, though these options are not available to clients based in the UK. This diverse selection of payment methods ensures a seamless and flexible funding experience tailored to your needs.

Fx Empire : Broker Deposit Methods – table

Forex Brokers :

Broker Chooser :

Fx Empire :

Forex Brokers :

Broker Chooser : Broker electronic wallets – table.

FP Markets supports the following electronic wallets:

FxPro Withdrawal Fees and Options

Fx Empire : Broker Withdrawal Methods – paragraph

Forex Brokers :

Broker Chooser : Broker withdrawal fees and options

FxPro generally does not charge withdrawal fees, making it cost-effective to access your funds. However, certain exceptions apply: a fee is incurred if you refund to your PayPal account more than six months after your initial deposit, or if you refund to Neteller or Skrill without any prior trading activity.

Withdrawals must be sent only to accounts registered in your name, ensuring security and compliance. During testing, withdrawals via credit card and bank transfer were processed within one business day, highlighting FxPro’s efficient fund handling.

To withdraw funds, simply log into your FxPro Direct account, navigate to the ‘Wallet’ section, select ‘Withdrawal,’ choose your preferred withdrawal method, and enter the amount you wish to withdraw. This straightforward process supports a smooth and reliable withdrawal experience.

Fx Empire : Broker Withdrawal Methods – Table

Forex Brokers :

Broker Chooser :

How long does FxPro withdrawal take?

Fx Empire :

Forex Brokers :

Broker Chooser : Below Withdrawal fees table.

FxPro prioritises quick and efficient withdrawal processing, typically completing requests within one business day during normal operating hours. However, the total time for funds to reach your account varies depending on the withdrawal method selected.

Withdrawal Processing Times by Method:

Bank Wire Transfers: International bank transfers usually take between 3 to 5 business days to arrive. For SEPA and local bank transfers, the processing time is generally faster, around 1 to 2 business days.

Credit/Debit Cards: Withdrawals to credit or debit cards may require up to 10 business days before the funds appear in your account.

E-Wallets (such as PayPal, Skrill, Neteller): These methods offer the fastest withdrawals, often completed within a single business day.

FxPro does not impose any fees for deposits or withdrawals. Nevertheless, you might encounter fees from external payment providers, especially banks involved in the transaction.

If your withdrawal has not been completed within the expected timeframe, it is recommended to contact Trade Wiki’s Client Accounting team. They can assist by providing transaction details, including SWIFT copies for bank transfers or ARN numbers for card payments.

To make a withdrawal, simply log in to your FxPro Direct account, go to the ‘Wallet’ section, and click on ‘Withdrawal.’ Follow the prompts to select your preferred withdrawal method and complete your request.

For comprehensive details on withdrawal options and processing times, visit FxPro’s official website.

How do you withdraw money from FxPro?

Fx Empire :

Forex Brokers :

Broker Chooser : Below Withdrawal fees table.

- Log in to your account (FxPro Direct)

- Go to ‘Wallet’

- Click on ‘Withdrawal’

- Select the withdrawal method

- Enter the withdrawal amount

FxPro caters to traders at all levels by offering a versatile range of trading platforms designed to suit diverse preferences and strategies. These include the intuitive FxPro Trading Platform, the widely respected MetaTrader suite (MT4 and MT5), and the flexible cTrader platform. Additionally, the FxPro Direct Mobile App enhances trading convenience by allowing users to execute trades, analyze markets, and manage accounts directly from their mobile devices.

Traders benefit from three primary platforms: FxPro Edge, MetaTrader, and cTrader. FxPro Edge, the broker’s proprietary web-based platform, boasts advanced charting capabilities and a responsive interface. While it may not yet rival the sophistication of industry leaders like Saxo, CMC Markets, or IG, recent updates have significantly improved its functionality. Features such as customizable layouts, animated tickers, and modular drag-and-drop windows offer a tailored user experience that distinguishes FxPro from brokers relying solely on MetaTrader.

In terms of charting, FxPro Edge provides smooth performance with 53 technical indicators and multiple chart types to support comprehensive market analysis. By comparison, cTrader offers an even broader array of 76 indicators and extensive drawing tools, delivering a sleek and powerful charting environment surpassing MetaTrader’s standard setup. A standout function within FxPro Edge is its drag-and-modify capability, allowing traders to adjust stop-loss and limit orders simply by dragging them on the chart, streamlining order management.

Beyond these platforms, FxPro supplies a solid selection of trading tools and third-party integrations. FxPro Edge comes preloaded with several default layouts alongside customizable widgets and modules. While FxPro’s platform offerings provide flexibility and a broad toolkit for traders, there remains potential for further enhancements to match the features and polish of top-tier trading platforms.

Fx Empire : Platform and Tools – Summary

Forex Brokers : Trading Platforms – Everything

Broker Chooser :

MetaTrader 4 Desktop Intro

Fx Empire : Metatrader 4 Desktop

Forex Brokers :

Broker Chooser : Maybe read

FxPro offers traders access to the widely recognized MetaTrader 4 (MT4) desktop platform, renowned for its advanced features that extend well beyond basic trading. MT4 supports both copy trading—allowing users to follow successful traders through signal services—and automated trading via Expert Advisors (EAs), which are custom-built programs designed to execute trades automatically based on predefined strategies.

With support for 39 languages, including Arabic and Vietnamese, the platform accommodates a broad international audience, making it accessible to traders worldwide.

Key Features of MetaTrader 4 on FxPro:

Price Alerts: Stay ahead of market movements by receiving notifications when your selected instruments reach target prices, allowing you to act without constant monitoring.

Customizable Watchlists: Build personalized watchlists to track your preferred trading instruments with real-time price updates in a dedicated market watch window.

One-Click Trading: Execute trades instantly with a single click, bypassing confirmation dialogs—a crucial advantage for active day traders needing swift execution.

Chart-Based Trading: Place and manage trades directly from the charts, keeping your focus on price action without switching to separate order entry screens.

This comprehensive toolkit enhances trading efficiency, enabling both beginners and seasoned traders to optimize their strategies seamlessly on FxPro’s MetaTrader 4 platform.

Fx Empire :

Forex Brokers :

Broker Chooser : Desktop platform – pros and cons

Pros:

- Clear fee report

- Price alerts

- Good customizability (for charts, workspace)

Cons:

- Search function could be improved

- No two-step (safer) login

- Poor design

Charts

Fx Empire : Metatrader 4 Desktop

Forex Brokers :

Broker Chooser :

MetaTrader 4 offers a powerful and comprehensive charting toolkit designed to enhance your trading analysis and decision-making. With a range of technical indicators, drawing tools, and flexible timeframes, it supports traders at all levels.

Charting Features on MetaTrader 4:

30 Technical Indicators: Utilize key analytical tools such as moving averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands to detect trends, momentum, and optimal entry or exit points in the market.

23 Analytical Objects: Employ versatile drawing tools including trendlines, Fibonacci retracements, and Gann angles to map out crucial support and resistance zones and forecast potential price movements.

9 Time Frames: Examine price action across multiple intervals, ranging from rapid minute-by-minute charts suited for day traders to monthly charts that provide a long-term market overview.

3 Chart Types: Choose between traditional bar charts, detailed candlestick charts, or simplified line charts to visualize market behavior in the way that best fits your trading style.

This extensive charting suite makes MetaTrader 4 a preferred choice for traders seeking precise and customizable market analysis tools to sharpen their strategies.

Orders

Fx Empire : Metatrader 4 Desktop

Forex Brokers :

Broker Chooser :

MetaTrader 4 equips traders with a comprehensive range of order types, enabling precise execution of diverse trading strategies to optimize market opportunities and manage risk effectively.

Key Order Types on MetaTrader 4:

Market Order: Instantly buy or sell at the best available market price, perfect for traders needing rapid entry or exit in fast-moving markets.

Limit Order: Predefine your entry or exit price, allowing automatic trade execution once the market reaches your specified level. This facilitates strategic planning without the need for constant market monitoring.

Stop-Loss Order: A crucial risk management tool that automatically closes a position when the price hits your set threshold, helping to limit potential losses and safeguard your trading capital.

Trailing-Stop Order: An adaptive stop-loss that moves with favorable price shifts, locking in profits dynamically while allowing your trade to continue benefiting from positive market trends.

By leveraging these versatile order types, traders can execute more disciplined and flexible trading plans, enhancing both control and confidence in their market engagements.

Mt4 WebTrader

Fx Empire : Metatrader 4 Desktop

Forex Brokers :

Broker Chooser :

- One-Click Trading: Execute trades quickly and efficiently with just a single click.

- Trading from the Chart: Enjoy the flexibility of trading directly from your charts, making it easier to act on market movements.

- Watchlists with Real-Time Quotes: Keep track of your favorite instruments and monitor live quotes effortlessly.

- Trade History: Easily access your past trades to analyze performance and refine your strategies.

- Advanced Charting: Benefit from 30 technical indicators that enhance your technical analysis and decision-making.

- Copy Trading and Automated Trading: Take advantage of copy trading to follow successful traders or automate your strategies for greater efficiency.

With these features, FxPro provides a robust trading experience through its Web Trader platform, making it a solid choice if you’re searching for a Forex broker that stands out among the best in the industry.

MT4 Mobile App

Fx Empire :

Forex Brokers :

Broker Chooser : Mobile app – Pros and cons – Should stay the same.

Pros:

- Good search function

- User-friendly

- Price alerts

Cons:

- No two-step (safer) login

Fx Empire : MetaTrader 4 Mobile App – Paragraph

Forex Brokers :

Broker Chooser :

The MetaTrader 4 mobile application is available for both Android and iOS, providing traders with essential tools to manage their positions on the go. Key features include customizable price alerts, seamless one-tap order execution, and the ability to place trades directly from interactive charts.

Most order types supported on the desktop version—such as pending orders and standard stop-losses—are also available on the mobile app. However, the trailing stop-loss feature, which dynamically adjusts stop levels as the market moves in your favor, is currently only accessible on the desktop platform.

To change the app’s language, users must modify the language settings of their entire device. While the MetaTrader 4 mobile interface retains a classic design that some may find dated, it still offers functionality that surpasses many other trading apps, making it a reliable choice for traders seeking flexibility and control away from their desks.

Fx Empire :

Forex Brokers :

Broker Chooser : Mobile app – From : Look and feel until Alerts and notifications.

Look and Feel

FP Markets has a great mobile trading platform, we really liked its design and user-friendliness. You will easily find all the features

Login and security

FP Markets provides only a one-step login for its mobile platform. A two-step authentication would be more secure and adding this feature should be high on any company’s list of security changes.

As an added safety feature, the broker provides a static pin made upon creation that you can use when logging in and there is fingerprint authentication for the app.

You can log in using biometric authentication, which is a convenient feature.

Search functions

The search functions are good.

You can search by typing the name of the product or by navigating the category folders.

Placing orders

You can use the following order types on the mobile trading platform:

- Market

- Limit

- Stop

There are also order time limits you can use:

- Good ’til canceled (GTC)

- Good ’til time (GTT)

Alerts and notifications

You cannot set alerts and notifications on the FP Markets mobile platform.

However, you can set up mobile push notifications on the desktop trading platform. It would be much easier if you could set these notifications on the mobile app itself.

Our analysts personally tested FP Markets’s mobile trading platform; read the FP Markets mobile app review for a detailed verdict on its performance and features.

Fx Empire : Metatrader 4 : My Key Takeaways

Forex Brokers :

Broker Chooser :

MetaTrader 4: Key Takeaways

MetaTrader 4 is one of the most widely used forex trading platforms worldwide. It’s the go-to option offered by many brokers and is trusted by millions of traders.

The platform is known for its strong performance and flexibility. It supports one-click trading, chart-based order execution, and custom alerts. Users can also place a full range of order types, including market and pending orders.

MT4 stands out on desktop with powerful tools for advanced users. It supports the use of Expert Advisors (EAs), which allow for automated trading and backtesting strategies.

Its interface is simple and focused on functionality, making it reliable for traders who value speed, precision, and custom setups.

Fx Empire : cTrader – Should stay the same just change the broker name.

Forex Brokers :

Broker Chooser :

Pros:

- User-friendly

- Good search function

- Price alerts

Cons:

- No two-step (safer) login

cTrader is a modern, intuitive trading platform designed to serve the needs of day traders, scalpers, and advanced algorithmic traders. Built to replicate an institutional trading environment, cTrader offers professional-grade tools and features that elevate your forex trading experience, especially for traders seeking precision and speed.

Key features of cTrader include:

Depth of Market (DoM) with Level 2 liquidity: View real-time liquidity from multiple providers to better understand market depth and price levels.

One-click and chart trading: Execute trades instantly with single clicks or directly from interactive charts for maximum efficiency.

Price alerts and market sentiment: Set customizable price alerts and access aggregated market sentiment data, showing the percentage of traders who are long or short across all cTrader brokers.

Comprehensive order types: Use market, limit, stop loss, stop limit, and trailing stop orders with flexible time-in-force options such as Good ‘Til Cancel (GTC) to tailor your trade management.

Robust charting tools: Analyze markets using 26 time frames, 4 different chart types, 76 technical indicators, and over 10 drawing tools available on the desktop platform.

Integrated news and economic calendar: Stay informed with up-to-date financial news and key economic events embedded within the platform.

Automated trading and backtesting: Develop, test, and deploy automated strategies using cBots—cTrader’s version of trading robots—offering functionality similar to MetaTrader’s Expert Advisors but within a sleek, modern interface.

cTrader combines advanced trading capabilities with a user-friendly design, providing a powerful alternative for forex traders who want institutional-level features without compromising ease of use.

FxPro Tradeable Instruments Intro

Fx Empire : Tradeable Instruments – Summary and paragraph under table

Forex Brokers : Range of Investments – Everything

Broker Chooser : Product Selection – Everything except the table

FxPro offers an extensive range of CFD trading instruments across multiple asset classes, including forex, stocks, commodities, futures, indices, and cryptocurrencies. With over 2,100 CFDs available, FxPro surpasses many competitors by providing traders with broad market access through a single platform.

The available instruments vary slightly depending on the trading platform selected. For instance, the MetaTrader suite grants access to more than 2,249 CFDs, encompassing forex pairs, shares, indices, metals, energies, and cryptocurrencies. Meanwhile, the cTrader platform offers an even wider selection. Additionally, FxPro’s BankPro app provides thousands of shares through a separate account, enhancing equity trading options.

While FxPro specializes in CFDs, it does not offer direct trading of real stocks or ETFs, nor can traders purchase underlying cryptocurrencies like Bitcoin; crypto trading is available only through CFDs. It’s important to note that cryptocurrency CFDs are not accessible to retail traders in the UK or residents trading via UK entities.

Overall, FxPro stands out for its strong coverage in commodities and cryptocurrencies, delivering diverse market exposure suitable for traders seeking flexibility across various financial instruments. This comprehensive offering supports both spot and futures markets, making FxPro a competitive choice for traders looking to diversify their portfolios.

Fx Empire : Tradable Instruments – Table gets put into below thing.

Forex Brokers :

Broker Chooser :

Insert Tradeable Instruments carousel

What are CFDs ?

Fx Empire : What are cfd’s?

Forex Brokers :

Broker Chooser :

A Contract for Difference (CFD) is a financial agreement where the buyer and seller exchange the difference in value of an asset between the time the contract opens and closes. Unlike purchasing the actual asset, CFDs allow traders to speculate on price movements – whether the price rises or falls – without owning the underlying security. This derivative instrument offers flexible opportunities to trade on various markets, including stocks, forex, commodities, and indices, making it a popular choice for both novice and experienced traders. By using CFDs, traders can potentially profit from both upward and downward market trends while managing exposure with leverage.

Social Trading

Fx Empire :

Forex Brokers :

Broker Chooser : Social Trading

A Contract for Difference (CFD) is a type of trading agreement where the buyer earns from the difference between the current price of an asset and its price when the trade started. CFDs are popular in trading because they let people profit from price changes without needing to own the actual asset. This makes them similar to other derivatives like futures contracts, offering flexible ways to trade on markets such as forex, stocks, indices, and commodities.

FxPro Instruments: Key Takeaways

Fx Empire : Broker Instruments: My Key Takeaways

Forex Brokers :

Broker Chooser :

FxPro offers an extensive range of tradable instruments, surpassing many CFD brokers in market variety. Traders gain access to U.S. stocks, equities from seven European nations, as well as both spot and futures markets. Additionally, FxPro features a strong selection of 39 cryptocurrencies, making it an ideal platform for investors seeking broad market exposure and opportunities in digital assets. This diverse offering supports portfolio diversification and positions FxPro as a top choice for traders aiming to explore multiple asset classes efficiently.

Fx Empire :

Forex Brokers : Range of Investments – Table

Broker Chooser :

Fx Empire : Leverage + Table

Forex Brokers :

Broker Chooser :

What is CFD Leverage?

Leverage is a key feature that attracts many traders to forex and CFD markets. It allows you to borrow capital to increase your trading position beyond the funds available in your account. This means you can control a larger market exposure with a relatively small investment.

However, leverage is often called a “double-edged sword” because while it can amplify your profits, it also increases the potential for significant losses. Even minor price fluctuations can lead to substantial gains or losses, so managing leverage responsibly is crucial.

Leverage levels vary depending on the asset class. CFDs on forex typically offer the highest leverage, whereas CFDs on cryptocurrencies tend to have much lower leverage limits.

For instance, at the FxPro Global Markets Limited entity, traders can access leverage up to 1:200. This means a $1,000 account balance could control positions worth up to $200,000. While this high leverage offers the opportunity for enhanced returns, it also demands careful risk management to avoid large losses.

Fx Empire :

Forex Brokers :

Broker Chooser : Account Opening – Pros and Cons

Pros:

- Fast

- Fully digital

- Low minimum deposit for forex accounts

Cons:

- None

FxPro Account Opening Process

Fx Empire : Broker Account opening Process

Forex Brokers :

Broker Chooser :

Opening an account with FxPro is a seamless, fully digital process designed to get you trading quickly. The entire application takes about 10 minutes to complete, and verification typically happens within just a couple of hours, ensuring a fast start to your trading journey.

Here’s a step-by-step guide to opening your FxPro account:

Begin by providing your country of residence, full name, email address, and setting a secure password.

Enter your nationality, date of birth, phone number, and residential address.

Share your employment details, including your employment status, industry, and highest level of education.

Supply financial information such as your annual income, net worth, source of wealth, and the purpose of opening the account.

Complete a brief questionnaire about your trading experience and financial knowledge to help tailor your account settings.

Choose your preferred trading platform – options include MetaTrader 4, MetaTrader 5, FxPro Edge, or cTrader – along with your default leverage, base currency, and preferred language for email communications.

Verify your identity and residency by uploading a valid government-issued ID (passport, national ID, or driver’s license) and a selfie for confirmation. To prove residency, submit a recent utility bill or bank statement dated within the last six months.

FxPro’s streamlined account setup prioritises both speed and security, allowing you to start trading with confidence and ease.

What is the minimum deposit at FxPro?

Fx Empire :

Forex Brokers :

Broker Chooser : What is the minimum deposit at Broker?

The required FxPro minimum deposit is $100.

Fx Empire : Broker Account Types and Their Benefits

Forex Brokers :

Broker Chooser :

Insert Forex Account Types carocel

Fx Empire :

Forex Brokers :

Broker Chooser : Account Types

FxPro offers a variety of account types tailored to meet the needs of different traders, combining speed, affordability, and advanced features to optimize the trading experience.

Standard Account (MT4/MT5): Designed for traders who prioritize quick execution and competitive low floating spreads, this account provides an efficient and cost-effective trading environment.

Raw+ Account (MT4/MT5): Featuring ultra-tight spreads starting from 0 pips, the Raw+ account is perfect for traders looking for precise pricing and minimal transaction costs.

Elite Account: Building upon the Raw+ offering, the Elite account includes exclusive rebates and VIP privileges, making it an excellent choice for high-volume traders seeking premium benefits.

cTrader Account: Traders using the cTrader platform benefit from exceptionally low spreads and a comprehensive suite of advanced tools, ideal for executing sophisticated trading strategies.

Each FxPro account type is engineered to deliver reliable trade execution and flexibility, empowering traders at every level to maximize their potential in the markets.

FxPro Demo Account

Fx Empire : Demo Account

Forex Brokers :

Broker Chooser :

FxPro offers demo accounts across all its platforms—including the FxPro Trading Platform, MetaTrader 4/5, and cTrader—providing an ideal environment for traders to hone their skills without financial risk. These practice accounts feature live market prices and realistic simulated conditions, allowing beginners to confidently experiment with trading strategies and familiarize themselves with platform tools.

Traders can access a wide range of assets such as forex, commodities, indices, stocks, and cryptocurrencies within the demo environment. This seamless transition from virtual to real trading ensures users are well-prepared when they decide to move into live markets.

FxPro Islamic Account

Fx Empire : Islamic Account

Forex Brokers :

Broker Chooser :

FxPro offers a swap-free Islamic account designed to follow Sharia law principles. This account allows traders to trade without paying or earning overnight interest, meeting the needs of those seeking Sharia-compliant trading options.

FxPro Restricted Countries

FxPro welcomes clients from most countries worldwide, offering broad global access to its trading services. However, there are specific jurisdictions where residents are not eligible to open accounts. These restricted countries include:

Afghanistan, Canada, French Southern Territories, Kosovo, Pitcairn, Sudan, Yemen, Aland Islands, the Democratic Republic of the Congo, Guam, Laos, Portugal (since 2022), Syria, Zimbabwe, Algeria, Côte d’Ivoire, Guyana, Puerto Rico, Trinidad and Tobago, Tunisia, American Samoa, Cuba, Iran, Sint Maarten (Dutch part), Spain, the United States, Azerbaijan, Curaçao, Liberia, Myanmar, Somalia, United States Minor Outlying Islands, Belgium, Equatorial Guinea, Israel, Libya, Bonaire, Sint Eustatius and Saba, Ethiopia, Norfolk Island, South Sudan, Vanuatu, Bosnia and Herzegovina, France, North Korea, Democratic People’s Republic of Korea (DPRK), Northern Mariana Islands, and the U.S. Virgin Islands.

This compliance with regional regulations ensures a secure and legally compliant trading environment for all eligible clients.

Fx Empire : Research

Forex Brokers : Research

Broker Chooser :

FxPro excels in delivering comprehensive market research, combining expert in-house analysis with a selection of proprietary and third-party tools tailored for traders of all levels. With fresh insights updated multiple times daily, FxPro ensures you stay informed and ahead of market trends.

The dedicated news platform, fxpro.news, categorises content into Market Overview, Cryptocurrency, and Technical Analysis, providing clear and actionable information. The Market Overview section offers timely updates on key economic releases and major geopolitical events that influence global markets, helping traders understand the fundamental drivers behind price movements.

For crypto traders, daily updates focus primarily on Bitcoin, highlighting significant developments and market impacts. Technical analysis reports cover forex, commodities, and equities, featuring detailed Elliott Wave insights alongside key support and resistance levels. These reports are published several times a day, offering practical guidance for making informed trading decisions.

Within the client portal, an integrated economic calendar keeps traders prepared for important upcoming events. Additionally, the FxPro Squawk, powered by LiveSquawk News, delivers real-time alerts on breaking news, economic data, and market-moving headlines, ensuring you never miss critical information.

FxPro’s blog complements these resources with multiple daily articles encompassing Market Overview, Technical Analysis, and Crypto Reviews. These are accessible directly through the FxPro Edge platform, which also integrates live news modules and a sentiment data dashboard featuring trading session times and summaries of top gainers and losers.

While FxPro continues to enhance its research offerings steadily, the combination of expert analysis, real-time news, and practical trading tools creates a well-rounded environment designed to empower traders in every market condition.

FxPro Research: Key Takeaways

FxPro delivers a powerful combination of expert in-house research alongside premium third-party tools, including Trading Central (available for funded accounts) and LiveSquawk News. These resources provide traders with timely, actionable insights tailored to different trading styles.

Active and short-term traders will find the Squawk service especially valuable, offering real-time alerts and market-moving ideas to capitalize on fast-changing conditions. Meanwhile, Elliott Wave analysis is an essential feature for swing traders and long-term investors, offering deeper market trend perspectives to support strategic decision-making.

By integrating these high-quality research tools, FxPro empowers traders with the knowledge and market intelligence necessary to enhance trading performance and confidence across diverse investment horizons.

Fx Empire :

Forex Brokers : Research – Table

Broker Chooser :

Fx Empire : Education

Forex Brokers : Education

Broker Chooser :

FxPro offers a comprehensive education hub designed to support traders at every experience level, from novices to seasoned professionals. The platform features interactive courses that cover essential topics such as fundamental analysis, technical analysis, and trading psychology. These courses are structured into easy-to-follow modules, with concise cards guiding learners step-by-step through each subject. Key areas include trend lines, support and resistance, chart patterns, risk management, and developing a solid trading plan. Progress tracking tools help maintain motivation and ensure a structured learning path.

In addition to written content, FxPro provides a variety of educational videos, platform tutorials, and recorded webinars through its dedicated YouTube channel, enriching the learning experience with visual and practical insights. Notably, advanced courses from CME Group are also included, offering video and text lessons paired with quizzes to reinforce understanding.

While the educational resources are robust and valuable, particularly the modules on trading psychology which help traders avoid costly mistakes, there remains room to enhance the breadth and variety of materials. Expanding video content, introducing interactive quizzes, and scheduling regular live webinars could further elevate the learning experience, bringing FxPro’s education offering closer to industry leaders.

Overall, FxPro’s educational resources are a solid foundation for traders aiming to improve their skills, providing both foundational knowledge and advanced insights in a user-friendly format that supports continuous growth and success.

Forex Broker Research: Key Takeaways

FP Markets offers a complete and beginner-friendly education hub with easy-to-understand courses, videos, webinars, and tutorials that cover both basic and advanced trading topics — making it a strong learning platform for new and growing traders.

Fx Empire :

Forex Brokers : Education Table

Broker Chooser :

Final Thoughts

Fx Empire : Bottom Line

Forex Brokers : Final Thoughts

Broker Chooser :

FxPro has firmly established itself as a trusted global leader in the forex and CFD trading space, boasting over 25 years of experience and multiple licenses from top-tier regulators worldwide. This extensive background contributes to its strong reputation for security and reliability among traders at all levels.

The broker offers a versatile suite of trading platforms, including the proprietary FxPro Trading Platform and Mobile App, alongside industry favourites such as MetaTrader 4, MetaTrader 5, and cTrader. These platforms are supported by powerful tools like Trading Central analytics, real-time FxPro Squawk news alerts, market sentiment indicators, and depth-of-market (DOM) data, providing traders with a comprehensive trading environment.

FxPro’s account offerings cater to diverse trading styles and budgets. While the Standard Account features slightly higher spreads than the industry average, cost-conscious traders can opt for raw spread accounts that offer tighter pricing. High-volume traders also benefit from exclusive rebates and VIP perks through the Elite account, maximizing trading efficiency and reducing costs.

A standout feature is FxPro’s broad range of tradable instruments, enabling traders to diversify their portfolios across forex, commodities, indices, stocks, and cryptocurrencies. This variety ensures ample opportunities for exploring different markets and strategies.

Educationally, FxPro supports traders with interactive courses and live webinars that cover key topics such as technical analysis, risk management, and trading psychology. These resources are especially valuable for beginners seeking to build confidence and knowledge.

FxPro’s robust infrastructure and flexible offerings make it well-suited for a wide spectrum of traders, from novices to seasoned professionals. It also excels in catering to algorithmic and automated trading, earning recognition as a leader in Algo Trading and MetaTrader platform excellence.

Although pricing may be somewhat higher compared to some competitors, the overall quality of platforms, tools, and support delivers strong value. The proprietary FxPro Edge platform is a notable addition, though its mobile availability is currently limited. Still, FxPro’s consistent execution quality and extensive features provide compelling reasons to consider it for your trading needs.

FxPro FAQ

Fx Empire : Faq

Forex Brokers : Faq

Broker Chooser : Faq

Is FP Markets safe?

FP Markets has a long operating history and is regulated by multiple Tier-1 authorities. I judge this well-established CFD broker to be relatively safe.

About Tradewiki.io

Our goal at Tradewiki.io is to deliver clear, unbiased reviews of top international forex brokers and prop firms, guiding you toward the best forex broker or prop firm that fits your needs. Since launch, Tradewiki.io has helped thousands of traders worldwide find, compare, and choose trusted forex brokers and prop firms.

Tradewiki.io Reviews